One of the most important things any trader should know before starting in the Prop Firm industry is the term “max drawdown.” Understanding what is max drawdown in Prop Firm can help traders protect their accounts, manage risk effectively, and increase their chances of passing the evaluation phase to gain funded capital, regardless of their experience level.

This article by Pfinsight.net will provide you with a comprehensive overview of the definition of what is max drawdown in Prop Firm, its importance, how Prop Firms apply this rule, and practical advice on managing drawdown effectively.

What is max drawdown in Prop Firm?

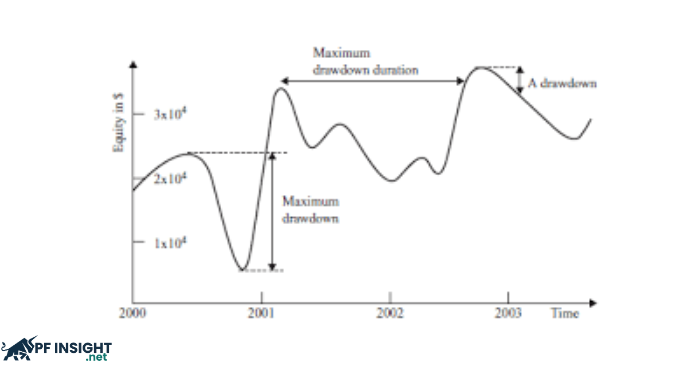

Max drawdown, also known as the maximum drawdown, is the largest amount your account can lose from the equity peak (highest point) to the equity low (lowest point) before violating the rules. In other words, it is the maximum loss limit allowed. If you exceed this threshold, you will fail the evaluation or lose access to the funded account provided by the firm.

Max drawdown is used in Prop Firms to ensure that traders do not lose all the capital provided by the company. Apart from teaching traders the discipline of risk management, this rule also protects the firm’s business operations from excessive risk-taking.

Example: If a Prop Firm sets a max drawdown of 10%, you cannot let a $100,000 account fall below $90,000. You will either fail the challenge or have your account terminated if you breach this level.

What is daily drawdown?

The daily drawdown measures the largest drop a trader experiences between the highest and lowest point within a single trading day, before reaching a new high. Even if the trading day ends in profit, this indicator still records the largest intraday decline.

While daily drawdown is limited to just one trading session, the max drawdown typically covers a longer period, which can extend over months or even years.

Why is max drawdown important in Prop Firms?

Understanding what is max drawdown in Prop Firm can help traders:

- Manage risk more effectively: Since traders know the maximum loss limit, they can calculate position sizes and trades more rationally.

- Increase chances of passing the evaluation: Most Prop Firms impose drawdown limits as a mandatory requirement during the challenge phase. Breaching this rule leads to loss of funding or forfeiting the challenge fee.

- Maintain accounts long term: Following the max drawdown rule when trading live accounts ensures capital protection and stable income.

- Preserve trading psychology: By knowing your risk limits, you avoid impulsive or reckless decisions.

Types of max drawdown in Prop Firms

Each Prop Firm may apply different drawdown rules. Understanding each type allows you to adjust your trading strategies accordingly. Below are three common types of max drawdown:

Max daily drawdown (maximum daily loss limit)

This is the maximum loss you can take within a single trading day. If you exceed this limit, your account will automatically be terminated.

Example: A $50,000 account with a 5% daily drawdown ($2,500). If you lose $2,600 in one day, you violate the rule.

Max overall drawdown (total loss limit)

This refers to the largest loss throughout the trading period – from the starting balance, or highest equity, down to the lowest point. Because it allows long-term risk control, it is the most common type of drawdown rule in Prop Firms.

Example: A $100,000 account with a 10% overall drawdown ($10,000). Even if you have open positions, you are in violation if your equity drops to $89,500.

Trailing drawdown (dynamic loss limit)

Trailing drawdown is a dynamic maximum drawdown that adjusts according to your account’s new equity highs. This means the limit moves upward as you generate profits.

Example: A $50,000 account with a 5% trailing drawdown ($2,500). Once your account grows to $52,000, the trailing drawdown moves to $49,500. This not only protects your profits but also enforces disciplined trading.

How to minimize max drawdown in Prop Firms?

Loss phases are unavoidable for all traders; what matters is how you manage them. Minimizing drawdowns not only protects capital but also helps you maintain stable trading psychology. Here are practical strategies:

- Use appropriate position sizing: The key to reducing risk is controlling lot sizes. Avoid opening trades that are too large for your equity. Moderate lot sizes keep losses within safe limits and prevent severe account damage.

- Always use stop-loss orders: One of the biggest mistakes traders make is neglecting stop-losses. A well-placed stop-loss prevents uncontrollable losses and protects your capital. A common rule is to limit risk per trade to no more than 1–2% of the entire account.

- Diversify markets and strategies: Do not rely on a single currency pair or strategy. Spreading trades across different instruments and methods reduces the impact of unfavorable market moves.

- Pause when your personal drawdown limit is reached: Stop trading if your account drops below your tolerance level. Before resuming, reassess your system, mindset, and market conditions. Do not let emotions drive revenge trading.

- Trade with focus and a clear strategy: Following a structured plan prevents impulsive decisions, which are the main cause of excessive drawdowns. Define rules for each session, including trade size, entry and exit points, and maximum daily loss.

Common mistakes traders make about max drawdown in Prop Firms

Although most traders know about max drawdown, many still violate the rules due to simple misunderstandings. Below are the most common mistakes:

- Confusing balance with equity: One of the worst mistakes is focusing only on account balance while ignoring equity. Since most firms include open positions in their calculations, you can breach the drawdown rule even if trades are not closed, as long as equity goes negative.

- Ignoring daily drawdown: Many traders only pay attention to overall drawdown, overlooking daily drawdown. Even if you stay within the overall limit, you can still lose the account by exceeding the daily loss allowance. This is a major reason why traders fail evaluations.

- Forgetting trading costs: Traders often forget spreads, commissions, or swap fees. These costs can accumulate and push your account beyond the allowed loss limit. For example, you may think you have $50 left before breaching drawdown, but a large commission could wipe it out.

- Increasing lot sizes after losses: The “revenge trading” mindset is a primary reason for breaching drawdown. Many traders increase lot sizes to quickly recover losses, but this only accelerates hitting the maximum drawdown. In Prop Firms, this is the fastest way to fail.

Conclusion

The information above provides a complete explanation of max drawdown. Hopefully, this article has answered your question what is max drawdown in Prop Firm? Do not forget to visit our website for more useful insights. Wishing every trader successful investments!