What is leverage in forex is one of the most common questions traders ask when they first enter the market, but it is also one of the most misunderstood concepts. Leverage allows traders to control a trading volume far larger than the actual capital in their accounts, directly affecting both potential profits and risk levels. Understanding how leverage actually works in trading is essential, as leverage is closely tied to margin, position size, and the long-term stability of an account. When leverage is used without a solid risk management framework, traders can easily experience rapid losses and deep drawdowns. This article will help you understand leverage in forex, from the basic concept to how it operates in real trading conditions.

- Understanding leverage in prop trading: A complete guide for beginners

- Top prop firm with high leverage in 2025

- Manual trading explained: advantages, risks, and when to use it

What is leverage in forex

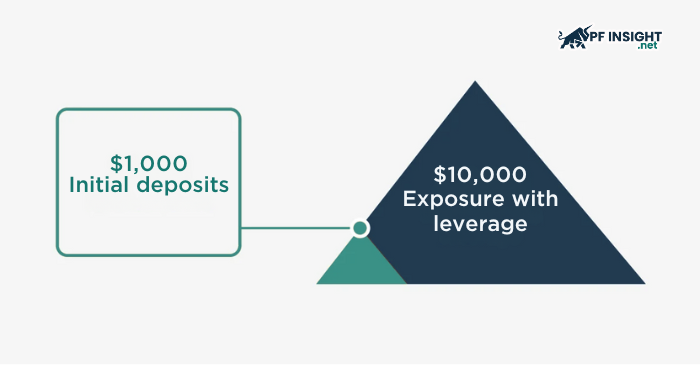

Leverage in forex is a mechanism that allows traders to trade volumes many times larger than the actual capital available in their accounts. In essence, leverage is not a bonus or a profit-generating tool, but a form of margin borrowing from the broker to open positions with greater value. Leverage ratios are commonly expressed as 1:10, 1:50, 1:100, or higher, indicating how much market value a trader can control for each unit of capital committed.

For example, with 1:100 leverage, a trader needs only 1,000 USD to open a position worth 100,000 USD in the forex market. It is important to understand that leverage does not change the win or loss probability of a trading strategy, but instead amplifies the scale of profits and losses based on price movements. For this reason, leverage always comes with higher risk if it is not used within a strict capital and risk management system.

How leverage works in forex trading

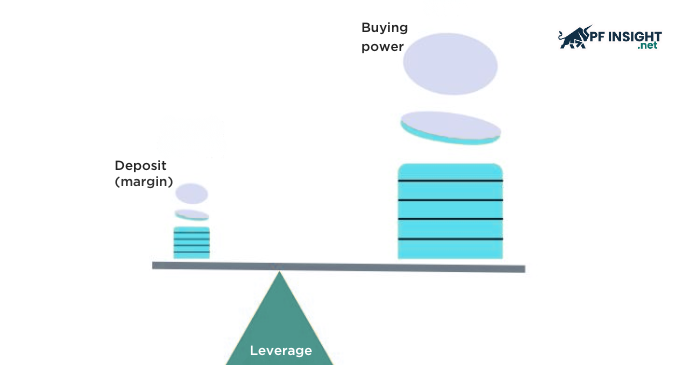

In forex trading, leverage operates through the margin mechanism, allowing traders to open positions larger than the actual capital available in their accounts. When a trade is opened, the broker holds only a small portion of the trade’s total value as margin, while the entire position remains fully exposed to market price movements. This mechanism is what makes leverage both a supportive tool and a source of risk if it is not properly understood.

To visualize this more clearly, the way leverage functions in a trade can be summarized as follows:

- The trader selects a leverage ratio, such as 1:50 or 1:100, which determines the required margin for each position.

- The broker requires margin that represents only a small fraction of the total trade value.

- Profits and losses are calculated on the full position size, not on the initial margin amount.

- Small price movements have a significant impact on the account because the position size has been amplified.

- Equity rises or falls more rapidly, directly affecting drawdown and the ability to sustain the account.

Therefore, leverage does not make the market move faster or slower. Instead, it increases the impact of each price movement on the trading account. Understanding this mechanism is fundamental for traders to control position size, manage risk, and use leverage responsibly in real trading conditions.

Leverage, margin and position size explained

Leverage, margin, and position size are three tightly connected elements in every forex trade, and misunderstanding their relationship is a common cause of rapid losses. Leverage determines the margin ratio, margin is the amount of money held to open a trade, and position size is the actual scale of the position in the market. In real trading, traders do not directly “choose margin,” but instead indirectly determine position size through leverage and trade volume. To clearly see how these three elements work together, consider the following step-by-step example:

Assume:

- Account balance: 1,000 USD

- Leverage ratio: 1:100

- Trading pair: EUR/USD

Step 1: Determine position size

With 1:100 leverage, a trader can open a position with a maximum value of up to 100,000 USD, equivalent to 1 standard lot of EUR/USD.

Step 2: Calculate the required margin

Required margin = Position value / Leverage

→ 100,000 USD / 100 = 1,000 USD

This means the entire account balance would be used as margin if the trader opens a full 1-lot position.

Step 3: Impact of price movement

With 1 lot of EUR/USD, each pip movement is equivalent to 10 USD.

- If the price moves against the position by 10 pips, the loss is 100 USD.

- If the price moves against the position by 50 pips, the loss is 500 USD.

With only a relatively small price movement, the account already experiences a significant drawdown.

Step 4: Adjust position size to control risk

If the trader reduces the position size to 0.1 lot:

- Position value: 10,000 USD

- Required margin: 100 USD

- Each pip is now worth only 1 USD

At this point, the leverage remains at 1:100, but the risk per price movement is much better controlled.

From this example, it can be seen that leverage itself is not dangerous. Position size is the factor that determines the actual level of risk. Traders can use high leverage and still trade safely if they properly control trade volume and the risk per trade.

How leverage affects profit, loss and drawdown

Leverage not only affects the profit and loss of individual trades, but also has a direct impact on drawdown and the long-term survivability of an account. Because profits and losses are always calculated on the full position size, the larger the leverage and trade volume, the stronger the impact on equity for the same price movement. This is why many traders experience deep drawdowns even when the market moves against them by only a short distance.

To better understand this, the impact of leverage can be viewed across three main aspects:

- Profit: when the market moves in the right direction, leverage allows profits to grow faster due to the larger position size.

- Loss: when the market moves against the position, losses are amplified at the same rate.

- Drawdown: a series of consecutive losses with a large position size can cause equity to decline sharply in a short period of time.

As a simple example, consider a 1,000 USD account:

- Trader A enters a 1-lot position using high leverage.

- Trader B enters a 0.1-lot position with the same leverage ratio.

If the market moves against them by just 30 pips:

- Trader A suffers a loss of approximately 300 USD, equivalent to 30% of the account.

- Trader B loses only 30 USD, equivalent to 3% of the account.

This difference shows that leverage itself does not directly cause drawdown. Instead, the way traders use leverage through position size is the decisive factor. When drawdown becomes too deep, psychological pressure increases, the ability to recover the account declines sharply, and hookup and traders are very likely to break their trading discipline.

Common leverage mistakes beginners make

For new traders, leverage is often seen as a tool for making quick profits rather than a factor that must be tightly controlled. This mindset leads to many common mistakes that push accounts into deep drawdowns early on. Below are the most frequent errors beginners make when using leverage in forex trading.

Using high leverage from the start

Many new traders choose high leverage because they believe small capital requires large leverage to make trading worthwhile. In reality, high leverage only accelerates losses if the trader lacks experience in risk control.

Confusing leverage with position size

Many traders believe that simply lowering leverage makes trading safer, while the core issue lies in trade volume. Even with low leverage, risk remains unchanged if the position size is too large.

Failing to calculate risk per trade in advance

Beginners often enter trades based on emotion without defining how much of their account they are willing to lose if the trade fails. When leverage is combined with large position sizes, just a few losing trades can cause serious damage.

Holding losing positions because they believe leverage will help price reverse faster

Leverage does not change market direction, yet many traders believe a larger position will help them break even more quickly. This mistake often leads to increasing losses and a breakdown of trading discipline.

Ignoring the psychological impact when drawdown occurs

When leverage causes large swings in equity, psychological pressure rises significantly. Beginners are highly prone to overtrading, revenge trading, or abandoning their original plan.

These mistakes do not come from leverage itself, but from how traders use it in practice. Identifying and avoiding these errors early is an important step toward more disciplined and sustainable trading.

How to use leverage responsibly in real trading

Using leverage responsibly does not mean avoiding leverage altogether, but rather understanding its role within the overall trading system. In practice, leverage should be viewed only as a tool that supports strategy execution, not as a factor that determines profitability. Traders who manage leverage well are those who control their position size, risk exposure, and psychological state.

To apply leverage effectively and sustainably, traders can follow these principles:

Prioritize risk control per trade

Define the maximum risk for each trade in advance, typically around 1–2% of the account, and then adjust position size accordingly, rather than starting with leverage.

Use high leverage with small position sizes

High leverage does not automatically mean high risk if trade volume is kept at a reasonable level. What matters is the impact of each pip on the account, not the displayed leverage ratio.

Keep margin usage at a safe level

Avoid using all available margin for one or a few trades. Maintaining sufficient free margin gives the account room to absorb price fluctuations and helps prevent margin calls when the market moves against the position.

Reduce leverage during periods of high market volatility

When the market experiences major news events or abnormal volatility, lowering trade size and effective leverage helps limit unnecessary drawdowns.

Monitor drawdown rather than focusing only on profit

Drawdown reflects the true risk level of a strategy. A system that uses leverage appropriately is one that keeps drawdown under control, even if profit growth is slower.

Conclusion

What is leverage in forex is not merely a question about leverage itself, but a core issue related to how traders manage risk and maintain long-term account stability. Leverage on its own is neither good nor bad. What matters is how traders use leverage through position size, margin, and trading discipline. When leverage is assigned the right role, traders can control drawdown, reduce psychological pressure, and trade in a more sustainable manner. Understanding how leverage actually works in trading is a foundational step that helps traders avoid common mistakes and build a sound capital management mindset. To further explore topics related to risk management and trading psychology, you can read more in-depth analysis at Pfinsight.net.