In technical analysis, the trendline breakout strategy is often considered one of the common approaches for identifying trend-based entry points. However, using breakouts in a mechanical way, without proper context or clear confirmation rules, has led many traders to experience false breakouts and inconsistent trading results.

Together with PF Insight, this article focuses on clarifying the role of trendlines within market structure, how to identify a valid breakout, entry rules based on price behavior, and the necessary confirmation factors.

- Volatility trading concepts that help traders adapt to changing market conditions

- Market structure trading: How traders identify trend and market direction

- How fair value gap trading helps traders optimize entry points

What is trendline breakout strategy

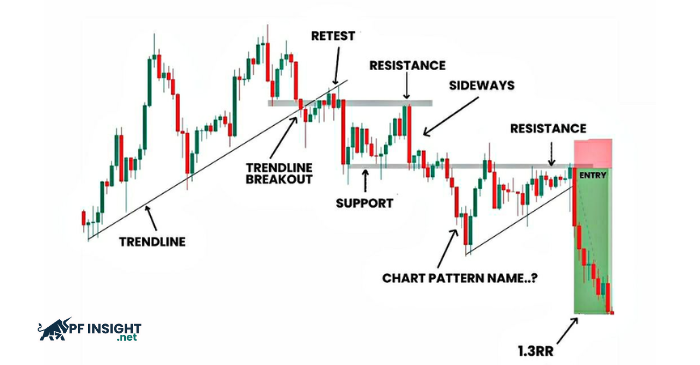

The trendline breakout strategy is an approach that focuses on the moment price breaks through a trendline, using that event to assess potential changes in price behavior and market structure. Rather than treating a trendline as a fixed entry zone, this strategy emphasizes how price reacts when the existing trend order is disrupted.

The core of a trendline breakout strategy does not lie in drawing a perfectly precise trendline, but in how traders interpret whether the breakout is meaningful or merely market noise.

The role of trendlines in market structure

Within a trendline breakout strategy, a trendline acts as a boundary representing a temporary balance between buyers and sellers. As long as price continues to move along the trendline, the trend structure remains intact. When price breaks this line, the market is signaling that the previous order may no longer be valid.

Therefore, a trendline is not a trading target, but a reference point for observing changes in price behavior. A breakout becomes significant only when it is accompanied by a clear shift in structure, rather than a brief or isolated price penetration.

Conditions for a trendline to be valid in a breakout strategy

Not every trendline is suitable for breakout analysis. In a trendline breakout strategy, a trendline should only be used when the following conditions are met:

- First, the trendline must clearly reflect price structure. The contact points should come from valid swings, showing an orderly sequence of price movement.

- Second, price should have interacted with the trendline multiple times to establish a market expectation. The more consistently a trendline is respected during trend development, the more meaningful its breakout becomes.

- Third, the trendline should exist within a defined trend context, not during sideways conditions or in a market lacking direction. Breakouts in environments without clear structure tend to be unreliable.

- Finally, the slope of the trendline should be reasonable. Trendlines that are too steep often represent short-term emotional movement and are more prone to false breakouts, while moderately sloped trendlines tend to reflect more sustainable trends.

What defines a valid breakout from a technical perspective

In a trendline breakout strategy, the critical question is not whether price breaks the trendline, but whether that break actually alters the market structure. A breakout should only be considered valid when it creates new conditions for price behavior, rather than being a temporary or isolated penetration.

Breakout and false breakout from a market structure perspective

A valid breakout occurs when the break of a trendline is accompanied by the invalidation of the previous structure. Price does not simply move through the trendline, but also shows that the market can no longer maintain its prior order. This is often reflected in post-breakout price swings that no longer respect previous swing levels.

In contrast, a false breakout occurs when price breaks the trendline without triggering any structural change. Price quickly returns to the previous area and continues to move according to the prior order. In this case, the breakout represents short-term noise rather than meaningful market information.

Another factor that cannot be overlooked is the preceding trend context. Breakouts that occur within a clearly defined trend tend to carry more significance than those forming in sideways conditions or during periods when the market lacks direction.

Technical conditions that indicate a meaningful breakout

In a trendline breakout strategy, a breakout should only be evaluated when multiple technical conditions appear simultaneously, rather than relying on a single signal.

- Clear price close outside the trendline: A candle closing outside the trendline indicates that the market accepts the new price area, rather than merely testing the breakout level temporarily.

- Post-breakout price behavior shows a change: Price maintains distance from the former trendline or forms a new price leg, instead of quickly returning to the breakout zone.

- The breakout is accompanied by a break in the prior structure: After the breakout, the previous swing structure is no longer maintained. If the price structure remains intact, the breakout is highly likely to lack significance.

Why a breakout should not be evaluated based on a single factor

One of the most common mistakes in a trendline breakout strategy is judging a breakout based on a single sign, such as price simply breaking a trendline. This approach overlooks the fact that a breakout is a process of changing price behavior, not a single moment in time.

Only when a breakout is placed within the context of market structure, price behavior, and aligned confirmation conditions does it become a reasonable basis for further entry analysis and risk management.

Entry rules in a trendline breakout strategy

Entry is not a reflexive action taken the moment price breaks a trendline, but the result of a breakout that has already been assessed as valid. Entry rules must be clear enough for traders to know when they are allowed to enter a trade and when they should stay out.

Entry based on candle close

- Entry should only be considered after a candle has fully closed outside the trendline.

- Entering before the candle closes increases the risk of a false breakout.

- The more clearly the candle closes away from the trendline, the stronger the confirmation for entry.

This approach prioritizes market acceptance of the new price area rather than predicting the outcome before the breakout is complete.

Aggressive entry vs conservative entry

Aggressive entry

- Entering immediately after the breakout candle.

- The advantage is an earlier entry and potentially higher risk reward.

- The risk is higher if the breakout lacks additional confirmation.

Conservative entry

- Waiting for price to retest the broken trendline area.

- The advantage is a higher probability due to extra confirmation.

- There is a risk of missing the trade if price does not return for a retest.

These two entry approaches are not opposites. They represent a trade-off between probability and entry position and should be chosen based on the specific context of the breakout.

When entry should be avoided

- A breakout occurs but the price structure has not clearly changed.

- Price closes very close to the trendline, lacking confirmation distance.

- The breakout forms within a sideways market or against the main trend.

- The entry is driven by fear of missing out rather than technical conditions.

In these situations, not entering a trade is part of discipline in a trendline breakout strategy, not a missed opportunity.

Breakout confirmation factors

Confirmation is not intended to identify additional entry signals, but to evaluate whether a breakout continues to remain valid after the initial break. Confirmation factors allow traders to monitor the quality of a breakout in real time, helping them avoid holding positions when the market shows a lack of commitment. When a breakout is no longer confirmed, adjusting the position or staying out becomes a necessary part of trading discipline.

Price action confirmation

- Price continues to move in the direction of the breakout rather than returning to the previous area.

- Post-breakout candles show clear range expansion instead of sudden contraction.

- Pullbacks after the breakout remain controlled and do not invalidate the newly formed structure.

Price action confirmation indicates that the market is accepting the new state, rather than reacting temporarily.

The role of retest after breakout

- Price returns to test the broken trendline area but does not close back inside it.

- The retest occurs with a smaller range compared to the initial breakout move.

- After the retest, price resumes movement in the breakout direction.

A retest does not always occur, but when it does, it provides additional insight into the level of market commitment to the new price zone.

When breakout confirmation is missing

- Price quickly moves back inside the trendline after the break.

- Post-breakout candles lack momentum and overlap significantly.

- The retest breaks through the breakout zone instead of acting as new support or resistance.

In these situations, the breakout is highly likely to lack validity. Exiting early or avoiding holding the position is an analysis-based decision, not an emotional reaction.

Risk management in breakout trading

Breakouts occur at moments when the market is changing state, so the risk does not lie in price moving against expectations, but in the breakout failing to maintain its validity as initially assumed. Risk management in breakout trading focuses on defining in advance the conditions that invalidate the setup, rather than trying to optimize profit on each individual trade.

- Stop loss should be tied to the breakout invalidation level: The stop-loss level should be placed in an area where, if price returns, the breakout no longer holds structural significance.

- Stop-loss distance must reflect natural price volatility: Placing a stop loss too close to the trendline makes the trade vulnerable to being stopped out during normal corrective moves.

- The risk-reward ratio should match the probability of the setup: High-probability breakouts often come with moderate profit expectations and do not require pursuing large R:R targets.

- Risk should be reassessed when price behavior changes: When price moves back inside the breakout zone or breaks the newly formed structure, reducing exposure or exiting the trade becomes necessary.

- Do not hold a trade simply to defend the original bias: Staying out of the market when a breakout loses validity is part of trading discipline, not a sign of incorrect analysis.

Common technical analysis mistakes in trendline breakouts

Many issues with trendline breakouts do not originate from the market itself, but from how signals are interpreted from the outset. When these misinterpretations repeat, breakouts gradually lose their analytical value and instead become a source of noise in the decision-making process.

- Treating a price touch or break of a trendline as sufficient to act: Price moving through a trendline is only a technical event, not a conclusion. When a breakout is judged based on this moment alone, traders often ignore the more important question of price structure and market state after the break.

- Drawing trendlines to fit personal expectations: Trendlines that are constantly adjusted to match new price movements tend to reflect a desire to confirm a bias rather than to describe actual price behavior. In this case, the breakout is no longer an observed signal, but a prearranged outcome.

- Confusing structural breaks with random volatility: Not every strong price move carries structural significance. Many breakouts merely reflect short-term volatility, lack follow-through, and fail to create a new price state. Trading under these conditions usually offers no clear edge.

- Prioritizing a better entry over breakout quality: Focusing too much on entry positioning can lead traders to accept breakouts that do not meet proper analytical conditions. An early entry or attractive risk–reward ratio cannot compensate for a breakout that lacks structural foundation.

- Treating trendline breakouts as standalone signals: When breakouts are detached from the broader context, each break becomes an isolated decision. This undermines analytical consistency and makes risk control significantly more difficult.

Conclusion

A trendline breakout strategy is effective only when it is viewed as an analytical support tool, not as an immediate action signal. Maintaining a conditional mindset and disciplined observation helps traders adapt more effectively as market conditions change. Thank you for taking the time to read this article, and we wish you effective trading and sustainable results. Do not forget to explore more in-depth content in the Technical Analysis section to further refine your approach.