In the competitive Forex market, STP broker are becoming the preferred choice of many investors. With a direct order processing mechanism, without going through a trading desk, this model ensures transparency, high order matching speed and attractive spreads. So how to choose the best STP Forex brokers? Together pfinsight.net find out more in the following article.

What is an STP broker?

STP brokers operate on the Direct Market Access (DMA) model, allowing traders to trade directly with top liquidity providers. Instead of acting as an intermediary to match orders, STP brokers transfer orders directly to the interbank market, where prices are formed by major banks and international financial institutions. This mechanism helps ensure transparency, fast order matching speed and limits price manipulation.

The products that STP brokers provide are usually aimed at professional traders, experienced and capable of maintaining high liquidity. Due to the nature of direct transactions with the interbank market, investors need to own capital larger than average to meet the requirements of volume and order matching speed.

How does the STP broker’s order matching mechanism work?

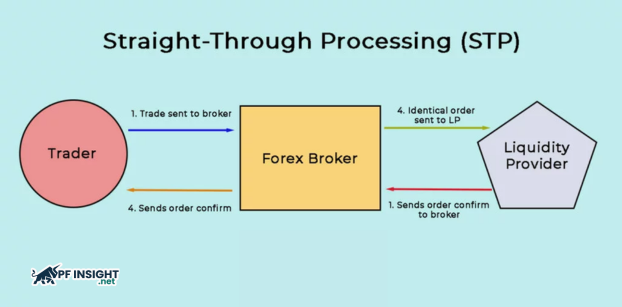

STP (Straight Through Processing) is a mechanism that allows Forex brokers to transfer and match orders automatically directly on the market, eliminating human involvement in the processing.

STP brokers operate by directly connecting traders’ orders to a network of liquidity providers such as banks, investment funds or large financial institutions, instead of matching orders internally. This mechanism ensures that transaction prices reflect the real market, without intervention or price manipulation. As a result, traders benefit from high order execution speeds, competitive spreads and much more optimal transaction costs than the traditional brokerage model.

STP brokers typically operate on a No Dealing Desk (NDD) model, where the broker does not intervene or take an adverse position on the trader. Instead of adjusting prices or controlling orders, they act as an intermediary connecting buyers and sellers directly, and collect fees or commissions from the volume of transactions executed.

The working process of STP in Forex is as follows:

- Step 1 – Trader initiates order: Traders make a trade request by transmitting order information to the broker, including the type of product they want to trade, the specific volume, and the target price they want to be filled in the forex market.

- Step 2 – Orders are sent directly to liquidity providers: STP brokers will send trading orders to a network of liquidity providers, including large banks, international financial institutions or other intermediary brokers, to find the best price.

- Step 3 – The system selects the current optimal price: Liquidity providers send back current quotes for the requested currency pair. The broker’s system then automatically identifies and selects the most competitive price from these quotes to ensure the trader’s order is optimally filled.

- Step 4 – Successfully matched order: Once the system determines the optimal price, the order will be matched immediately through a fully automated process. The entire process is fast to eliminate manual human involvement.

- Step 5 – Brokers earn commissions: Brokers earn income from each matched order, usually based on a fixed fee or a small percentage of the total transaction value. This is the main source of profit that helps the broker maintain its operations and provide services to investors.

In general, the STP model gives traders direct access to market prices, helping the order matching process take place faster and more efficiently. As a result, traders enjoy competitive spreads and optimal transaction costs. In addition, the STP broker also ensures high transparency because all orders are executed directly through reputable liquidity providers.

The benefits when choosing a floor, what is an STP broker?

More and more traders are choosing STP forex brokers thanks to the outstanding advantages that this model brings. Trading through STP brokers helps them enjoy a transparent order matching process and many other advantages suitable for today’s competitive environment.

- Orders are processed at super-fast speed: STP brokers operate on automated processing technology, allowing for near-instant order execution. This mechanism not only shortens transaction times but also minimizes latency, helping investors react faster to price fluctuations in the Forex market.

- Optimal pricing: When trading through an STP broker, traders enjoy direct access to real market prices. This allows them to receive competitive quotes, narrow spreads, and significantly reduce the costs incurred during the trading process.

- No conflicts of interest: STP exchanges follow the No Dealing Desk (NDD) mechanism, which means they do not directly intervene in traders’ orders. As a result, the exchange never takes an adverse position with the client, completely eliminating the risk of conflicts of interest and ensuring a transparent and fair trading environment.

- Transparency in trading: Traders’ orders are matched directly with top liquidity providers, ensuring transparency throughout the entire process. As a result, the price of the order is an accurate reflection of the real market, providing transparency in every transaction.

- Improved order matching quality: Traders are directly connected to liquidity providers without going through an intermediary processing step. This automatic mechanism helps the order matching process take place quickly, ensuring that orders are executed with the highest accuracy.

- Access to deep liquidity: The STP model connects traders directly with top liquidity providers, ensuring optimal pricing. This results in efficient, fast order execution, offering superior trading conditions.

Top 5 reputable STP brokers today

Below is a comparison table of the best STP brokers today:

|

Broker |

Legal regulations | Spread | Commission per Lot | Execution Speed | Minimum Deposit |

| IC Markets | ASIC, CYSEC, FSA (Seychelles), SCB (Bahamas | 0 pips | $6 per lot | ~30 ms |

$200 |

|

FP Markets |

MIFID-ESMA, ASIC, FSCA, CYSEC | 0 pips | $3 per side | ~40 ms |

$100 |

|

XM |

ASIC, CySEC, IFSC, DFSA, FCA | 0 pips | $3.50 per side | ~40 ms | $5 |

| FxPro | FCA, MIFID-ESMA, CYSEC, EDR, SCB (Bahamas) | 0 pips | $4.50 per side | – |

$100 |

|

Tickmill |

FCA, MIFID-ESMA, CYSEC, FSA (Seychelles) | 0 pips | $2.00 per side | – |

$100 |

IC Markets

IC Markets is considered one of the leading STP brokers, known for its ultra-low spreads, fast execution speeds and access to deep liquidity from major financial institutions. Orders are routed directly to more than 50 reputable liquidity providers such as Goldman Sachs, Citibank or Barclays, ensuring that the execution price reflects the market. Thanks to the transparent STP mechanism, IC Markets provides optimal trading conditions for professional traders and institutions. IC Markets eliminates the risk of dealing desk price manipulation. By using the state-of-the-art Equinix NY4 infrastructure, the platform ensures extremely fast order matching speeds of just 40 milliseconds, providing a smooth and accurate trading experience.

FP Markets

Thanks to the application of the STP model with an average order processing speed of only 40 milliseconds and direct connection with many of the world’s leading banks, FP Markets is considered one of the most reputable STP Forex brokers, providing a transparent and reliable trading experience. With the mechanism of transferring orders directly to institutional liquidity providers, it helps to completely eliminate conflicts of interest and bring a transparent trading environment. The platform offers spreads from 0.0 pips with a commission fee of only 3 USD per side, creating optimal conditions for investors. In particular, the broker also ensures fast execution, minimizing slippage even in periods of strong market fluctuations due to important economic news.

XM

As one of the best STP brokers, XM offers ultra-low spreads, transparent execution, and seamless performance on both MT4 and MT5 platforms. The Zero Spread account offers a fixed commission of $3.50 per side, ensuring accurate execution while maintaining strict regulatory standards from reputable financial authorities. XM’s 0 pip spreads help investors significantly reduce transaction costs, while still ensuring direct access to the market through a network of tier-1 liquidity providers, resulting in faster and more transparent order execution.

FxPro

FxPro stands out for its transparent execution and multi-platform support. The broker offers access to four different trading platforms, including cTrader, MT4, MT5, and FxPro Edge, allowing for flexible order execution. With spreads starting from 0.0 pips and automated execution, FxPro offers a seamless trading experience suitable for both retail and professional traders. FxPro’s cTrader platform gives traders access to Level II market depth, along with advanced order management tools. This feature is useful for advanced STP strategies, helping to optimize order execution and improve trading performance.

Tickmill

Thanks to its commission-based pricing model, direct connections to major financial institutions and FCA regulation, Tickmill is considered by the trader community as one of the top reputable STP brokers. The broker’s Pro account offers spreads from 0.0 pips with a commission of just $2 per lot, giving traders access to real interbank prices, ensuring fast execution and optimal costs in all market conditions.

Compare STP and ECN Forex brokers

Choosing the right STP broker depends on each person’s goals, strategies and trading style. If you are someone who prioritizes minimal spreads, high transparency and direct access to the interbank market, the ECN (Non-Dealing Desk) model will be the top choice. On the contrary, for traders looking for super-fast execution speed and high performance, willing to accept a little commission fee, the STP platform will be the optimal solution. In short, choosing a forex broker should be based on your risk tolerance, capital size and long-term financial goals.

| Pricing structure | Order matching method | Suitable for which trader? | |

| STP broker | The main source of income for STP brokers is from the widening of the price spreads quoted by liquidity providers. They usually apply floating spreads, which change according to the actual market fluctuations without charging fixed commissions. | STP brokers automatically route client trade orders directly to liquidity providers for matching. |

STP technology provides fast and efficient order execution, ideal for both scalpers and long-term investors. |

|

ECN broker |

ECN brokers provide real-time quotes, which helps traders receive lower spreads, especially when the market is highly liquid. | Traders’ orders are connected directly to liquidity providers and other traders.

Orders are matched at the best price in the order book. |

ECN platforms are optimized for scalping strategies and high frequency trading. |

Advantages and disadvantages of STP broker

Advantage:

- Instant order execution thanks to direct connection to top liquidity sources.

- Flexible spreads are smaller than market maker brokers.

- Operates without going through an intermediary order processing department, ensuring objectivity in transactions.

- Allows execution of orders of various sizes.

Disadvantages:

- High spreads lead to higher trading costs.

- Spreads fluctuate widely, especially when the market is highly volatile.

- Order matching may be slow when the market is going through a period of active trading.

Advantages and disadvantages of ECN broker

Advantage:

- Low spreads thanks to direct connection to various liquidity sources.

- Anonymous transactions, reducing the risk of price manipulation by intermediaries.

- Prices are clearly displayed, eliminating any conflicts of interest.

- Direct connection to the market, ensuring orders are matched instantly and reflect real prices.

Disadvantages:

- The platform charges a commission on each transaction.

- Spreads can widen significantly when markets experience high volatility.

- ECN accounts usually require higher deposits.

How to choose the best STP Forex brokers?

To choose a reputable STP broker, you can rely on the following factors:

- Legal regulations: Traders should only choose STP brokers licensed by reputable regulatory agencies and comply with strict financial standards, to ensure the highest level of safety and benefits for investors.

- Clear policies and terms: Transparent policies and terms help traders understand their rights, obligations and the broker’s operating procedures. This includes regulations on transaction fees, capital withdrawals, order processing and trading conditions, ensuring traders can make safe and effective investment decisions.

- Order processing speed: Prioritize STP brokers that can match orders quickly and accurately, with an average processing time of less than100 milliseconds. At the same time, at least 2/3 of the orders are done at competitive prices, ensuring a stable and efficient trading experience.

- Trading platform: Traders Shouldprioritize the supplierseasy-to-use platform, friendly to newbies likeMetaTrader 4 & 5, while supporting advanced platforms for professional traders. In addition, STP brokers must also be compatible with third-party tools, which helps optimize strategies and manage transactions effectively.

- Trading tools: It is important when choosing an STP broker to provide a variety of trading tools on many types of assets (Forex, Metals, Indices) so that investors can flexibly grasp and optimize different profit opportunities in the market.

- Support services: Traders should carefully consider the support and education services of the broker. This helps traders quickly grasp market trends, and evaluate the quality of service as well as the practical application of the learning materials provided by the broker.

Conclude

In summary, choosing a reputable STP broker brings many advantages to traders, including fast order execution, competitive spreads and direct access to liquidity. With a transparent trading environment, reduced conflicts of interest and automated processing technology, STP brokers are the ideal choice for both new and professional investors, helping to optimize efficiency and minimize risks in Forex trading.