In modern financial markets, timing entries is just as important as predicting trend direction. Smart money entry models are built around how institutions such as banks and hedge funds actually execute trades, rather than relying on common retail technical signals. These models focus on market structure, liquidity, and institutional order flow to identify high-probability entry zones. When applied correctly, they allow traders to align with large capital movements and significantly improve long-term consistency. In this guide from Pfinsight.net, you will learn a complete framework for using smart money entry models the professional way.

- Institutional order flow explained: how smart money really moves financial markets

- Is MT4 safe to use and what traders should check before installing

- Market imbalance zones explained and why price reacts strongly

What are smart money entry models?

Smart money entry models are trading frameworks built around how large financial institutions such as banks, hedge funds, and market makers actually participate in the market. Rather than relying on traditional technical indicators, these models focus on price structure, liquidity flow, and institutional order behavior to identify high-probability entry zones. The primary objective is to trade in the same direction as smart money after the market has completed its liquidity accumulation and distribution phases.

The core characteristics of smart money entry models include:

- Focusing on market structure to identify the true directional bias

- Targeting liquidity zones where retail traders commonly place stop-loss orders

- Using order blocks and fair value gaps to refine entry precision

- Prioritizing high risk-to-reward setups with strict risk control

- Applying multi-timeframe analysis to filter noise and improve accuracy

Core principles behind institutional trade execution

To understand how large institutions execute trades, traders must first grasp the core principles that drive price behavior in financial markets. Institutional participants do not react to short-term signals but instead build positions based on market structure, liquidity flow, and supply-demand imbalances. When these three elements align, the market often produces high-probability entry opportunities in the direction of smart money.

Market structure and trend alignment

Market structure reflects how price forms higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Large institutions consistently trade in alignment with the dominant structure to maximize trend continuation potential.

By correctly identifying swing highs, swing lows, and key structure breaks, traders can recognize when the market transitions from consolidation into expansion phases. Entries aligned with the higher-timeframe trend tend to deliver stronger consistency and improved long-term performance.

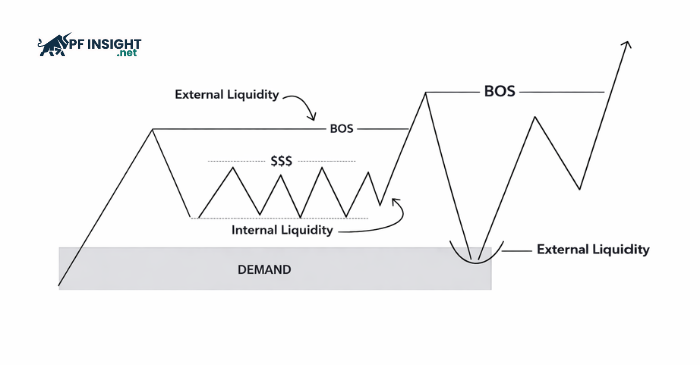

Liquidity engineering and stop hunt zones

Liquidity is the fuel that allows institutions to enter and exit large positions efficiently. Price frequently moves toward areas where retail stop-loss orders cluster, such as previous highs, previous lows, or clearly defined ranges.

These liquidity sweeps are often mistaken for false breakouts, but in reality they serve as mechanisms for smart money to accumulate sufficient volume before driving price in the intended direction. Recognizing stop-hunt zones helps traders avoid premature stop-outs while positioning alongside institutional flow.

Order flow and imbalance concepts

Order flow reveals the real-time pressure between buyers and sellers. When large orders enter the market aggressively, price typically moves rapidly and creates imbalance zones, commonly referred to as fair value gaps or price inefficiencies.

Institutions often revisit these areas to rebalance positions before the trend continues. Combining order flow analysis with market structure and liquidity concepts enables traders to pinpoint where smart money is most likely to re-engage the market.

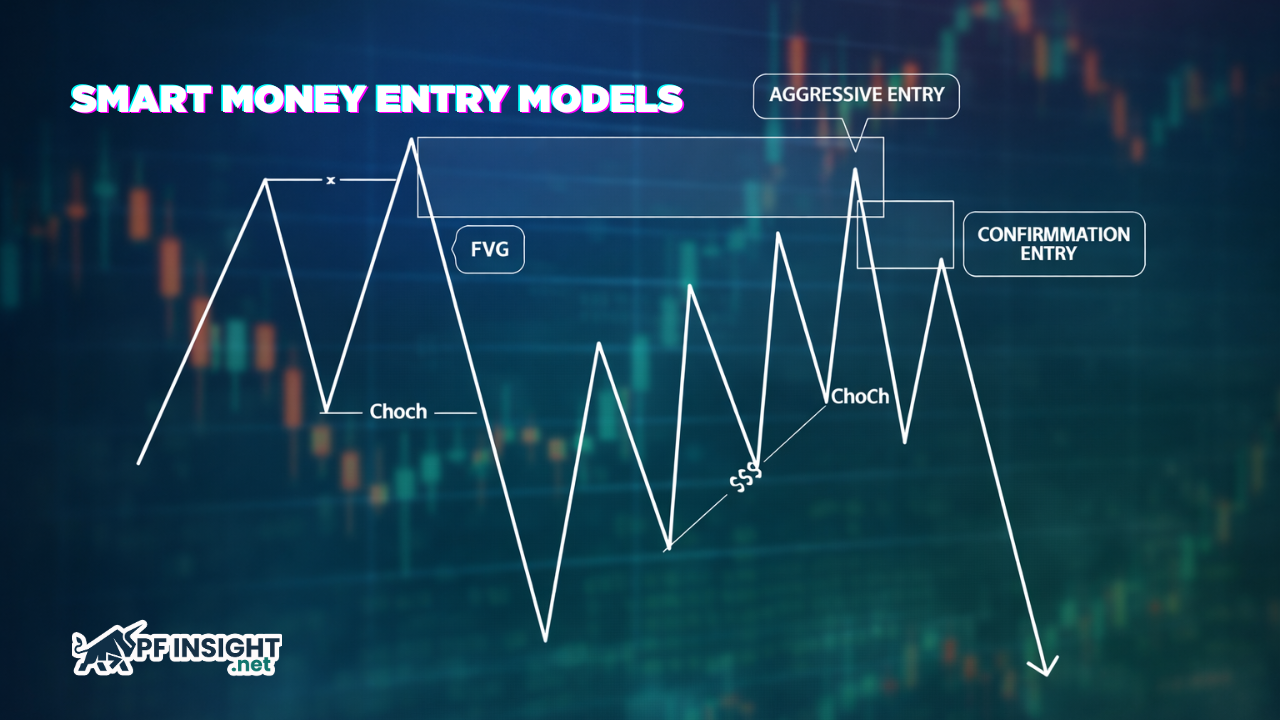

The most effective smart money entry models used by professionals

Professional traders do not rely on a single signal but build entry systems around market context. Each smart money entry model reflects a different phase of institutional behavior, including accumulation, distribution, and price expansion. By understanding the mechanics behind each model, traders can select the right setup for specific market conditions rather than forcing trades in unsuitable environments.

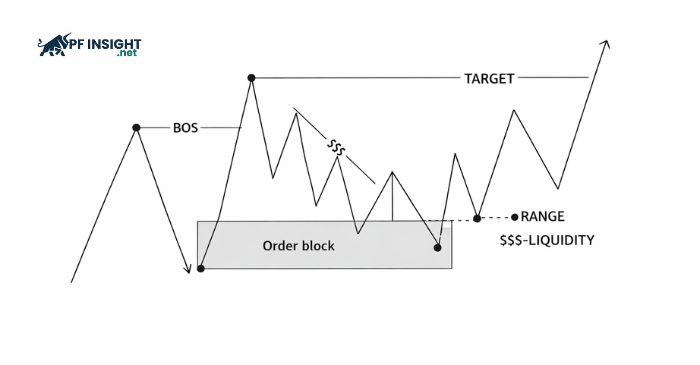

Breaker block entry model

A breaker block forms when a key order block is decisively broken, signaling a shift in market control from buyers to sellers or vice versa. This typically occurs after a prolonged phase of institutional accumulation or distribution.

From a market structure perspective, breaker blocks are often accompanied by a break in the previous trend and the formation of new swing points in the opposite direction. In terms of liquidity, the breakout usually sweeps stop-loss orders clustered around prior support or resistance levels.

Rather than chasing the initial breakout, professional traders wait for the price to retrace back into the breaker block zone. A strong reaction at this level suggests institutional participation defending their entry area, often preceding the continuation of the newly established trend.

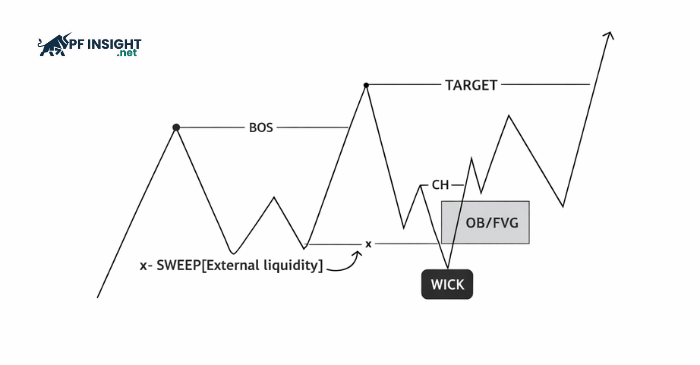

Order block + liquidity sweep entry

The relationship between institutional entrance zones and liquidity hunting is the foundation of this paradigm. The market frequently pushes past significant highs or lows to initiate retail stop-loss orders and unleash trapped liquidity prior to a significant price expansion.

The liquidity sweep usually manifests as a sharp spike or false breakout within a brief time span from a structural perspective. Following that, the price quickly moves back into adjacent order blocks, where institutional traffic starts to take up the available liquidity.

Before moving in the direction of a reversal or continuation, astute money traders wait for obvious price movements inside the order block after the sweep. This stage has the greatest potential for reward with the least amount of risk exposure.

Fair value gap re-entry model

When institutions drive prices aggressively in a short amount of time, they produce substantial imbalances between purchasing and selling pressure, which are represented by fair value discrepancies. These zones typically emerge following significant news releases or the conclusion of accumulation stages.

A fair value difference indicates places where prices were not negotiated effectively from the standpoint of order flow. In terms of structure, they usually emerge during strong expansion stages of trends fueled by smart money.

Expert traders don’t follow the first breakout. Rather, they wait patiently for the price to return to the fair value gap. Before the trend continues its next leg, institutional positioning is frequently indicated by continuation signs that emerge inside the zone.

Market structure shift confirmation model

This model focuses on the moment when market control shifts from one side to the other. After liquidity is swept, price typically breaks the previous trend structure and begins forming a new sequence of swings in the opposite direction.

From a market psychology perspective, this is the phase where most retail traders still expect the old trend to continue, while institutions have already started repositioning in the new direction. In terms of order flow, strong displacement moves confirm that large capital has entered the market.

Smart money traders wait for pullbacks into key technical zones, such as order blocks or fair value gaps within the new trend, to execute high-probability entries, rather than attempting to pick tops or bottoms emotionally.

Step-by-step framework to execute smart money entries

To trade in alignment with smart money consistently, traders must follow a structured process rather than chasing isolated signals. Large institutions always analyze the market from higher timeframes down, identify where liquidity is concentrated, and only execute trades when price reaches strategic zones. The framework below reflects how institutional traders build high-probability setups.

- Higher timeframe bias: Define the primary market direction on higher timeframes such as weekly and daily charts by focusing on market structure, accumulation or distribution phases, and key price levels where smart money is likely defending positions.

- Liquidity targeting: Map out areas that naturally attract large order flow, including previous highs and lows, clearly defined ranges, and clusters of retail stop-loss orders. These zones often act as magnets for price before the next directional move unfolds.

- Lower timeframe entry refinement: Drop down to lower timeframes to pinpoint precise entry models such as market structure shifts, reactions at order blocks, or fair value gap retracements. This approach tightens risk while maximizing reward potential.

Risk management for institutional-style trading

In smart money trading, risk management is the foundation of long-term survival and capital growth. Large institutions do not aim for quick profits from a handful of trades; instead, they build systems designed to preserve capital and compound statistical edge over hundreds of executions. Every decision is structured to control downside first, before maximizing upside. Core principles of institutional-style risk management include:

- Capital preservation first: Prioritize protecting capital by keeping risk per trade small and consistent, allowing the account to recover smoothly even after losing streaks.

- Balanced risk exposure: Distribute risk evenly across multiple trades rather than concentrating size into a single setup, preventing large equity drawdowns.

- Predefined invalidation levels: Clearly define where a trade thesis is proven wrong using market structure and liquidity logic, enabling fast exits when conditions fail.

- Statistical edge optimization: Continuously track performance of smart money entry models and focus capital on those with proven long-term expectancy.

- Psychological discipline: Execute the trading plan consistently without emotional stop adjustments, revenge trading, or risk escalation.

Common mistakes traders make with smart money entries

Trading without higher timeframe context

One of the biggest mistakes traders make when applying smart money entry models is focusing only on lower timeframes such as M1, M5, or M15 while ignoring the broader structure on daily and weekly charts. In contrast, institutions always establish directional bias on higher timeframes before refining entries on lower ones.

Without a clear higher timeframe bias, traders often enter positions against the dominant flow of capital, even when lower timeframe setups look technically perfect. This typically results in small wins followed by large losses when price continues in the primary trend direction.

Chasing breakouts instead of waiting for liquidity sweeps

Many traders react emotionally when price breaks strongly through key support or resistance and immediately enter in the breakout direction. In smart money trading, however, these moves often serve to attract liquidity rather than signal true trend initiation.

Institutions frequently push price beyond obvious levels to trigger retail stop losses and pending orders before executing their real directional move. Chasing breakouts commonly leads traders to buy short-term tops or sell temporary bottoms.

Misidentifying order blocks and fair value gaps

Not every strong candle represents institutional activity, and not every price gap reflects meaningful imbalance. A common error is marking excessive order blocks and fair value gaps without aligning them with market structure or liquidity context.

When these zones lack confirmation from order flow or structural shifts, they tend to fail quickly. This results in frequent low-quality entries and significantly reduces the reliability of smart money setups.

Overtrading smart money setups

Smart money entry models perform best under specific market conditions, such as after clear liquidity sweeps or confirmed structural shifts. Many traders, however, attempt to apply these models continuously, even during choppy or range-bound markets. Overtrading not only erodes statistical edge but also exhausts psychological discipline, leading to impulsive decisions and poor risk control.

Ignoring risk management rules

Even high-probability smart money entries are not guaranteed winners. When traders move stop losses, increase position size to recover losses, or risk too much per trade, a few losing trades can wipe out weeks of gains. Institutions survive because they treat small losses as part of the system. Abandoning risk management is the fastest way to destroy any trading edge.

Expecting instant results

Many traders approach smart money concepts expecting fast profits. In reality, this methodology is built on long-term probability, requiring time to understand structure, read liquidity, and execute consistently.

Just as institutions develop edge across thousands of trades, smart money trading demands patience and continuous refinement. Those seeking immediate results usually quit before the strategy delivers its true potential.

Conclusion

Smart money entry models provide traders with a structured approach built on market structure, liquidity, and institutional order flow rather than emotional or indicator-based signals. When applied within the proper market context and supported by disciplined risk management, these models can significantly improve long-term trading accuracy and consistency. To continue developing advanced trading skills, explore more in-depth articles in our Knowledge Hub section.