Disciplined traders with strong risk management skills can gain access to funded accounts on thePropTrade. The platform is drawing attention from the trading community thanks to its rigorous evaluation process and attractive profit-sharing model. But is investing in thePropTrade the right move? Let’s explore in this thePropTrade Review below.

What is thePropTrade?

In 2024, QuantElite-FZCO established ThePropTrade, a proprietary trading business headquartered in the United Arab Emirates. The goal is to provide international traders with abundant capital and a friendly trading environment.

Having held executive positions at BDSwiss, HF Markets, IronFX and FXGM, Mr. Andreas Andreou is a co-founder and expert with over 20 years of experience in the Forex industry.

In addition to helping develop PropTrade, his extensive business and operational experience has shaped a comprehensive support plan for traders.

Trading products

thePropTrade provides users with access to a variety of financial products, allowing them to diversify their strategies and portfolios:

- Forex: Major, Exotic and Minor Currency Pairs.

- Indices: Major indices from global markets such as S&P 500, NASDAQ, DAX and FTSE,..

- Commodities: Precious metals (gold, silver), agricultural products, energy.

- Cryptocurrency: Coins that are traded a lot in the world such as BTC, ETH,..

With the flexibility to apply multiple strategies and easily adjust to market fluctuations, this multi-asset approach increases traders’ ability to generate consistent profits over the long term.

thePropTrade Program

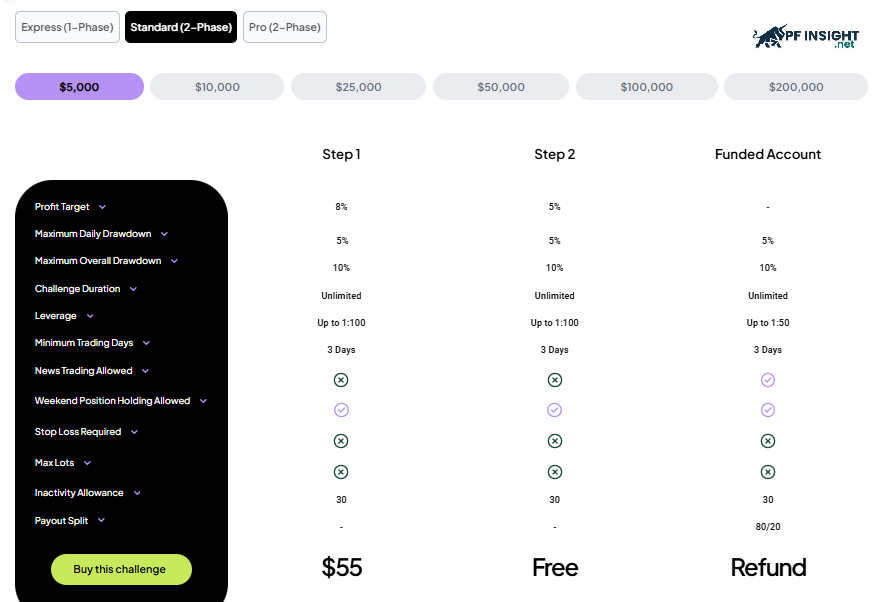

Standard 2-Phase Evaluation and Express Account are two funding options offered by thePropTrade. Both methods are aimed at assessing the trader’s competence, self-control, and risk management. If successful, you will receive a funding account to trade with.

Standard 2-Phase Evaluation

A trader’s trading skills are assessed in two consecutive and clearly defined evaluation steps in the Standard 2-Phase Evaluation method.

Phase 1

During the evaluation period, traders have a time limit, usually 10 to 30 days, to achieve a profit target of 8% to 10%. They must also adhere to strict risk management guidelines, including a maximum daily loss and overall drawdown. To determine whether a trader is suitable for management funding, this stage aims to assess the trader’s ability to generate consistent profits while maintaining discipline and effective risk control.

Phase 2

A lower profit target, typically around 5%, is the target at which the trader enters Phase 2 after completing Phase 1. To ensure the trader maintains trading discipline, risk management rules remain in effect. By simulating real market conditions, this two-step process finds and selects traders who have the self-control and expertise necessary to manage a real account with the allocated funds.

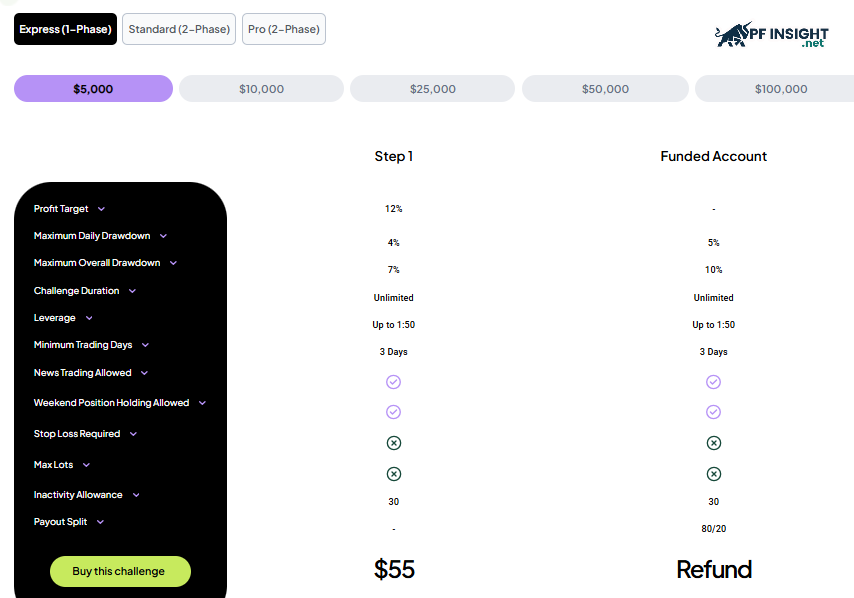

Express (1-Phase)

The Express Account offers traders a one-step approval process for those looking to access capital quickly. With reduced approval times, traders can focus on their trading performance. Key features of the Express Account include quick approval times, clear requirements, and greater trading flexibility.

- No fixed rules: Traders are free to work at their own pace and are not bound by trading frequency or style.

- Weekly Payouts: Profit withdrawals, more flexibility and rewards are advantages for profitable traders.

- Fast Access: The Express Account is specially designed for confident, low-risk traders who want instant access to directly funded trading.

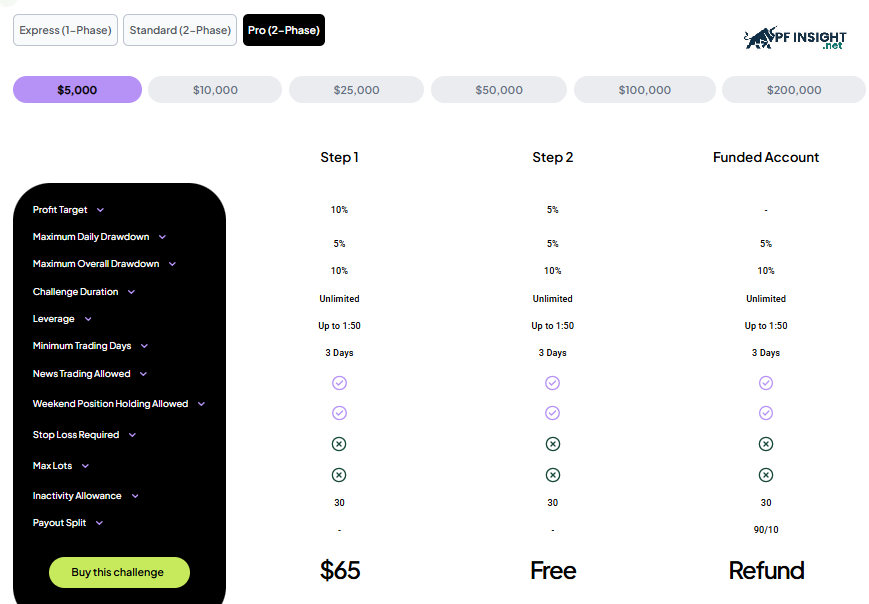

Pro 2-Phase Challenge

The Pro 2-Phase Challenge is for experienced traders who can use sophisticated strategies and perform effectively in a real market environment. This program more closely simulates real trading conditions by combining a two-phase structure with more detailed rules.

- Allowed to trade on news: Traders have more freedom in implementing strategies as they are allowed to hold positions on important news events.

- Weekend Trading Allowed: This challenge is perfect for trend and position traders because, it allows keeping positions open over the weekend.

- Higher Profit Target: The trader’s ability to produce consistent results under more difficult circumstances will be tested when the profit target is set at 10%.

Scaling strategy

Through its scaling program and evaluation model, thePropTrade provides traders with an easy-to-use yet effective path to capital. The process begins with a two-stage evaluation, which includes reasonable profit targets and realistic trading conditions. Only disciplined traders with good risk management skills are allowed access to real capital accounts through this strategy.

After passing the assessment, traders will receive funding of up to $200,000 and have the opportunity to grow if they continue to make profits. thePropTrade offers traders maximum flexibility in their trading strategy and style by allowing news trading, holding positions over weekends, and no minimum trading days required, unlike many other companies that have strict limits.

Instant funding options are available on thePropTrade for traders who want to accelerate their journey. With low fees and 1:100 leverage available on all accounts, this program is more accessible and attractive to a wider range of traders.

thePropTrade Trading Platform

TradeLocker, an advanced interface integrated with TradingView, powers thePropTrade, providing traders with access to a sophisticated charting toolkit and a flexible, customizable environment. From desktop, web browser, and mobile apps, TradeLocker offers cross-platform accessibility, ensuring high flexibility and a seamless user experience in any trading situation.

TradeLocker’s outstanding features:

- Supports in-depth market analysis with over 50 drawing tools and 100 technical indicators.

- With one-click trading, traders can quickly seize market opportunities thanks to simplified trade execution.

- Seamless trading experience that allows traders to manage their positions anytime, anywhere across desktop, web and mobile platforms.

- Enhanced charting and social trading features, promoting a collaborative trading environment, integrated with TradingView.

By combining an advanced, user-friendly platform with a variety of supporting tools, PropTrade creates a comprehensive trading environment that makes it easy for traders to achieve their financial goals.

Leverage, fees and trading rules at PropTrade

Trading Rules

PropTrade enforces the following principles to encourage disciplined trading:

- Profit Target: During the challenge period, must achieve 12% profit target.

- Daily Drawdown: The maximum amount that can be lost in 1 day is 4% of the initial account balance.

- Maximum Drawdown: Over time, a trader can lose up to 7% of their initial account balance.

- Minimum Days: To ensure stable trading, there must be a minimum of three trading days.

- News Trading: News trading is allowed in Express and Pro challenges but not in Standard challenges, on all difficulty levels.

- Weekend Status: Allowed to participate in any type of challenge.

- Stop Loss Conditions: Although not mandatory, traders are encouraged to apply risk control measures.

- Inactivity Rule: Every 30 days, traders are required to make at least one trade, either open or close.

Spread

To minimize trading costs, thePropTrade offers competitive and affordable spreads on many currency pairs. For example, GBP/USD is 0.5 pips, AUD/USD is 0.7 pips, NZD/USD is 0.9 pips, while EUR/USD and USD/JPY are just 0.3 pips.

Swap Fee

With 0.0 swaps on all products at thePropTrade, traders can hold positions overnight without incurring additional costs. Thanks to the transparent fee structure, traders can predict costs and adjust strategies with greater accuracy and flexibility.

Leverage

To suit different styles, PropTrade offers a variety of leverage options:

- Forex, Indices, Metals and Oil: Up to 1:50

- Cryptocurrency: Tied at a fixed 1:2 ratio

Payment options

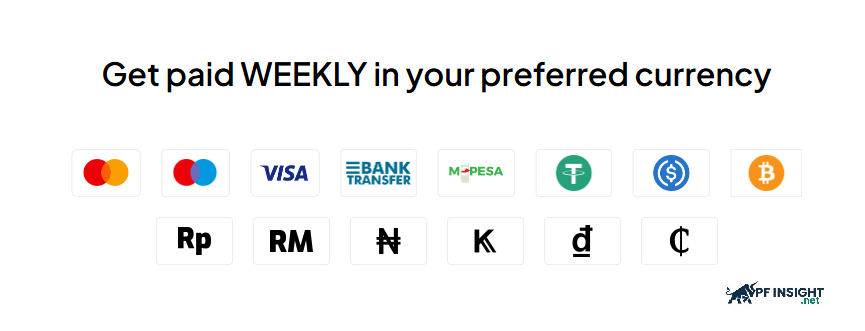

To meet the needs of international traders, thePropTrade offers a wide range of secure and practical payment options. To ensure flexibility and speed of deposits and withdrawals, users can choose from a variety of traditional and modern methods, including bank transfers (1–3 business days), Visa and MasterCard debit/credit cards (instant processing), or cryptocurrencies such as Bitcoin, Ethereum and USDT (processed within hours).

Withdrawal conditions

Sponsored traders can withdraw profits every two weeks after completing the evaluation process. Depending on performance and scalability, thePropTrade’s attractive 80% profit sharing rate can be increased to 90%. Withdrawal requests are processed quickly, usually within 1-3 business days, ensuring smooth trading.

Additionally, even small profits can be withdrawn as PropTrade has no payout threshold. This ability supports more flexible strategies and promotes active trading.

Refund Policy

Once both stages are completed and the trader receives their first payout, the assessment fee will be fully refunded. To demonstrate the company’s commitment to rewarding only top performers, the assessment fee will not be refunded if any stage is not completed.

Payment Proof

ThePropTrade pays out every two weeks, ensuring fast, transparent withdrawals of profits without any unclear terms. Many traders confirm the quick and easy withdrawal process. In addition, the company uses affiliate platforms to make its payment history public, which helps to enhance its credibility and reputation.

thePropTrade Review Is It Worth Investing?

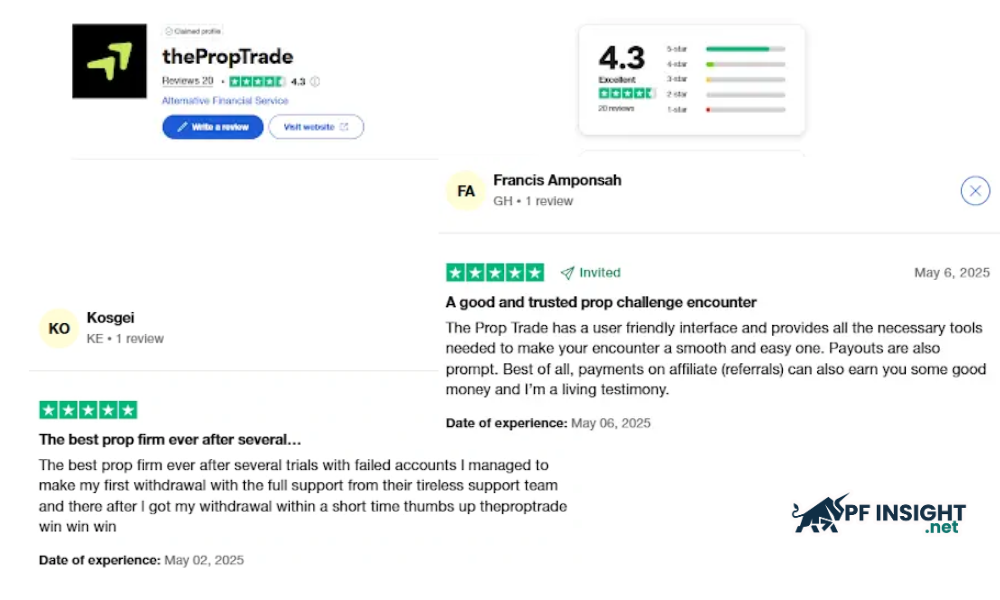

With 20 reviews and an “Excellent” rating, thePropTrade has 4.3 out of 5 stars on Trustpilot. Most users rated it 5 stars, praising its transparency, ease of use, and efficient support. The overall high level of satisfaction is reflected in the small number of feedback expressing concerns.

However, some reviews have expressed concerns about PropTrade’s lack of an office address, as well as unclear licensing and regulations. These factors have the potential to erode trust and raise doubts about transparency and the safety of customers’ funds.

Although PropTrade advertises itself as a cutting-edge, trader-focused proprietary trading firm, prospective investors and traders should still conduct their own due diligence. To ensure that their decision to partner with the firm is based on clear and accurate information, it is important to understand the firm’s operating structure, disclosure policies, and legal status.

thePropTrade Review shows that thePropTrade’s efficient funding model and trader-friendly features are helping the company strengthen its position in the proprietary trading market. The platform offers easy accessibility without sacrificing professionalism, with features such as a two-stage review process, transparent trading conditions, and affordable trial fees.