Proprietary trading firm FXIFY provides capital to traders across various asset classes, including forex, stocks, and metals. FXIFY can be an attractive option if you’re looking to start investing. But is FXIFY truly reliable and the right fit for you? Let’s take a closer look in this detailed FXIFY review.

What is FXIFY?

FXIFY was incorporated as a proprietary trading company in London, UK, in May 2023, under the legal name FXIFY Solutions Limited.

Co-founders David Bhidey and Peter Brown run the company, which aims to support professional traders through a scaling program, managing accounts worth up to $400,000. Traders enjoy an attractive 80% profit sharing, which can increase to 90% if they trade consistently.

Trading products

FXIFY offers 101 instruments covering a wide range of assets, giving investors a wide range of attractive trading options.

- Forex: 42 currency pairs including major, exotic and minor.

- Index: 13 major market indices such as S&P 500, DAX,..

- Commodities: Crude oil (WTI and Brent) and metals (gold and silver)

- Cryptocurrency: Popular coins like BTC, ETH,..

- Stocks: FXIFY offers traders 30 popular stocks, including Apple, Amazon and Tesla, and only supports MT5.

FXIFY Challenge Program

To meet the needs of traders of all skill levels, FXIFY offers exciting challenges such as instant assessments as well as one, two and three step programs.

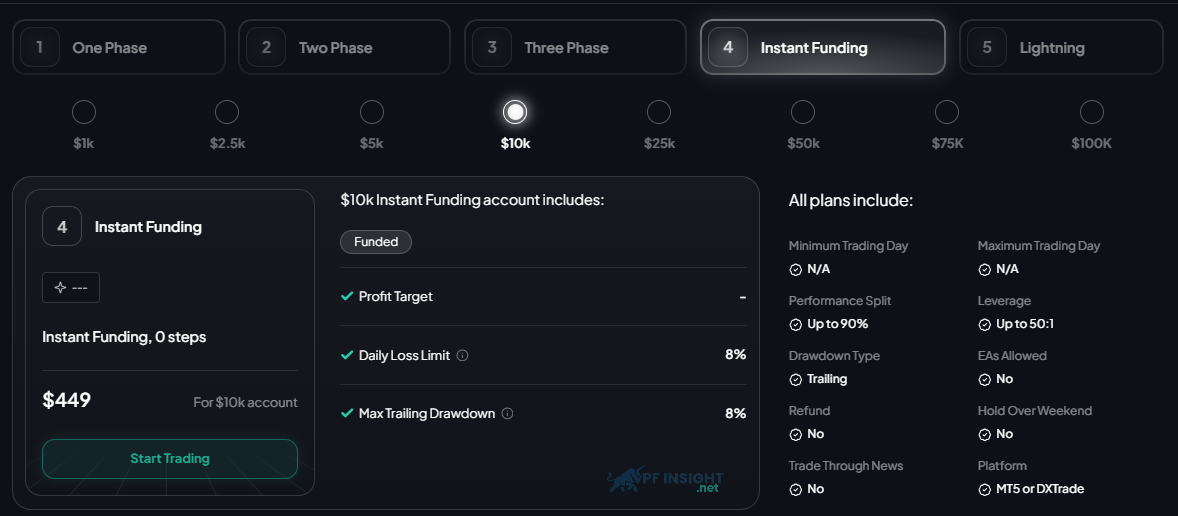

Instant Funding

With FXIFY’s Instant Funding program, you can get instant trading capital without going through an assessment process. You can start trading right away, take advantage of attractive profit sharing rates of up to 90% and withdraw your profits every 14 days.

This account is perfect for those who want to take on the challenge and start making money right away as it has a fixed drawdown of just 8%, no minimum trading days and no profit targets. It is a fast and flexible way to get funds and is best suited for traders who are confident in their trading skills.

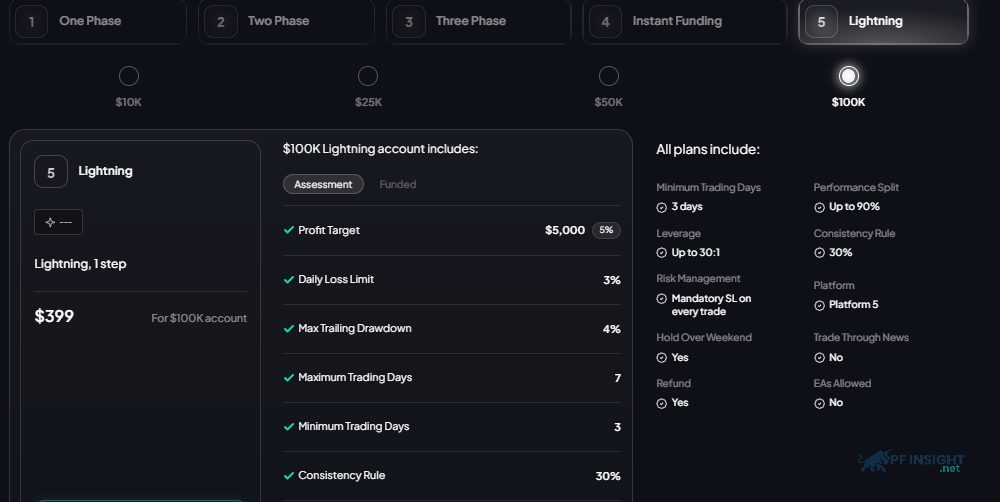

Lightning Challenge

Lightning Challenge is FXIFY’s fastest approval program, allowing traders to access capital in just 7 days. With a 5% profit target, 3% daily loss limit and 4% maximum drawdown, it is ideal for experienced traders looking to grow capital quickly while successfully managing risk.

FXIFY’s Lightning Challenge is less risky but still offers a profit share of up to 90%, as opposed to the Phase One Challenge which only requires a 10% profit. Quick profits are possible as traders can withdraw their first payout 7 days after the account is funded.

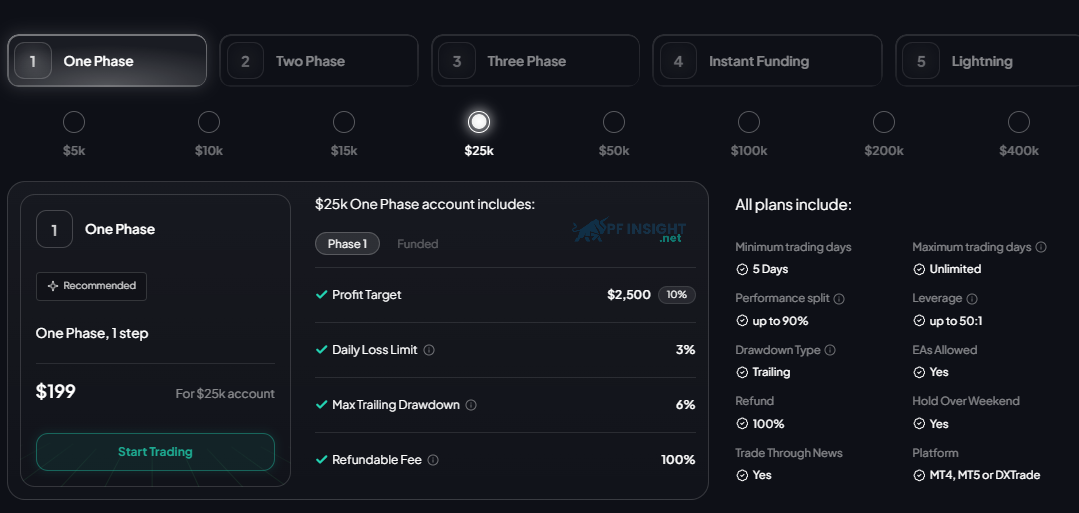

One Phase

With just one step of assessment, FXIFY’s One Stage Challenge offers a simple path to funding. You must achieve a 10% profit, limit your daily losses to 3% and withdraw no more than 6%. Unlike the Lightning Challenge, which has no time limit, this program allows you to trade according to your own strategy and trading style.

After your first trade, you have flexibility and control over your earnings as you can request a withdrawal at any time and receive up to 90% of your profits after funding.

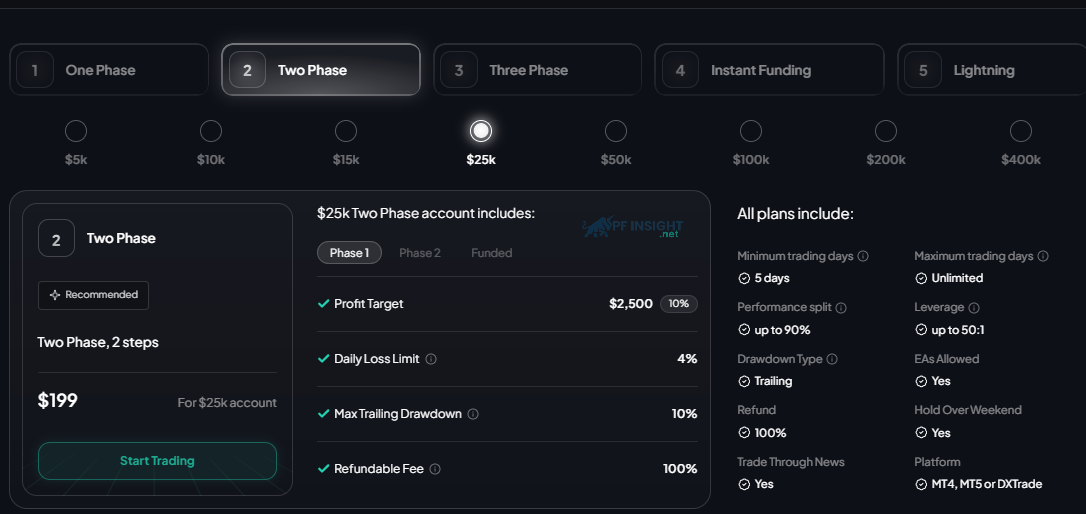

Two Phase

The two-stage challenge offered by FXIFY is a methodical assessment process that traders must complete in two stages to demonstrate consistency and risk management. While maintaining a 4% daily loss limit and a 10% maximum drawdown, you must achieve a profit of 10% in Stage 1 and 5% in Stage 2.

You can get up to 90% of your profits after completing both stages and receiving your funding. Notably, traders have the most flexibility in managing their earnings as they can request to withdraw their first profits whenever they want after their first real trade.

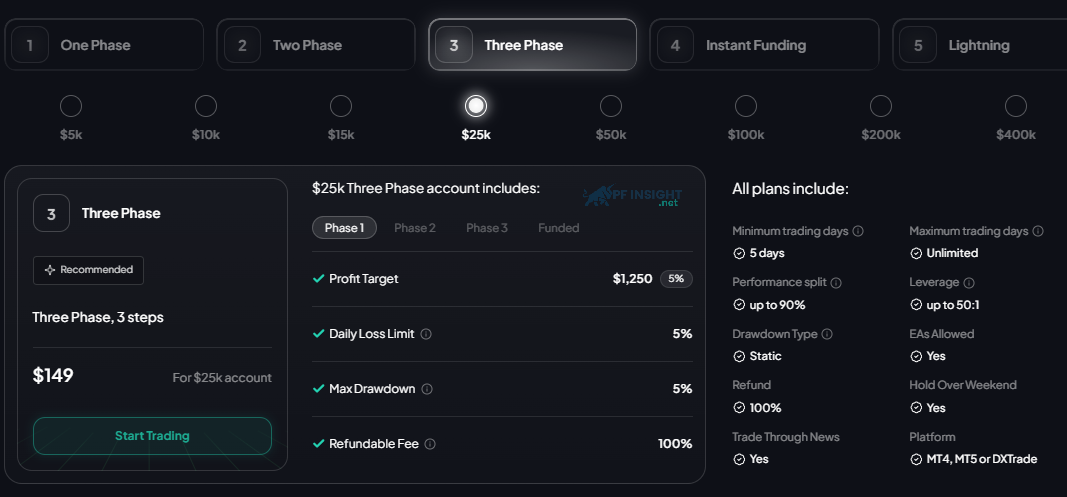

Three Phase

The Three Stage Challenge from FXIFY offers a less risky and more conservative funding path, perfect for traders who prefer to take it slow and take it easy with less pressure.

At each stage, you must achieve a 5% profit while maintaining a maximum daily loss of 5% and a maximum drawdown of 10%. With a lower profit target, you have the flexibility to adjust your approach and better control your risk.

After depositing, you will be eligible for attractive profit sharing of up to 90% and have the flexibility to request withdrawals right after your first real trade.

Additional utilities

You can improve account protection, increase leverage, increase withdrawal frequency and increase profit sharing with FXIFY’s optional add-ons. However, once the account has been funded, these upgrades cannot be changed and can only be selected at the time of initial payment.

- Higher Profit Split Ratio (+20%): Allows you to retain a larger portion of your trading profits by increasing the profit split ratio to 90/10.

- Bi-Weekly Payouts (+5%): This feature allows you to access your earnings faster by allowing for bi-weekly withdrawals instead of monthly as default.

- Performance Protection (+15%): You can withdraw the remaining profit instead of losing everything in case of violating the prescribed drawdown.

- Increased Leverage (+25%): Increased leverage of 50:1 for gold and forex gives more options when deciding on trading volume. This option is only available on MT4/MT5 accounts.

With these add-ons, you can customize your account according to your preferred payment method, trading style, and risk tolerance.

Expansion strategy

FXIFY’s expansion program is designed to encourage traders to maintain consistent performance. Your account will be boosted by 25% if you make a 10% return in the first three months, with at least two of those months being profitable. If you continue to hit similar goals after the initial increase, you can double your account size every three months.

FXIFY Prop Firm Trading Platform

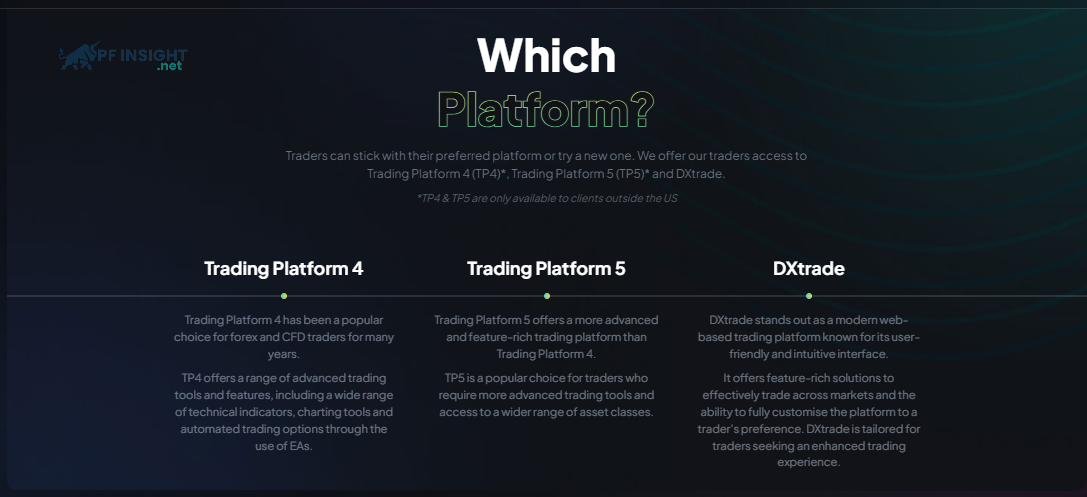

The trading experience is diversified as FXIFY supports three major platforms: MT4, MT5 and DXTrade, all of which integrate TradingView. However, the type of challenge account you choose will determine your access.

MetaTrader 4 (MT4)

MetaTrader 4 is a popular trading platform that is ideal for Forex and CFD trading due to its high level of automation and fast execution. FXIFY’s tier one, two and three accounts are compatible with MT4. For traders using Expert Advisors (EAs) as well as manual strategies that require minimal latency, MT4 is the best choice due to its superior stability, fast execution and flexible customization.

MetaTrader 5 (MT5)

An improved version of MetaTrader 4, MetaTrader 5 offers more sophisticated analytical tools, a wider variety of order types and the ability to trade on more assets. At FXIFY, MT5 supports all account types, including Lightning and Instant Funding. The platform is perfect for traders who use more effective risk management tools, trade stocks and cryptocurrencies, and need in-depth market analysis.

DXTrade and TradingView

With TradingView integrated, DXTrade offers an advanced browser-based trading platform with sophisticated technical analysis tools and powerful charting. The platform is available for FXIFY’s Trial One, Two, Three and Instant accounts. DXTrade is especially suited for traders who value a customizable workspace, indicator integration and the ability to execute trades without installing software.

FXIFY Trading Fees and Leverage

FXIFY’s flexible pricing structure gives you the choice of low spreads with per lot commissions or clear fixed fees.

Leverage

FXIFY has a maximum leverage limit of 2:1 for stocks and cryptocurrencies, 10:1 for indices, and 30:1 for forex and gold. These restrictions are intended to prevent traders from taking on too much risk when trading highly volatile assets. To give you more flexibility in your trading strategy, FXIFY offers an upgrade option during checkout, allowing you to increase your leverage to 50:1 on forex and gold for a unique 25% challenge fee.

Commission Fee

FXIFY charges a commission of $6 per lot traded on Forex, metals, indices and cryptocurrencies using a raw spread model. This model is particularly suitable for traders interested in tight spreads to minimize trading costs. The fact that FXIFY does not currently offer a swap-free account is a disadvantage and may be a barrier for Islamic or long-term traders. However, the company claims to be considering implementing this feature in the future, promising greater accessibility and flexibility for a wider audience.

Fee Spread

With a raw spread model based on FXPIG data, FXIFY offers spreads as low as 0 pips on popular currency pairs such as EUR/USD and XAU/USD, especially during the busiest trading hours in London and New York. This helps professional traders maximize trading costs. The best way to estimate actual trading costs is to use FXIFY’s demo account to monitor price movements over the trading time frame and determine whether it suits your strategy, as the company does not publish average spreads.

Payment and Profit Distribution

Payment method

Depending on the type of challenge and account size you choose, FXIFY’s challenge fees can range from $39 to $2,950.

Fees increase if you want to add features like performance protection, higher profit splits, bi-weekly payouts, or higher leverage. The cost of a $400,000 account with all the configuration options can be as high as $3,298. This allows traders to customize their accounts to suit their individual needs.

Available payment options include:

- Credit or Debit Card: When you pay, processing is instant and verification takes minutes.

- Bank Transfer: Typically takes 1 to 3 business days to process.

- Cryptocurrency: Payments with Ethereum and Bitcoin are often faster than conventional banking methods.

Each challenge fee at FXIFY is paid only once. On the first payment, FXIFY will refund the entire initial challenge fee, especially if you withdraw with profit after the evaluation period.

Payment policy

You can choose an add-on during registration to increase your base profit rate from 80% to 90% with FXIFY. As soon as you make your first profitable trade during the active trial period, you can request your first payout. For standard challenges, there is no minimum withdrawal amount, but for Instant Deposit accounts, the minimum amount is $50. This allows traders to have better control over cash flow and profit management.

Here is the payment mechanism of FXIFY:

- Initial Withdrawal: After first successful live transaction.

- Withdrawals after: Monthly, or bi-weekly if you have purchased any optional add-ons.

- Once a withdrawal request is submitted, the account will be placed in read-only mode until the funds are released, which usually takes place within 24 to 48 hours.

Single stage accounts provide more flexibility for account growth, where the maximum withdrawal amount will be returned to the account’s original balance after withdrawal.

Customer Support

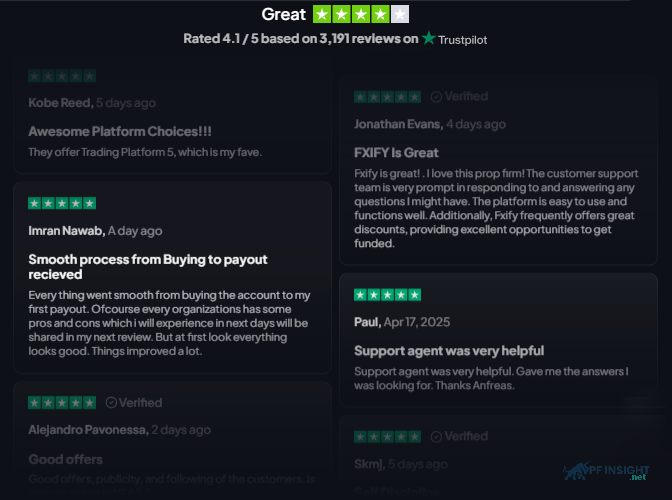

While FXIFY offers email and live chat support, user reviews show that support is not always consistent. While live chat is available 24/7, some users have complained about delays and inconsistent quality of advice. A more professional and responsive live support team would greatly improve the user experience, although their Support Center only provides basic information and a fairly comprehensive FAQ section.

FXIFY Review Is It Legit?

FXIFY is backed by FXPIG, a forex broker with License No. 014578 issued by the Vanuatu Financial Services Commission (VFSC). Being backed by a licensed entity still brings a certain level of oversight, although FXIFY is unregulated – like most other proprietary trading firms. While VFSC regulations are not as stringent as those of organisations such as the FCA (UK) or ASIC (Australia), having a license still provides an advantage, especially as many businesses in this sector are not subject to any regulatory oversight.

On Trustpilot, FXIFY has an average rating of 4.2/5 stars from over 3,621 users. Feedback is generally positive, especially regarding the fast payment process and easy-to-understand trading rules that suit traders of all levels.

Through the FXIFY Review article, we found that FXIFY is a good choice for traders who value flexibility as it offers a wide range of pricing options and account customization. However, for those looking for a simple solution, the additional costs of complex features like higher leverage or fast payouts can make this model too expensive. For those who value clarity and variety in trading, the lack of transparency in spreads and the range of markets traded is another drawback.