More and more prop trading firms are being established to support traders in accessing additional capital for trading and profit opportunities. Among them, FundYourFX – a relatively new prop firm – has recently gained attention from both the Vietnamese and global trading communities. However, alongside positive feedback, FundYourFX has also faced several negative reviews, including allegations of being a scam or failing to share profits as promised.

So what is the truth? Is FundYourFX a scam or a trustworthy platform? Let’s find out in today’s detailed review with Pfinsight.net.

What is FundYourFX?

FundYourFX is known as one of the emerging prop firm projects in the financial market. According to publicly available information, FundYourFX is a fund management company headquartered in the United Kingdom, founded in 2021.

FundYourFX aims not only to provide capital to traders as a prop firm but also to make a positive impact on the world and the community. Therefore, their profit-sharing mechanism is quite unique:

- The trader, who directly generates trading performance, receives 50% of the profit.

- FundYourFX takes 40% to operate and improve the system.

- The remaining 10% is donated to charitable organizations.

This information shows that FundYourFX is striving to build a reputation as a community-driven organization in the financial industry – something rarely seen in the profit-oriented prop trading space.

Contact Information:

- Website: https://fundyourfx.com

- Email: info@fundyourfx.com

- Phone: +44 330 551 9966

- Address: 128 City Rd, London, EC1V 2NX, United Kingdom

How Does FundYourFX Work?

With a one-time fee, FundYourFX offers traders funded accounts to start trading and earn profits. You’ll become a funded trader after completing their evaluation challenge.

Depending on the account you choose, you can access funding of up to $1,000,000. Specifically, you must register for a plan that suits your needs and pass a practice assessment before you can begin trading.

Currently, FundYourFX offers five different account types, all of which follow similar rules. Traders are required to adhere to the firm’s regulations, including:

- A weekly loss limit of 5%

- A maximum drawdown of 10%

- A mandatory stop-loss for each trade

It’s important to note that your profit target is always lower than the maximum drawdown, and it equals 10% of your maximum account balance.

After passing the practice evaluation, each account has a set maximum scaling target:

- The standard account can grow to $100,000

- The intermediate account can grow to $280,000

- The professional account can grow to $1,000,000

Larger accounts come with a 60% profit share, while the two smaller ones offer 50% – which is relatively low in the industry. Furthermore, critical information like leverage is not disclosed on their website. We attempted to contact them about this, but received no response.

FundYourFX Review – Trading Products

Unlike many other prop firms, FundYourFX currently offers traders a limited range of trading products. Upon registration, traders can access the following instruments:

- Forex: Major, minor, and exotic currency pairs with competitive spreads, fast execution, and 24/5 availability – allowing traders to deploy their strategies more flexibly.

- Commodities: Gold and a few other precious metals

- Indices: Popular indices like US30, NAS100, SPX500, GER30

- Cryptocurrencies: Major digital assets such as Bitcoin (BTC/USD), Ethereum (ETH/USD), and more

In general, FundYourFX is not an ideal choice for traders seeking a wide variety of trading instruments. The firm focuses primarily on select Forex and crypto assets, so traders looking for diversification may want to consider other prop firms offering broader market access.

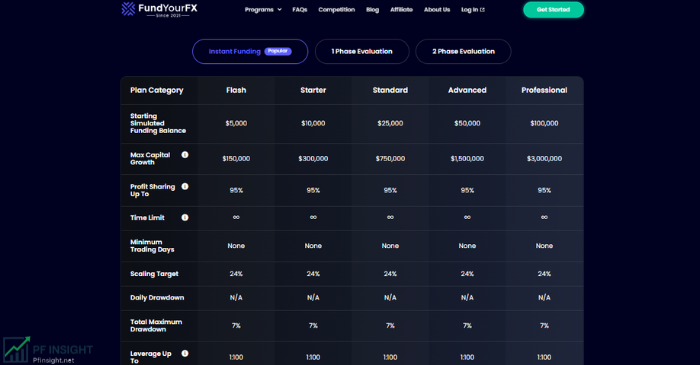

FundYourFX Review – Account Types

To meet the increasing demand from traders, FundYourFX currently offers five different account types. Here are the details:

Flash Account

- Starting Simulated Funding Balance: $5,000

- Max Capital Growth: $150,000

- Profit Sharing Up To: 95%

- Scaling Target: 24%

- Total Maximum Drawdown: 7%

- Leverage Up To: 1:100

- Account Price: $199

Starter Account

- Starting Simulated Funding Balance: $10,000

- Max Capital Growth: $300,000

- Profit Sharing Up To: 95%

- Scaling Target: 24%

- Total Maximum Drawdown: 7%

- Leverage Up To: 1:100

- Account Price: $380

Standard Account

- Starting Simulated Funding Balance: $25,000

- Max Capital Growth: $750,000

- Profit Sharing Up To: 95%

- Scaling Target: 24%

- Total Maximum Drawdown: 7%

- Leverage Up To: 1:100

- Account Price: $910

Advanced Account

- Starting Simulated Funding Balance: $50,000

- Max Capital Growth: $1,500,000

- Profit Sharing Up To: 95%

- Scaling Target: 24%

- Total Maximum Drawdown: 7%

- Leverage Up To: 1:100

- Account Price: $1,840

Professional Account

- Starting Simulated Funding Balance: $100,000

- Max Capital Growth: $3,000,000

- Profit Sharing Up To: 95%

- Scaling Target: 24%

- Total Maximum Drawdown: 7%

- Leverage Up To: 1:100

- Account Price: $3,299

Highlights of FundYourFX Accounts

- Capital Scaling: Traders’ accounts can scale up if they achieve a 24% profit target.

- Attractive Profit Split: One of the highest in the prop firm industry, with up to 95%.

- Strict Drawdown Limit: The 7% cap encourages disciplined risk management.

- Reasonable Leverage: 1:100 leverage balances risk and trading flexibility.

FundYourFX offers a wide range of account types with scalable capital from $5,000 to $100,000, making it suitable for traders at all levels. However, the entry costs are relatively high compared to other prop firms, so traders should carefully weigh the costs, expected performance, and the firm’s reliability before registering.

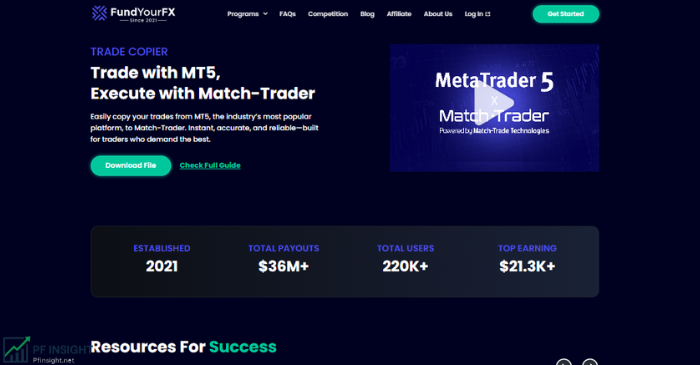

FundYourFX Review – Trading Platform

Instead of offering its own platform, FundYourFX partners with reliable brokers to provide traders access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5) – two of the most widely used platforms globally.

MT4 is known for its user-friendly interface, fast execution, and customizable features for indicators and trading bots (EAs).

MT5 is a more advanced version offering multiple timeframes, faster data processing, and comprehensive analytics – ideal for experienced traders.

FundYourFX also supports mobile trading via MT4/MT5 apps for iOS and Android, allowing traders to manage trades on the go.

However, since FundYourFX works with multiple brokers, trading conditions such as spreads, latency, and execution quality may vary. Traders should research the assigned broker carefully, as some accounts may have different leverage or trading costs.

FundYourFX Review – Deposits & Withdrawals

FundYourFX offers a wide range of flexible and secure payment methods, optimized for convenience across regions. Traders can deposit or purchase accounts using:

- Credit/Debit Cards (Mastercard, Visa)

- Bank Transfers

- E-wallets: Neteller, Skrill

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT

All transactions are processed securely – usually within minutes to a few hours – using SSL encryption, ensuring maximum protection of personal and financial data.

However, in some cases, it may take several days to a full week for FundYourFX to approve and transfer funds to a trader’s account. This is one of the major complaints regarding FundYourFX, with some accusing the firm of deliberately delaying or withholding withdrawals.

Once traders meet the minimum criteria and verification policies, they are allowed to withdraw their profits (up to 95%) using the same methods as deposits. Most withdrawal requests are processed within 1 to 3 business days, and most payment channels do not incur additional withdrawal fees.

Keep in mind that withdrawals are only allowed if the trader has met specific profit-sharing requirements for their account type, including hitting the profit target and complying with trading rules.

FundYourFX Review – Customer Support

To support traders effectively, FundYourFX provides multiple support channels, including:

- Live Chat on their website

- Support Email: support@fundyourfx.com

- Quick Contact Form

- Social Media: FundYourFX is present on Facebook, Twitter, and Telegram for updates and community support

However, many users have reported that FundYourFX’s response time is slow and delayed. Some traders also claim that the support team does not fully resolve issues or provide sufficient transparency. This is a significant concern traders should consider when deciding to invest with FundYourFX.

FundYourFX Review 2025 – Final Observations

While FundYourFX has several advantages – such as flexible profit withdrawals, no time limit on evaluations, and multilingual support – traders should also pay close attention to the following limitations:

- Limited Asset Offerings: Most available instruments are cryptocurrencies, with very few Forex pairs, indices, or commodities. This can be challenging for traditional market traders.

- Low Initial Profit Split: New traders start at just 50% profit sharing and must meet specific targets to earn up to 95%. This is lower than many competitors that offer 70–80% from the beginning.

- Basic Referral Program: While there is a referral option, FundYourFX lacks multi-tier affiliate structures or commission boosts. Many traders expect this to improve in the future.

Conclusion

From this comprehensive FundYourFX Review, it’s clear that while the firm offers some appealing trading conditions, there are also notable concerns beneath the surface. Most critically, FundYourFX does not provide any information about its regulatory licenses or security policies – a major red flag for many traders.

We hope this review helps you gain a clearer perspective and make an informed decision about whether to invest with FundYourFX. Be sure to explore more prop firm reviews on our website to compare options and choose the most suitable platform for your trading goals.

Good luck, and successful trading!