Funded Trading Plus is an ideal choice for those looking to enter the professional trading world without committing a large amount of capital. With clear policies, attractive profit splits of up to 90%, and competitive pricing, this platform is gaining increasing attention. In this review, we will Funded Trading Plus Review the company’s key features and advantages to help you determine whether Funded Trading Plus is the right brokerage firm for you.

What is Funded Trading Plus?

Funded Trading Plus (FT+), established in 2021 in the United Kingdom, aims to help talented traders grow their trading careers by providing professional tools and access to substantial investment capital.

The company evolved from Trade Room Plus, a reputable live trading room for retail traders that began operations in 2013. FTP Ltd is a registered International Business Company (IBC) in Saint Lucia, ensuring the legal foundation for Funded Trading Plus.

Funded Trading Plus is owned by Simon Paul Massey along with a team of Wall Street and London professionals, brokers, data analysts, and liquidity providers. The platform has now expanded its presence to over 165 countries worldwide.

Trading Rules on Funded Trading Plus

Rules of trading style

Regardless of whether the trader is in the evaluation phase or has already been funded, he is not allowed to hold opposing positions on multiple accounts. As this behavior is considered cheating, the account may be closed without refund. The purpose of this rule is to prevent systematic abuse and ensure fairness for all participants.

Rules for using Expert Advisors

Expert Advisors (EAs) are allowed in Funded Trading Plus programs. The use of arbitrage strategies, which exploit price differences between markets or brokers, is prohibited for EAs. This practice is considered unfair in the context of proprietary trading.

Policy on the Possibility of Holding orders on Weekends

In most programs, Funded Trading Plus typically allows traders to hold positions over the weekend. With the exception of the Master Trader Program (Instant Deposit), the program automatically closes simulated positions on Fridays at 9:30 PM GMT (4:30 PM EST). While this is a program-specific rule, Funded Trading Plus’ policy is quite flexible, and non-compliance will not result in account closure.

Stop loss request

Funded Trading Plus gives traders the freedom to manage risk in the way that best suits them by not requiring them to use stop loss orders in their trading program. This policy is especially beneficial for experienced traders who use alternative strategies to control losses and protect capital effectively without the need for traditional stop loss.

Funded Trading Plus Review Program and Evaluation

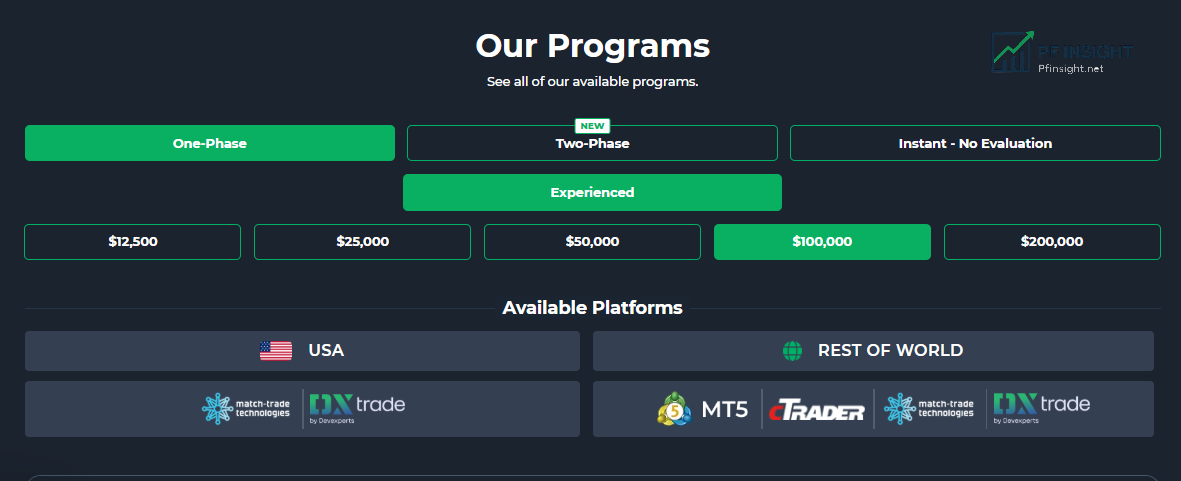

Types of Evaluation

- One-stage: One-step evaluation process.

- Two Phases: Two distinct phases of model evaluation.

- You can trade instantly with simulated money using the new Instant Trading – No Review feature, skip the review step.

The program levels of Trusted Trader, Experienced Trader, Advanced Trader, Master Trader and Master Trader are also available through Funded Trading Plus. This tiered model is designed to meet the unique requirements and experience levels of each trader.

The “FT+ Trader” stage, which follows the standard framework used in the programs to be assessed, represents the successful completion of the assessment.

Funded Trading Plus Trading Program

Prestige Trader Program

With a two-stage review account and a static withdrawal mechanism that fixes maximum loss limits based on initial balance, the Prestige program makes it easy for traders to manage and predict their trading risks.

Profit target

The profit target in Phase 1 is 10% of the initial capital, and the profit target in Phase 2 is an additional 5%. In both phases, there must be at least three profitable trading days and a daily profit of at least 0.5% of the account balance. Now, these phases do not have to be consecutive, giving you flexibility.

Trading conditions

Longer-term strategies benefit greatly from the Prestige program’s ability to hold positions over weekends and without stop-loss orders. Furthermore, Funded Trading Plus does not impose any time limits on completing the evaluation or using the FT+ Trader account, as long as you continue to participate in at least one simulated trade for 30 days.

Escalation Plan

The program’s expansion plan stipulates that traders must generate a 20% return to qualify for the capital increase. Traders must meet several requirements to qualify for this capital increase, including a minimum number of profitable trading days, withdrawing funds from the FT+ Trader account at least once, remaining active for at least two months, generating a 20% return when needed, and continuing to generate a 20% return on the current balance.

Experienced Program

The Experienced Trader program, for experienced traders, includes a one-stage test (FT+ Trader stage) that assesses trading skills in a context very similar to real market conditions.

Profit target

The profit target is 10% of the initial capital. To achieve this target, the trader must not lose more than 6% of the initial balance or more than 4% of the previous day’s balance.

Trading conditions

Since there is no limit to the number of days of simulated trading required to complete the assessment, traders are free to practice the strategy to their ability. However, the account must be used for at least one simulated trade every 30 days to remain active.

Expert Advisors (EAs) are allowed, no minimum trading days are required, stop-loss orders are not allowed, and positions can be held over weekends. The maximum simulated leverage that can be used is 30:1.

Profit distribution and withdrawal

You will split the initial simulated profits 80/20 at the start of the FT+ Trader phase, with 80% going to you. Once you reach 20% simulated profits, this can increase to 90/10, and once you reach 30%, this can increase to 100/0.

You can start withdrawing simulated profits from the first day and continue withdrawing every 7 days. Except for bank fees or currency conversion fees, FT+ does not charge any fees, and the minimum withdrawal amount is $50.

Every time you increase your simulated profit in your FT+ Trader account by 10%, you can request an upgrade to the next simulated account level, which is part of the program’s explicit upgrade program.

Drawdown Lock

A notable feature is that the maximum loss will no longer be determined using accumulated losses after the FT+ Trader account has earned more than 6% of the initial balance. The new maximum drawdown will be the total current balance, which will better protect trading results.

Advanced Program

The Advanced Trader program has two evaluation stages before moving to an FT+ Trader account. Stage 1 requires a 10% return, and Stage 2 requires a 5% return.

Trading conditions

This Funded Trading Plus program applies 1:30 leverage and has no time limit, just like other FT+ programs. However, the withdrawal restrictions are stricter – maximum 10% of total balance and 5% per day.

Trading Rules

Requiring a stop loss order for each trade is an important rule. Furthermore, holding orders over the weekend is prohibited, which may limit some long-term trading strategies.

Escalation Plan

To qualify for account equity increase, the Escalation Plan requires a 20% profit. This plan is suitable for traders who prefer clear rules, are willing to adhere to mandatory stop-loss orders, and do not hold positions over the weekend, as the Advanced Trading Program has two review periods and strict withdrawal limits. Additionally, short-term swing trading styles are best suited to the 20% profit target.

Premium Trader Program

The Premium Trader program has two evaluation periods before moving to an FT+ Trader account. With its flexible design and favorable trading conditions, the program is especially suitable for traders using strategies based on the smart money flow concept.

Profit target

Phase 1 and Phase 2 of the program require simulated returns of 8% and 5% respectively, assuming that the allowed drawdown limit is always met. With a daily cumulative loss limit of 4%, a maximum cumulative drawdown of 8%, and a relative drawdown, the program offers traders a reasonable balance between risk and flexibility.

Withdraw profits

After activating your FT+ Trader demo account, you have 7 days to request your first withdrawal. Withdrawals are made every 7 days, with a minimum amount of $50.

Trading conditions

The daily drawdown is 4%, the relative drawdown limit is 8% and the profit target is 8% in stage 1 and 5% in stage 2. This program of Funded Trading Plus allows holding orders overnight or on weekends without stop loss.

Escalation Plan

Every time you achieve a simulated profit of 10% in your Funded Trading Plus account, you can increase your account equity by 10% according to the expansion plan, up to a maximum of $2.5 million. The conditions are to have the required ending balance, no open positions, achieve the required profit and continue to achieve 10% profit at the current level. Each application will undergo a strict risk control process for evaluation.

Master Trader Program (Instant Capital)

With the Master Trader program, you don’t need an assessment period and can receive money immediately. This is a great option for traders who want to earn money right away.

Profit target

Set a simulated profit target of 5%. Using the simulated drawdown of 5%, risk management will adjust this target to the highest equilibrium point.

Order holding regulations

Holding orders over the weekend is prohibited, all Funded Trading Plus trades will be automatically closed on Friday at 9:30pm GMT. However, this rule is quite flexible and violation will not result in your account being locked.

Other trading conditions

The use of EA is allowed. The maximum volume of the simulated lot depends on the available margin. Depending on the asset, the maximum simulated leverage of 30:1 may vary.

Profit distribution and withdrawal

Starting with a simulated 80/20 profit split, traders can request withdrawals on the first day and then every 7 days thereafter. $50 is the minimum withdrawal amount and FT+ does not charge any fees other than bank or conversion fees, if applicable.

Escalation Plan

This package offers a scaling simulation package of up to $5,000,000. You can request a daily upgrade when your ‘FT+ Trader’ account reaches 10% of the simulated profit. Note that scaling does not cause a drawdown, it only increases the simulated buying power.

Elimination of Drawdown Trailing

The 5% depreciation will stop when the simulated profit target of 5% is reached. The initial balance will be converted to the least loss point.

Experienced Trader Program

During the FT+ Trader phase, traders can request an account upgrade every time they achieve an additional 10% of simulated profit. If they purchase the Advanced Add-on, the program allows for a simulated capital upgrade of up to $5,000,000. The upgrade does not reduce the drawdown, but it increases the purchasing power. Upgrades can only be requested once per day, and all requests are subject to a risk assessment.

Prestige Trader Program

After earning an additional 20% simulated profit during the FT+ Trader phase, the trader can request an increase in the profit share ratio.

The eligibility criteria are a minimum number of profitable days, a minimum required profit level, at least one withdrawal, an account that has been active for at least two months, a 20% profit level on the closing balance, and the ability to continue earning a new 20% profit level at the current level. All requests for share rate increases are subject to a risk assessment, and these levels cannot be ignored.

Advanced Trader Program

To grow sponsored accounts, the program requires a profit target of 20%. However, the program does not provide exact details on the frequency of expansion or the amount of capital raised at each stage.

Premium Trader Program

Each time a trader makes an additional 10% profit, they can increase their account size up to a maximum of $2.5 million. FT+ Trader accounts need to reach the target balance, have no open positions, reach 10% of the closing balance, and reach an additional 10% of the current level to qualify. No thresholds can be missed, and all requests must pass a thorough risk assessment.

Master Trader Program

In simulation, traders can increase their account size to $5,000,000 with this program. Once your FT+ Trader account reaches 10% of the simulated profit, you can request a daily expansion. Your simulated buying power increases with the expansion, but your current capital level remains the same.

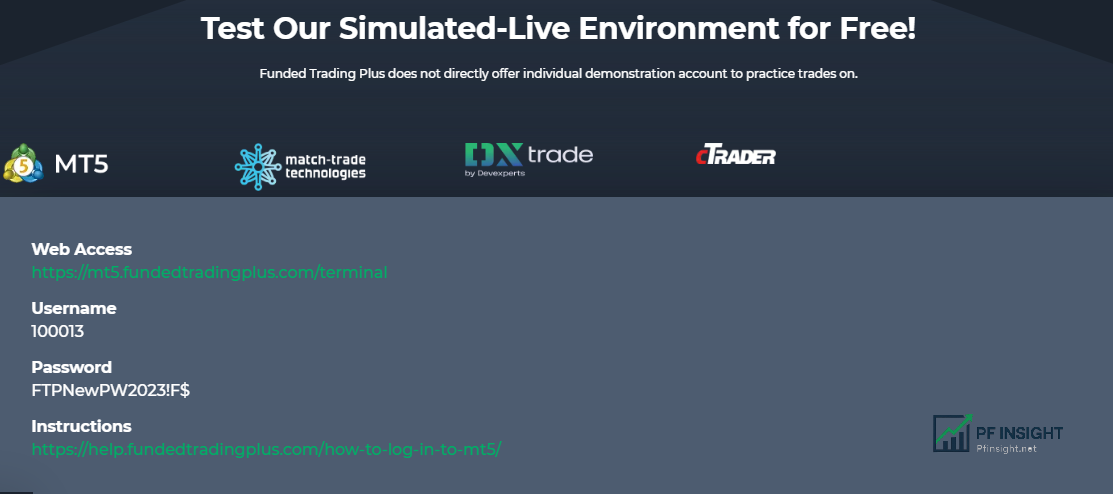

Trading Platforms on Funded Trading Plus

Funded Trading Plus supports several trading platforms for participants:

- MetaTrader 5 (MT5): One of the most widely used trading platforms in the world is MT5. Both beginners and experienced traders can benefit from MT5’s great flexibility and wide range of asset support, making it suitable for a wide range of strategies from short-term to long-term.

- Match-Trader: This platform is compatible with desktop, mobile and web platforms, integrates TradingView charts, real-time market data, access to signal providers and the option of a demo or live account.

- DXtrade: DXtrade’s online trading platform is accessible from any device and offers sophisticated risk management features such as market routing limits, pre-trade validation, and customizable trading hours.

- cTrader: Algorithmic trading, automation, copy trading, advanced orders, third-party signals, market analysis tools, and risk management are just some of the powerful features that cTrader offers. The platform offers flexible access via web browser, mobile, and desktop.

Payment Options

There are currently many payment methods. For both participation fees and profit withdrawals, Funded Trading Plus accepts many payment options, such as bank transfer, cryptocurrencies, and other flexible methods.

Fee payment methods are similar and include credit/debit cards such as Mastercard and VISA. Additionally, you can customize the payment frequency to 3, 5 or 7 days, depending on your personal needs.

Customer Support

Funded Trading Plus’ support team is always available to answer any questions about the platform, deposits or account setup. Traders can contact them via email at info@fundedtradingplus.com or by phone at +44 333 090 9800.

In addition to traditional contact methods, Funded Trading Plus also offers support via social media such as Facebook, Instagram, and Twitter. Answers to frequently asked questions can be easily found on the FAQ page. With quick responses and a friendly community, the Discord channel is a great source of support.

In summary, traders looking for access to a wide range of programs, flexible regulations, and attractive capital growth potential should consider Funded Trading Plus. The platform stands out for its active community and dedicated support. Traders should research each program thoroughly to choose the program that best suits their strategy and goals.