Funded Next, a global trading company, is gaining popularity for its trader-centric strategy. With tens of thousands of users worldwide, the company offers flexible funding options and comprehensive support resources. So, is Funded Next the right platform for your trading strategy and goals? Today’s Funded Next Review will take a detailed look at the company’s policies, offers, and services.

What is Funded Next?

Funded Next, an international proprietary trading company based in the UAE, was founded in 2022 and is owned by NEXT Ventures, headed by Syed Abdullah Jayed. Eightcap, an Australian Securities and Investments Commission (ASIC) licensed brokerage, is the platform’s partner, ensuring safety and transparency for users.

Funded Next targets a diverse clientele with different investment philosophies. Directly funded accounts can be opened through the platform’s two flexible funding models. From the first demo evaluation stage, traders will benefit from unlimited retries, profit sharing of up to 90% and 15%.

Trading products

By providing traders with access to 83 financial markets across 4 major asset classes: Forex, indices, commodities and cryptocurrencies. Funded Next supports the diversification of effective trading strategies.

- Forex: 50 currency pairs including major, exotic and minor pairs.

- Index: 18 major popular indexes in the market such as US30, NAS100, SPX500 and GER40,..

- Commodities: 5 items (precious metals and energy)

- Cryptocurrency: 10 most traded coins such as BTC, ETH, LTC,…

Funded Next Challenge Program

The two main challenge models that FundedNext offers are Stellar and Stellar Lite. Stellar Lite uses a 2-step evaluation process, while Stellar allows for 1 or 2-step evaluation.

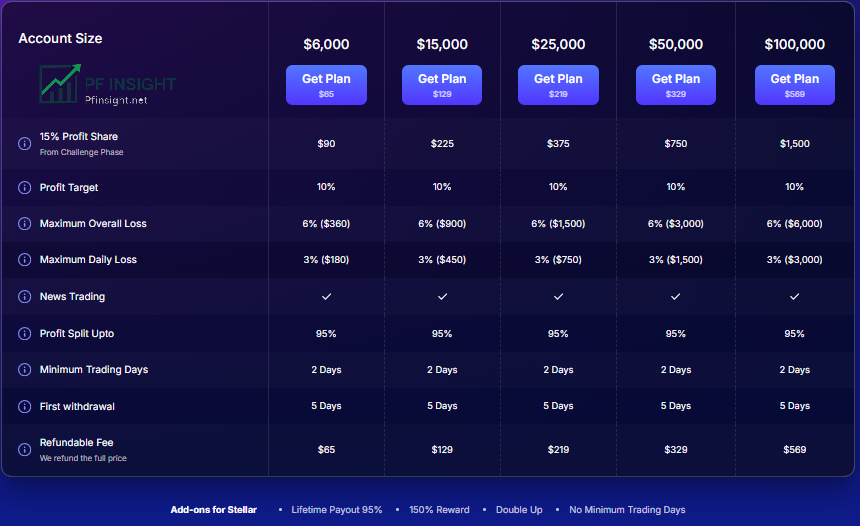

Stellar One Step

Stellar One Step is Funded Next’s most basic challenge model, requiring traders to achieve a 10% profit target, 6% total profit, and a 3% daily withdrawal limit. Even during the challenge, there is no time limit for completion, you will still receive 15% profit from the first day. This model is perfect for experienced traders who want to speed up the evaluation process and get an instant funding account.

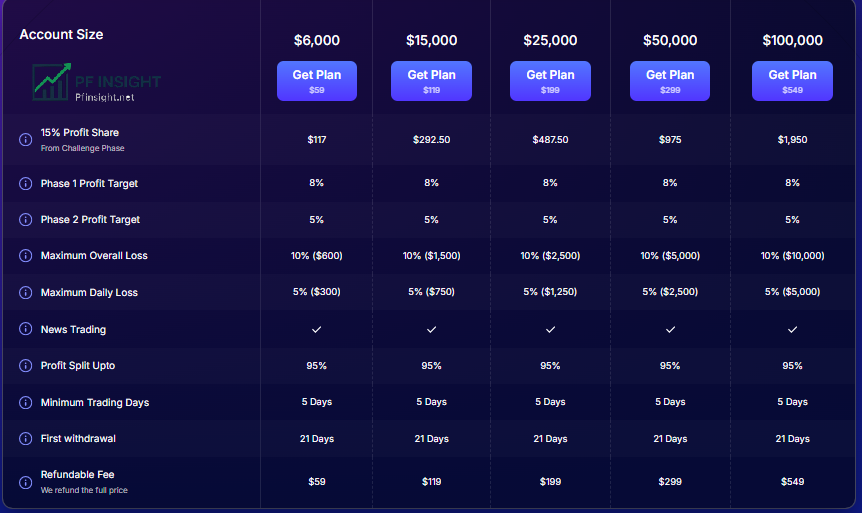

Stellar Two Step

Funded Next’s Stellar Two Step Challenge allows traders more time but requires an additional verification step. The maximum loss to be achieved is 10% and the daily loss limit is 5%, along with two profit targets of 8% in Stage 1 and 5% in Stage 2. This model is suitable for those who value consistency and stability over speed. Similar to the One Step model, you are not limited by the time to complete each step and still receive 15% profit share throughout the challenge.

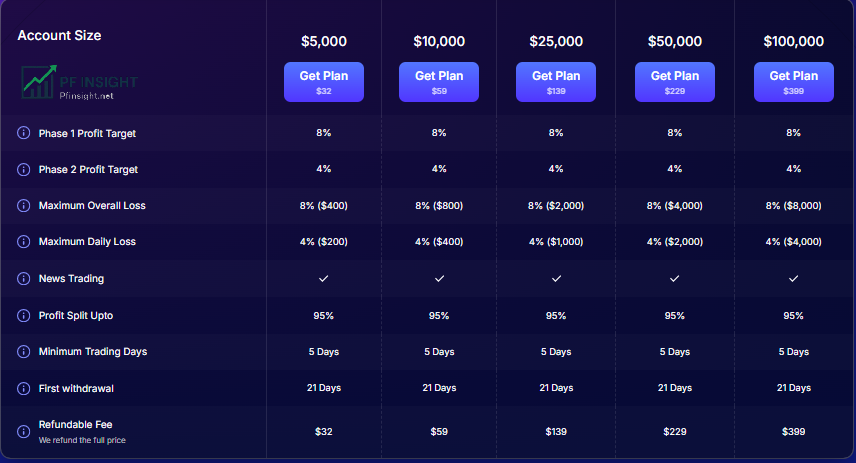

Stellar Lite

Funded Next’s least expensive option is Stellar Lite, with fees starting at just $32. This two-step rating model is similar to Stellar Two Step, but with stricter requirements: Return targets of 8% and 4%, respectively.

During the challenge period, there is no profit sharing, but once you pass, you will receive up to 95% of the profits from the funding account. Additionally, Stellar Lite offers benefits such as bi-weekly payouts and increased loss limits, ideal for those who want to start with flexibility without having to spend too much money.

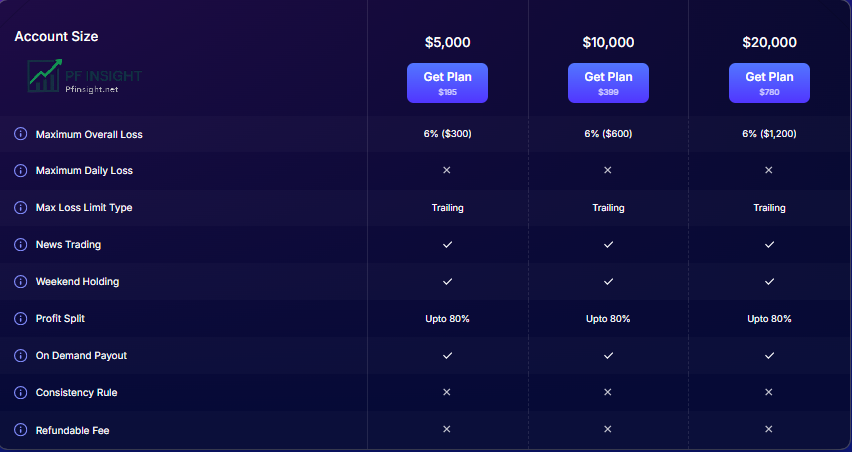

Stellar Instant

Stellar Instant offers instant access to a funded account without any hassle or evaluation period. This model is for experienced traders who are confident in their abilities. Stellar Instant allows for on-demand payouts and has a 6% loss limit. However, Stellar Instant’s participation fee is non-refundable, unlike other models.

Challenge Add-Ons

You can customize the challenge to your own needs with Funded Next’s optional add-ons. For an additional 20% fee, the “Unlimited Minimum Trading Days” is one of the most popular add-ons.

This option is available to all accounts in Stellar Lite and accounts under $25,000 in Stellar One Step and Two Step. If you want to complete the challenge quickly without having to maintain multiple consecutive trading days, this is the perfect option.

For a 25% fee, Stellar Lite traders can increase their overall loss limit to 10%, providing more flexibility when trading in volatile market conditions than other models. You can also opt for the “95% Lifetime Reward” upgrade, which comes with a 30% fee and applies to all models and account sizes, if you want to get the biggest profit share right away.

While the cost may add up, these add-ons will help traders with a clear strategy overcome obstacles more easily and adapt.

Funded Next Futures

Funded Next recently introduced a dedicated futures trading service, allowing US traders to trade directly on the company’s platform and put their skills to the test. Prices for a $100,000 account start at just $129 and go up to $449.

With extremely competitive spreads and commissions, leverage can be up to 1:100. Funded Next’s strong liquidity platform from partner Eightcap ensures a more seamless and efficient trading experience for users.

Funded Next offers attractive profit sharing, up to 95% after funding and 15% during the challenge period. For traders who want to access their funding account quickly and efficiently, the evaluation method used is the one-step challenge.

Expansion strategy

Funded Next launches the Expansion Plan for traders who have demonstrated consistently high performance for four months. Account size will be increased by up to 40% for eligible traders, with a maximum capital allocation limit of $4 million.

To ensure transparency and fairness in the selection process, the eligibility requirements for participation in this plan include specific performance standards:

- Account growth of at least 10% for 4 consecutive months.

- Minimum two interest payments within a 4 month period.

- The most recent trading cycle must be profitable.

- Traders’ accounts will be checked and their balance may be increased by 40% if they meet these requirements.

Funded Next Trading Platform

Funded Next offers access to 4 popular platforms:

MetaTrader 4

MT4 is a popular platform that stands out for its support of a wide range of EAs and technical indicators. It is an ideal choice for forex, commodity, and index traders. Additionally, users can build automated strategies using the MQL4 programming language.

MetaTrader 5

More order types and indicators are among the many tools and features that make MT5 a more modern trading platform than MT4. In addition to an integrated economic calendar to keep track of market news, the platform also supports automated trading through EAs written in MQL5. The ability to connect to TradingView enables in-depth analysis and charting.

Traders will be unable to access TradingView for a while as the platform is not ready for the system update. However, once restored, you will be able to trade using MT5 as usual and access TradingView directly from the Funded Next dashboard.

cTrader

cTrader is a user-friendly trading platform that supports complex order types and transparency through Level II market depth pricing, designed specifically for manual traders. The platform is available flexibly on mobile, web, and desktop. However, cTrader users are required to pay a platform fee of $10.

Match-Trader

As a browser-based trading platform, Match-Trader is designed to be fast, easy, and installation-free. With a modern, user-friendly interface, the platform is ideal for those who want to trade on the go or are frequently on the go.

Match-Trader offers all the features a trader needs, although it lacks some of the more complex tools found in MT5 or cTrader. The best part is that, unlike cTrader, Funded Next does not charge any additional platform fees.

Funded Next Transaction Fees

Funded Next has been conducting business through its own brokerage, FNmarkets, since May 2025. Instead of relying on external brokers like Eightcap previously, all order execution and spreads are managed directly through FNmarkets.

Spread

While Funded Next does not publish its spreads directly on its website, FNmarkets offers accounts a clear and transparent spread model:

- Standard Account: Spreads from 1.5 pips, no commission

- ECN Account: Spreads from 0.0 pips, $6 commission per trade

- Cent Account: Spreads from 1.5 pips, no commission

These options offer better price control and order execution, which is especially beneficial for traders who receive funding from FNmarkets.

Commission Fee

Depending on the challenge model, the commission will be different:

- Stellar 1-Step & 2-Step: $5 for Commodities and Forex per Lot

- Stellar Lite: $7 for commodities and forex per lot

Cryptocurrencies and Indices: No Commissions for Any Type of Challenge

Payment options

Deposit and withdrawal

Funded Next accepts a variety of payment methods, mainly cryptocurrencies such as Bitcoin, Ethereum, USDT, and USDC. Users can also use other convenient payment systems such as Apple Pay, Google Pay, and AstroPay, as well as e-wallets such as PayPal and Skrill.

- USDT (TRC20): Min $20, Max $4,999

- USDT (ERC20) and USDC (ERC20): Min $50, Max $4,999

- RiseWorks: Minimum $50, with processing fees up to 3%

- TC Pay (For Iran Customers Only): Min $20, Max $5,000

Funded Next allows traders to choose the payment method that suits them and does not charge withdrawal fees. Typically, withdrawal requests are processed within one day. Any withdrawals under $20 will be rolled over to the next payment cycle.

Payment Rules

- Regardless of the amount requested, the payment transaction fee is the same for all methods and can be up to 3%.

- Monthly, biweekly or weekly

- Via direct transfer or stablecoin

- Minimum withdrawal amount is $100.

- Average payment speed is 5 hours (guaranteed under 24 hours).

Customer Support

Funded Next offers 24/7 customer support via live chat and email. In addition to providing a detailed FAQ section that answers most user queries, the chatbot system works efficiently and quickly answers common questions. Additionally, you can contact Funded Next on social media platforms such as Facebook, Instagram, YouTube, Discord, and Telegram.

However, the system sometimes results in broken links and limited question coverage. Response times via email and chat can be slow, but sponsored traders receive Pro Support, which allows them to connect directly with the in-house technical team for more in-depth and efficient support.

Is Funded Next Review reputable?

As Funded Next is an educational institution rather than a stockbroker or financial institution, it is exempt from regulation by the financial regulator. Funded Next has an excellent Trustpilot score of 4.6 from over 2,700 reviews, indicating their high credibility. Traders should do their due diligence before participating to ensure Funded Next is a good fit for their needs and risk tolerance.

In conclusion, Funded Next is a Propfirms platform that is gradually asserting its position in the international trader community thanks to its flexible business model, attractive profit sharing mechanism and comprehensive support services. Both beginners and experienced traders can benefit from Funded Next’s diverse challenge options, diverse trading platforms and transparent scaling mechanism. To ensure efficiency and safety, thorough research is required before joining, as with any other platform.