FTMO Fund is a long-standing funding company that seeks talented traders who can generate consistent returns while managing risk. This FTMO Review will help you understand the FTMO challenge process, trading goals, participation costs, and how to assess your abilities before receiving funding.

What is FTMO?

FTMO is the oldest Prop trading company in the Czech Republic. The fund started its operations in 2020 with the goal of providing capital to professional traders. FTMO stands out for its transparent evaluation process, which consists of two stages: challenge and verification.

With an average settlement time of just around 8 hours, FTMO currently processes over 6 million orders per month for traders from over 180 countries.

FTMO has won the Deloitte Technology Fast 50 award for three consecutive years and has been featured in Forbes magazine. They use an assessment process that includes the FTMO Audit and Challenge stages. Once passed, traders will be able to manage accounts of up to $400,000 at FTMO Proprietary Trading.

FTMO Review Challenges When Participating

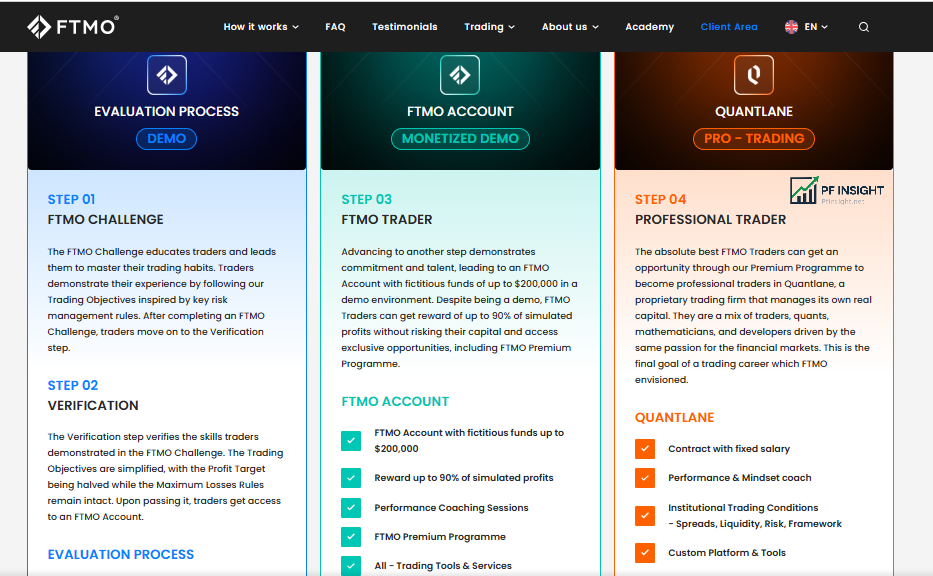

Evaluation Process

You must pass 2 rigorous rounds of competition to be sponsored by this fund and become a professional trader of FTMO.

Step 1: FTMO Challenge

All accounts can participate in the FTMO Challenge for up to 30 days. Traders must complete the set trading goals during this period. You will be transferred to the next stage, if you reach the profit target before the deadline and follow the rules.

The challenge requires a one-time payment, with additional costs based on the size of your desired account. Once you pass the assessment, there will be no additional fees for the Verification stage and the FTMO Trader program.

Note: When you become a sponsored trader, FTMO will refund your challenge fee through the first portion of the profit you receive.

Step 2: Verify

You will not be charged any additional fees to move to the Verification stage after completing the FTMO Challenge. However, 10 consecutive trading days is still the minimum required. Therefore, to reach your profit target, you need to trade at least 10 days within a 60-day period. After the Verification process, you will be invited to join FTMO as a sponsored trader.

Step 3: FTMO Trader

After completing step 3, you officially become a FTMO sponsored trader. The company’s real account will be connected to your account. With the usual profit sharing ratio of 80:20, you can withdraw 80% of the profit directly to your personal bank account.

Free to repeat FTMO challenge

Traders will receive a new FTMO Challenge for free if they complete the Verification stage or FTMO Challenge without reaching the Profit Target but strictly adhere to the risk limits (such as Daily Maximum Loss and Total Maximum Loss) and achieve a profit of even $0.01. In the proprietary trading industry, this is an attractive benefit, giving traders more opportunities to demonstrate their skills without incurring additional costs.

FTMO account size

FTMO offers a variety of challenge accounts, mainly Normal mode, with different risk levels, including 10,000, 25,000, 50,000, 100,000 and 200,000. Depending on the capital size, the participation fee can range from 89€ for a 10,000 account to 1,080€ for a 200,000 account.

Trading Objective

The account type (Fixed or Flexible), currency, and initial account balance are used to determine the trading target in the FTMO Challenge. Specifically, the maximum loss during the challenge is 10% of the initial balance, and the maximum daily loss is limited to 5%. Meanwhile, the profit target is 10% of the initial account balance.

Trading Platform

With live data feeds from top liquidity providers, FTMO offers all clients MT4, MT5, DXtrade and cTrader trading accounts, ensuring high quality and accuracy.

FTMO sets itself apart from other Prop Firms with a number of standout features. Live MetriX is a remarkable tool that provides in-depth analysis of each trader’s trading performance. The Trading Journal tool also helps traders grow more sustainably by tracking progress and customizing strategies over time.

Through the FTMO Academy, the fund establishes a solid educational foundation, equipping traders with the skills needed to succeed in the financial markets. Among the many useful resources provided are in-depth information on financial instruments such as stocks, commodities and forex, as well as basic trading knowledge.

In addition, by setting risk limits and closely monitoring trading goals, FTMO’s Mentor app helps traders develop their discipline. FTMO provides traders with a professional learning environment where they can continuously improve their strategies and achieve long-term success in the financial markets with the support of performance coaches and a comprehensive system of educational tools.

Trading assets

FTMO offers a diverse portfolio of trading instruments, ideal for traders looking to diversify their portfolio. Traders can choose from a wide range of markets, including stocks, commodities, forex, indices and many other asset classes.

FTMO offers a versatile platform that caters to a wide range of trading options, suitable for a variety of investment strategies and styles, whether you want to trade popular currency pairs or explore highly volatile assets.

Account Types

FTMO Fund currently offers traders the following 2 main account types:

- FTMO Account: Choosing this type of account will help you avoid holding positions overnight or over the weekend, as well as avoid trading on news. The maximum leverage for the account is 1:100, ideal for traders who want high leverage.

- FTMO Swing: This low risk account type allows trading during news events and holding positions overnight or over the weekend. The maximum leverage of FTMO Swing is 1:30

Since both FTMO account types are available as demo accounts, traders can practice without risking real money. With flexible pricing ranging from $10,000 to $200,000, traders can choose from FTMO Challenge packages to suit every experience level and personal financial goals.

Offering a wide range of services to meet the different trading requirements of the modern financial market, FTMO is the perfect platform for both inexperienced and experienced traders.

During the first and second stages of the FTMO Challenge, you are free to trade whenever there is an important economic news release. After passing, if you have a valid and active FTMO account, you must exercise extreme caution when trading during news periods. Regular account restrictions will not apply if you use the FTMO Swing account type to trade news.

Cost of participation

You will be required to pay an initial fee to become a FTMO Funded Trader. This fee will be refunded through your first profit if you complete the three steps and receive funding. However, if you wish to restart a new FTMO Challenge after failing the assessment steps, you will be required to pay this fee again.

The chosen trading account balance and the chosen risk level are the two main factors that determine the fee structure. Fees will be calculated and paid in the currency corresponding to the region you live in.

Risk Level: Normal

- Account 10,000: Fee 139.50

- Account 25,000: Fee 225.00

- Account 50,000: fee 310.50

- Account 100,000: Fee 486.00

- Account 200,000: Fee 972.00

Risk Level: Aggressive

- Account 10,000: Fee 225.00

- Account 25,000: fee 310.50

- Account 50,000: Fee 486.00

- Account 100,000: Fee 972.00

As can be seen, the cost of entering the aggressive risk level is also equivalent to the next highest level in the standard risk option and FTMO does not offer a $200,000 account.

FTMO Fund Withdrawal Method

FTMO distributes profits to traders every month 30 days after the first trade on a live account. However, you can request to withdraw profits earlier. You can request to withdraw profits after 14 days from the start of trading, instead of waiting for the full 30 days.

You do not need to achieve any profit target when trading on FTMO’s real account. You will receive a portion of the funds based on the commitment ratio as long as you are profitable. FTMO will still take profits according to the profit sharing ratio as usual if you choose to keep all profits to expand your account and do not request a withdrawal.

Customer Support

FTMO provides customer service through multiple channels, including live chat, phone, WhatsApp at +420 910 920 310 and email support@ftmo.com.

FTMO’s support team is available via live chat and email 24/7. Phone support is available Monday to Friday, 9am to 5pm CEST. Furthermore, FTMO caters to clients from many countries by providing services in 18 different languages. Clients can also make an appointment to meet in person at FTMO’s office in Prague, Czech Republic.

Should I join FTMO fund?

For forex traders, FTMO is the perfect proprietary trading company. The vetting and verification process is designed to be clear and transparent. Many traders trust FTMO because of its reasonable entry fees and support for well-known trading platforms.

FTMO seeks talented traders and provides funded accounts with attractive profit sharing rates from 80% to 90% of their profits.

The downside of the fund is that it is not directly regulated by major financial institutions. However, to prevent fraud, FTMO closely monitors the activities of the team and the behavior of traders. The platform ensures the safety and transparency of accounts and transactions by strictly adhering to internal security protocols. Profits are carefully distributed using a variety of safe and reliable payment methods.

Participation in any funding program, including FTMO, involves risk. Traders must strictly adhere to the rules set out in each evaluation stage. If you violate the loss limit or fail to achieve the profit target, you may lose your initial participation fee. Therefore, careful preparation and effective risk management are extremely important.

Advantages of FTMO fund

- Is a long-standing fund trading company in the market.

- Traders can try the feature on a demo account.

- Numerous metrics are available on the dashboard interface to help traders analyze their trading performance.

- Diversified portfolio

- 80% to 90% of trader profits are distributed through profit sharing.

- Once the trader completes the review process and makes money with the funded account, the fee will be refunded.

- Many fiat currencies and cryptocurrencies can be traded.

- High level of transparency about account types, rules and fees

Disadvantages of FTMO fund

- Higher return target than some other funds.

- The exam fee is also a bit high.

- No supervision

Article by https://pfinsight.net/ FTMO Review. It is found that FTMO has become one of the leading proprietary trading companies, providing traders with a great opportunity to practice their skills without using personal capital, minimizing financial risks and focusing on actual trading performance. Before joining, you should carefully study the company’s rules to ensure safe trading.