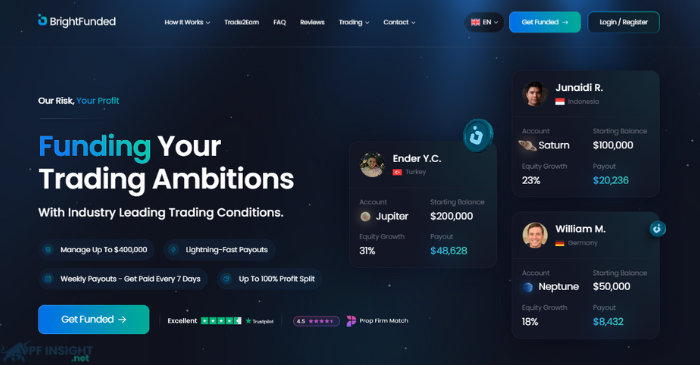

The proprietary trading industry is growing rapidly, with new firms constantly entering the market to provide traders with access to funded capital. Among the latest contenders gaining attention is BrightFunded, a relatively new prop firm that has captured the interest of aspiring traders thanks to its bold marketing approach and compelling funding programs. However, with an increasing number of firms launching, it becomes essential to evaluate whether BrightFunded is a trustworthy and reliable platform – or just another short-lived venture.

In this BrightFunded Review 2025, we will dive deep into BrightFunded’s funding structure, rules, payout systems, trading conditions, and additional trader perks. Our goal is to help you determine whether BrightFunded is worth your time, trust, and capital.

About BrightFunded

Launched in 2023, BrightFunded is a relatively new proprietary trading firm that offers traders access to funded accounts of up to $400,000. The firm allows traders to execute trades across various instruments through its proprietary platform. It is currently headquartered in Dubai and Amsterdam, and is led by CEO Jelle Dijkstra. Despite its short operational history, BrightFunded has quickly built a positive reputation for professionalism, fast payouts, and a streamlined trader experience.

BrightFunded Review – Funding Programs

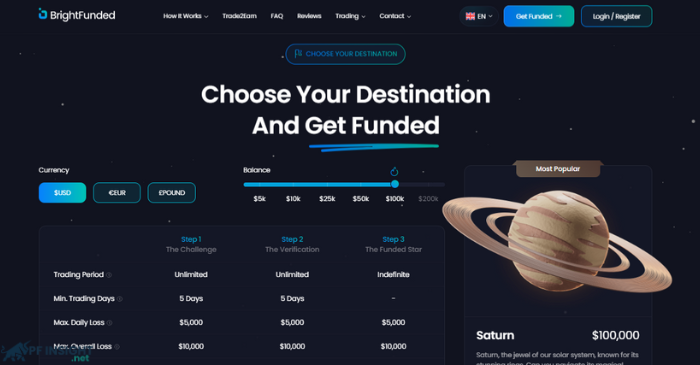

BrightFunded offers a single two-step evaluation program, with account sizes uniquely named after planets in the solar system. This creative approach gives a distinctive identity to each tier of funding.

- Time Limit: Unlimited

- Minimum Trading Days: 5 days required in each phase

- Maximum Drawdown: 10%

- Daily Drawdown Limit: 5%

- Phase One Profit Target: 8%

- Phase Two Profit Target: 5%

Once a trader completes both evaluation phases, they become eligible for a funded account. The first profit split payout can be requested 30 days after the first trade on the funded account. After that, payouts are issued bi-weekly.

The default profit split starts at 80%, but can increase to 90% and even 100% as traders progress through the firm’s scaling plan. Traders also have access to optional features like instant bi-weekly or weekly payouts and early access to a 90% profit share under certain conditions.

BrightFunded Review – News Trading Rules

BrightFunded grants traders significant freedom to trade around news events during the evaluation phases. However, once traders reach the “Funded Star” account phase, stricter rules apply.

Traders are prohibited from placing any market orders, stop losses, take profits, limit orders, or stop orders within five minutes before or after a major scheduled news release. For example, if a high-impact news release is scheduled for 12:30, no such orders are allowed between 12:25 and 12:35.

Violating this rule is considered a soft breach, meaning the trader will not lose their funded account, but any profits generated from trades during the restricted window will be forfeited and non-refundable.

However, trades that remain open for more than 48 hours are exempt from the news restriction, providing flexibility for swing traders and long-term strategies.

BrightFunded Review – Scaling Plan

BrightFunded offers an unlimited scaling opportunity, allowing traders to continually grow their accounts without an upper limit.

Each funded account is evaluated every four months, starting from the first trade. During this period:

- The trader must generate a minimum of 10% profit over four months.

- They must be profitable in at least two of the four months.

- The trader must have received at least two payouts during the evaluation period.

- The account must have a positive balance at the time of the scaling request.

Once these conditions are met, the account balance is increased by 30% of its initial value.

With each successful scale-up, the profit split also improves:

- After the first scale-up, it increases to 90%.

- After the third scale-up, it reaches 100%, allowing traders to keep the entirety of their profits.

BrightFunded Review – Symbols & Trading Costs

BrightFunded offers a wide range of trading instruments, catering to the diverse needs of retail and professional traders alike. Their platform supports trading in:

- Forex

- Indices

- Commodities

- Metals

- Cryptocurrencies

The trading conditions are generally favorable. Spreads on Forex pairs are competitive, and trading fees are remarkably low – only $3 per lot. Even better, indices can be traded without any commission fees, making them an attractive option for traders who frequently engage in index speculation. The diversity and affordability of tradable assets make BrightFunded a suitable choice for various trading styles and strategies.

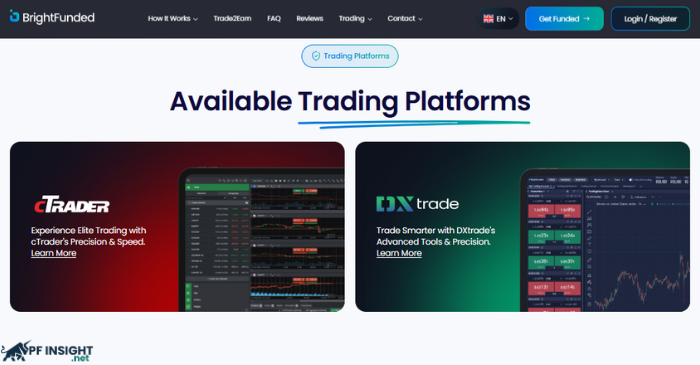

BrightFunded Review – Trading Platforms

At present, BrightFunded only offers access to its proprietary trading platform. This platform combines the visual and user-friendly aspects of TradingView with features similar to cTrader, creating a modern and streamlined trading experience.

However, one notable drawback is the frequent disconnection issues, which some users find frustrating. BrightFunded has explained that these disconnections are intentional for security reasons, and many users have expressed understanding, appreciating the firm’s focus on safety.

That said, there’s good news ahead. BrightFunded has officially announced that cTrader will soon be supported, which is a significant upgrade. cTrader is widely recognized for its advanced charting tools, intuitive interface, and efficient order execution – making it one of the most respected platforms in the CFD trading world.

BrightFunded Review – Trader Dashboard

While BrightFunded’s trader dashboard is relatively basic compared to top-tier firms, it is well-designed and highly functional. It may lack in-depth PnL charts or detailed statistical breakdowns, but it provides all the essential information a trader needs, including:

- Real-time trading history

- Evaluation progress tracking

- Account metrics and rules

The clean interface and focus on usability ensure that traders can easily monitor their performance and stay compliant with evaluation rules.

BrightFunded Review – Customer Support

Customer support at BrightFunded is one of its strongest features. The live chat function is the fastest and most effective way to get help. Support agents are:

- Highly knowledgeable

- Responsive

- Polite and professional

In addition to live chat, traders can also receive community-based assistance through Discord, where BrightFunded’s moderators actively engage with users, answer questions, and maintain a supportive environment.

BrightFunded Review – Trade2Earn Loyalty Program

To further enhance trader engagement, BrightFunded offers a unique loyalty program called Trade2Earn. This initiative rewards traders with tokens for every trade, whether it results in a win or a loss.

These tokens can be redeemed for a range of benefits, including:

- Increased profit share

- Higher challenge fee refunds

- Relaxed drawdown limits

- Reduced evaluation phase profit targets

- Free or discounted evaluations

The tokens accumulate automatically as traders continue trading, adding an extra layer of motivation. While it’s important to maintain a focus on profitability, the Trade2Earn program provides a welcome bonus for active and disciplined traders.

BrightFunded Review – Conclusion

BrightFunded is a promising new entrant in the prop trading space, offering competitive funding options, fair evaluation conditions, and generous profit splits. Its commitment to unlimited scaling, a clear and fair evaluation model, and a 90 – 100% payout structure gives serious traders a real opportunity to grow capital with consistent performance.

The low trading fees, solid customer service, and diverse product offerings make BrightFunded accessible and attractive to both new and experienced traders. Its Trade2Earn loyalty program is also a refreshing innovation in an increasingly competitive market.

However, traders should be aware of a few downsides – particularly the limitations of the proprietary platform, which is prone to disconnection issues, and the basic trader dashboard, which lacks detailed analytics. That said, the upcoming integration with cTrader could resolve many of these technical concerns and greatly enhance the user experience.

If you’re a trader seeking a reliable, growth-oriented prop firm with flexible rules and strong support, BrightFunded is certainly worth considering in 2025. Just make sure you understand the platform’s current limitations and follow the trading rules closely to maximize your chances of success.

For more insights and updates, visit Pfinsight.net.