In 2025, the number of Prop trading firms is increasing, attracting the attention of new traders who want to grow without risking all their money. In this context, Alpha Capital Group stands out as an attractive option. Not only does the company offer a clear funding program, it also stands out for its flexibility in trading rules and dedicated support. Let’s explore the details in the Alpha Capital Group Review to determine whether this is the right partner for you?

Alpha Capital Group Review

What is Alpha Capital Group?

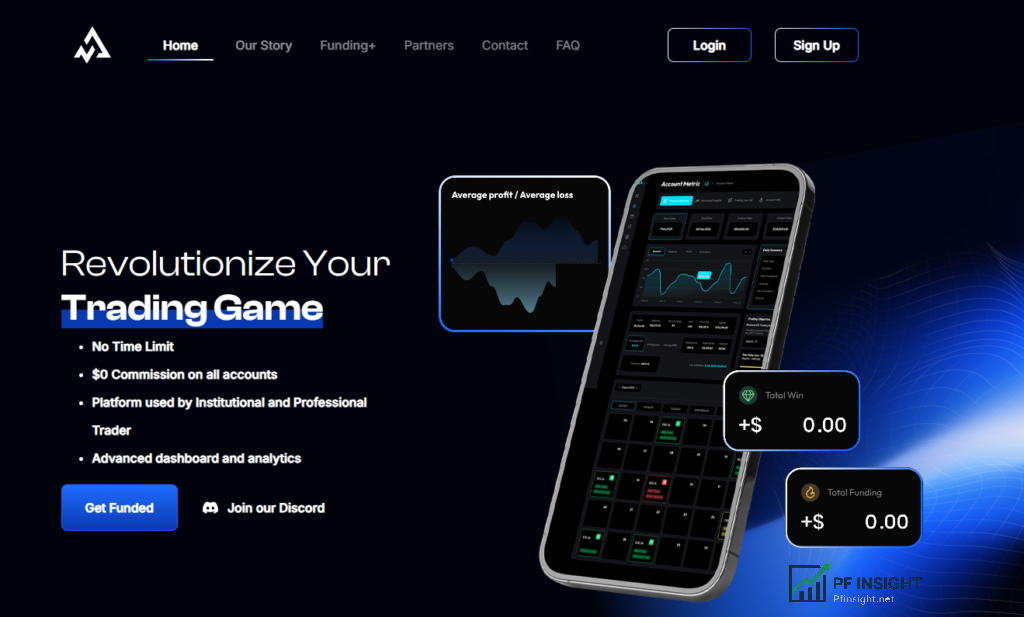

Founded in November 2021, Alpha Capital is a proprietary trading firm headquartered in London. The company launched ACG Markets, a brokerage firm regulated by the Seychelles Financial Services Authority (FSA), in April 2022.

For professional or semi-professional traders looking for reputable and flexible funding, Alpha Capital offers funding opportunities of up to $200,000 per account, with the ability to grow capital up to $2 million.

Alpha Capital’s evaluation process is flexible and has no deadlines, which is one of the company’s highlights. Thanks to this, traders can develop their own strategies according to their own capabilities.

The platform also offers a modern dashboard with comprehensive analytics to track performance and improve efficiency. In particular, the commission-free model reduces trading costs, providing a financial advantage and helping participants trade better.

Trading products

Alpha Capital Group offers participants a variety of assets:

- Forex: Major, Exotic and Minor Currency Pairs.

- Metals: Trade gold, silver with leverage that varies according to strategy.

- Index: Allows trading of stock indices and cash indices, leverage varies by account type.

- Energy: Oil with variable lever.

- Cryptocurrency: While ACG Markets may offer this service, it is unclear whether Alpha Capital Group’s funding or review accounts are directly supported.

Alpha Capital Group trading Program

Alpha Pro

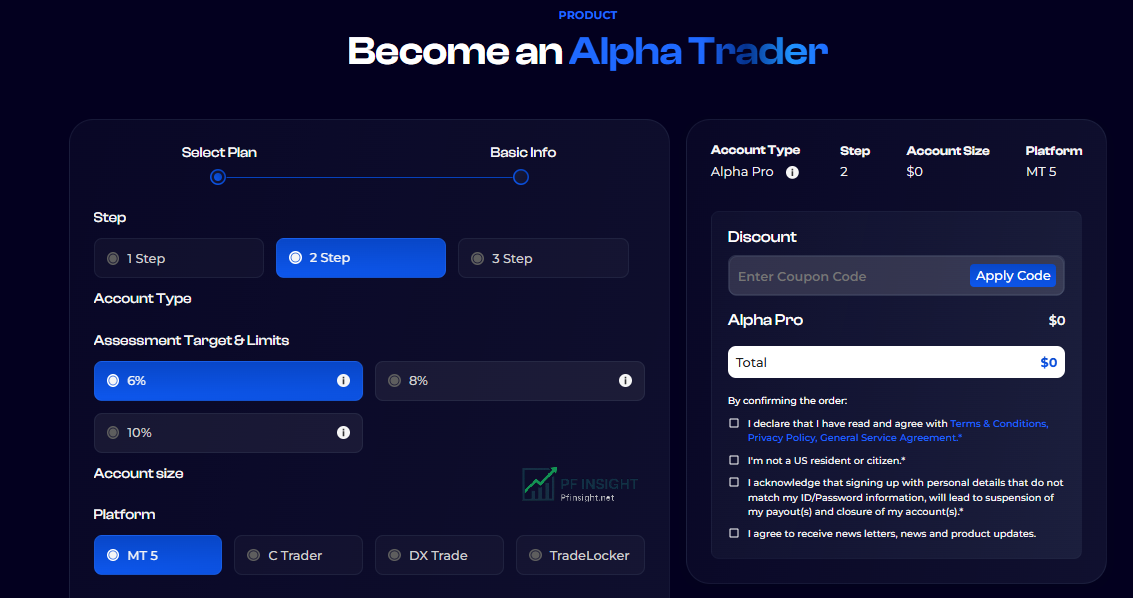

When signing up, traders can choose a Stage 1 profit target of 8% or 10% with Alpha Pro, a regular two-step evaluation package.

The target for Phase 2 is set at 5%. This plan has a daily withdrawal limit of 5% based on the balance and a static maximum withdrawal of 10%. Stability and effective risk management are ensured by requiring a minimum of 3 trading days for each evaluation period.

Maximum leverage for traders choosing the Alpha Pro package is 1:100 for Forex, 1:30 for metals, 1:20 for indices and 1:10 for oil. The ability to hold positions over the weekend during the evaluation period is a great benefit, however, Qualified Analyst accounts are not eligible for this feature.

Alpha Pro has strict time restrictions on news trading: Positions cannot be opened or closed within two minutes before or after the release of important news.

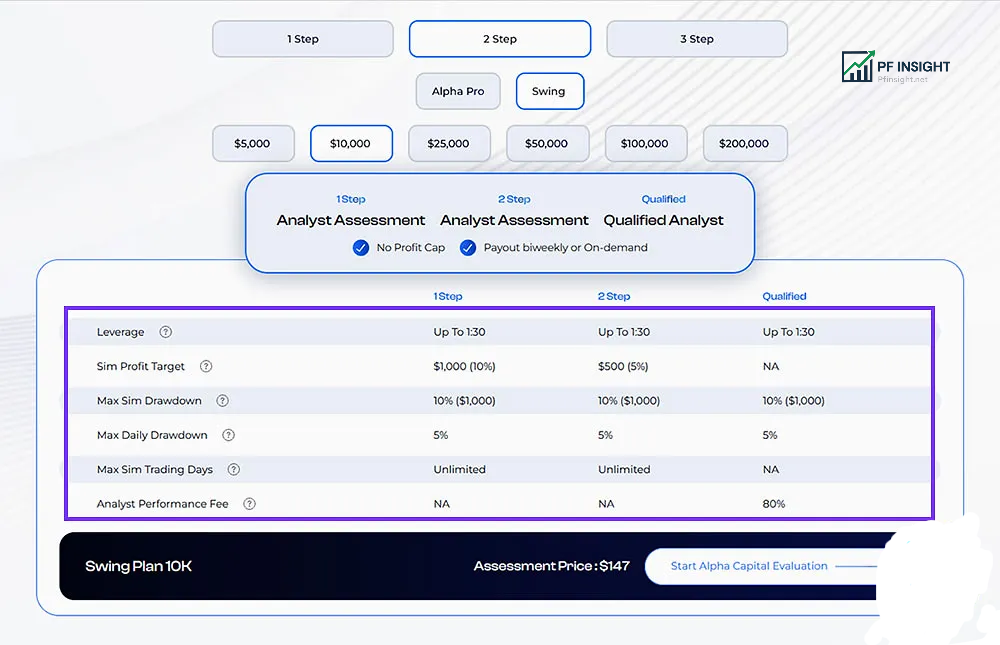

Alpha Swing

The Alpha Swing program is specially designed for traders who hold positions overnight and prefer long-term strategies.

The profit target for Phase 1 is 10% and Phase 2 is 5%. Depending on the account balance, the plan applies a daily drawdown limit of 5% and a static maximum drawdown of 10%. Each evaluation period requires at least three trading days. To comply with risk management, Alpha Swing offers leverage of 1:30 for Forex, 1:9 for metals and 1:10 for indices and oil.

The Alpha Swing package offers significant flexibility in long-term strategies by allowing swing traders to hold positions over the weekend at any given time.

Although news trading is allowed, a position must be held for more than 2 minutes to be considered valid if it is opened within 2 minutes of the news release. A professional trading environment with clear risk controls is ensured by the Alpha Swing account’s strict adherence to the prohibition of “gambling” trading behavior.

Alpha One

The Alpha One package shortens the time to access a live account by using a one-step evaluation model. Stage 1 requires the trader to achieve a profit target of 10%. Dynamically monitored, maximum drawdown is limited to 6% of the account peak.

However, the maximum daily withdrawal is 4%, determined by equity or balance, whichever is greater. The program takes at least 1 trading day to complete the evaluation.

Alpha One offers a maximum leverage of 1:30 for Forex, 1:9 for metals and 1:10 for oil and indices. Traders are allowed to hold positions at any time of the week, just like with the Swing plan. Although only 5 minutes before and after major news releases are allowed, news trading is also allowed. Another notable feature is the on-demand performance fee feature, allowing for better control over cost and profit management.

Alpha Three

Alpha Three has a 3-phase evaluation framework and targets 8% in Phase 1, 4% in Phase 2, and 4% in Phase 3.

Calculated on balance or equity, whichever is higher, the maximum daily drawdown is 4%, while the static maximum drawdown is capped at 6%. The assessment process takes at least three trading days to complete each stage.

Leverage up to 1:50 for Forex, 1:9 for metals and 1:10 for indices and oil are available with this package. You can hold positions at any time of the week, just like the Swing package. For better risk control, news trading is allowed, but only 5 minutes before and after the release of important economic news.

Expansion strategy

Alpha Capital Group offers expansion packages for funded accounts at Alpha Pro, Alpha Swing and Alpha Three, in addition to the starter packages. High-performing traders can increase their virtual capital by up to $2 million across all their expansion accounts with this expansion package, which helps promote steady growth in trading volume.

The trader must achieve a profit of 10% on the account and submit a rate adjustment request to initiate the rate adjustment process. 10% of the account’s initial balance will be used as the rate adjustment amount. However, the account must be in a drawdown period and all profits must be withdrawn, bringing the balance back to the initial level for approval.

Traders must wait at least 5 trading days after the scaling account is activated before the first Performance Fee is charged. This ensures a methodical, transparent and risk-controlled scaling process.

The maximum lot size remains the same at the first level. At the second level, the maximum lot size will increase by 10% for qualified traders.

Alpha Capital Group Trading Rules

Funding limit

Each trader at Alpha Capital Group has a maximum funding limit of $400,000, which is divided equally between the Pro, Swing, One, and Three packages. As explained, each account type will have specific guidelines regarding the minimum number of trading days, risk limits, and profit targets.

Limitationsevil strategy

Alpha Capital Group restricts certain trading strategies, particularly those that exploit irrational price movements or exploit unrealistic prices. Prohibited strategies include:

- Arbitration

- Latency Trading

- Front-running price feeds

- Exploitation of pricing errors

- High-frequency trading (HFT)

- Reverse trading or group hedging

- Order book spamming (mass placement of deceptive orders)

All transactions must be initiated by the account owner, the use of third party account management services is not allowed.

Policy sUsing Expert Advisors (EA)

Alpha Capital Group generally allows the use of Expert Advisors (EAs), but prohibits HFT trading strategies and latency arbitrage. Some users have reported issues using EAs, including being denied profit payouts. Notably, during Alpha’s monthly free trading competitions, the use of EAs is completely prohibited to ensure fairness and transparency for all participants.

Weekend order holding rules

Alpha Capital allows weekend holding. However, depending on the plan phase, there may be some exceptions. This applies especially to Phases 1 and 2 of the Alpha Pro plan, as well as Swing, One and Three plans.

Holding weekend orders is considered small for qualified professional accounts, profits may be lost, but the account remains open as long as the balance remains below the maximum withdrawal.

Trading PlatformAlpha Capital

Alpha Capital provides access to a number of platforms for its users as follows:

- MetaTrader 5 (MT5): With advanced charting tools, additional order types, and market depth capabilities, MT5, an upgraded version of MT4, is suitable for advanced trading. Accessible via web browser on Windows, macOS, Android, and iOS.

- cTrader: cTrader has an easy-to-use interface, detailed charts, and fast execution times. Both novice and experienced traders can take advantage of the platform’s many advanced features. The platform is accessible via web, Android, macOS, and Windows.

- DX Trade: This platform is built for institutions, supporting high-frequency trading (HFT), custom workflows, and advanced order types in addition to high liquidity.

- Alpha Trader: A proprietary platform that combines sophisticated TradingView charts, algorithmic tools, and a unique user interface currently under development. Built to provide the best possible trading experience. Expected to launch soon.

Payment Options on Alpha Capital

Deposit and withdrawal

Alpha Capital Group offers consumers flexibility and convenience by accepting payments via PayPal e-wallet, credit cards and cryptocurrencies.

Alpha Capital Group offers a variety of withdrawal options from funded accounts, including wire transfers (WIRE, ACH, SWIFT) and electronic payment systems such as Rise and Wise. However, due to the lack of regulatory oversight, cryptocurrency withdrawals are not supported, which is not in line with Alpha Capital Group’s strict compliance standards.

Alpha Capital Group’s processing time is quite simple: Account upgrades take 24 to 48 hours, while order execution fees typically take about 2 business days. The first order execution fee requires at least 5 trading days with a consistent strategy.

Starting 14 days after the first trade, traders are allowed to withdraw profits every two weeks. Subject to restrictions such as the “40% Best Day rule” and a minimum 2% gross profit, some plans allow withdrawals on demand.

Payment rules

The on-demand performance fee payment option is available for Alpha Pro, Swing, One and Three accounts, subject to two conditions:

- Traders must adhere to the 40% Best Day Rule

- Maintain a minimum gross profit of 2% on account balance.

Note: Traders will not be able to participate in the standard bi-weekly payment cycle if they select the on-demand payment option.

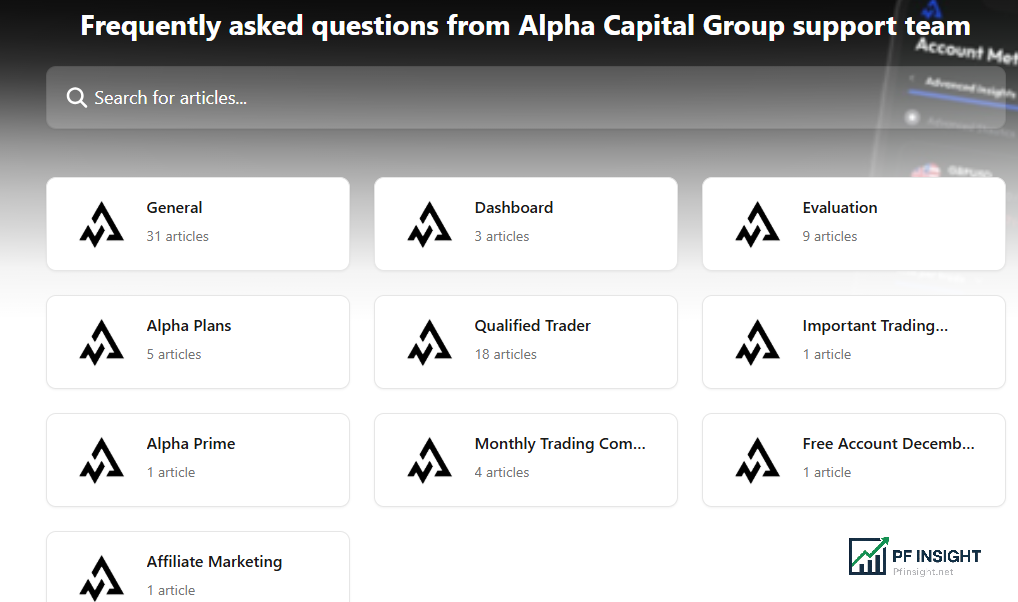

Customer Support

Alpha Capital Group’s customer support is open Monday to Friday, 8:00 to 20:00 (GMT). Live chat and Discord responses may be slower on weekends. To ensure that users receive prompt and efficient support, Alpha Capital Group offers a variety of support channels:

- Email: Info@alphacapitalgroup.uk

- Live chat: Available online (slower response time on weekends).

- Discord: For the community, the server is up and running.

- Help Center (FAQ): information on their website.

- No phone number provided.

Through the Alpha Capital Group Review, we can see that Alpha Capital Group is a worthy choice for traders who want to develop their skills and access large capital without risking their personal capital. With many flexible funding packages, reasonable leverage, transparent evaluation system and multi-channel customer support, Alpha Capital Group is gradually asserting its position in the prop trading market. However, you should carefully study the company’s policies and trading programs before participating.