In periods when the market lacks strong directional momentum, the range trading strategy becomes a useful tool for many traders. This strategy is based on the assumption that price tends to oscillate within a defined range, creating opportunities to buy low and sell high. When combined with appropriate confirmation signals, range trading can offer a stable and consistent edge.

- How to define a dealing range in trading markets with real examples

- How traders use premium and discount zones for better entries

- How smart money liquidity theory explains price movements

What is a range trading strategy?

Range trading strategy is a trading method based on identifying clear support and resistance zones where price frequently fluctuates. Traders utilize the market’s recurring reactions within these ranges to find entry points to buy low and sell high.

Unlike trend-following trading strategies that focus on clearly directional price movements, range trading exploits the recurring oscillations between fixed price levels. This method is highly effective in sideways markets, where volatility remains consistent and price behavior is relatively stable over time.

How range trading strategy exploits market volatility

To effectively apply a range trading strategy, traders need to pay attention to several key factors to optimize their trading approach and increase their chances of achieving positive results:

Recognizing price ranges in the market

In range trading strategies, identifying price ranges is fundamental to the entire trading process. Traders rely on common technical tools, including trend lines, moving averages, and technical indicators, to determine upper and lower limits where price frequently reacts. These boundaries provide clear market structure, helping traders make consistent decisions and minimize unnecessary risk.

Identifying effective entry and exit zones

Once the price range has been clearly defined, traders need to focus on selecting appropriate entry and exit points within this area. Accurately identifying trading points helps to take advantage of price reversals, while improving the effectiveness and profitability of the strategy.

By placing buy entry points near support zones and sell entry points near resistance zones, traders can enter the market at areas where price has repeatedly reacted in the past. This approach effectively capitalizes on recurring price movements within a defined range. Simultaneously, setting a reasonable exit point allows traders to lock in profits in time before the price reaches the opposite boundary of the trading range.

Integrating risk management into trading

Risk management is essential when applying a price range trading strategy. Traders need to proactively protect open positions and prepare loss-limiting plans in situations where the market breaks out of the defined range.

Risk management in range-based trading is typically achieved through stop-loss orders, intentionally placed below the support zone for buy orders and above the resistance zone for sell orders. This approach allows traders to predetermine the maximum loss for each trade, while limiting negative impacts when the market moves against expectations and breaks out of the defined range.

Top 5 effective range trading strategies

Range trading strategies offer flexible approaches for traders in the financial markets. Instead of applying a single fixed strategy, traders often adjust or combine different methods based on experience, risk appetite, and current market conditions. The popular strategies below illustrate how traders effectively capitalize on price movements within a range.

Horizontal channel trading strategy

Price channels provide a visual framework that helps traders assess price behavior and plan effective trades. They are identified from support and resistance levels based on past price movements, reflecting areas where buying and selling forces have strongly interacted. A valid price channel is formed when two parallel boundaries representing support and resistance clearly define the price range.

- Support levels: These levels act as temporary price bottoms, where buying demand outweighs selling pressure. When trading near these areas, traders have the opportunity to enter the market at favorable price points, taking advantage of price rebounds and benefiting from upward movements within the trading range.

- Resistance levels: These represent areas where supply typically prevails, creating pressure that makes it difficult for prices to continue rising. Executing sell orders near resistance levels allows traders to capitalize on repeated downward price movements and seize potential reversal opportunities in the market.

Bollinger bands trading strategy

In range trading strategies, Bollinger Bands are commonly used to analyze price volatility and the range of price fluctuations. The indicator’s structure consists of an upper band, a lower band, and a moving average, which acts as a pivot point. When the market experiences high volatility, the bands expand, and when volatility weakens, they narrow, providing important signals about price behavior within the range.

- When applying this strategy, traders monitor price behavior against Bollinger Bands to find trading signals. If the price approaches or touches the lower band, this usually indicates an oversold market, thus being seen as a potential opportunity to open a buy position.

- Conversely, when the price approaches or touches the upper band of the Bollinger Bands, the market is often considered to be in an overbought state. In this context, many traders see this as a potential signal to open a short position and expect a price correction.

Through Bollinger Bands, traders can assess market volatility and identify potential entry and exit points by monitoring the relationship between price and these bands.

Range breakout trading strategy

The range breakout trading strategy is a popular approach that helps traders capitalize on strong price movements in the market. Within the context of a range trading strategy, traders focus on observing sideways market phases where price is confined within a well-defined range. When the market has accumulated for a sufficient period, they patiently wait for breakout signals to enter trades in the direction of the new price movement.

A breakout occurs when the price exits a trading range by breaking through an upper resistance level or a lower support zone. Once these key price levels are clearly identified, traders can enter trades promptly to capitalize on strong price movements and emerging trends following the breakout.

Range breakout is built on the assumption that a move out of a sideways market reflects a significant shift in market sentiment. When price breaks through established boundaries, the likelihood of a new trend emerging often increases.

Implementing this strategy requires traders to carefully study previous price patterns, utilize necessary confirmation indicators, and apply effective risk management to balance potential profits with possible losses.

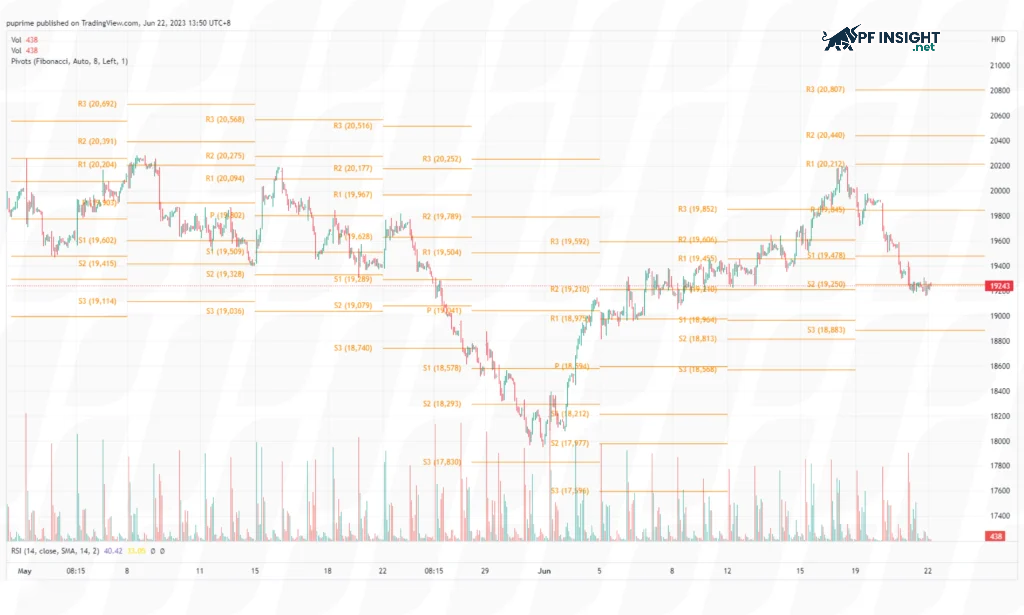

Pivot Points trading strategy

Pivot points are a popular technical analysis tool that assists traders in identifying potential support and resistance levels. This strategy provides key reference price points, making trading decisions clearer.

When applying a range trading strategy, day traders often rely on pivot points to identify key price levels. These pivot points are calculated from the previous session’s price movements and provide clear support and resistance levels.

Support levels represent price zones likely to attract buying pressure, while resistance levels indicate where selling pressure may emerge. Due to their intraday nature, pivot points help traders effectively identify trading ranges.

The pivot point strategy allows traders to take advantage of intraday support and resistance levels. Buying near support is done with the expectation of a price rebound, while selling near resistance helps traders exploit potential market corrections or reversals.

Range bar trading strategy

Range bar strategies operate based on price fluctuations rather than timeframes like conventional charts. Instead of creating candlesticks minute by minute or hour, each bar is formed when the price moves within a certain range. This range is set by the trader, helping to eliminate market noise and focus on the truly significant price movements.

In range trading strategies, using range bars helps traders focus on analyzing the nature of price movements and momentum. Instead of relying on time, traders observe price action as it reaches the extreme points of the range bars, thereby identifying potential support and resistance zones.

This approach allows traders to adapt flexibly to changing market conditions and more accurately assess the importance of each price movement.

To effectively apply the range bar strategy, traders need to determine the appropriate range size for the market they are trading in. Combining supporting analytical indicators with sound risk management will help optimize trading performance and limit adverse fluctuations.

Key mistakes to avoid when using range trading strategy

Range trading strategy is considered a clearly structured trading method; however, it’s not always easy to implement effectively. Challenges arising during trading can undermine results if left unchecked. Understanding common pitfalls and how to mitigate them is crucial for perfecting the trading method.

Inaccurate recognition of sideways trading ranges

A common mistake when applying range trading strategies is treating temporary price swings as signs of a sideways market, causing traders to enter trades too early and face unnecessary risk. A reliable price range typically only emerges when the market repeatedly reacts at support and resistance levels without creating higher highs or lower lows.

To avoid misjudgments, traders should use ATR to assess whether volatility is decreasing and apply Pivot Points to identify price levels that are likely to act as range boundaries.

Ignoring price range breakout signals

Holding a position for too long while the market has moved out of a sideways trend can quickly turn a safe trade into a losing one. A sudden surge in volume along with widening Bollinger Bands often reflects a change in market dynamics.

When the closing price definitively breaks outside the previous range, especially accompanied by strong buying or selling pressure, it is highly likely that the market is forming a new trend. In this case, continuing to trade within the price range would increase unnecessary risk.

Lack of discipline in risk management

A key element of a range trading strategy is proper risk management through placing stop-loss orders in the right places. Placing stop-losses too close to the entry point can cause traders to be eliminated from the market by mere price fluctuations. Conversely, not using stop-losses will lead to uncontrollable losses when the range is broken.

Therefore, stop-loss orders are often placed outside the range boundaries to reflect actual changes in market structure. Combined with a reasonable risk/reward ratio, this helps enhance the sustainability of the strategy.

Applying trading strategies at the wrong market timing

Price range trading is no longer suitable when the market begins to break out of the consolidation phase and a new trend emerges. During these times, price ranges are easily broken, reducing the reliability of support and resistance levels.

The ADX indicator is a useful tool for assessing trend strength, with an ADX below 25 typically indicating a sideways market. When volatility remains low and prices fluctuate within a narrow range, range-trading conditions are generally considered more favorable.

Overtrading within a price range

Overtrading is a common problem in range trading strategies, especially when traders try to exploit every small price fluctuation. This approach not only increases risk but also diminishes overall effectiveness due to accumulated transaction costs.

A more effective strategy is to patiently wait for the price to reach confirmed support or resistance levels. Additionally, using oscillating indicators like RSI or Stochastic helps filter out noise and identify entry points with a higher probability of success.

Conclude

With an approach focused on price action and key price zones, the range trading strategy helps traders make clear, well-grounded decisions. According to pfinsight.net, to achieve long-term effectiveness, traders need to patiently wait for high-quality setups, strictly adhere to risk management principles, and be ready to stop using the strategy when the market shifts into a trending phase. Discipline is the key factor that ultimately determines success.