Quantitative trading strategies use mathematical models, historical data, and automated algorithms to identify buying and selling opportunities in the market. If you are wondering what quant trading is, this article by pfinsight.net will guide in detail how to build and deploy quant trading effectively.

- Best no evaluation Prop Firm offering direct funded accounts

- Prop Firm challenge mistakes every trader should avoid

- 7+ Expert tips on how to pass Prop Firm challenge and get funded

What are quantitative trading strategies?

Quantitative trading strategies are methods that use data, algorithms, and mathematical models to estimate future profitability. This is considered a systematic form of trading, where traders rely on probability and statistical analysis to make decisions instead of relying on personal feelings or judgment.

Quantitative trading strategies are capable of handling multiple variables such as price, volume, volatility, and technical signals simultaneously. When pre-defined conditions are triggered (e.g., “when X happens, execute Y”), the system automatically executes the trade order. With high speed, accuracy, and consistency, this method helps traders maintain discipline and eliminates the emotional element in the decision-making process.

The core elements that make up quant trading

Quantitative trading is not only based on data but also a tight combination of mathematics, technology and strategy. Understanding the components that make up quantitative trading strategies helps investors build a more efficient, accurate and sustainable trading system.

- Mathematical models: These models aim to predict the future direction of prices by analyzing past data, while considering factors such as price, volume, and other important parameters in the financial markets.

- Algorithms: Algorithms automate the entire trading process, executing orders based on pre-programmed rules. Thanks to their ability to process data in real time, they can react to market fluctuations significantly faster than humans.

- Data analysis: Quantitative trading relies on data analysis. Traders often mine historical data to spot trends, build models, and test strategies to ensure effectiveness before deploying them in real market conditions.

- Risk management: Risk control plays a key role in quantitative trading strategies. Strategies are often designed with measures to limit losses, including placing stop-loss orders, allocating capital appropriately, and diversifying the portfolio to protect profits.

Quantitative trading strategy implementation process

To build an effective quantitative trading strategy, traders need to follow a certain process before applying it to the real market. Below are 4 steps to perform quant trading as follows:

Step 1: Choose a trading strategy

Choose a quantitative trading strategy that suits your capabilities and the characteristics of the market you are targeting. If the market is stable, you can apply the mean reversion strategy, while when the trend is strong, momentum trading will be more effective. Individual traders should start with a basic model and gradually develop it into a more complex system. Do not forget to clearly define the hypothesis and goals before programming or testing the strategy.

Step 2: Conduct backtest

Collect high-quality, noise-free historical market data. Run the model on every small price movement to ensure accuracy. Apply walk-forward validation to detect signs of over-optimization. Record every entry, exit, and slippage, and if the performance disappears, adjust the strategy.

Step 3: Start trading

When implementing quantitative trading strategies, integrate your trading scripts with reputable brokers’ APIs. Only enable automated orders during high-liquidity periods to minimize slippage. Monitor execution speeds, system errors, and market sentiment, as even small delays can significantly impact profits.

Step 4: Risk control

Maintain a safe volume-to-equity ratio. Integrate stop-loss orders and timed exit mechanisms into your scripts. Apply a variety of quantitative trading strategies, prioritizing strategies that reduce overall risk. Regularly evaluate risk metrics and eliminate strategies that violate established limits.

5 popular quantitative trading strategies

Quantitative trading strategies are increasingly popular thanks to their ability to analyze data and make automated decisions based on mathematical models. Below are 5 quantitative trading strategies that help traders optimize profits and effectively control risks in the financial markets.

Mean Reversion

This quantitative trading strategy is based on the assumption that prices tend to revert to the mean after deviating from it. The algorithm is designed to monitor indicators such as moving averages, z-scores or Bollinger Bands.

When the price moves beyond the normal range, the system automatically opens an opposite position, taking advantage of the market’s correction back to the equilibrium zone. To control risk, stop-loss orders are placed just outside the price range. Profit targets are usually at the moving average or at the midpoint of the range, depending on which signal appeared first in the market.

Historical data analysis shows that the mean reversion strategy is most effective when applied to currency pairs that fluctuate in a narrow range or stocks with high liquidity and are less affected by news. However, the risk of overfitting can still occur, so it is necessary to test the model with out-of-sample data. At the same time, it is advisable to apply a volatility filter to avoid entering the market when the trend is too strong, minimizing signal distortion.

Momentum

This quantitative trading strategy takes advantage of price momentum by buying rising assets and selling falling ones. The algorithm sorts the portfolio based on performance over the last 3 or 12 months, or by the Relative Strength Index (RSI). The top performers are bought, while the bottom performers are shorted.

The strategy is rebalanced monthly to shift capital to new market leaders. Momentum often works well in stocks and cryptocurrencies, where crowd psychology creates a sustained uptrend. However, the risk of sudden price reversals is present, so a combination of trailing stops and time-based stops is recommended to protect profits.

Building a diversified portfolio helps to minimize the impact of individual stock movements. Momentum strategy remains one of the most popular and widely researched quantitative trading strategies, as its effectiveness has been proven across many different markets and historical periods.

Statistical Arbitrage

Statistical arbitrage (stat-arb) strategies focus on exploiting short-term price discrepancies between highly correlated assets, such as two similar stocks or ETFs. The model tracks the spread between them and, when the difference exceeds a predetermined z-score, the system opens a long position in the undervalued asset and a short position in the overvalued asset, taking profits when the price returns to equilibrium.

The stat-arb strategy requires a high level of discipline and minimal transaction costs, as even small slippages can wipe out an advantage. Traders should use high-frequency data to simulate the mean reversion cycle of the spread, and set a hard stop timer to avoid position drift. With good risk management, this strategy can generate consistent returns and is largely neutral to market volatility.

Trend Following

Among quantitative trading strategies, the trend following strategy is still considered the basic principle: “trade with the main trend until it ends.” This model often uses moving average crossover signals, ATR filters and price channels to determine the direction of the market. When the price breaks the top of the channel, the algorithm opens a buy position, conversely, when it falls to the bottom of the channel, it triggers a sell order with a stop-loss based on a fixed ATR multiple.

Trend following strategies often have low win rates but can yield large profits when they correctly capture long-term trends. This method is based solely on price action, without the need for fundamental analysis, making it suitable for futures, Forex, and cryptocurrency markets. Tests on long-term historical data show that trend following still provides sustainable profits, despite occasional significant drawdowns.

Volatility and options strategies

Volatility-based quantitative trading systems focus on the strength of price fluctuations rather than simply identifying trends. These strategies continuously measure realized volatility from recent return data and adjust trade volume or risk levels to adapt to changing market conditions.

Options-based quantitative trading strategies go further by taking a clear view on volatility rather than simply predicting price direction. Traders can use a variety of structures, such as covered calls, protective puts, vertical spreads, or delta-neutral portfolios, to take advantage of changes in implied volatility. The goal is to generate steady profits from market volatility, even when the asset price does not move strongly in a particular direction.

3 quantitative trading platforms without code

For most individual traders, programming in Python or C++ can be a daunting task at first. However, there are now many no-code tools that make it easy to create and deploy quantitative trading strategies. These platforms allow users to build, test, and automate strategies without any in-depth programming knowledge.

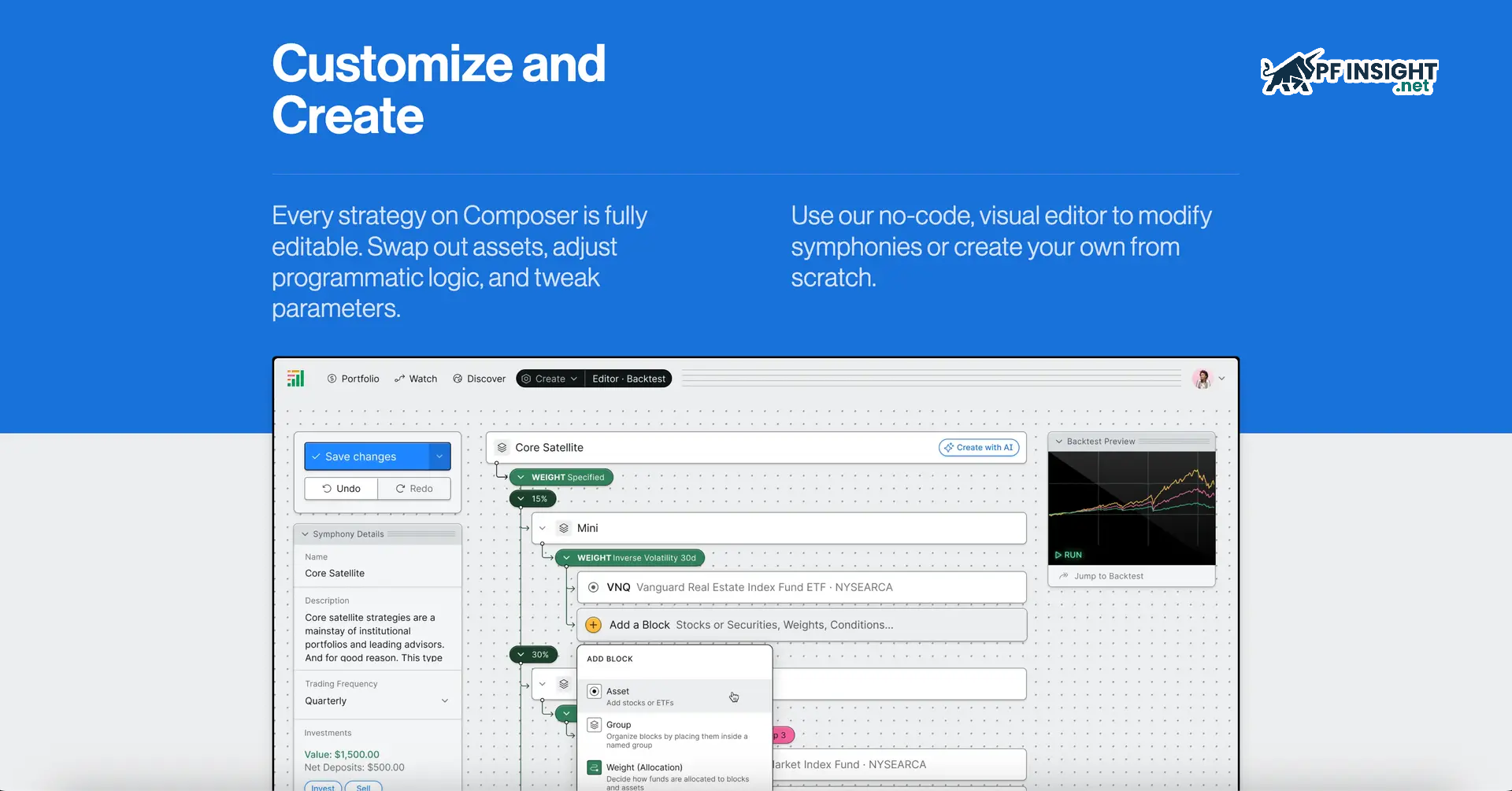

Composer

Composer is an AI-powered trading platform that makes it easy for users to design, test on historical data, and automatically deploy quantitative trading strategies without requiring specialized programming skills.

Traders can design a fully personalized quantitative trading strategy by entering natural language requests, such as “build a strategy that fits your current portfolio” or “suggest potential alternatives.” You can also explore and customize strategies shared by the community. Once you have selected a model you like, the system will automatically execute the transaction intelligently with just one click, saving you time and optimizing your investment performance.

The platform is intuitive and innovative, making it easy for anyone to access and deploy professional automated stock trading strategies without complex technical knowledge.

TrendSpider

TrendSpider integrates advanced technical charts with cloud alerting and automated trading bots that require no programming, allowing connection and execution via webhooks. In August 2025, the platform introduced Sidekick – an AI assistant capable of converting natural language descriptions into scan commands, recognizing patterns, analyzing signals and suggesting optimal strategies based on historical data.

Sidekick helps traders turn ideas into automated trading processes by automatically setting up alerts and bot rules. It also allows simultaneous analysis across multiple timeframes, helping to confirm more accurate signals and optimize strategy performance.

Tickeron

Tickeron is an AI-powered trading platform that provides ideas and signals for a wide range of assets such as stocks, ETFs, Forex, and cryptocurrencies. Tickeron’s AI system is capable of recognizing technical patterns, predicting price movements, and suggesting optimal buy and sell points based on statistical probabilities.

Users can tap into signals from Tickeron’s custom “AI robots,” which are designed to monitor the market in real time, send alerts, and recommend trading opportunities tailored to individual strategies. The platform also offers trading simulation, risk assessment, and portfolio management support for both novice and professional traders.

Conclude

Quantitative trading strategies are ushering in a new era of modern trading, where data and algorithms play a central role. Thanks to technology and AI, traders can optimize performance, minimize emotions, and make decisions based on probabilities. While not eliminating risk completely, quantitative trading offers a more scientific, logical, and sustainable approach for all investors.