The Prop Firm trading format has gradually become the top choice for traders in the market due to its growing ability to provide traders with access to abundant capital without exposing them to large financial risks. This capability is made possible by a carefully considered Prop Firm business model, which benefits both the company and experienced traders.

Today’s article on Pfinsight.net will reveal the core principles of the Prop Firm business model and share the trading secrets that consistently generate profits. Let’s dive in!

What is the Prop Firm business model?

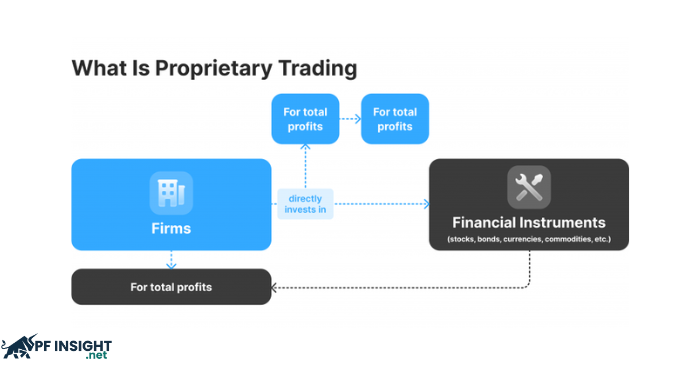

A Prop Firm, short for Proprietary Trading Firm, is a type of exclusive trading business that allows traders to access capital so they can trade in financial markets instead of using their own funds. This concept reduces personal financial risk for experienced traders who lack capital while giving them access to significant funding.

Traders typically have to pass one or more evaluation stages before receiving actual funded accounts. During this process, they must prove they can trade consistently and adhere to strict risk management rules, such as daily loss limits, position sizing, and leverage usage. Profits are shared according to a predetermined ratio – such as 80% to the trader and 20% to the firm – so that both parties benefit.

How do Prop Firms make money?

Prop Firms earn direct profits from traders’ trading results, unlike brokerage firms that profit from fees or spreads. The profit-sharing ratio set by the Prop Firm business model determines a trader’s payout.

For example, with an 80/100 profit split, a trader receives $8,000 from $10,000 in trading profit, while the firm keeps $2,000. Each Prop Firm has its own profit-sharing scheme, often based on trading volume, strategy, and trader expertise.

Understanding the Prop Firm business model

The Prop Firm business model differs significantly from the models of licensed financial institutions, hedge funds, and high-frequency trading companies. To understand these differences, traders should note the following about Prop Firms:

- They do not trade with real money directly; they manage demo accounts.

- Trades from demo accounts are copied into real accounts managed by retail proprietary trading firms using trade-copying software.

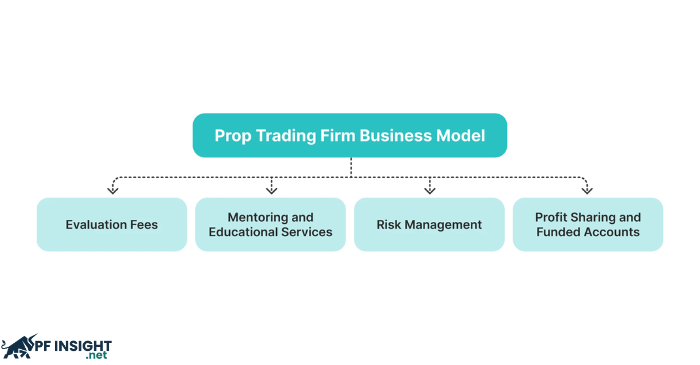

- The business strategy of retail proprietary firms includes:

- Partner managers providing trading capital.

- Searching for profitable retail traders who lack funding.

- Using paid challenges as initial tests and a substantial monthly revenue source.

- Few retail traders successfully pass these challenges.

- Charging monthly fees for capital access.

- Continuously earning through profit-sharing while also paying traders.

- Removing traders who violate strict withdrawal schedules or risk management rules.

Do Prop Firms use real money?

In most cases, when trading with Prop Firms, real money is not directly used. All challenges and evaluations are conducted on demo accounts. This can be misleading, as the term suggests a professional trading company; however, many retail proprietary trading firms are classified as financial games and remain unregulated.

Prop Firms provide evaluation accounts in the form of demo accounts through partnerships with brokers, funded by potential traders. The primary income of such firms comes from one-time evaluation fees, which may then be used in live accounts run by highly skilled traders.

Since funded accounts are also demo-based, the Prop Firm business model removes direct risk for the firm. Over 90% of failed challenges contribute to the pool used for paying out real money rewards. Only a small number of retail Prop Firms provide traders with a clear path to managing live portfolios, monthly income, performance bonuses, and contracts.

Benefits of the Prop Firm business model for traders

- Use of company capital instead of personal funds: The Prop Firm business model allows traders to trade using company capital, reducing personal financial risk while still enabling profit potential.

- Access to advanced trading technology: Firms offer state-of-the-art trading platforms, real-time market data, and comprehensive analytical tools.

- Fast and personalized support: With a limited number of traders, Prop Firms can resolve issues faster than traditional brokers.

- Lower trading costs: Some Prop Firms reduce trading costs since their profits come from traders’ performance.

- Higher leverage: The Prop Firm business model often allows larger leverage than personal accounts, maximizing returns.

- Flexible working environment: Depending on company policy, traders may work remotely or in-office.

- Learning and simulation opportunities: Many Prop Firms offer training programs and free demo accounts for skill development.

- Liquidity benefits: Proprietary firms often hold large securities inventories, enabling smoother trading even in illiquid markets.

Challenges and risks when joining a Prop Firm

- Lack of regulation: Many Prop Firms operate without oversight from financial regulators, increasing potential legal risks.

- Risk deposit requirements: Some firms require upfront deposits, which are uninsured.

- Restricted trading styles: Many firms forbid overnight positions, limiting long-term strategies.

- Recurring fees: Registration, withdrawal, evaluation, and other fees can reduce net profits.

- Psychological pressure: Even without using personal funds, traders must meet profit targets to keep their accounts active.

- Lack of employee benefits: Prop Firm traders are independent contractors and do not receive job security or insurance benefits.

Should you choose the Prop Firm WeMasterTrade?

With more and more Prop Firm projects emerging, WeMasterTrade stands out in the industry. Although relatively young, it has attracted significant attention through ISO certification, industry awards, and diverse trader support policies.

WeMasterTrade offers funded accounts of up to $100,000, supports Expert Advisors (EAs), copy trading, and multiple trading styles. It also enables trading across various assets on the MT5 platform. With a 90% profit split, fast payouts within 24-48 hours, and Vietnamese-language support, the firm appeals to both beginners and traders seeking quick access to capital.

However, given its newness and lack of long-term global reviews, traders should start small, verify service quality, and study withdrawal rules, profit targets, and payout policies carefully. For those who value speed and local-language support, WeMasterTrade can be a good choice – provided they have a solid trading plan to minimize risk.

Conclusion

The above provides a complete overview of the Prop Firm business model. Hopefully, this has given you the clearest possible insight into how it works and what to watch out for. Visit our website for more updates on other Prop Firm projects. Wishing you trading success!