In a constantly volatile market, identifying optimal entry points is more crucial than ever. Premium and discount zones are tools that help traders position their actions within the correct market context, avoiding buying at the top or selling at the bottom. By combining these price zones with market structure, traders can trade more disciplined and logically. Today’s article from PF Insight will guide traders on how to identify premium and discount zones and apply them effectively to real-world trading.

- How smart money liquidity theory explains price movements

- Institutional trading concepts explained for retail traders

- How traders analyze price inefficiency in trading across financial markets

What are premium and discount zones?

The principle of high and low price zones emphasizes the importance of entering trades at the right time. Instead of chasing short-term fluctuations, traders focus on buying at low prices and taking profits or short selling when the market approaches high prices.

Premium and discount zones help traders assess whether an asset is trading at a high or low price in the current market context. Instead of just looking at the instantaneous price, traders analyze price movements on charts to identify significant zones, which often coincide with support and resistance levels. These zones play a crucial role in finding advantageous entry points and managing risk more effectively.

Premium zone

A premium zone describes the area where an asset’s price is trading above its current reference price. In an uptrend, the premium zone represents price levels where the market has significantly expanded from previous corrections. At this point, the asset is generally considered relatively expensive, leading to stronger profit-taking pressure or selling reactions.

Many traders view high price zones as potential resistance areas, where selling pressure is often stronger. As prices approach these zones, profit-taking by buyers or the opening of new short positions may increase. Additionally, premium zones often coincide with significant psychological milestones or Fibonacci levels that have previously generated notable price reactions.

Discount zone

A discount zone describes an area where the price of an asset is trading below the current market level. In a downtrend, the discount zone reflects price levels where the market has corrected significantly from previous periods. At this point, the asset is often considered relatively cheap, attracting buyer interest and leading to a price rebound.

Many traders view discount zones as potential support areas where buying pressure increases when prices are perceived as attractive. As the market approaches these zones, accumulation or opening of long positions may become more apparent. Similar to premium zones, discount zones coincide with important psychological levels or Fibonacci levels that have previously triggered price reactions.

How to identify premium and discount zones

There are many ways to assess whether the price is within premium and discount zones, depending on the trader’s analytical method. Among them, Fibonacci Retracement is the most widely used tool due to its intuitiveness and effectiveness.

The identification process is carried out in the following steps.

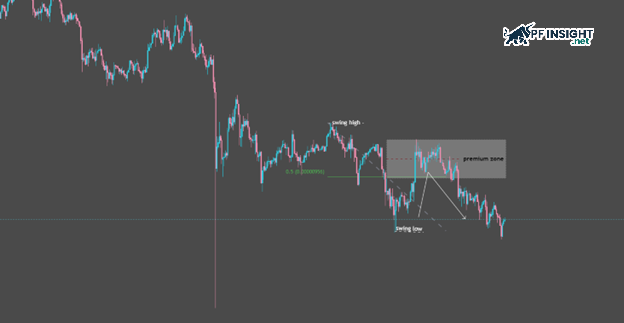

Identifying premium zones

To accurately identify the premium zone, traders need to start by defining a clear price range. This includes analyzing the most recent impulse wave and highlighting swing highs and swing lows on the H4 or D1 timeframe. Next, apply Fibonacci Retracement from the top to the bottom of the bearish range, eliminating unnecessary levels and retaining only the 50% level to enhance chart visibility.

- The 0.50 level on the Fibonacci Retracement represents the central area of the price range, often considered the market’s equilibrium point within the defined trading range.

- Prices above 0.50 are considered premium zones, where the price is trading higher than the average value of the range.

- Prices below 0.50 are considered the discount zone, reflecting a lower price range compared to the equilibrium level.

- The 0.50 zone can also be manually identified using the formula: (Highest price + Lowest price) / 2, which helps traders quickly determine the midpoint of the price range.

- Any price level above 0.50 is considered a premium zone, where traders often consider short-selling opportunities. In these areas, stop-loss orders are typically placed above the nearest swing high to effectively control risk.

The concept of premium and discount zones becomes more effective when combined with other trading tools. For example, when the price enters a premium zone, traders can wait for confirmation signals such as a bearish engulfing candlestick pattern closing below the low of the previous candle. When placing a sell order at a high price, the target is usually the nearest low, the discount zone of the same price range, or traditional technical levels.

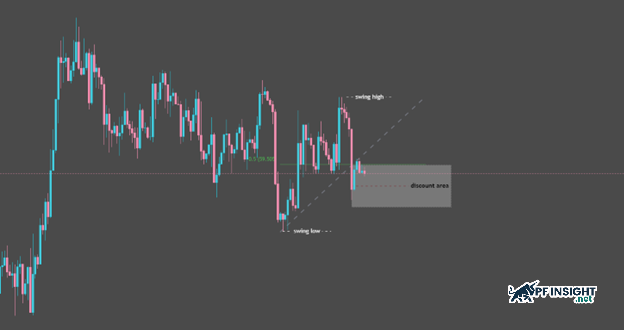

Identifying discount zones

Traders should only look for discount zones after a clear market context is established. This includes identifying the swing range, recognizing the most recent impulse wave, and highlighting key highs and lows on the daily or 4-hour chart. Next, apply Fibonacci Retracement from the swing low to the swing high within the uptrend, eliminating unnecessary levels and keeping only the 50% level for easy observation.

- The 0.50 mark on the Fibonacci Retracement represents the midpoint of the entire price range, often considered the equilibrium zone between buying and selling pressure.

- Prices below 0.50 are considered discount zones, where traders prioritize looking for buying opportunities. In these cases, stop-loss orders are typically placed below the bottom of the most recent decline to effectively manage risk.

The concept of discount zones needs to be flexibly combined with other technical factors to improve the probability of successful trades. At low price levels, traders can look for bullish candlestick signals indicating that buying pressure is beginning to prevail. When buying in a downtrend, reasonable targets include the nearest swing high, the premium of the current price range, or traditional resistance levels.

Trading strategies based on premium and discount zones

Trading strategies based on premium and discount zones help traders identify advantageous price positions, avoid buying high and selling low, and improve risk management.

The classic retracement entry strategy

This strategy is particularly well suited for trend-following swing traders. However, it requires a clearly defined market structure, where price forms higher highs in an uptrend or lower lows in a downtrend. Once clean Fibonacci zones are identified, traders focus on finding entry points at the appropriate premium and discount zones in alignment with the trend to optimize the risk–reward ratio.

How to do it:

- Bullish scenario: Wait for the price to retrace to the discount zone, usually within the Fibonacci levels of 50% to 78.6% of the previous uptrend.

- Confirming entry: Prioritize observing bullish signals such as hammer candlesticks, bullish engulfing candlestick patterns, or bullish FVG structures indicating the emergence of buying pressure.

- Risk management: Execute a buy order with a stop loss placed below the bottom of the discount zone, possibly below the 78.6% level or the nearest swing low.

- Profit target 1: The equilibrium zone of the price range, corresponding to the 50% Fibonacci level.

- Profit target 2: The peak of the previous uptrend wave, corresponding to 0%.

- Risk management: Each trade should only carry a risk level of 1–2% of total capital. Entry volume should be calculated based on the distance from the entry point to the stop-loss point. Prioritize using automatic stop-loss orders to protect your account when the price breaks out of the equilibrium zone.

The counter trend premium/discount reversal strategy

This method is best suited for experienced traders, especially during sideways or weakening market phases. However, traders must focus on identifying premium and discount zones after prolonged price movements. When the market rises sharply and the price enters the high premium zone (approximately 0–23.6%), traders look for signs of weakness such as decreasing volume, RSI divergence, combined with CHOCH or MSS to confirm a potential reversal.

How to do it:

- Identifying overextended prices: When the market rises sharply beyond its fair value (or falls deeply in a bullish reversal scenario).

- Wait for the CHOCH signal: This is indicated by the price breaking through the nearest high in an uptrend, suggesting that the market structure is beginning to change.

- Fibonacci Retracement: Draw from the highest peak just formed down to the newly confirmed bottom.

- Identifying new premium zones: This serves as a basis for finding short-term sell entry points.

- Be patient and wait for the price to retrace to the new premium zone: Instead of entering a trade immediately when the structure is broken.

- Execute a sell order when there is clear confirmation: Based on price action or appropriate technical signals.

- Trading objective: Aim for the equilibrium point of the new range, then the corresponding discount zone.

Note: This strategy goes against the main market trend, so traders should reduce their order size and manage risk carefully. If the price quickly restructures according to the original trend, it is necessary to proactively exit the trade early to limit losses.

Multi-timeframe confluence trading strategy

The multi-timeframe confluence trading strategy is suitable for position traders and trend traders with large capital. This strategy leverages the power of consensus across multiple timeframes, especially when premium and discount zones coincide on both larger and smaller timeframes. When these price zones appear simultaneously, the probability of a successful trade is often significantly improved.

How to do it:

- Daily timeframe (D1): Used to identify the primary trend and key price zones, serving as the overall market picture.

- 4-hour timeframe (H4): Helps identify intermediate price zones and secondary market structure within the daily trend.

- 1-hour timeframe (H1): Focuses on finding precise entry points, ensuring alignment with the context of both D1 and H4.

- Setup conditions: The trend on the D1 chart is upward; the price on the H4 chart is correcting to the discount zone, creating an advantage for a buy order.

- Setup on H1: Price corrects downwards within the H4 range, a support FVG appears for the entry point.

- Convergence: All three timeframes confirm a unified trading scenario.

- Trading parameters: Entry point at 44.560, stop loss at 44.400, and target at 45.200, corresponding to the daily premium zone.

Why do traders fail when trading premium and discount zones?

Many traders fail when trading premium and discount zones not because of flawed strategies, but because of mechanical application, lack of market context, and insufficient risk management discipline.

- Ignore market structure on larger timeframes: Many traders tend to focus only on lower timeframes to find entry points, while failing to assess the market context on larger timeframes like D1. This easily leads them to trade against the main trend or miss important signals about the overall price direction. Analyzing higher timeframes helps traders grasp the bigger picture and adjust their strategies to align with the main trend.

- Trading without proper stop-loss and risk control: A common mistake when trading premium and discount zones is neglecting to set stop-loss orders or failing to manage risk effectively. Even when entering a trade at an advantageous price level, traders can still suffer significant losses if they hold a losing position for too long. Risking too much capital in a single trade can severely damage the account. Setting appropriate stop-loss orders in each price zone helps protect capital and maintain long-term trading viability.

- The transaction was made too early, lacking confirmation conditions: Lack of confirmation is one of the common mistakes that leads traders to fail when trading premium and discount zones. Entering a trade simply because the price touches a desired zone, without waiting for confirmation signals such as strong candlestick patterns, structural changes, or clear reversal signs, often results in unreliable positions. Patiently waiting for confirmation ensures the market is reacting correctly to the price zone and supports the trader’s trading idea.

- Excessive and unnecessary trading: Many traders fall into overtrading due to a fear of missing out or a desire to trade continuously. This often leads to an accumulation of low-quality trades, increased losses, and prolonged psychological stress. Focusing on a small number of quality trades, rather than quantity, is an effective way to limit unnecessary risk.

Conclude

Premium and discount zones offer a significant advantage to traders by helping them identify high-probability price zones instead of chasing the market. However, this advantage is only realized when coupled with sound capital management, technical confirmation, and trading discipline. Instead of striving for perfection, focus on consistent practice to make premium and discount zones a solid part of your trading system.