As a leading technology provider for proprietary trading brokerage firms, Trade Tech Solutions offers modern platforms that meet the needs for scalability and automation. This helps prop firms improve the performance, transparency, and control of their trading systems. The rapid growth of proprietary trading technology is driving consolidation across the market. Instead of maintaining complex,…

Category Archives: Industry Updates

Topstep, a well-known futures trading company, is currently the target of criticism on social media due to a series of technical issues on its proprietary trading platform. The wave of protests from the trading community is growing as the user experience is severely disrupted. In response, Michael Patak, the company’s founder and CEO, has officially…

PU Prime, a globally licensed online broker, has officially introduced the Official Verification Hub, a centralized verification tool designed to enhance trust, security, and transparency for the trading community. This launch is seen as an important step in the company’s strategy to protect users and raise safety standards across the online trading industry. Official Verification…

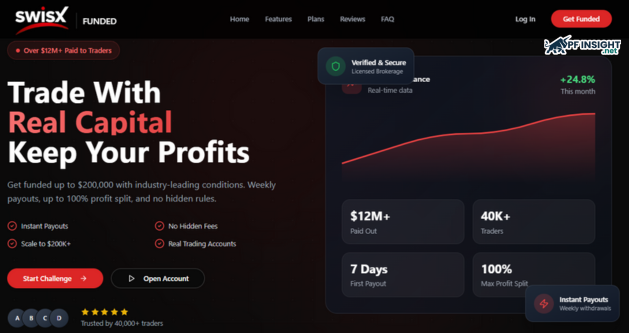

The advanced proprietary trading platform SwisxFunded.com has officially launched globally, offering Instant Funded Accounts up to $50,000 for traders. The company is committed to creating a superior trading environment with transparent rules and fast payouts, eliminating the barriers and delays often found in traditional proprietary trading firms, giving traders immediate access to real capital. SwisxFunded…

About 10 months after reaching an acquisition agreement with private equity firm CVC, Czech proprietary brokerage FTMO completed its acquisition of OANDA yesterday, Monday. To make the transaction official, the proprietary brokerage giant had to go through a rigorous regulatory process and receive the necessary approvals from five different regulatory bodies. A bold move or…

Prop trading firm PipFarm has introduced multi-currency accounts, allowing traders to fund and trade challenges in USD, EUR, or GBP without facing conversion fees or FX uncertainty. The firm confirmed that Japanese yen (JPY) accounts will be added soon, supporting its broader expansion into global markets. PipFarm rolls out multi-currency accounts for global traders PipFarm…

Jump Trading has officially joined Kalshi, starting market-making operations on the event betting platform. The large proprietary trading firm is a pioneer in tapping into the new market, which is seen as a cross between Wall Street finance and Silicon Valley technology. Their operations will help increase liquidity for Kalshi. The Chicago-based trading firm has…

The futures trading market is witnessing a significant event. ProjectX, a digital trading platform provider trusted by many exchanges, is preparing to make a major shift in its business model. ProjectX plans to terminate all service contracts with “third-party” platforms by the end of February 2026, according to a brokerage firm confirmed via a Discord…

The Surat-based proprietary trading scandal, once considered a small-scale incident, has spread far and wide, affecting traders across India, according to new investigative documents. The Moneycontrol report also found that some exchanges allowed individual traders to use prop trading accounts without applying any risk controls or identity verification. Industry insiders are raising concerns about unusual…

A recent financial crash has left many leveraged traders in the NCR, Jaipur, Ranchi and Kolhapur regions facing a severe crisis, with many becoming insolvent and fears of a spillover to other cities. Prop trading scam from Surat spreads nationwide The proprietary trading scandal that began in Surat earlier this year is spreading rapidly across…