Many traders struggle to identify trends and market direction not because they lack tools, but because they do not fully understand how price is formed and how it moves. Market structure trading provides an analytical framework that helps traders clearly see the relationship between swing highs, swing lows, and break of structure points, allowing them to understand why a trend emerges, persists, or comes to an end. When market structure is read correctly, a trend is no longer a subjective feeling but an observable outcome of price behavior.

In this article, PF Insight analyzes how market structure helps traders identify trends and market direction in a more logical and consistent way.

- How order block trading reflects institutional buying and selling pressure

- How traders use price action trading to read market structure without indicators

- Hedging Forex strategy: When it makes sense and when it doesn’t?

What market structure really shows in forex

Market structure in Forex is not a technical pattern meant to decorate a chart, but a way the market organizes price movement over time. Each swing high and swing low reflects a collective decision between buyers and sellers, where liquidity is attracted and positions are built or exited.

When price forms new highs and lows, the market is answering a simple question: whether the current price level is being accepted. If price is repeatedly accepted at higher levels, an ascending structure develops. Conversely, when higher prices are rejected and the structure begins to form lower highs, it signals that selling pressure is gradually taking control.

Market structure therefore does not predict the next move, but provides context. It shows who is in control, which side is defending the current structure, and which side is being forced to exit positions. Price movements that may appear random on the chart are, in reality, the result of continuous processes of accumulation, distribution, and liquidity seeking.

More importantly, market structure helps traders distinguish between noise and genuine change. A deep pullback does not necessarily indicate a reversal if the higher-level structure remains intact. Only when the structure is clearly broken does the market begin to transition into a new state of trend and market direction.

How market structure defines trend and direction

Market structure defines trend not through prediction, but by observing how the market accepts or rejects price levels. Direction is formed from structure, not from feelings or isolated signals.

An uptrend is identified when

- Price forms higher highs, showing that the market accepts higher price levels.

- Higher lows are maintained, confirming that buying pressure continues to control the structure.

- Pullbacks are corrective moves within the trend, not reversals.

As long as the structural low is not broken, direction is still considered bullish.

A downtrend is identified when

- Price consistently forms lower highs, indicating that higher prices are being rejected.

- Lower lows appear, confirming that selling pressure is dominant.

- Rallies are corrective moves within the downtrend.

Direction only changes when the bearish structure is clearly broken.

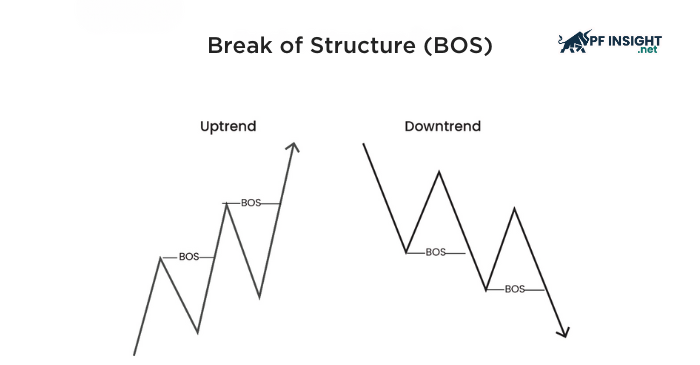

The role of Break of Structure (BOS)

- A BOS occurs when price breaks a key structural level in the direction of the existing trend.

- It signals trend continuation rather than trend exhaustion.

- BOS helps traders reinforce their bias and avoid exiting positions too early.

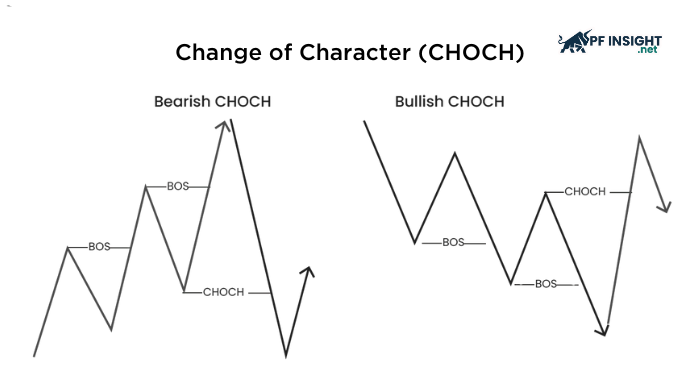

The role of Change of Character (CHOCH)

- CHOCH occurs when price breaks structure in the opposite direction of the main trend.

- It serves as an early warning of a potential shift in direction.

- CHOCH is not an entry signal, but an alert that further confirmation is needed.

What market structure truly helps traders achieve

- Distinguishing short-term volatility from genuine trend changes.

- Avoiding overreaction to news events or single strong candles.

- Maintaining a trading bias based on structure rather than emotion.

Market phases and directional context

Market phases describe recurring states of the market over time, but they only become meaningful when placed within the context of market structure. Phases do not help traders predict where price will reverse. Instead, they help explain which stage of the trend cycle the market is currently in.

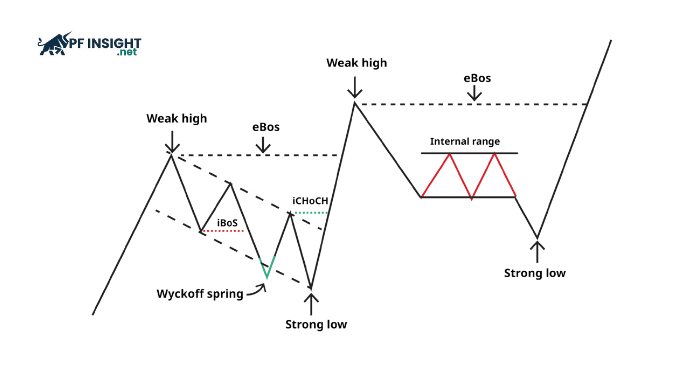

Accumulation

Accumulation typically appears after a prolonged decline, when the market begins to slow down and no longer forms clear new lows. Price moves within a relatively narrow range, reflecting a temporary balance between buyers and sellers. During this phase, selling pressure gradually weakens, but a bullish structure has not yet formed, so direction remains unclear.

Uptrend (Expansion)

When the market breaks out of accumulation and starts forming higher highs and higher lows, the expansion phase of an uptrend begins. Direction becomes more consistent as structure is preserved through pullbacks. Corrections during this phase usually reinforce the trend rather than signal a reversal.

Distribution

Distribution appears after a strong uptrend, when momentum starts to fade. Price often moves sideways at higher levels, giving the impression that the market is resting. However, within the structure, the balance is shifting. This phase frequently produces false breakouts, as liquidity is absorbed before direction truly changes.

Downtrend (Markdown)

Once a bearish structure is confirmed, the market enters a decline. Price forms lower highs and lower lows, showing that higher price levels are consistently rejected. Direction during this phase is usually clear until the bearish structure is convincingly broken.

The role of market phases in defining direction

Market phases are not tools for timing entries. They provide contextual insight into the market’s condition. While market structure identifies whether the trend is rising or falling, market phases explain whether that trend is forming, expanding, or weakening. This combination helps traders avoid premature reactions and maintain a bias aligned with the broader market picture.

BOS, CHOCH, and structure shift explained simply

In market structure trading, BOS and CHOCH are not technical terms meant to be memorized. They are ways the market communicates whether a trend is continuing or beginning to change. Understanding the role of each concept helps traders avoid reacting too early to short-term fluctuations.

Break of Structure (BOS)

A BOS occurs when price breaks a key structural level in the same direction as the current trend. In an uptrend, this happens when price breaks above the most recent high. In a downtrend, it occurs when price breaks below the most recent low. A BOS shows that the market is accepting a new price level and continuing to maintain the current direction. For this reason, BOS is used to confirm a trend, not to predict a reversal point.

Change of Character (CHOCH)

CHOCH appears when price breaks structure in the opposite direction of the main trend. In an uptrend, breaking an important low signals that buying momentum is starting to weaken. In a downtrend, breaking a key high suggests that selling pressure is no longer fully in control. CHOCH serves as an early warning, alerting traders that the current direction may be losing validity, but it is not sufficient on its own to confirm a reversal.

Market structure shift

A structure shift occurs when the market not only signals a warning but also confirms a new structure. This typically involves a prior CHOCH, followed by a BOS in the new direction. Once the new structure is formed and defended, the market direction truly changes. At this point, traders no longer view the move as a correction, but as the beginning of a new trend.

Using BOS and CHOCH in their proper roles

BOS helps traders maintain bias in line with the existing trend. CHOCH signals when traders should reduce expectations and observe more closely. A structure shift allows traders to adjust their overall perspective. When placed in the correct context, these three elements help traders read the market consistently rather than reacting to each individual price movement.

Reading market structure step by step

Reading market structure is not about finding a fixed pattern, but about building a habit of observing price in a logical sequence. When the process is followed correctly, traders can avoid focusing on details too early and losing their sense of direction.

Step 1: Identify meaningful swings, not every swing

The first step is to identify significant swing highs and swing lows, meaning levels where price clearly reacts and causes a structural change. Not every small zigzag matters. Marking too many swings makes the structure cluttered and distorts the reading of direction.

Step 2: Define direction first, entry later

After identifying the key swings, the trader needs to answer a simple question: is the market forming higher highs and higher lows, or the opposite? Direction must be defined before thinking about entries. If direction is unclear, any setup is only speculative.

Step 3: Observe how structure is defended or broken

The market reveals its intent through how it defends or breaks structure. When lows in an uptrend are consistently held, it shows that buying pressure remains in control. When a key structure is broken, traders should reassess their current bias instead of trying to defend an existing view.

Step 4: Place short-term movement into the correct context

Pullbacks, consolidations, or strong intraday moves only have meaning when placed within the larger structure. A sharp move on a lower timeframe does not imply a change in direction if the higher-timeframe structure remains intact.

Step 5: Read structure as a flow, not as isolated points

Market structure should be read as a continuous process, not as a collection of separate signals. Traders need to follow how price transitions from one structure to another, rather than waiting for a single BOS or CHOCH to act.

Step 6: Be patient and wait for clear structure

The market does not always provide clean signals. When structure is unclear or repeatedly distorted by false breaks, staying on the sidelines is part of reading market structure correctly. Clarity in structure must always come before any trading decision.

Common mistakes traders make with market structure

Market structure is a conceptually simple analytical framework, but it is very easy to misuse in practice. Most mistakes do not come from a lack of knowledge, but from reading structure in an inappropriate context.

Reading structure too early

Many traders rush to label a trend based on only a few initial price swings. When structure has not yet clearly formed, calling a trend bullish or bearish is often driven more by emotion than observation. This leads traders to enter positions against the market’s actual direction.

Confusing pullbacks with reversals

A deep correction within a trend is often misinterpreted as a reversal signal. In reality, as long as the higher-level structure remains intact, these moves are simply pullbacks. Reacting too early to corrections causes traders to exit positions prematurely or reverse at the wrong time.

Overreacting to CHOCH

CHOCH is a warning signal, not confirmation of a new trend. Many traders treat CHOCH as an immediate reversal entry, which leads to trading in noisy conditions. When a new structure has not been confirmed, the risk of false signals is very high.

Ignoring higher-timeframe structure

Market structure is hierarchical. Focusing only on structure on lower timeframes while ignoring the larger picture causes traders to trade against the dominant flow. Direction on higher timeframes always carries more weight when defining overall bias.

Overcomplicating structure

Adding too many concepts, lines, and technical labels to the chart strips market structure of its core value. Structure only needs to reflect key highs, lows, and major breaks. When charts become cluttered, trading decisions also become inconsistent.

Defending personal bias

One of the biggest mistakes is clinging to a personal view when the market has already shown signs of change. Market structure exists to help traders adjust their perspective to the market, not to prove who is right or wrong. When structure changes, bias must change with it.

Conclusion

Market structure trading helps traders understand trends and market direction through the way price forms, protects, and breaks structure over time. When structure is read correctly, traders no longer react to every minor fluctuation but make decisions based on clear market context. Combining market structure with patience and sound risk management makes the trading process more consistent.

We wish you effective trading, and do not forget to explore more in-depth analyses in the Knowledge Hub to continue refining your market perspective.