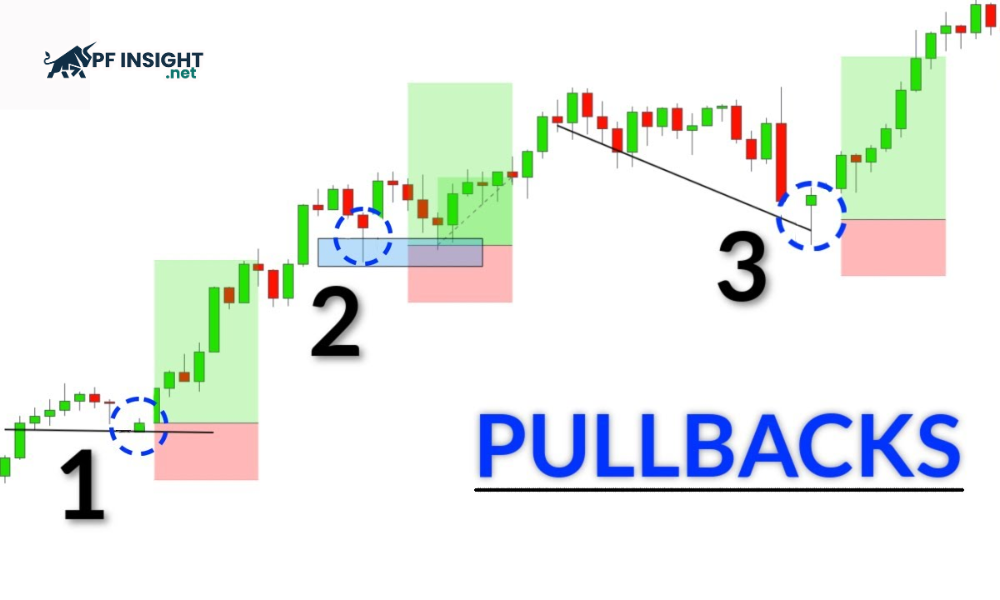

Finding the right entry point is key to improving trading performance in the financial markets. The pullback trading strategy stands out for its ability to optimize risk by focusing on corrective phases within strong trends. This strategy allows traders to trade with the trend instead of risking breakouts. This article from PF Insight will help…

Category Archives: Trading Basics

In a financial market environment that operates at increasingly higher speed, understanding how news affects sentiment and why economic data can trigger immediate volatility in currency pairs, indices, or commodities is essential for every trader. When major reports such as inflation, employment, or interest rate decisions are released, liquidity can shift within seconds and generate…

In the volatile world of finance, identifying market trends is crucial for effective trading. The trend trading method has become a popular choice due to its ability to help traders follow the main flow of price movement. This approach not only reduces market noise but also optimizes entry points. Copy trading for beginners: How to…

Copy trading has become one of the fastest-growing trading methods for beginners because it allows investors to replicate the strategies of experienced traders and access the markets with far more simplicity than analyzing and making decisions on their own. However, copy trading for beginners does not guarantee profit and can involve significant risks if newcomers…

Algorithmic trading system use technology to automate the entire trading process, from data analysis to order execution. This approach focuses on speed, accuracy, and the ability to process large amounts of information that humans can hardly achieve. In this article, PF Insight will analyze how algorithmic trading works and the advantages. Scalping trading techniques tools…

Scalping is a short-term trading strategy that focuses on capturing small but frequent price movements and requires speed, precision, and an almost immediate reaction. Because the profit on each trade is very small, execution speed becomes the decisive factor that helps scalpers reduce processing delays, limit slippage, and maintain stable performance in highly liquid markets….

In the financial world, position trading strategy stands out as a safe and effective trading method for long-term investors. Instead of reacting to each price move, this strategy focuses on holding positions for weeks to months. With the combination of technical analysis and trading discipline, position trading gives patient traders a superior advantage. Swing trading…

Swing trading strategies are the core of the swing trading method, a trading approach that focuses on capturing short and medium term price movements. Instead of seeking minute-by-minute profits like day trading, swing trading targets broader market moves and typically holds positions for several days to several weeks. In this article, PF Insight provides a…

Day trading has become one of the most popular trading styles among those who prefer a fast pace and the potential for same-day profits. Instead of holding positions overnight, day traders focus on intraday price movements, the small, frequent fluctuations that occur throughout the trading session. By understanding how the market moves minute by minute…

Arbitrage forex is widely regarded as one of the most attractive strategies in currency trading because it is based on exploiting price differences across markets to generate almost risk-free profit. Although the concept sounds simple, executing arbitrage in the forex market requires speed, sophisticated technology, and a deep understanding of how the foreign exchange market…