When starting forex trading, most traders tend to focus on entry points, indicators, or leverage while overlooking a foundational factor that determines an account’s survival trade volume. Understanding the different lot types in forex is not about trading larger positions but about controlling risk and structuring positions appropriately. This article by PF Insight clearly explains…

Category Archives: Trading Basics

In Forex trading, understanding price measurement units is essential for every investor. One of the fundamental yet crucial concepts is the pip. So, what is a pip, and why does it directly affect profits, losses, and capital management? Mastering this concept will help traders read charts more accurately and calculate risks effectively from the very…

What is leverage in forex is one of the most common questions traders ask when they first enter the market, but it is also one of the most misunderstood concepts. Leverage allows traders to control a trading volume far larger than the actual capital in their accounts, directly affecting both potential profits and risk levels….

Many traders leave the market not because their trading strategy is poor, but because they fail to control drawdown in the early stages. Without a clear drawdown management approach, even a short losing streak can place significant pressure on an account and make recovery difficult. Drawdown control methods refer to principles that limit account decline…

In financial trading, the risk reward ratio plays a crucial role in determining a trader’s long-term sustainability in the market. Even with accurate entry points, an imbalanced risk reward ratio can still cause an account to deteriorate over time. In this article, pfinsight.net explains how to build an effective risk reward ratio, helping traders limit…

Trong phân tích kỹ thuật, nhiều nhà giao dịch tìm kiếm tín hiệu từ các chỉ báo để giải thích thị trường. Tuy nhiên, đối với những người theo dõi giao dịch dựa trên hành động giá , chính chuyển động giá đã chứa đủ thông tin để hiểu cách thị trường vận hành thông…

When the Forex market becomes unpredictable, relying on a single trading direction can expose traders to significant risks. The hedging Forex strategy offers a more flexible approach, allowing traders to protect their capital against unexpected reversals. Although it is not a strategy suited for every trading style, hedging still plays an important role in risk…

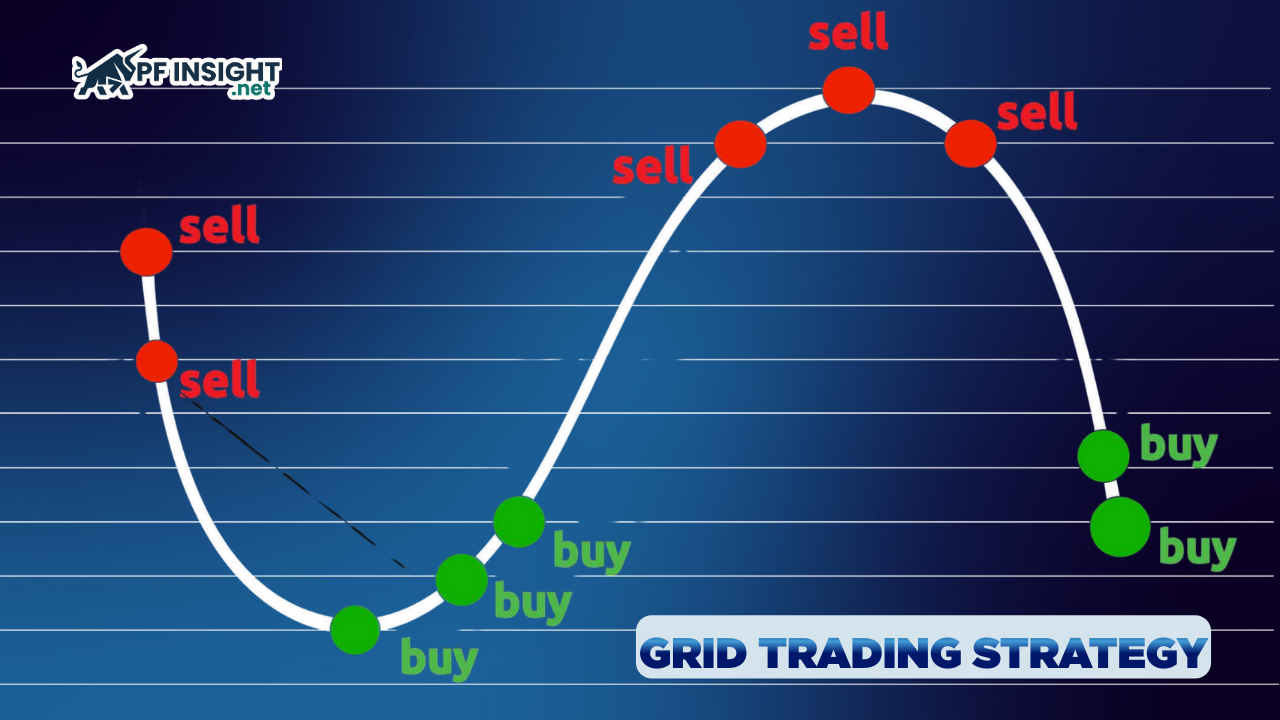

In financial markets, price does not always move in a clear trend. Many periods are defined by sideways price movement, where prices fluctuate within a limited range and make directional predictions difficult, especially for beginners. In such conditions, strategies that rely heavily on trend identification often struggle to perform consistently. This is why the grid…

The trend following strategy has long been one of the foundational trading approaches, not because it promises quick profits, but because it emphasizes consistency in the trading process. In market conditions that are constantly changing and difficult to predict, many traders continue to choose trend following as a clearly structured approach. Rather than attempting to…

A breakout trading strategy is a popular approach in the forex market that focuses on capturing strong price movements when the market breaks through key support or resistance levels. When a breakout occurs, volatility often increases and price tends to develop a clearer directional move. This article explains how breakout trading works in forex, along…