Position trading is a long-term investment method, based on fundamental analysis and market trends to determine entry and exit points. Compared to short-term trading, this method is less subject to daily fluctuations, helping investors take advantage of major trends and optimize profits. In this article, join PF Insight to explore the strategies, advantages and disadvantages…

Category Archives: Technical Analysis

Scalping trading strategies are suitable for traders who want to make quick profits by opening many orders in a short period of time. This method requires traders to understand the market structure, manage risks closely and maintain high discipline. In this article, PF Insight will analyze the best scalping strategies and important supporting tools to…

In technical analysis, trend confirmation indicators are key tools that help traders identify trends into profits. These indicators assess the stability and momentum of prices, thereby filtering out noise signals or false trends. As a result, traders can make accurate decisions, avoid risks and optimize their trading strategies. 5 Must-know quantitative trading strategies for consistent…

Quantitative trading strategies use mathematical models, historical data, and automated algorithms to identify buying and selling opportunities in the market. If you are wondering what quant trading is, this article by pfinsight.net will guide in detail how to build and deploy quant trading effectively. Best no evaluation Prop Firm offering direct funded accounts Prop Firm…

In 2025, the Forex market will be more exciting and challenging than ever. To seize opportunities, traders need to update accurate trading signals in real time. Telegram groups sharing free Forex signals are becoming more and more popular, helping both new and professional traders improve their strategies and maximize profits. In this article, PF Insight…

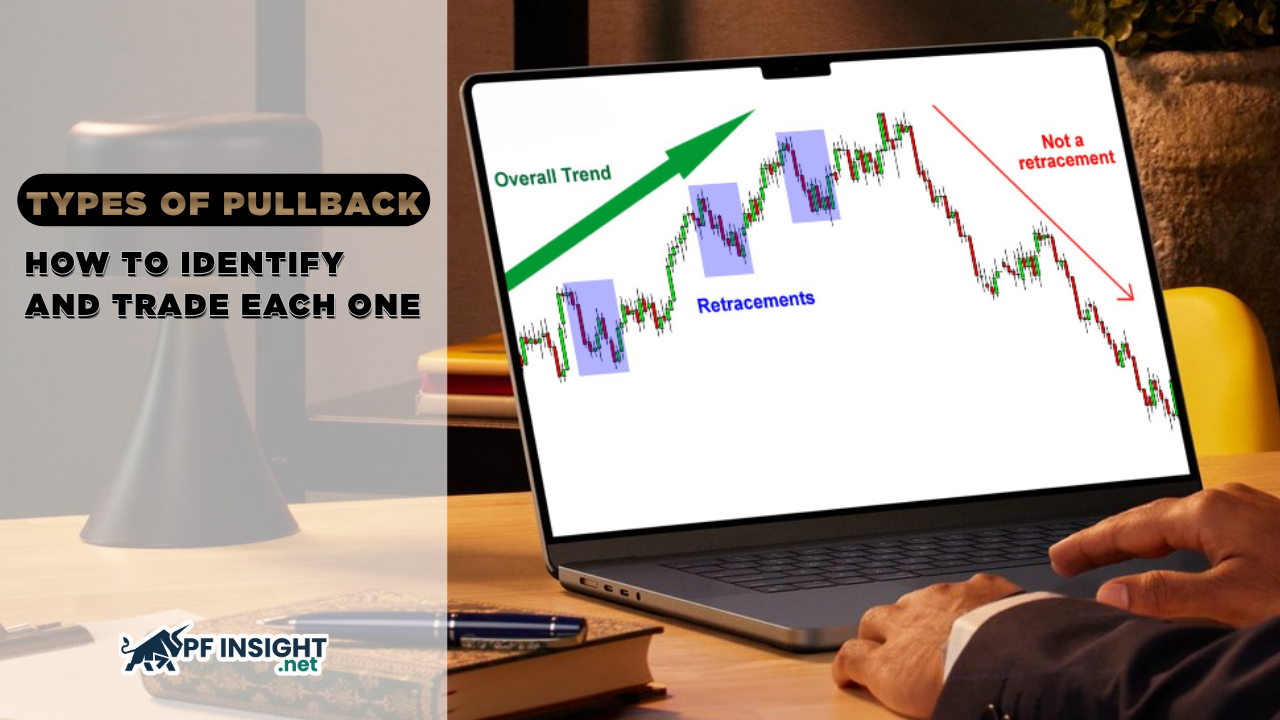

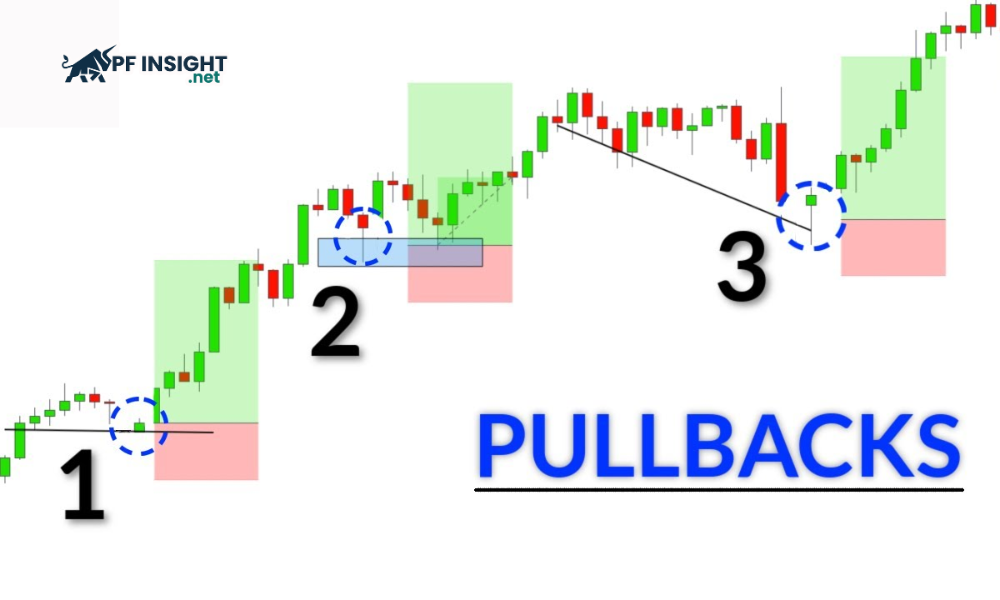

In trend trading, understanding and identifying pullbacks is a key factor that helps traders determine optimal entry points while minimizing risk. A pullback allows traders to join an existing trend during temporary price retracements, rather than chasing breakouts or trying to catch tops and bottoms. Knowing the types of pullback helps traders distinguish between a…

Momentum indicators are technical tools that help traders assess the strength and speed of price changes, thereby determining the momentum of the current trend. Understanding and applying these indicators correctly helps traders grasp favorable entry points and avoid noise signals. This article will analyze what momentum indicators are, how to use them and trading strategies….

For traders using MetaTrader 5, technical indicators are an important “weapon” to support analysis and trend identification. However, not everyone knows how to install indicators on MT5 properly. The following article by PF Insight will guide you step by step to install, activate and use indicators to maximize the power of the MT5 platform. What…

In the financial market, prices never move in a straight line but always fluctuate continuously. This fluctuation creates both opportunities and challenges for traders when finding appropriate entry and exit points. In particular, pullback is a common phenomenon, representing a temporary adjustment in the main trend. So what is a pullback? Let’s pfinsight.net find out…

In the volatile Forex market, smart account management is the foundation for traders to maintain efficiency and limit risks. MT4 account management not only provides comprehensive monitoring of trading activities but also supports profit optimization and tight capital management. The following article will help you understand the concept, forms of account management and how to…