The Relative Strength Index, commonly referred to as the RSI indicator, is one of the most widely used momentum tools in technical analysis. Thanks to its simple structure and clear scale ranging from 0 to 100, RSI is especially appealing to new traders. However, this simplicity often leads beginners to misunderstand how RSI actually works….

Category Archives: Technical Analysis

In technical analysis, early detection of reversal signals helps optimize profits. The stochastic oscillator is one of the most important indicators, helping to identify overbought or oversold conditions in the market. This allows traders to make smarter trading decisions, minimize risks, and improve investment efficiency. MACD indicator tips to get better long term results Liquidity…

Fibonacci retracement is one of the most widely used technical tools for identifying price zones where the market may pause, bounce, or continue following the prevailing trend. Originating from a mathematical concept, Fibonacci retracement has become popular in trading because of its ability to reflect market behavior through key price levels during a pullback. In…

The MACD indicator is one of the most powerful technical analysis tools, widely used by traders to identify trends and reversal signals. Thanks to its ability to combine moving averages and momentum, MACD helps traders identify entry and exit points more accurately. Understanding how MACD works is crucial for improving trading performance. Liquidity grab strategy:…

The liquidity grab strategy is one of the key concepts within smart money concepts and is used to explain why the market frequently creates liquidity sweeps before moving in its true direction. For many new traders, these sweeps are often mistaken for real breakouts or reversal signals, leading to poorly timed entries and causing them…

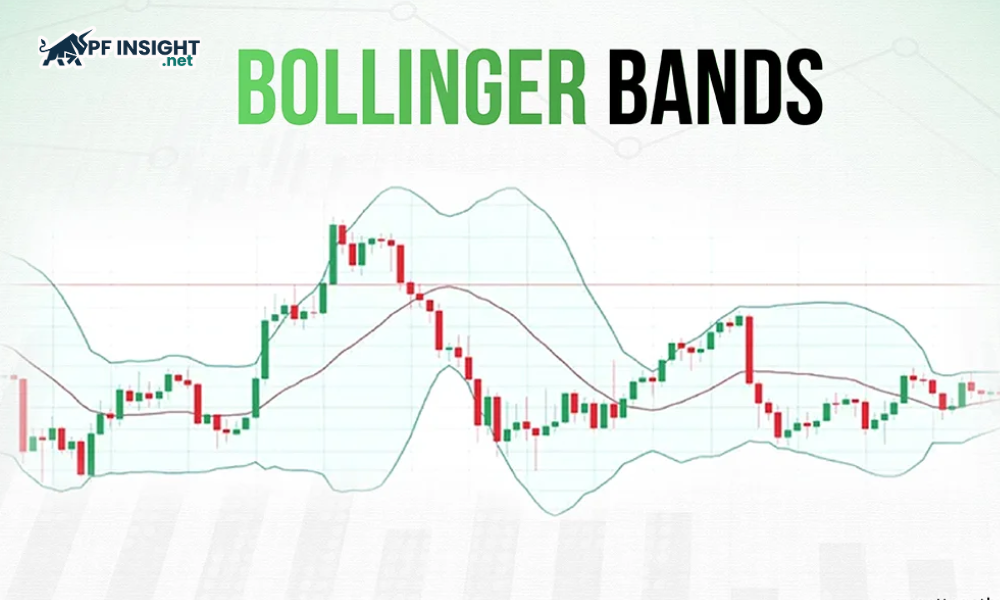

Bollinger Bands is a famous technical indicator that helps traders visually identify trends and market volatility. This tool, developed by John Bollinger, helps assess risks and find potential trading opportunities. So how do Bollinger Bands work and how can they be applied effectively? Let’s pfinsight.net explore the details in this article. Automated trading system benefits…

As markets move faster and price data becomes increasingly complex for traders to process manually, an automated trading system helps execute trades with greater accuracy, discipline and consistency. By automating the decision-making process, traders can minimize emotional influence and maintain strict adherence to their strategy across all market conditions. From basic algorithmic rules to more…

In trading, most traders do not lose because their analysis is wrong but because they take on too much risk for too little potential reward. Asymmetric trading introduces a completely different mindset. It is an approach where the potential reward is always significantly greater than the amount of risk you take, allowing you to protect…

Position trading is a long-term investment method, based on fundamental analysis and market trends to determine entry and exit points. Compared to short-term trading, this method is less subject to daily fluctuations, helping investors take advantage of major trends and optimize profits. In this article, join PF Insight to explore the strategies, advantages and disadvantages…

Scalping trading strategies are suitable for traders who want to make quick profits by opening many orders in a short period of time. This method requires traders to understand the market structure, manage risks closely and maintain high discipline. In this article, PF Insight will analyze the best scalping strategies and important supporting tools to…