Many traders struggle to identify trends and market direction not because they lack tools, but because they do not fully understand how price is formed and how it moves. Market structure trading provides an analytical framework that helps traders clearly see the relationship between swing highs, swing lows, and break of structure points, allowing them…

Category Archives: Technical Analysis

Fair value gap trading is a strategy favored by many modern traders to identify unfilled price gaps in the market. By analyzing these price zones, investors can optimize entry points, reduce risk, and increase the probability of successful trades in highly volatile environments. In this article, PF Insight guides you on how to analyze and…

In technical analysis, order block trading is often viewed as a tool for identifying price zones where large institutions are active. However, order blocks should not be understood as standalone trading signals but rather as the result of buying and selling pressure formed during the execution of large-scale orders. In today’s article, Pfinsight.net analyzes how…

Smart Money Concepts is an analytical method focused on the trading behavior of large financial institutions – the “players” capable of leading market trends. Instead of following traditional indicators, Smart Money Concepts helps traders understand how large sums of money create liquidity, manipulate prices, and identify high-probability entry zones. This is a crucial mindset for…

Mean Reversion trading focuses on exploiting temporary market imbalances when prices move away from the average. This method is not suitable for emotional trading but requires discipline, patience, and the ability to assess the overall context. Combining technical indicators with strict capital management principles helps increase the probability of success. In this article, PF Insight…

VWAP trading strategy, or volume-weighted average price, is a measure of the average price traded throughout the day based on both price and trading volume. This indicator helps traders understand where the current price stands relative to the market’s average level. VWAP is especially useful in intraday trading, where timing and execution efficiency are critical….

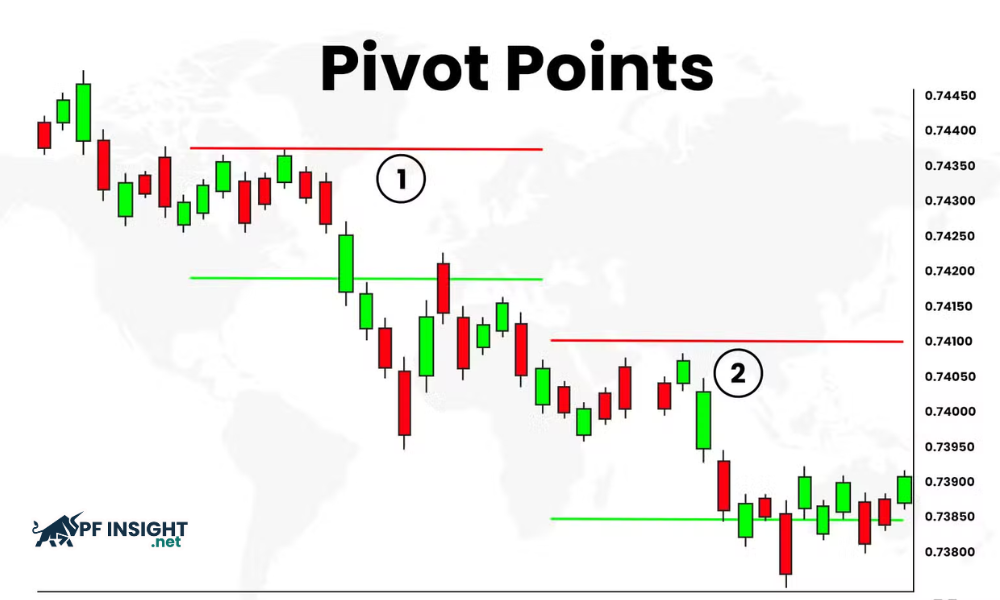

Pivot Points Trading is not simply a calculation tool, but also a method that helps traders logically understand market structure. Based on price data from the previous session, this method helps traders optimize entry points and manage risk more effectively in highly liquid markets. What is the ATR Indicator and how it works in trading…

The ATR indicator, short for Average True Range, is a technical indicator designed to measure market volatility rather than predict price direction. For beginners, understanding this distinction is critical. Many new traders focus on whether price will move up or down, while overlooking a more important question: how much the market is likely to move….

Parabolic SAR is considered a useful tool for identifying entry and exit points and managing trends. This indicator is particularly effective when the market has a clear trend, helping traders closely follow the upward or downward momentum of prices. Understanding how Parabolic SAR works correctly will help traders reduce signal noise and improve trading performance….

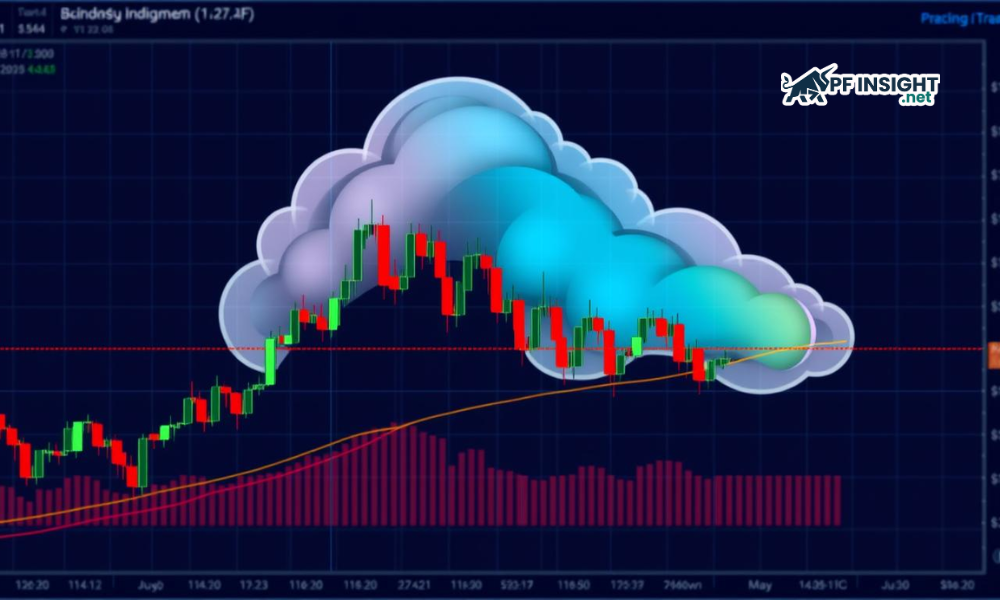

The Ichimoku cloud is considered one of the most comprehensive technical analysis tools, allowing traders to observe trends, momentum, and key price zones on a single chart. With its clear and easily recognizable structure, the Ichimoku cloud helps identify the dominant trend as well as potential entry points. In this article, PF Insight will help…