Many traders have experienced the feeling of entering a trade the moment they spot a “breakout incoming” signal, only for price to reverse, throwing off the timing and eliminating the edge. With a bollinger bands squeeze, the issue is not the tool itself, but how we read the signal and act too quickly. That is…

Category Archives: Technical Analysis

Momentum indicator trading is an indispensable tool for traders who want to gain a deeper understanding of price behavior in financial markets. By measuring the rate of price change, the Momentum indicator helps detect early signals of overbought, oversold, or weakening of the current trend. Applying the momentum indicator correctly will help traders make more…

Stochastic RSI is an indicator widely used by traders to identify when the market may be overbought or oversold. Compared to traditional RSI, this indicator tends to react faster and generate signals more frequently, helping traders spot momentum shifts earlier. However, because of its high sensitivity, it can also fluctuate sharply and produce noisy signals…

For traders, understanding market conditions is essential when building a sustainable trading strategy. Overbought and oversold levels reflect the degree of market euphoria or panic, providing crucial clues about the likelihood of a trend reversal or continuation. Properly applying these levels helps traders improve timing and manage risk more effectively. What are overbought and oversold…

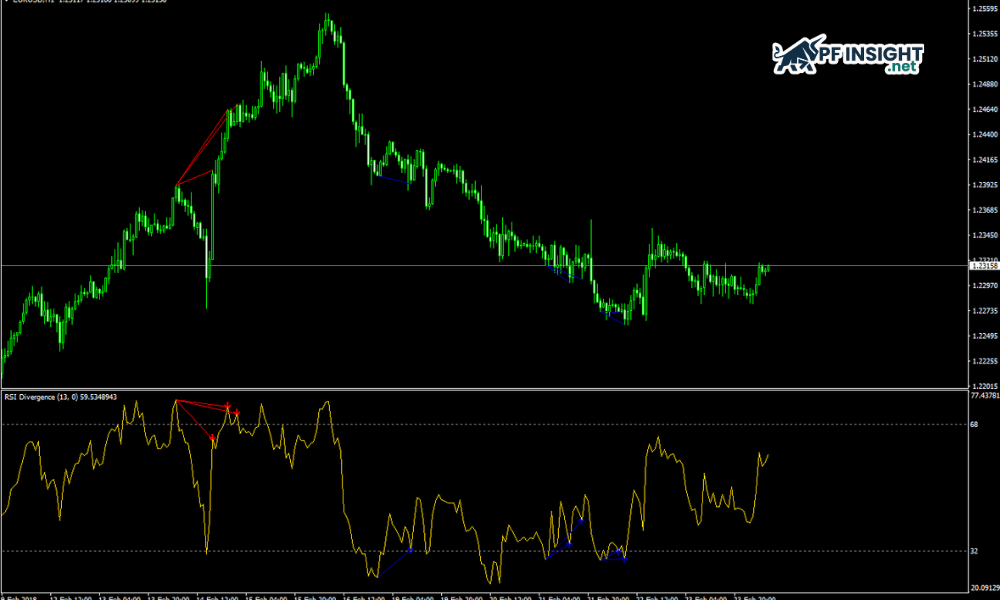

In technical analysis, the RSI divergence is a powerful tool that helps traders detect early signals of price reversals. When the RSI indicator does not align with the price trend, it signals a potential change in market momentum, helping traders make more accurate entry decisions and reduce the risk of losses. MACD histogram: How it…

Many traders start with MACD because it is easy and familiar, but the longer they trade, the more they realize one issue: signals often come late, after price has already moved a significant distance. Meanwhile, the MACD histogram can reveal market momentum shifts earlier, acting like an “early warning system” before an actual crossover appears….

Support and resistance are foundational concepts that help traders understand how price reacts at key areas on a chart. Learning how price pauses, bounces, or stalls at these zones is the first step toward reading charts in a systematic way. This article focuses on clarifying the most basic concepts, making it suitable for traders who…

In financial trading, markets don’t move randomly but always follow recurring patterns over time. Understanding market cycles in trading helps traders identify whether the market is in an accumulation, growth, distribution, or recession phase. By grasping market cycles, traders can choose appropriate strategies, avoid emotional trading, and improve long-term investment efficiency. Market structure trading: How…

In technical analysis, the trendline breakout strategy is often considered one of the common approaches for identifying trend-based entry points. However, using breakouts in a mechanical way, without proper context or clear confirmation rules, has led many traders to experience false breakouts and inconsistent trading results. Together with PF Insight, this article focuses on clarifying…

Not all trading strategies depend on upward or downward trends. In fact, only traders who truly understand volatility can turn risk into advantage. Volatility trading concepts focus on measuring, analyzing, and trading based on the intensity of price fluctuations, thereby helping traders build strategies that adapt to all market conditions. Market structure trading: How traders…