The ATR indicator, short for Average True Range, is a technical indicator designed to measure market volatility rather than predict price direction. For beginners, understanding this distinction is critical. Many new traders focus on whether price will move up or down, while overlooking a more important question: how much the market is likely to move….

Category Archives: Knowledge Hub

Parabolic SAR is considered a useful tool for identifying entry and exit points and managing trends. This indicator is particularly effective when the market has a clear trend, helping traders closely follow the upward or downward momentum of prices. Understanding how Parabolic SAR works correctly will help traders reduce signal noise and improve trading performance….

The Ichimoku cloud is considered one of the most comprehensive technical analysis tools, allowing traders to observe trends, momentum, and key price zones on a single chart. With its clear and easily recognizable structure, the Ichimoku cloud helps identify the dominant trend as well as potential entry points. In this article, PF Insight will help…

The Relative Strength Index, commonly referred to as the RSI indicator, is one of the most widely used momentum tools in technical analysis. Thanks to its simple structure and clear scale ranging from 0 to 100, RSI is especially appealing to new traders. However, this simplicity often leads beginners to misunderstand how RSI actually works….

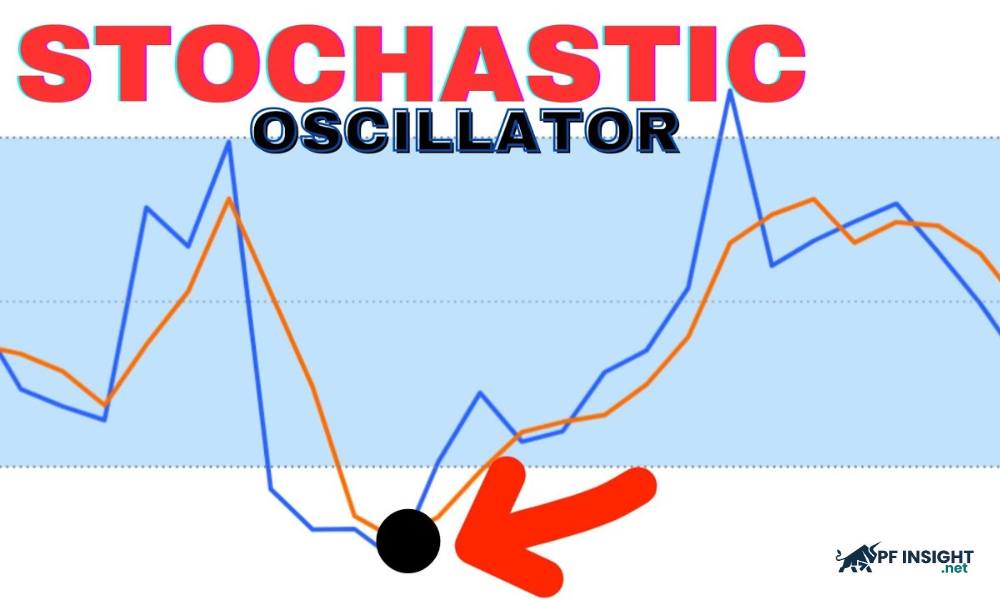

In technical analysis, early detection of reversal signals helps optimize profits. The stochastic oscillator is one of the most important indicators, helping to identify overbought or oversold conditions in the market. This allows traders to make smarter trading decisions, minimize risks, and improve investment efficiency. MACD indicator tips to get better long term results Liquidity…

Fibonacci retracement is one of the most widely used technical tools for identifying price zones where the market may pause, bounce, or continue following the prevailing trend. Originating from a mathematical concept, Fibonacci retracement has become popular in trading because of its ability to reflect market behavior through key price levels during a pullback. In…

The MACD indicator is one of the most powerful technical analysis tools, widely used by traders to identify trends and reversal signals. Thanks to its ability to combine moving averages and momentum, MACD helps traders identify entry and exit points more accurately. Understanding how MACD works is crucial for improving trading performance. Liquidity grab strategy:…

The liquidity grab strategy is one of the key concepts within smart money concepts and is used to explain why the market frequently creates liquidity sweeps before moving in its true direction. For many new traders, these sweeps are often mistaken for real breakouts or reversal signals, leading to poorly timed entries and causing them…

In a financial market environment that operates at increasingly higher speed, understanding how news affects sentiment and why economic data can trigger immediate volatility in currency pairs, indices, or commodities is essential for every trader. When major reports such as inflation, employment, or interest rate decisions are released, liquidity can shift within seconds and generate…

In the volatile world of finance, identifying market trends is crucial for effective trading. The trend trading method has become a popular choice due to its ability to help traders follow the main flow of price movement. This approach not only reduces market noise but also optimizes entry points. Copy trading for beginners: How to…