Smart Money Concepts is an analytical method focused on the trading behavior of large financial institutions – the “players” capable of leading market trends. Instead of following traditional indicators, Smart Money Concepts helps traders understand how large sums of money create liquidity, manipulate prices, and identify high-probability entry zones. This is a crucial mindset for…

Category Archives: Knowledge Hub

Trong phân tích kỹ thuật, nhiều nhà giao dịch tìm kiếm tín hiệu từ các chỉ báo để giải thích thị trường. Tuy nhiên, đối với những người theo dõi giao dịch dựa trên hành động giá , chính chuyển động giá đã chứa đủ thông tin để hiểu cách thị trường vận hành thông…

When the Forex market becomes unpredictable, relying on a single trading direction can expose traders to significant risks. The hedging Forex strategy offers a more flexible approach, allowing traders to protect their capital against unexpected reversals. Although it is not a strategy suited for every trading style, hedging still plays an important role in risk…

Mean Reversion trading focuses on exploiting temporary market imbalances when prices move away from the average. This method is not suitable for emotional trading but requires discipline, patience, and the ability to assess the overall context. Combining technical indicators with strict capital management principles helps increase the probability of success. In this article, PF Insight…

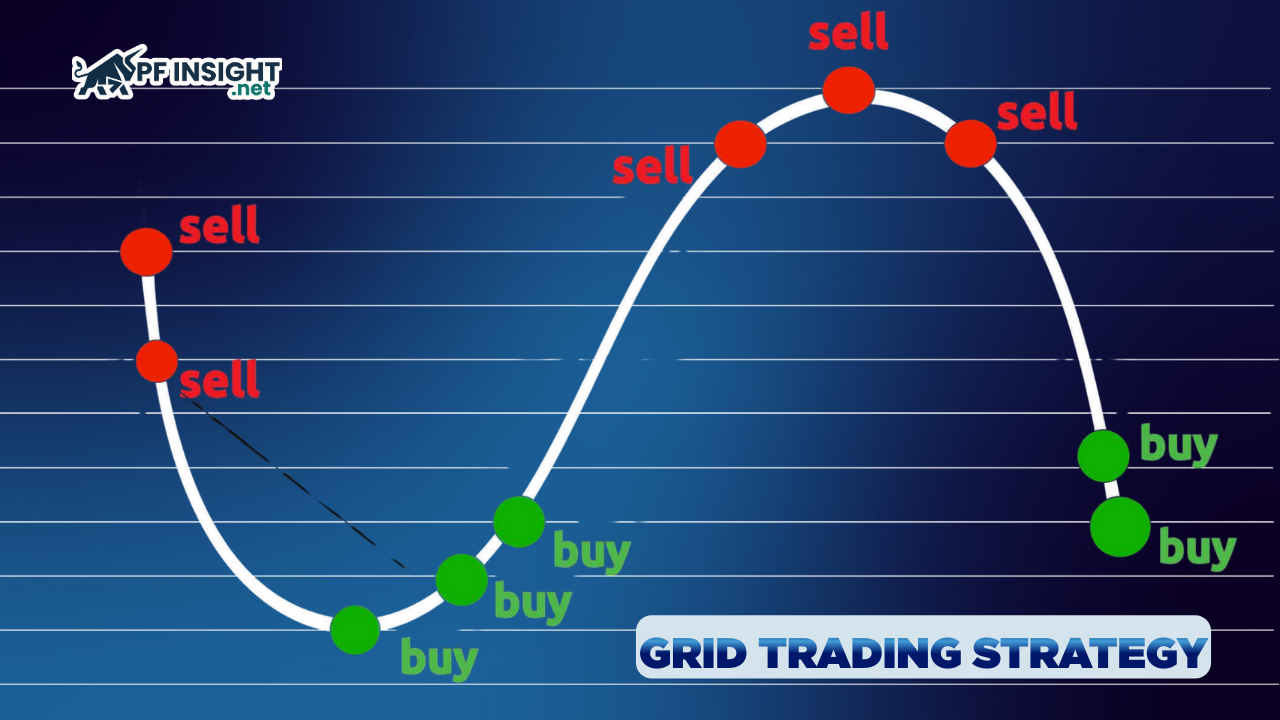

In financial markets, price does not always move in a clear trend. Many periods are defined by sideways price movement, where prices fluctuate within a limited range and make directional predictions difficult, especially for beginners. In such conditions, strategies that rely heavily on trend identification often struggle to perform consistently. This is why the grid…

The trend following strategy has long been one of the foundational trading approaches, not because it promises quick profits, but because it emphasizes consistency in the trading process. In market conditions that are constantly changing and difficult to predict, many traders continue to choose trend following as a clearly structured approach. Rather than attempting to…

A breakout trading strategy is a popular approach in the forex market that focuses on capturing strong price movements when the market breaks through key support or resistance levels. When a breakout occurs, volatility often increases and price tends to develop a clearer directional move. This article explains how breakout trading works in forex, along…

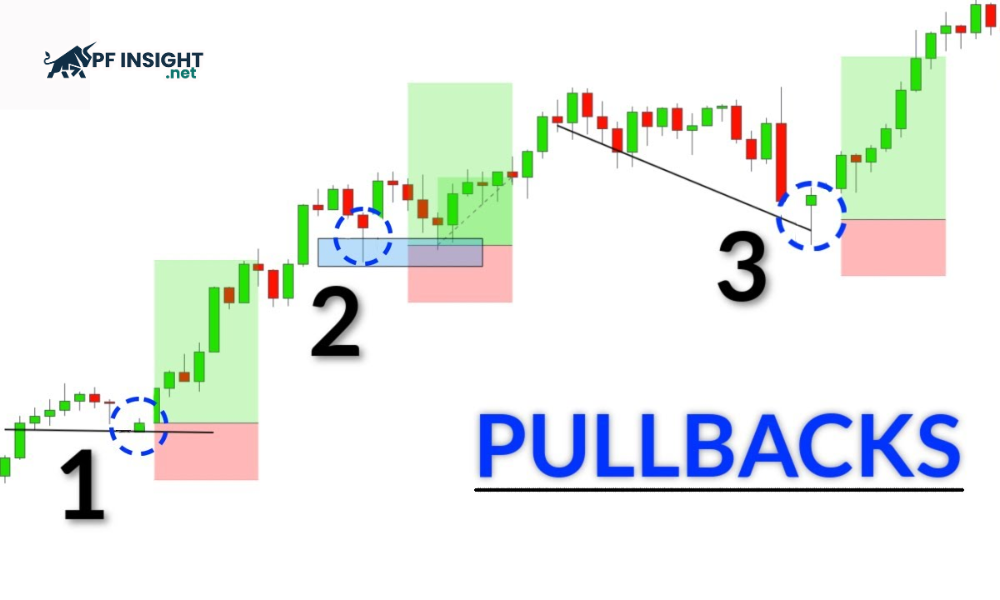

Finding the right entry point is key to improving trading performance in the financial markets. The pullback trading strategy stands out for its ability to optimize risk by focusing on corrective phases within strong trends. This strategy allows traders to trade with the trend instead of risking breakouts. This article from PF Insight will help…

VWAP trading strategy, or volume-weighted average price, is a measure of the average price traded throughout the day based on both price and trading volume. This indicator helps traders understand where the current price stands relative to the market’s average level. VWAP is especially useful in intraday trading, where timing and execution efficiency are critical….

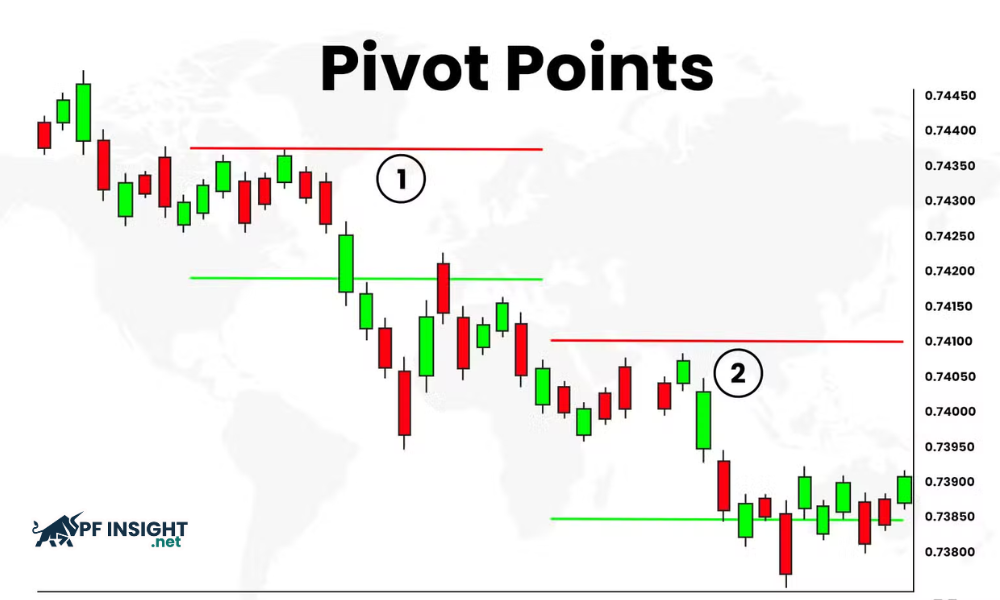

Pivot Points Trading is not simply a calculation tool, but also a method that helps traders logically understand market structure. Based on price data from the previous session, this method helps traders optimize entry points and manage risk more effectively in highly liquid markets. What is the ATR Indicator and how it works in trading…