To become a successful trader, you need to master the prop trading basics. This article provides an overview of proprietary trading, including its benefits and challenges, as well as key strategies to enhance trading performance. Let’s find out more in the article below with PF Insight. Trading indices for beginners: key concepts and how index…

Category Archives: Knowledge Hub

Pullbacks often provide some of the most attractive risk-to-reward opportunities in trending markets, yet many traders enter too early and get caught in temporary reversals. The difference between a high-probability setup and a failed trade usually lies in confirmation. Pullback confirmation methods help traders distinguish between a healthy retracement and a potential trend reversal. Instead…

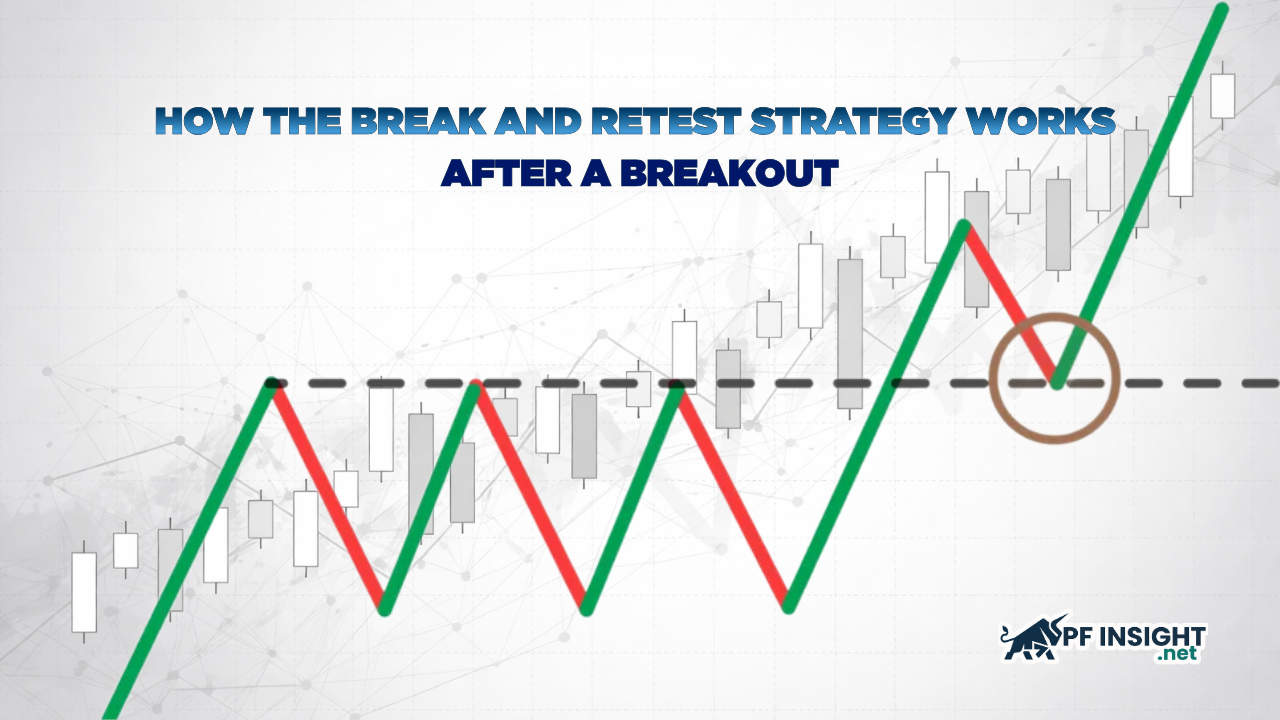

Breakouts often attract aggressive entries, but not every breakout leads to a sustained trend. Many traders struggle with timing, especially when price moves quickly beyond key support or resistance levels. The break and retest strategy offers a more structured approach by waiting for the price to return to the broken level before committing to a…

What is the consistency rule? The consistency rule is one of the most important and common terms in the Prop Firm market. But how important is the consistency rule in Prop Firm investing? How is this rule applied? What should traders pay attention to in order to apply the consistency rule effectively and achieve the…

Index trading has become increasingly popular thanks to its stability, predictable market movements, and lower risk compared to trading individual stocks. However, to get started the right way, traders need to understand what an index truly represents, how its price is formed, and the factors that influence its volatility. With PF Insight, you will learn…

Many traders are fascinated by trading, but to understand how it works, investors need to be familiar with the terminology and language. Today’s article will summarize the important trading glossary, helping new investors gain the confidence needed to approach and navigate the volatile financial markets. What is trading glossary? Trading glossary, also known as “trading…

In technical analysis, Reversal Candlestick Patterns are an important tool that helps traders identify potential changes in market direction. These patterns provide early signals so that traders can proactively enter or exit the market before a real trend reversal takes place. To make it easier for you to get familiar and apply them effectively, PF…

Proprietary trading is a high-risk environment that requires both the right strategy and a sharp mind. Success largely depends on psychological readiness and mental strength. Developing the right trading mindset will improve a trader’s chances of long-term success by helping them stay calm, make informed decisions, and react quickly to changes in the market. In…

Proprietary trading firms are rapidly developing, and they are now considered one of the most effective investment methods that bring high profitability for traders with limited personal capital. However, to trade successfully, Prop Firm projects must be equipped with advanced trading platforms such as MT4, MT5, and cTrader. Among these, the cTrader platform stands out…

The Prop Firm trading format has gradually become the top choice for traders in the market due to its growing ability to provide traders with access to abundant capital without exposing them to large financial risks. This capability is made possible by a carefully considered Prop Firm business model, which benefits both the company and…