Many traders have experienced the feeling of entering a trade the moment they spot a “breakout incoming” signal, only for price to reverse, throwing off the timing and eliminating the edge. With a bollinger bands squeeze, the issue is not the tool itself, but how we read the signal and act too quickly. That is…

Category Archives: Knowledge Hub

Momentum indicator trading is an indispensable tool for traders who want to gain a deeper understanding of price behavior in financial markets. By measuring the rate of price change, the Momentum indicator helps detect early signals of overbought, oversold, or weakening of the current trend. Applying the momentum indicator correctly will help traders make more…

Stochastic RSI is an indicator widely used by traders to identify when the market may be overbought or oversold. Compared to traditional RSI, this indicator tends to react faster and generate signals more frequently, helping traders spot momentum shifts earlier. However, because of its high sensitivity, it can also fluctuate sharply and produce noisy signals…

For traders, understanding market conditions is essential when building a sustainable trading strategy. Overbought and oversold levels reflect the degree of market euphoria or panic, providing crucial clues about the likelihood of a trend reversal or continuation. Properly applying these levels helps traders improve timing and manage risk more effectively. What are overbought and oversold…

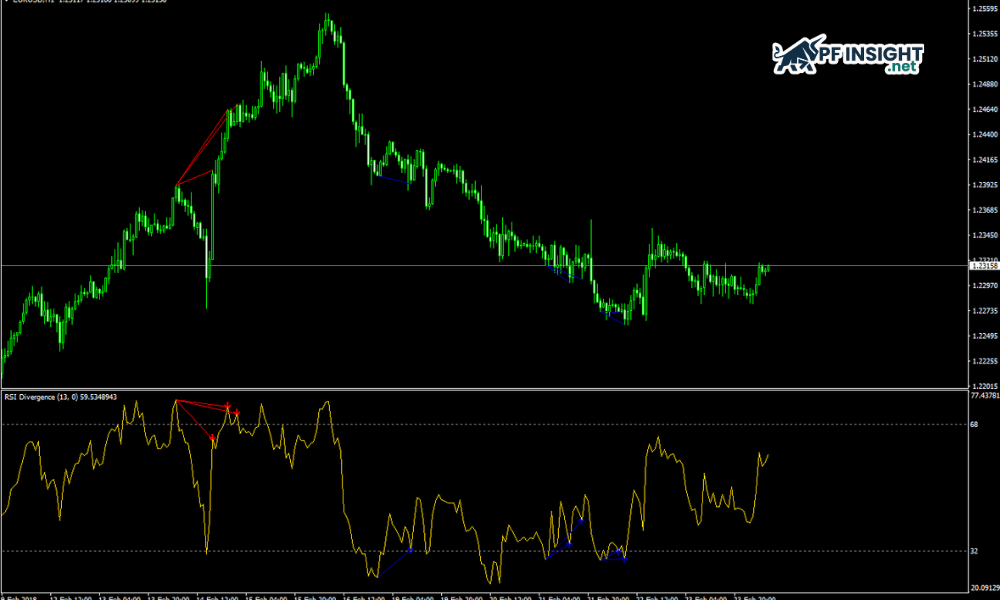

In technical analysis, the RSI divergence is a powerful tool that helps traders detect early signals of price reversals. When the RSI indicator does not align with the price trend, it signals a potential change in market momentum, helping traders make more accurate entry decisions and reduce the risk of losses. MACD histogram: How it…

Many traders start with MACD because it is easy and familiar, but the longer they trade, the more they realize one issue: signals often come late, after price has already moved a significant distance. Meanwhile, the MACD histogram can reveal market momentum shifts earlier, acting like an “early warning system” before an actual crossover appears….

Trading discipline is an important factor that helps traders maintain long-term consistency. With the right trading discipline tips, you can limit emotion-driven decisions, avoid breaking rules, and keep performance consistent over time. In this article from Pfinsight.net, you will learn practical trading discipline tips to stay consistent in the long run. Backtesting trading strategies and…

Backtesting trading strategies is a fundamental step that helps traders evaluate the effectiveness of a strategy before applying it to the real market. By testing the strategy against past price data, traders can understand how the strategy reacts to different market conditions. Backtesting doesn’t guarantee future profits, but it helps mitigate risk and build confidence…

Backtesting often gives new traders a sense of certainty. The strategy appears profitable, the equity curve looks relatively stable, and historical numbers seem to confirm that everything has been validated. At this stage, many traders believe they have found a method that can be applied in live markets. However, that sense of confidence largely comes…

Algorithmic trading basics are crucial for traders to understand how computers automatically execute orders based on pre-programmed rules. Instead of relying solely on human emotion, algorithmic trading leverages data, processing speed, and mathematical logic to optimize trading decisions. Mastering these fundamental principles allows traders to approach the modern market more effectively and systematically. FOMO trading…