The liquidity pool concept is a fundamental pillar in DeFi, enabling DEXs to swap tokens continuously without relying on a traditional order book. In trading, many traders also observe that price often gets “pulled” toward liquidity levels, where large clusters of pending orders and stop-losses are concentrated. Although these belong to different contexts, both revolve…

Category Archives: Knowledge Hub

Liquidity sweep trading is not a mechanical entry strategy, but a way to read market intent through liquidity. When price quickly breaks above a recent high or below a recent low and then sharply reverses, it often signals a liquidity sweep. Understanding this behavior helps traders avoid FOMO, improve entry timing, and trade in alignment…

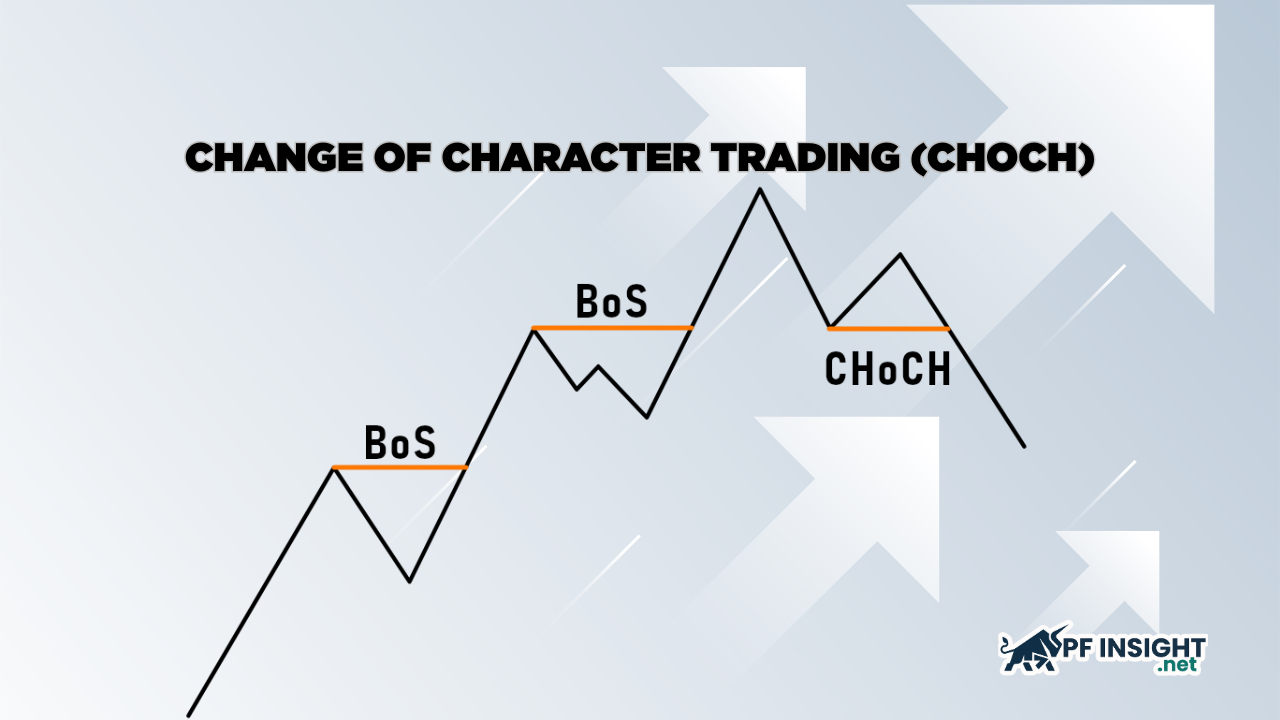

Change of character trading (CHOCH) is one of the most important concepts in market structure, helping traders recognize when the market starts to “change character” and may be preparing for a reversal. However, many traders still confuse CHOCH with Break of Structure (BOS) because both involve price breaking key structural levels. In this article, Pfinsight.net…

Many traders incur losses by trying to catch tops and bottoms while ignoring signs that the market structure has already changed. Break of structure trading addresses this issue by waiting for clear confirmation from price action before entering a trade. When the structure is broken, it often signals that either buyers or sellers have taken…

When observing the market, what confuses traders most is not whether price is going up or down, but whether that trend is truly reliable or just temporary noise. Many traders enter based on gut feeling or a few strong candles, only to get “reversed” shortly after because they are trading against real directional pressure. This…

The ADX indicator (Average Directional Index) is an important tool that helps traders measure the strength of a trend rather than simply identifying price direction. In a constantly fluctuating market, understanding whether a trend is strong or weak allows traders to avoid emotional entries. The ADX indicator is especially useful for filtering market noise, reducing…

Trend strength indicators play a crucial role in helping traders assess whether a trend is strong enough to trade. The market needs to know not only whether it’s rising or falling, but also how sustainable that trend is. By using trend strength indicators, traders can filter out sideways phases, optimize entry points, and improve the…

Moving average crossovers are an important tool that helps traders confirm trends instead of guessing tops and bottoms. When the short-term moving average crosses above or below the long-term moving average, a clear and credible trading signal emerges. In this article, PF Insight will analyze the advantages, disadvantages, and how to optimize moving average crossovers…

Average true range volatility (ATR) is one of the simplest yet most useful indicators, helping traders clearly understand market volatility before placing a trade. In fact, many stop-loss hits happen not because you misread the trend, but because your stop was “too tight” relative to volatility at that time. In this article, Pfinsight.net will walk…

Many traders incur losses not because they lack a strategy, but because they ignore trend & confirmation when entering trades. Markets tend to move in trends, and only when those trends are clearly confirmed do trading opportunities become truly high quality. Understanding and applying trend & confirmation correctly helps traders trade more systematically, maintain discipline,…