Affiliate marketing is one of the key factors contributing to the rapid growth of the Prop Firm financial market in recent years. Thanks to affiliate performance programs for Prop Firms, traders around the world can access and profit from this market. However, tracking affiliate performance is not an easy task. Not all affiliates bring equal value – some generate high-quality traders, while others focus only on short-term sign-ups without sustainable profit. So, how to track affiliate performance for Prop Firms? Today’s article from Pfinsight.net will provide you with the most effective methods to track, evaluate, and optimize affiliate program results. Let’s find out!

What is an affiliate program in Prop Firms?

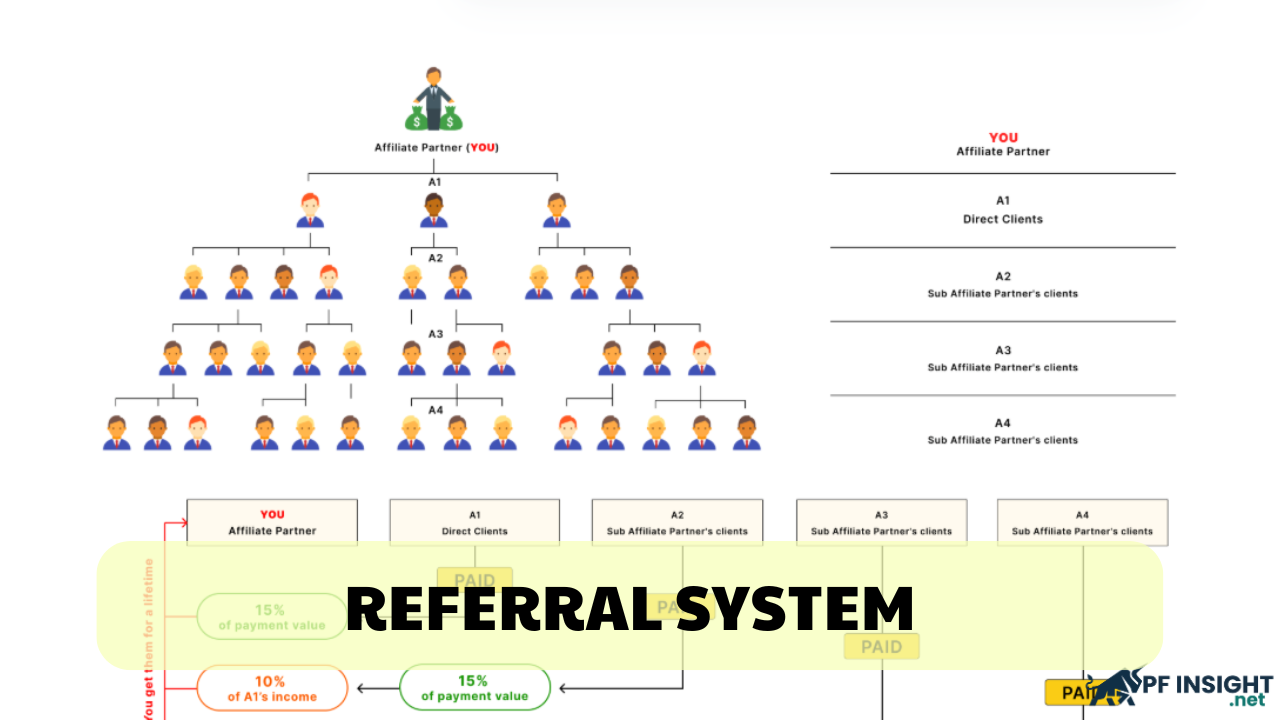

A Prop Firm affiliate program is a form of affiliate marketing in which individuals or groups (known as affiliates) promote the services of a Prop Firm – a company that provides trading capital to traders.

Affiliates are paid based on specific actions performed by the referred individuals when they successfully convince new traders to register accounts at the Prop Firm or join trading challenges via referral links. Examples of such actions include:

- Registering and paying for an evaluation challenge package.

- Completing the challenge and becoming a funded trader.

- Continuing to trade and generate profit for the company.

The importance of tracking affiliate performance for Prop Firms

Affiliate marketing projects are essential for attracting potential clients in the Prop Firm trading sector. However, such programs can only bring long-term benefits if Prop Firms actively track and evaluate the performance of their affiliates.

Here’s why tracking affiliate performance is crucial:

Identify affiliates that bring real value

Not all affiliates are the same. While some only generate low-quality traffic or sign-ups, others help Prop Firms attract serious and experienced traders.

By tracking performance metrics (such as clicks, conversion rates, retention rates, etc.), you can identify high-quality affiliates and focus your resources on supporting and investing in them.

Optimize commission costs and marketing budgets

Tracking performance allows you to determine which commission payouts truly generate profit.

To maximize ROI (Return on Investment), you can adjust your commission structure or reallocate budget if an affiliate generates ineffective traffic or low conversion rates.

This helps increase the net profit from affiliate marketing while preventing overspending on underperforming affiliates.

Improve trader retention rate

Even if a referred trader completes a challenge, not all of them remain active over time.

By tracking affiliate performance for Prop Firms, companies can identify which affiliates bring in traders with consistent trading behavior, then expand partnerships with those affiliates.

On the other hand, if an affiliate repeatedly brings “try-and-quit” clients, it’s worth reconsidering their commission structure or marketing approach.

Prevent fraud and ensure transparency

Fraudulent traffic in affiliate systems – such as bots generating fake clicks or sign-ups – cannot be ignored. By monitoring performance in real time, Prop Firms can:

- Detect suspicious activities such as traffic spikes, mismatched conversions, or low retention rates.

- Prevent financial loss.

- Additionally, maintaining transparency and clarity in affiliate programs helps build trust among all partners.

Strengthen relationships and retain loyal affiliates

Performance tracking is not just about control – it’s also about recognizing and rewarding top affiliates fairly.

When affiliates see that your Prop Firm is open, fair, and timely in rewards, they are more likely to stay loyal and promote your brand actively.

Building trust and long-term relationships between Prop Firms and their affiliate networks is an essential element of sustainable growth.

Make data-driven decisions

Tracking affiliate performance allows Prop Firms to make informed, data-driven decisions instead of relying solely on intuition. You can quickly determine:

- Which traffic sources perform best.

- Which advertising platforms deliver the highest conversion rates.

- Which affiliates have the most growth potential.

As a result, Prop Firms can improve ROI, optimize long-term profitability, and refine their overall marketing strategy.

How to track affiliate performance for Prop Firms?

Tracking affiliate performance for Prop Firms is an essential process that helps measure, optimize, and expand a sustainable affiliate network. Therefore, firms must build a clear tracking system to identify which affiliates bring real profit and which campaigns perform best.

Use dedicated tracking software and affiliate dashboards

Most Prop Firms today use affiliate management platforms to handle their programs. These tools help monitor all relevant data, including clicks, sign-ups, conversion rates, and commissions.

Some popular platforms include:

- Tapfiliate – easy to use and effective for finance-related websites.

- Impact.com – ideal for large Prop Firms with multiple campaigns.

- PartnerStack – a powerful tool for partner management and automated payments.

- FirstPromoter – a common choice among fintech and Prop Firm trading companies.

These platforms provide real-time dashboards, allowing firms to track affiliate performance, compare results, and assess ROI per campaign.

Integrate internal trading systems with CRM data

For Prop Firms, tracking only clicks and conversions is not enough. They must also assess the quality and activity of referred traders. This can be done by integrating CRM (Customer Relationship Management) or trading platform data. When combined, Prop Firms can see:

- Which affiliate referred which traders.

- Which traders are currently active.

- The total trading volume or profit generated.

This integration allows Prop Firms to evaluate affiliate effectiveness based on long-term trader value rather than initial sign-ups, accurately determining each trader’s LTV (Lifetime Value).

Establish regular reports and KPIs

Setting performance metrics (KPIs) is just as crucial as collecting data when tracking affiliate success. Common KPIs for Prop Firms include:

- Click-through rate (CTR) – measures how often users click affiliate links.

- Conversion rate (CR) – measures how many traders register or purchase a challenge.

- Cost per acquisition (CPA) – measures the average cost per new trader.

- Trader retention rate – the percentage of traders who remain active over time.

- Revenue per affiliate – the average income generated per partner.

Weekly or monthly reports help Prop Firms track trends, identify anomalies, and adjust programs promptly.

Ensure accurate and transparent tracking

Delayed payments or unclear tracking systems can quickly damage affiliate trust. Prop Firms must ensure that their systems:

- Track clicks and conversions in real time.

- Display clear information on dashboards.

- Define precise commission terms and payment schedules.

Transparent affiliate programs not only retain loyal partners but also strengthen the firm’s reputation within the trading community.

Use data to improve the affiliate program

Once comprehensive data is collected, use it for action – not just storage. Prop Firms can:

- Reward top affiliates with exclusive offers.

- Enhance marketing materials for underperforming campaigns.

- Adjust commission structures to match trader quality.

- Explore new markets or distribution channels.

Sustainable Prop Firm growth and an efficient, transparent, and scalable affiliate system depend on how effectively data is leveraged.

Common mistakes when tracking affiliate performance

Even experienced Prop Firms can make errors when tracking affiliate performance. Below are common mistakes to avoid:

- Lack of tracking goals: Without clear objectives (such as trading volume, retention rate, or ROI), collected data becomes meaningless.

- Focusing on quantity over quality: High sign-up numbers don’t always equal success if traders don’t stay active or generate profit.

- Using unreliable tracking systems: Inaccurate data can lead to commission errors and loss of affiliate trust.

- Ignoring long-term trader performance: Evaluating only initial sign-ups without checking whether traders remain active is a major oversight.

- Not using data for optimization: Tracking is pointless without follow-up actions such as adjusting campaigns or refining commission models.

Conclusion

In summary, tracking affiliate performance is not just part of a Prop Firm’s marketing strategy – it’s a core component of long-term growth and sustainability. Hopefully, this article has answered your question: how to track affiliate performance for Prop Firms?

Don’t forget to visit our website for more valuable insights. Wishing all traders success!