Financial investing is increasingly favored and chosen by many traders. However, not every trader has enough capital to participate in financial projects. This is why many Prop Firms have emerged, helping traders access investment capital at low costs. Accordingly, traders only need to pass certain challenges to receive funding of up to $200,000 and enjoy profit splits of up to 90%. So, what is a Prop Firm challenge? How to pass Prop Firm challenge? What should traders keep in mind? Let’s explore this topic in detail with Pfinsight.net in today’s article.

What is a Prop Firm challenge?

A Prop Firm challenge is an organized evaluation designed to assess a trader’s ability to invest and generate profits without violating specific conditions, rules, and risk guidelines set by the company. Traders are typically provided with a simulated account and are required to achieve predetermined profit targets without exceeding the maximum drawdown or other risk thresholds.

After successfully passing the Prop Firm challenge, traders will receive a funded account, allowing them to trade using the company’s capital and share in the profits.

The importance of the Prop Firm challenge

As you may know, the operations of Prop Firms differ significantly from regular brokerage firms. When working with a Prop Firm, traders use the company’s capital to trade and share profits, instead of using their own capital as in traditional brokerage models. However, to receive funding, traders must pass the set challenges.

In simple terms, the challenges from a proprietary trading firm – also known as a Prop Firm challenge – are designed to assess a trader’s proficiency, reliability, risk tolerance, and other relevant factors.

Generally, passing a Prop Firm challenge is not easy and requires trading experience. The purpose of this challenge is to evaluate every aspect of your trading skills, including profitability and loss control. Some firms require traders to pay an entry fee, which can be lost if the challenge is not passed. Therefore, the Prop Firm challenge serves as a filter, protecting both your investment and the company’s capital.

So, how to pass Prop Firm challenge? Let’s dive into the practical tips to pass a Prop Firm challenge effectively and quickly.

7+ tips on how to pass Prop Firm challenge

Understand the challenge rules and objectives

How to pass Prop Firm challenge? The first step is to thoroughly understand the company’s rules. Each Prop Firm will have its own specific rules and conditions for traders to pass, such as profit targets, drawdown limits, and risk management requirements. Therefore, before deciding to join any Prop Firm, traders must assess their abilities and carefully review the company’s conditions.

Example:

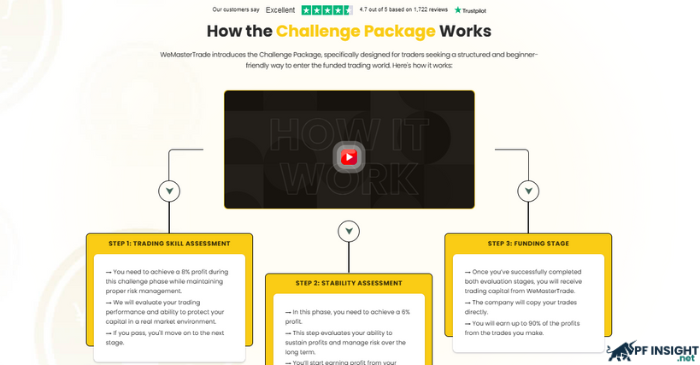

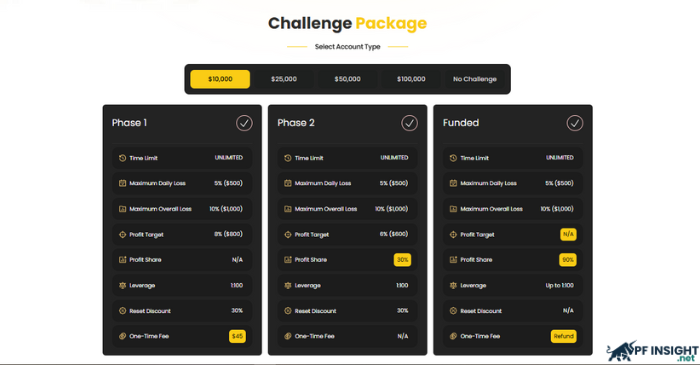

Unlike other Prop Firms, WeMasterTrade offers two different programs – Instant Funding and Challenge Funding. For Instant Funding, traders do not need to pass any challenges to receive capital. But for Challenge Funding, traders must pass the following conditions:

- Phase 1: Profit target ~8%, no consistency requirement.

- Phase 2: Profit target ~6%, with certain requirements for risk management and trading consistency.

- Daily Loss Limit: Around 4% of initial balance.

- Max Loss Limit: Around 6% of initial balance.

It is crucial to fully understand the rules. Many traders fail because they misunderstand or overlook important details, which prevents them from passing the Prop Firm challenge.

Build a clear and realistic trading plan

To pass a Prop Firm challenge, you need a trading strategy that is both realistic and clearly defined. Your trading plan must be straightforward, easy to follow, and comply with the firm’s rules.

Steps to do this:

- Decide on one or two trading strategies that fit the challenge conditions and stick to them. Consistency is key if you want to pass a Prop Firm challenge.

- Set profit targets: Break down a 10% overall profit target into smaller daily or weekly goals to make the challenge more manageable.

- Manage trading risk: Ideally, risk no more than 1% per trade to avoid major setbacks from a bad trading day.

Backtest and forward test your strategy

To pass a Prop Firm challenge, you must backtest your plan before starting. Simulate various market conditions to identify which aspects of your strategy work and which need improvement. Evaluate drawdown limits, risk/reward ratios, and win/loss rates.

After backtesting, run forward tests on a demo account to verify its effectiveness in real-time market conditions. Both processes ensure you are fully prepared to pass the Prop Firm challenge.

Master risk and money management

Effective risk and money management are essential to pass a Prop Firm challenge. Without them, achieving the profit target will be extremely difficult.

- Use stop-loss orders: Every trade should have a stop-loss to prevent large losses, which is critical for passing a Prop Firm challenge.

- Focus on small, consistent wins: Aim for steady, smaller gains rather than high-risk, high-reward trades.

- Avoid revenge trading: If you hit the daily loss limit, take a break and reassess. Trading based on emotions usually leads to bigger losses, reducing your chances of passing the Prop Firm challenge.

Keep your emotions in check

Managing emotions is one of the most important aspects of how to pass Prop Firm challenge. Trading is not only a technical skill but also a mental game.

- Develop a growth mindset: Learn from mistakes and view failures as opportunities for improvement. This mindset can significantly increase your ability to pass a Prop Firm challenge.

- Don’t obsess over results: Focus on executing your plan rather than fixating on outcomes. If you stick to your strategy, your chances of passing the Prop Firm challenge will naturally increase.

Stick to a consistent trading schedule

One secret to passing a Prop Firm challenge is maintaining a consistent trading routine:

- Trade during peak hours: The London and New York sessions offer the highest liquidity, which can improve your odds of passing the challenge.

- Avoid trading during major news events: Volatility can spike during these times, making risk control more difficult and increasing the chance of failing the Prop Firm challenge.

Review your progress daily

To pass a Prop Firm challenge, you must track both your technical performance and emotional state. Regularly reviewing your trades helps ensure you remain aligned with your strategy, improving your chances of passing the challenge.

Conclusion

Overall, how to pass Prop Firm challenge is a question that many traders are asking today. Hopefully, through this article, traders now understand the steps and strategies required to successfully pass a Prop Firm challenge. Don’t forget to visit our website for more valuable trading insights. Good luck, and may you succeed in passing your Prop Firm challenge!