The futures trading platform FundingTicks is facing a serious crisis of confidence after unilaterally changing its trading rules. The retroactive implementation of the new terms last week has sparked outrage among the global investment community.

The main point of contention is the mandatory minimum order holding time of one minute, a direct barrier for scalpers. This makes investors feel that their assets are unprotected and could be seized at any time through arbitrary rule changes by the exchange.

Traders face chaos after the retroactive rule change

In the proprietary trading sector, it’s understandable that organizations update regulations to reflect market fluctuations.

However, FundingTicks’ action of retroactively applying these changes to all accounts caused significant outrage. This violated a fundamental principle of fairness, as traders had committed to and worked based on the old rules.

FundingTicks’ unilateral cancellation of results or reduction of profits for traders who had passed the challenge was a shocking act for the financial community. These individuals had paid a significant fee to participate in the challenge and had diligently traded according to the clearly stated rules at the time. Now, being penalized for newly introduced regulations represents a serious breach of their initial commitments.

The changes to FundingTicks’ regulations have created a new system of barriers, adding to the difficulties faced by traders. The most controversial point is the imposition of a one-minute minimum order holding time, replacing the previous unlimited flexibility, which directly stifles fast trading strategies.

In addition, performance requirements were also raised, with the minimum daily profit increasing from $150 to $200 and the required number of profitable days increasing from five to six.

Furthermore, users’ financial benefits have been directly reduced, with the profit-sharing rate dropping to 80% from the previous 90%, along with new withdrawal limits, making it more difficult than ever to realize profits.

In an attempt to appease public opinion following the controversial rule changes, FundingTicks chose to focus on promoting the increased withdrawal limits on social media platforms. However, this communication strategy was seen by the trading community as an attempt to overshadow other stringent regulations.

FundingTicks officially entered the market earlier this year, built by the same creative team that operates the popular Contract for Difference (CFD) trading platform Funding Pips. The connection between these two entities lies not only in the development teams but is also personalized by Khaled, who has publicly confirmed his role as both owner and CEO of both brands.

Wave of fury: Traders flocking to Social Media in mass protest

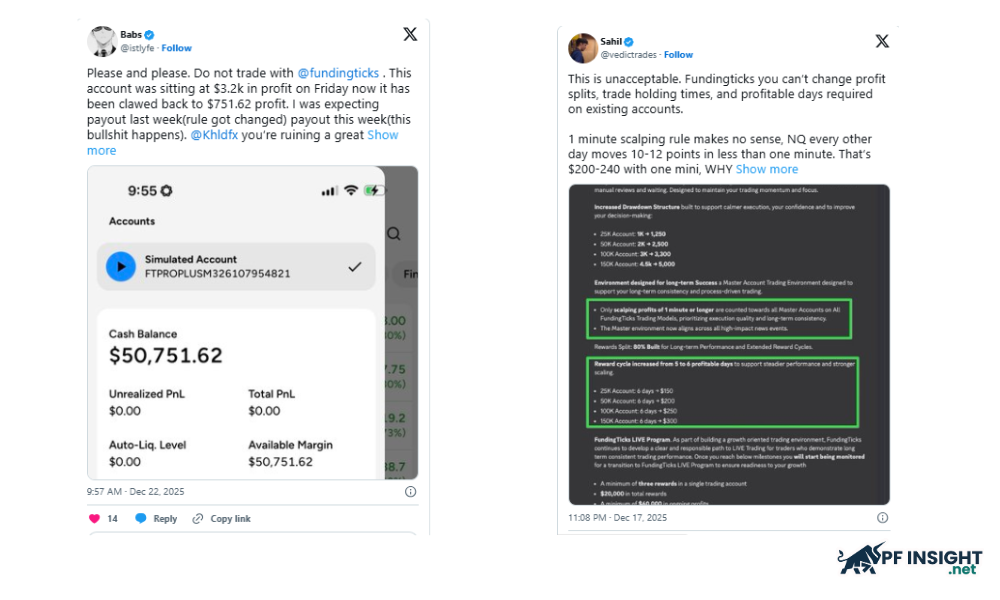

On platform X, user Sahil strongly protested FundingTicks’ unilateral changes. He asserted that imposing new profit-sharing ratios, setting order holding times, and changing the mandatory number of profitable days for active accounts was unacceptable. According to Sahil, these policies should have been subject to community consultation instead of being imposed unilaterally. He emphasized that the old rules were more balanced and sustainable for both sides.

He frankly criticized the mandatory one-minute order holding rule as completely meaningless and impractical in trading.

Through a social media post, Babs publicly expressed his outrage at the significant loss of his actual profits. From a previously earned profit balance of $3,200, his account now holds only $751.62 after the platform implemented retrospective rule changes.

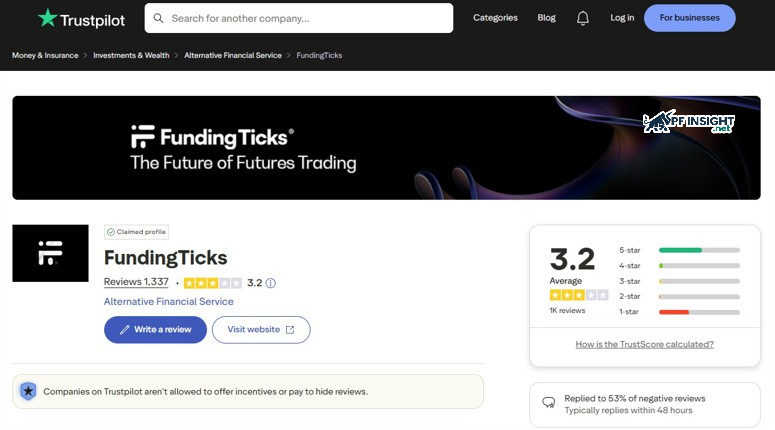

FundingTicks’ reputation is at risk of collapse as trader outrage spreads to its community review site, Trustpilot. From a platform that maintained a stable rating of 4.1 in October, its TrustScore has now plummeted to just 3.2. With over 1,000 new negative reviews appearing, the exchange’s Trustpilot page has become the focal point of intense criticism.

Currently, the crisis of confidence at FundingTicks is worse than ever, with 38% of all reviews on Trustpilot receiving at least one star. These numbers reflect the resolute stance of the trading community in opposing the new policies. Notably, this is not the first time this ecosystem has encountered trouble; last year, Trustpilot had to temporarily suspend the profile page of FundingPips – a platform within the same system – before restoring it later.

Introducing FundingTicks

FundingTicks.com establishes its position in the proprietary trading industry by providing access to the CME futures market with capital resources previously reserved for large financial institutions. Through strategic technology partners including NinjaTrader, Tradovate, and especially TradingView, the platform allows traders to execute strategies on a modern and stable interface.

FundingTicks was built with the goal of being the ideal destination for traders of all skill levels. For beginners, the platform offers a clearly structured assessment process and achievable profit targets, helping them develop discipline without feeling overwhelmed. Meanwhile, experienced traders find value in the flexible account sizes, ranging from $25,000 to $100,000.

With its diverse program offerings, FundingTicks effectively caters to the needs of various trading styles, from day traders and long-term trend-following investors to copy traders.

Key features of FundingTicks:

- Freely choose to operate on leading platforms such as TradingView, NinjaTrader, or Tradovate.

- We offer a variety of funding models, optimized for each individual trading strategy.

- The regulatory framework and profit targets are publicly and clearly stated.

- With an attractive profit-sharing ratio, traders receive up to 90% of the results.

- Profits are paid out periodically every 5 days, and the processing is usually quick, taking only about a week.

- Start managing an account up to $25,000 for just $99/month.

- Eliminate the daily drawdown limit and instead use a system that calculates the maximum drawdown based on the end-of-day balance.

For more information about Prop Firm, visit our website regularly!