FunderPro is facing a strong backlash from the trading community after rejecting numerous payment requests, citing suspected violations of its “device sharing” policy. Many traders argue that these allegations are unclear and inconsistently applied, raising concerns about the transparency and fairness of the company’s control policies.

FunderPro accused of wrongfully denying payouts despite traders’ compliance

Two traders have accused FunderPro of closing their accounts and refusing payments without justification. The fund cited reasons such as “shared access” or “device violations,” but the traders assert that they fully complied with regulations and operated independently. The incident is causing a stir in the investment community, raising serious questions about the transparency of FunderPro’s account management for its funded users.

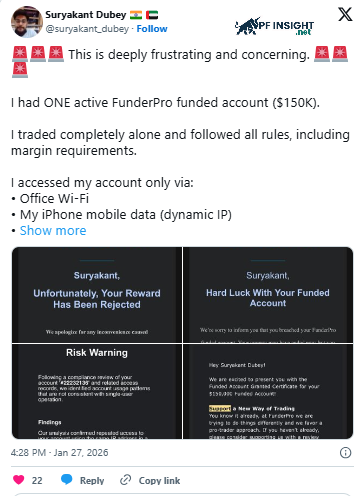

Trader @suryakant_dubey on X has just reported a serious incident. After submitting a request to withdraw $10,000 from his $150,000 account on January 23rd, his account was immediately flagged as “compromised.” This unusual coincidence is raising concerns about the platform’s transparency when users make large profit withdrawals.

The trader asserted that he only used his personal iPhone connected via his home Wi-Fi, office Wi-Fi, and cellular network. He emphasized that this access history was consistent and he had never encountered any problems before. His assertion that no third party interfered demonstrates that his devices and networks are entirely his own, refuting the platform’s accusation of violating “shared access” rules.

According to the trader, the violation only “suddenly” appeared when he requested a withdrawal. FunderPro cited the IP address to attribute the violation to device sharing, but he insisted it was his own connection. Using the client’s current IP address as evidence of a violation is paradoxical, suggesting an unfounded refusal of payment.

“How can I share my account with myself?” this trader wrote. He believes the system misidentified him, turning a technical error into a policy violation accusation. He claims he was a victim of an incomplete or misconfigured algorithm.

Despite achieving impressive trading results and meeting withdrawal requirements, this trader’s account was mercilessly frozen. FunderPro refused to pay out the outstanding profit balance, despite him having proven his competence through his high ranking on the leaderboard.

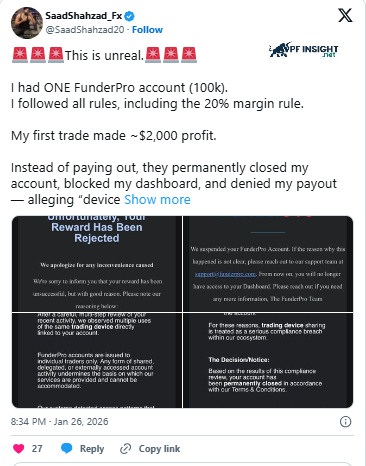

Another victim, @SaadShahzad20, reported a similar experience with a $100,000 funding account at FunderPro. Immediately after earning his first $2,000 in profit, the system closed his account and blocked all access. Citing the vague reason of “device sharing,” this incident further reinforces suspicions about the fund’s lack of transparency in handling withdrawal requests.

Similar to the previous case, this trader stated that the violation was only pursued when he was due to receive payment. Throughout the entire process of opening and operating the account, no warnings were given. He asserted that he did not own multiple accounts, did not copy trades or use mirroring software, and denied all allegations of fraud from the fund.

The two traders demanded that the fund provide more credible and transparent evidence. They argued that the violations needed to be proven with specific data, rather than appearing suddenly after they requested a withdrawal. They found the application of retroactive law to deny payment unacceptable.

Traders question the transparency of FunderPro’s policies

The incident has raised significant concerns within the trading community regarding how funds implement access policies. Many argue that the flexible switching between home, office, and mobile Wi-Fi networks is a common practice today. Automatically attributing this as proof of “account sharing” is impractical and disadvantageous to genuine mobile traders.

The unusual timing of the violation flags has raised suspicions, as the warnings only appeared when the traders withdrew funds. Both traders maintain that their accounts were completely normal beforehand. To date, FunderPro has remained silent and has not issued any public response to explain these specific allegations.

What does the FunderPro case mean for traders?

This incident serves as an important reminder that traders need to thoroughly understand how funds monitor equipment and IP addresses. When disciplinary decisions are made, a lack of transparency in enforcement easily leads to disputes. The community demands that proprietary trading firms have clear dialogue mechanisms and provide concrete evidence when refusing payments, instead of making unilateral decisions that erode trader confidence even when they have followed the rules.

While the matter remains unclear, this serves as a reminder that operational risks from funds are just as dangerous as market risks. Traders not only need to beat the charts but also must contend with the uncertainties stemming from the platform’s own management processes.

For more information about Prop Firm, visit our website regularly!