About 10 months after reaching an acquisition agreement with private equity firm CVC, Czech proprietary brokerage FTMO completed its acquisition of OANDA yesterday, Monday. To make the transaction official, the proprietary brokerage giant had to go through a rigorous regulatory process and receive the necessary approvals from five different regulatory bodies.

A bold move or a smart steal?

The financial terms of the deal have not been disclosed. However, to finance the OANDA acquisition, FTMO has secured a large credit line of $250 million from a consortium of Czech banks, with UniCredit acting as the lead lender.

FTMO has officially entered the traditional brokerage industry after completing the OANDA acquisition deal. FinanceMagnates.com previously revealed that CVC acquired OANDA in 2018 at an estimated valuation of $162.5 million, indicating the historical value of this retail brokerage firm.

The company took the initiative to set up a separate brokerage division last year, appointing Michael Kamerman as its CEO. While the move is significant, experts are still waiting for confirmation on whether FTMO plans to apply for additional brokerage licenses from other jurisdictions.

FTMO CEO and Co-founder Otakar Šuffner stated that the company will not lose sight of its core business: modern proprietary trading platforms. His vision is to build a unified trading platform that will serve all types of clients. This platform will effectively combine proprietary trading and brokerage, providing traders with optimal tools.

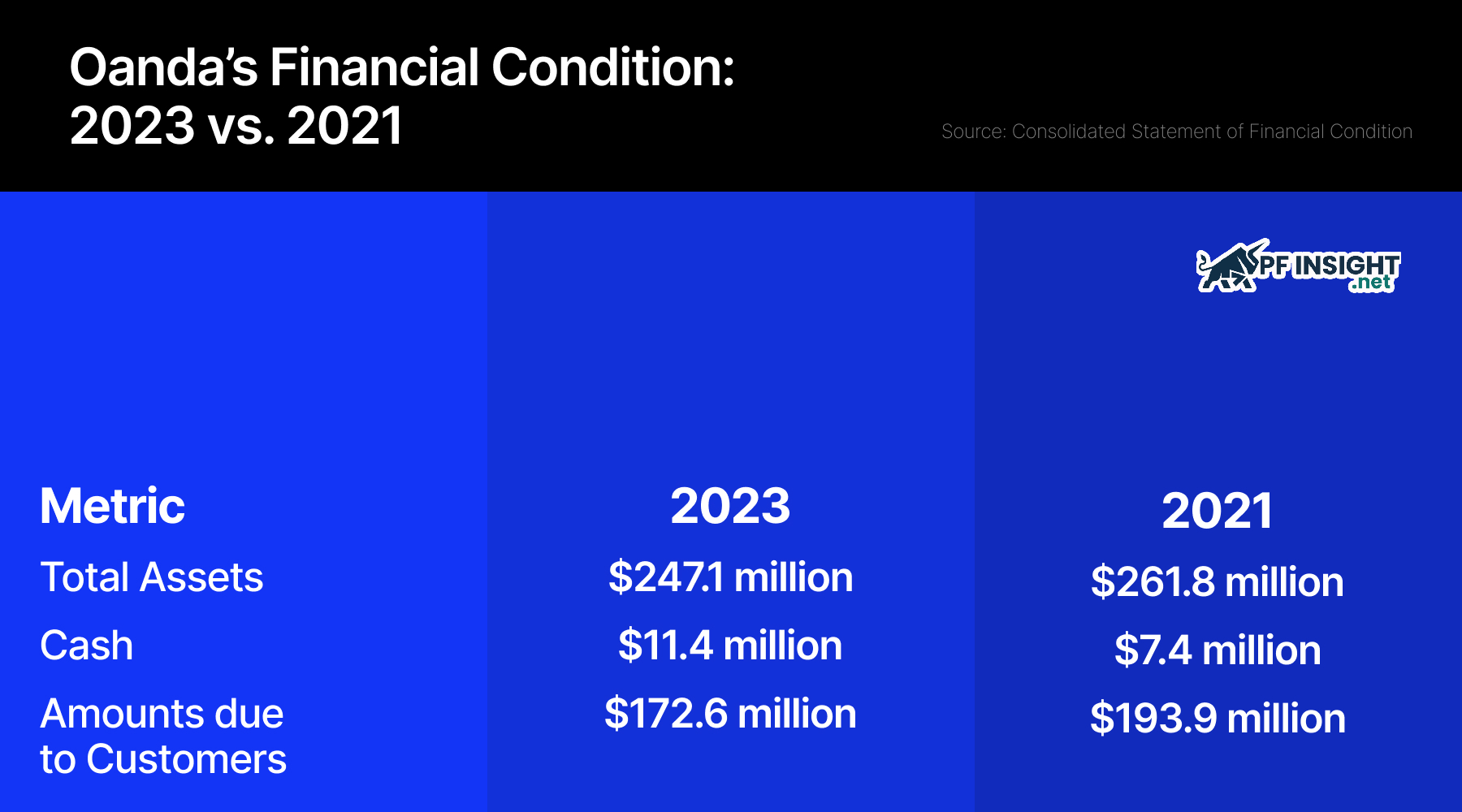

OANDA is a reputable broker in retail trading, specializing in margin forex and CFDs. Established in 1996, the company is distinguished by its strict regulation. OANDA is present in the world’s core financial markets, including New York, London, Warsaw, Singapore, Tokyo and Sydney, ensuring global access.

“This acquisition accelerates our growth,” said Gavin Bambury, CEO of OANDA. He said it will allow the company to offer clients a smarter, more innovative, and more integrated trading experience.

A few months before the FTMO acquisition, OANDA launched its own proprietary trading brand, OANDA Prop Trader. This unit is still in operation. However, the recent merger announcement made no mention of the fate or future plans for OANDA’s existing proprietary trading brand.

The growing trend of prop firm – broker consolidation

FTMO is one of the leaders in the rapidly growing proprietary trading sector. The company was founded by Otakar Šuffner (CEO) and Marek Vašíček (CTO). Importantly, both co-founders still hold the company together and own a controlling stake.

The parent company’s filings show FTMO’s financial dominance. In 2024, it recorded $329 million in revenue and a net profit of over $62 million. Even just the year before, the company’s subsidiary had a remarkable revenue of over $213 million, cementing its leadership position.

FTMO’s entry into the brokerage market comes as CFD rivals Axi, IC Markets, ATFX and Hantec already have independent proprietary trading divisions. Notably, ATFX’s Drew Niv recently said the company has converted more than 10% of its proprietary users into traditional brokerage clients, a testament to the effectiveness of the integration.

Several proprietary brokers have applied for foreign brokerage licenses. However, this move is mainly seen as a strategy to easily obtain MetaTrader licenses. Very few companies use these licenses to provide real brokerage services. More importantly, none have entered the market as large and ambitious as FTMO.

For more information about Prop Firm, visit our website regularly!