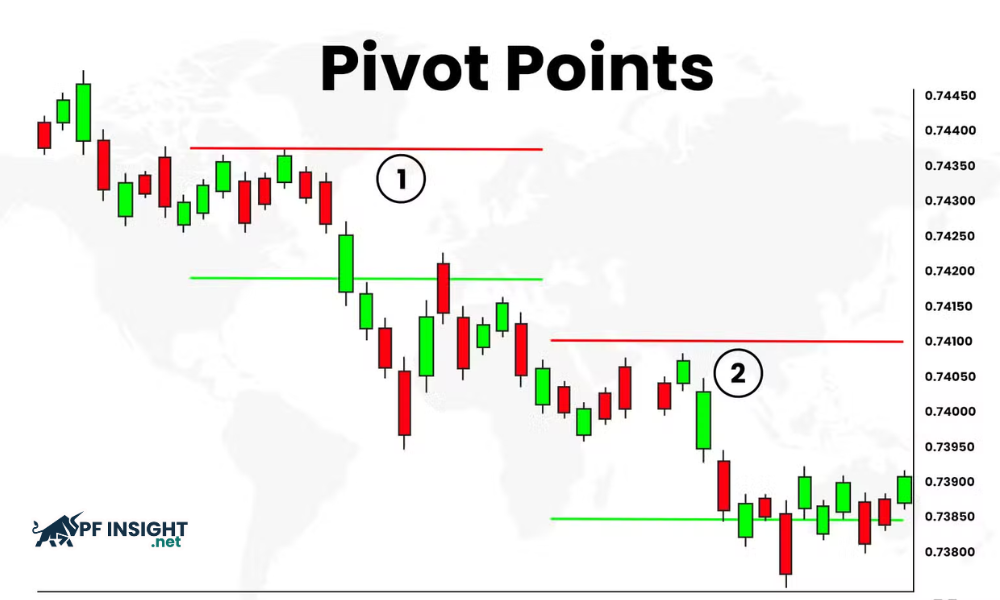

Pivot Points Trading is not simply a calculation tool, but also a method that helps traders logically understand market structure. Based on price data from the previous session, this method helps traders optimize entry points and manage risk more effectively in highly liquid markets. What is the ATR Indicator and how it works in trading…

PU Prime, a globally licensed online broker, has officially introduced the Official Verification Hub, a centralized verification tool designed to enhance trust, security, and transparency for the trading community. This launch is seen as an important step in the company’s strategy to protect users and raise safety standards across the online trading industry. Official Verification…

The ATR indicator, short for Average True Range, is a technical indicator designed to measure market volatility rather than predict price direction. For beginners, understanding this distinction is critical. Many new traders focus on whether price will move up or down, while overlooking a more important question: how much the market is likely to move….

Parabolic SAR is considered a useful tool for identifying entry and exit points and managing trends. This indicator is particularly effective when the market has a clear trend, helping traders closely follow the upward or downward momentum of prices. Understanding how Parabolic SAR works correctly will help traders reduce signal noise and improve trading performance….

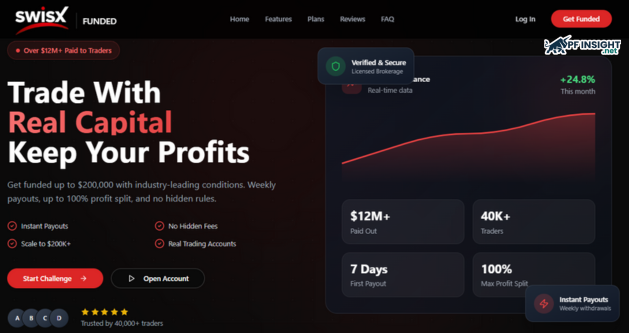

The advanced proprietary trading platform SwisxFunded.com has officially launched globally, offering Instant Funded Accounts up to $50,000 for traders. The company is committed to creating a superior trading environment with transparent rules and fast payouts, eliminating the barriers and delays often found in traditional proprietary trading firms, giving traders immediate access to real capital. SwisxFunded…

The Ichimoku cloud is considered one of the most comprehensive technical analysis tools, allowing traders to observe trends, momentum, and key price zones on a single chart. With its clear and easily recognizable structure, the Ichimoku cloud helps identify the dominant trend as well as potential entry points. In this article, PF Insight will help…

The Relative Strength Index, commonly referred to as the RSI indicator, is one of the most widely used momentum tools in technical analysis. Thanks to its simple structure and clear scale ranging from 0 to 100, RSI is especially appealing to new traders. However, this simplicity often leads beginners to misunderstand how RSI actually works….

In technical analysis, early detection of reversal signals helps optimize profits. The stochastic oscillator is one of the most important indicators, helping to identify overbought or oversold conditions in the market. This allows traders to make smarter trading decisions, minimize risks, and improve investment efficiency. MACD indicator tips to get better long term results Liquidity…

Fibonacci retracement is one of the most widely used technical tools for identifying price zones where the market may pause, bounce, or continue following the prevailing trend. Originating from a mathematical concept, Fibonacci retracement has become popular in trading because of its ability to reflect market behavior through key price levels during a pullback. In…

In August 2023, the global proprietary trading community witnessed the sudden collapse of My Forex Funds, one of the largest prop trading companies. This event caused a major shock and raised many questions about the stability and legal regulation of this business model. Recently, MFF issued an important announcement stating that a Canadian court has…