Average true range volatility (ATR) is one of the simplest yet most useful indicators, helping traders clearly understand market volatility before placing a trade. In fact, many stop-loss hits happen not because you misread the trend, but because your stop was “too tight” relative to volatility at that time. In this article, Pfinsight.net will walk…

Many traders incur losses not because they lack a strategy, but because they ignore trend & confirmation when entering trades. Markets tend to move in trends, and only when those trends are clearly confirmed do trading opportunities become truly high quality. Understanding and applying trend & confirmation correctly helps traders trade more systematically, maintain discipline,…

As a leading technology provider for proprietary trading brokerage firms, Trade Tech Solutions offers modern platforms that meet the needs for scalability and automation. This helps prop firms improve the performance, transparency, and control of their trading systems. The rapid growth of proprietary trading technology is driving consolidation across the market. Instead of maintaining complex,…

Many traders have experienced the feeling of entering a trade the moment they spot a “breakout incoming” signal, only for price to reverse, throwing off the timing and eliminating the edge. With a bollinger bands squeeze, the issue is not the tool itself, but how we read the signal and act too quickly. That is…

Momentum indicator trading is an indispensable tool for traders who want to gain a deeper understanding of price behavior in financial markets. By measuring the rate of price change, the Momentum indicator helps detect early signals of overbought, oversold, or weakening of the current trend. Applying the momentum indicator correctly will help traders make more…

Stochastic RSI is an indicator widely used by traders to identify when the market may be overbought or oversold. Compared to traditional RSI, this indicator tends to react faster and generate signals more frequently, helping traders spot momentum shifts earlier. However, because of its high sensitivity, it can also fluctuate sharply and produce noisy signals…

For traders, understanding market conditions is essential when building a sustainable trading strategy. Overbought and oversold levels reflect the degree of market euphoria or panic, providing crucial clues about the likelihood of a trend reversal or continuation. Properly applying these levels helps traders improve timing and manage risk more effectively. What are overbought and oversold…

Moneta Funded (monetafunded.com) is a new proprietary trading brand announced by David Bily, Founder & CEO of Moneta Markets. It is a proprietary trading firm that benefits from direct support from reputable brokers. The core objective of this platform is to establish a transparent and fair career progression path for the global trading community. By…

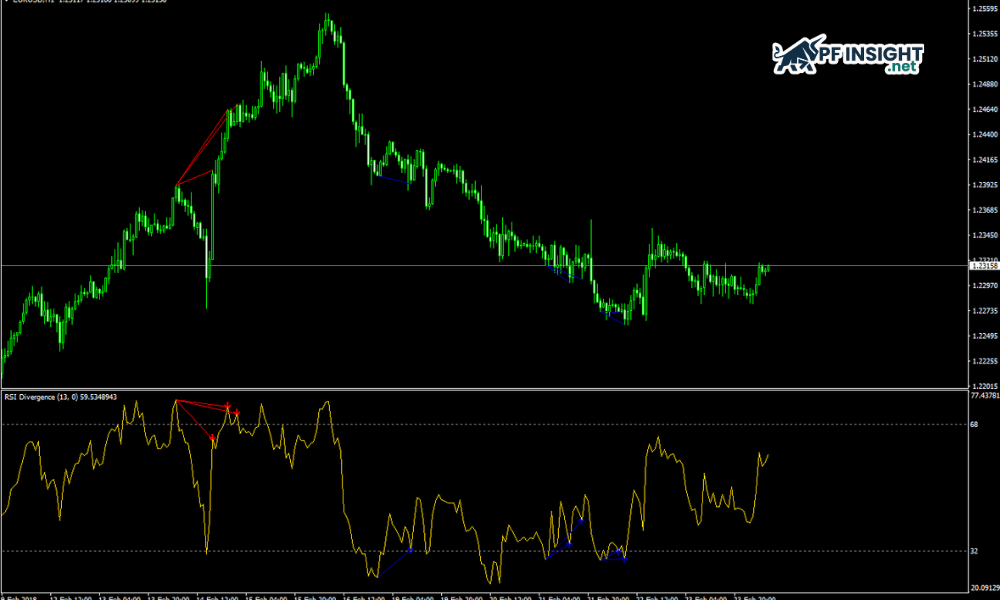

In technical analysis, the RSI divergence is a powerful tool that helps traders detect early signals of price reversals. When the RSI indicator does not align with the price trend, it signals a potential change in market momentum, helping traders make more accurate entry decisions and reduce the risk of losses. MACD histogram: How it…

Many traders start with MACD because it is easy and familiar, but the longer they trade, the more they realize one issue: signals often come late, after price has already moved a significant distance. Meanwhile, the MACD histogram can reveal market momentum shifts earlier, acting like an “early warning system” before an actual crossover appears….