In forex trading, entry costs are a factor many investors tend to overlook, yet they have a direct impact on long-term profitability. One of the most important costs is the spread. Today’s article from PF Insight, Forex spreads explained, will help you understand what spreads are, how they are formed, why different brokers offer different spread levels, and how to choose the right spread to match your trading strategy.

- Forex lot types explained and how to choose the right position size for your account

- What is a pip in Forex trading and why it matters for beginners

- What is leverage in forex and how does it actually work in trading

What is the spread in Forex?

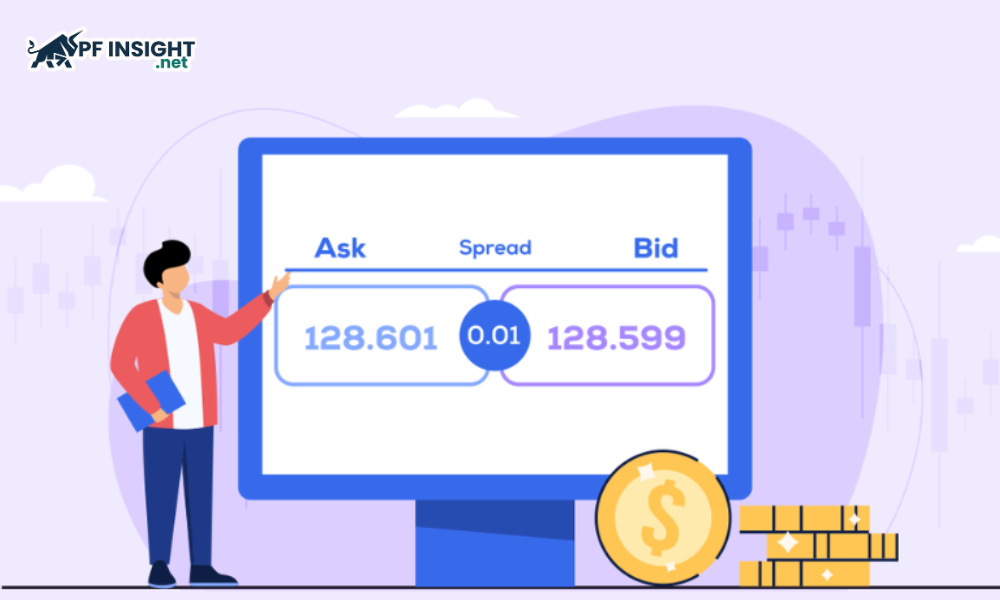

Spread in Forex represents the difference between the price at which a trader can buy and sell a currency pair at the same time. This difference is considered the basic cost that a trader pays for each trade. The spread is directly included in the bid and ask quotes, meaning that when a position is opened, the trader has already incurred a certain cost before the market moves in a favorable direction.

When Forex spreads explained, traders need to understand that spreads fluctuate in pips – the smallest unit of price movement. Typically, a pip is located at the fourth decimal place, while for currency pairs involving JPY, it is calculated at the second decimal place. Additionally, trading volume also directly affects the total cost, especially for high-frequency trading strategies.

When participating in the Forex market, each trade involves the exchange of two currencies. The first currency in the pair is called the base currency, while the second acts as the quote currency. On a trading platform, the bid price indicates the price at which a trader buys the base currency, and the ask price shows the corresponding selling price.

How do spreads impact a trader’s profits and risk?

Understanding spreads helps traders accurately assess trading costs, allowing them to manage risk and optimize profits in the Forex market.

- Impact when opening a trade: When a trade is opened, the trader immediately incurs an initial loss equivalent to the spread. This means the price must move in a favorable direction by at least the spread amount for the trade to break even.

- Effect of trading frequency: The more trades executed, the higher the total spread cost. This is particularly important for short-term strategies such as scalping, where traders frequently enter and exit positions in a short period.

- Impact on overall profit: Although the spread represents only a small portion of each trade, it can significantly erode profits when accumulated over many trades, especially for strategies targeting small profit margins.

- Spread volatility: Spreads are not fixed and can fluctuate depending on the time of day, market conditions, and liquidity levels. Additionally, major economic events and the type of trading account can cause spreads to vary across different brokers.

Which types of spreads exist in Forex?

When Forex spreads explained, you will see that spreads in Forex come in various forms. Each type of spread has its own impact on trading performance, particularly in how traders manage costs and optimize strategies under different market conditions.

Fixed spreads

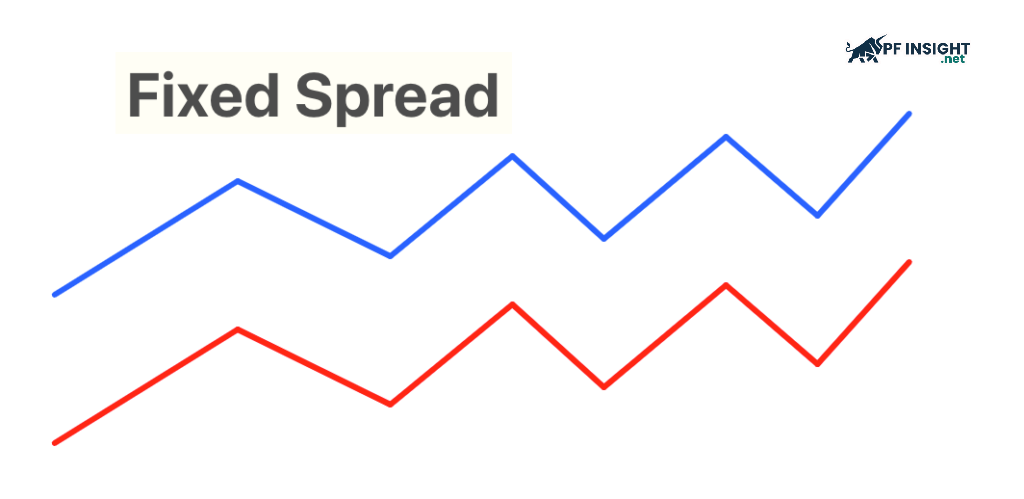

Fixed spreads can be considered a safe option for traders who prioritize stability. Whether the market is calm or highly volatile, the price difference remains fixed, making it easy for traders to calculate transaction costs from the outset. Knowing the entry cost beforehand provides a sense of control and reduces psychological pressure, especially suitable for beginners who are not yet accustomed to the constantly changing nature of floating spreads.

Advantage:

- Predictable costs: Traders can know the spread they will have to pay for each trade in advance, making it easier to calculate costs and manage capital more effectively.

- High stability: Fixed spreads help build consistent trading plans, which is especially useful when operating automated trading systems that require cost stability.

- Suitable for low-volatility markets: This type of spread is suitable for traders who trade during quiet market periods or who employ strategies that do not depend on strong price fluctuations.

Disadvantages:

- Less competitive trading costs: Compared to floating spreads, fixed spreads are generally higher than the average during stable market conditions, increasing total trading costs over time.

- Risk of broker disruption: During periods of high market volatility, brokers may be unable to maintain fixed spreads, leading to requotes or delayed order execution.

- Not optimal in high-liquidity markets: When liquidity is abundant, traders using fixed spreads may pay higher costs compared to floating spreads, which are usually lower under these conditions.

Floating (Variable) spreads

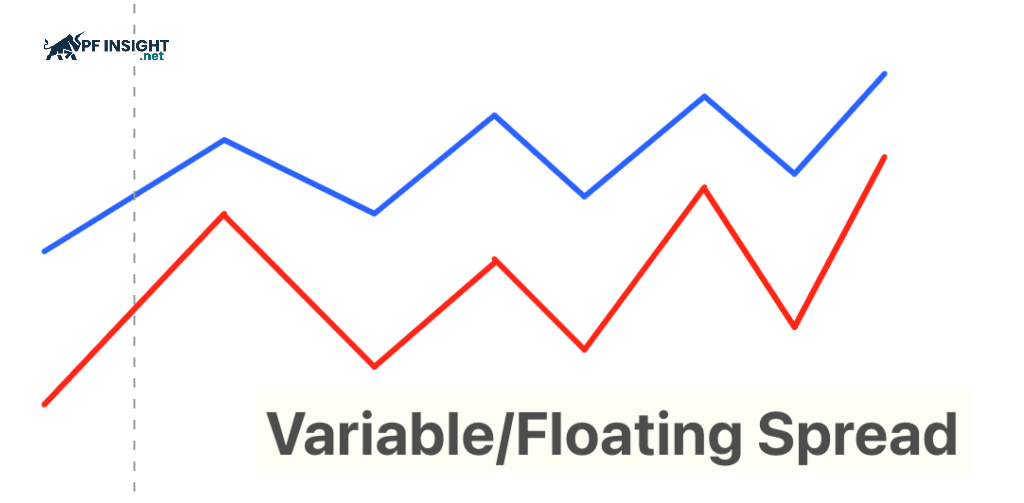

Floating spreads are characterized by their flexibility, constantly changing according to market developments. When liquidity is abundant and the market is less volatile, the spread is usually very low, reducing transaction costs. Conversely, during important economic news releases or when the market experiences significant volatility, the spread can widen rapidly. Many experienced traders believe this type of spread accurately reflects actual supply and demand and provides a high degree of transparency.

Advantage:

- More competitive trading costs: Under normal market conditions, floating spreads are usually lower than fixed spreads, especially when liquidity is high and trading volumes are large.

- Reflects market movements: Variable spreads directly mirror supply and demand, giving traders a clearer view of the actual state of the Forex market at any given time.

- Suitable for active trading sessions: This type of spread benefits traders dealing with major currency pairs during peak hours when liquidity is abundant and spreads tend to narrow.

Disadvantages:

- Unpredictable costs: Floating spreads can widen suddenly, increasing trading costs beyond expectations and making it difficult to plan budgets and trading strategies.

- Higher risk in volatile markets: During periods of high volatility or important news releases, bid-ask spreads can rise sharply, increasing trading costs and affecting risk management.

- Greater risk of slippage: With variable spreads, trades may be executed at worse prices than expected if spreads widen unexpectedly, especially when liquidity decreases.

Raw spreads

Raw spread represents the price difference closest to the interbank market, where prices are determined by actual supply and demand. This type of spread is usually very low, even close to zero under high liquidity conditions. However, instead of including costs in the spread, the broker charges a commission on each transaction. This model is suitable for high-volume traders who prioritize transparency and want precise control over costs.

Advantage:

- Transparent costs: Raw spreads eliminate hidden fees within the spread, allowing traders to clearly see the actual cost of each trade.

- Closest to market rates: The spread closely reflects interbank market rates, giving traders access to more accurate and authentic trading prices.

- Optimized trading costs: With very low spreads, traders have the opportunity to reduce total trading costs, especially when trading large volumes or at high frequency.

Disadvantages:

- Separate commission fees: With a raw spread account, brokers charge a fixed commission per trade, which can reduce profits for traders with small capital or low trading volumes.

- Higher capital and experience required: Raw spread accounts typically require more capital and are suited for experienced traders who understand cost structures and know how to optimize trading strategies.

When Forex spreads explained, traders will realize that each type of spread has its own advantages and disadvantages. Choosing the right spread depends on trading style, trade volume, risk tolerance, and the overall strategy the trader is implementing.

How to calculate spread costs in forex trading

When learning about Forex spreads explained, traders will see that calculating the spread is not complicated. Simply compare the bid and ask prices of a currency pair – the difference between these two prices represents the spread cost of the trade.

Spreads = Ask price – Bid price

In there:

- Ask price: The price a trader must pay when opening a buy order for a currency pair.

- Bid price: The price the market accepts when a trader sells a currency pair.

After determining the price difference, traders can convert the spread to pips by dividing it by the pip value. Typically, this value is 0.0001 for most currency pairs and 0.01 for pairs involving JPY.

Spread in pips = Spread/Pip value

Let’s examine how to determine the spread through a specific example using the EUR/USD currency pair. In this pair, EUR acts as the base currency, and USD is the quoted currency. Through the hypothetical situation below, you will see how the spread is formed and how to apply the calculation formula in real-world trading conditions.

Let’s assume that at the time you are monitoring the market, the trading platform is displaying the buy and sell prices for the EUR/USD pair as follows:

- Bid price: 1.0983

- Ask price: 1.0986

The price difference is calculated by subtracting the purchase price from the selling price.

- Spread = Ask − Bid

- Spread = 1.0986 − 1.0983 = 0.0003

To convert the price difference to pips, you can divide the spread by the standard pip value of the EUR/USD pair:

- Spread (pip) = 0.0003 / 0.0001 = 3 pip

Therefore, the price difference for the EUR/USD pair is 3 pips.

Causes of changes in forex spreads

In Forex spreads explained, understanding the mechanism of spread formation is crucial for traders to control costs and optimize profits. The price difference is not fixed but is influenced by many different factors. Below are the main factors that directly affect spread in the Forex market.

The impact of currency pair popularity on spreads

According to Forex spreads, the most traded currency pairs typically have very high liquidity. Major pairs like EUR/USD, USD/JPY, or GBP/USD attract a large number of traders, resulting in lower and more stable spreads compared to less popular pairs.

Highly liquid currency pairs typically have very low bid-ask spreads, as the gap between the bid and ask is narrowed due to high trading volume. EUR/USD is a prime example, with spreads on many exchanges often remaining below 1 pip under normal market conditions. Similarly, popular pairs like GBP/USD and USD/JPY also boast competitive spreads. Conversely, less frequently traded pairs tend to have wider spreads due to limited liquidity.

Forex trading time

The spread in Forex trading is not fixed but changes depending on the time of trading. The market operates 24/7 but is divided into separate trading sessions: Asian, European, and American. Each session has different trading volumes and volatility levels, leading to significant differences in spreads.

- European session (London): This is the most active session in the Forex market. Due to high trading volumes and abundant liquidity, the spreads of major currency pairs such as EUR/USD and GBP/USD are usually very low, making it suitable for short-term trading.

- Asian session (Tokyo): The Asian session has a slower trading pace compared to other sessions. Spreads are generally stable and relatively low for JPY-related pairs, but market volatility is usually not very strong.

- North American session (New York): When the U.S. session overlaps with the European session, the market reaches its highest liquidity of the day. This helps narrow spreads for many major currency pairs and provides traders with numerous opportunities for effective trading.

The impact of market volatility on spreads

The volatility of the Forex market reflects the intensity of price fluctuations and directly impacts the spread. When the market is highly volatile, the bid-ask spread often widens significantly. This is how brokers manage risk in unpredictable market conditions, especially during sensitive periods such as the release of important economic news.

During periods of high market volatility, traders need to be cautious because wide spreads can distort entry and exit points. Large price spreads not only increase transaction costs but also increase the risk of slippage. Therefore, applying risk management tools such as stop-loss orders and volume limits is crucial to protecting accounts.

Top 3 effective Forex trading strategies based on spreads

Focusing too much on low spreads can cause traders to overlook other crucial elements of a trading strategy. In fact, the key to sustainability lies in combining spread management with market analysis, risk management, and trading discipline. By applying the right strategies, you can limit the impact of spreads and improve long-term trading performance.

Low spread currency pairs strategy

The low-spread currency pairs strategy aims to optimize transaction costs by prioritizing currency pairs with low spreads. Major pairs such as EUR/USD, USD/JPY, and GBP/USD are often chosen because they possess high liquidity and large trading volumes, helping to keep price differences to a minimum.

When trading popular currency pairs with low spreads, traders can reduce costs right from the opening and closing of orders. Small spreads help traders save on brokerage fees, maintaining higher profits. This is an effective strategy, similar to choosing investments with low transaction fees, where every small saving makes a big difference over time.

To successfully implement the strategy, traders need to understand market trends, choose peak trading times, and work with a broker offering competitive spreads. Closely monitoring spread fluctuations is essential, as even major currency pairs can widen spreads during economic events or periods of significant market volatility.

Time-based spread trading

Time-based spread trading focuses on capturing market rhythms and their impact on transaction costs. Traders choose entry points during sessions with high liquidity and low spreads, often coinciding with the trading hours of major financial centers, to optimize costs.

Forex spreads explained that trading during the overlapping hours between London and New York offers a significant advantage for traders. Low spreads are achieved thanks to high liquidity from these two key markets, from 13:00 to 17:00 GMT. Traders can take advantage of this time to execute large orders at low cost and with optimal efficiency.

Asian trading sessions are important but often come with wider spreads due to lower liquidity. Experienced traders typically avoid trading during quiet market times, such as early morning or late evening. Choosing trading times that coincide with peak sessions can help reduce spread costs and increase profit margins, while also limiting slippage risk.

Scalping with tight spreads

Scalping with tight spreads is a fast trading strategy that focuses on small profits within a single session. Traders open and close orders within minutes or seconds, taking advantage of even the smallest price fluctuations to profit while minimizing spread costs.

Forex spreads explained indicate that scalping traders need to focus on brokers with extremely low spreads for their strategies to be effective. Low spreads reduce transaction costs, allowing them to profit from small market fluctuations. This is a crucial factor in making high-intensity trades consistently profitable.

Professional scalping traders rely on modern trading platforms and real-time market data to execute orders instantly. They prioritize major currency pairs like EUR/USD, where spreads are consistently low. This strategy requires quick reflexes, in-depth market knowledge, and strong psychological discipline. While offering high profit potential, scalping also carries significant risks and demands considerable skill and experience.

Conclude

Understanding transaction costs is a crucial step to success in Forex. Forex spreads explained helps traders understand how price differences affect profit and risk. By choosing the right currency pair, optimal trading hours, and a reliable broker, you can effectively control spreads and improve trading performance.