To trade effectively and successfully in the Prop Firm market requires traders to have strategies and expertise to avoid slippage as well as knowing how to choose Prop Firms with fast order execution rates. Today’s article from Pfinsight.net will provide you with comprehensive knowledge about execution speed & slippage in prop trading. Let’s take a closer look!

What is execution speed & slippage in Prop Trading?

What is execution Speed?

The speed at which a trade is executed after a trader clicks the “Buy” or “Sell” button is called execution speed. In Prop Firm investing, execution speed is extremely important because it directly affects a trader’s profits.

For example, you may be filled at a lower price than expected, which will reduce your profit or increase your loss if the market is volatile and the proprietary firm’s system executes orders slowly.

What is slippage in Prop Trading?

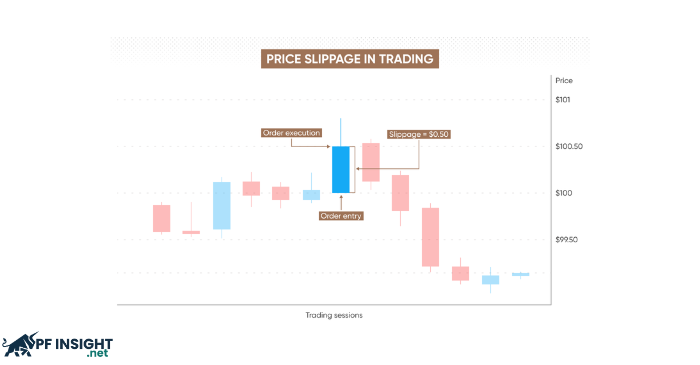

Slippage occurs when a trade order is executed at a price different from the expected one due to delayed execution speed or market volatility. This often happens during significant news events, insufficient liquidity, or highly volatile markets.

For example, slippage occurs when a gold order is placed at $1,900/oz but is executed at $1,901/oz.

Why are execution speed & slippage in Prop Trading important?

Direct impact on actual profits

Proprietary traders often use short-term tactics (day trading, scalping) or execute large trade volumes. Therefore, fast order execution at the right price helps traders maximize profits.

At the same time, minimal slippage helps reduce unwanted price differences and thus minimize hidden costs.

Determining the success of a strategy

Strategies including scalping, news trading, and high-frequency trading (HFT) rely entirely on execution speed. This approach can lose its competitive edge and potentially shift from profit to loss if execution speed is slow or slippage is severe.

Ensuring fairness for traders

Proprietary traders use the company’s capital to trade, and their actions impact pricing, payouts, and the ability to raise more funds. A solid technology platform (direct market access, low-latency servers) ensures traders are not at a competitive disadvantage compared to the market.

Reducing psychological risks

Significant slippage and slow execution can cause traders to lose confidence in the platform, leading to stress, mistakes, or missed opportunities. Conversely, traders feel safer executing their ideas quickly and consistently.

Enhancing the attractiveness and reputation of the firm

Skilled traders are often drawn to brokerage firms that offer low slippage and fast execution speeds. This provides brokerages with a significant competitive advantage.

Causes of slippage in Prop Trading

Slippage results from certain market conditions and technological considerations; it is not random. You can learn to anticipate when slippage is most likely to occur and take preventive action by understanding these underlying reasons. An essential aspect of a skilled trader’s activity is always monitoring these four main factors.

High volatility increases slippage

Volatility is a double – edged sword. While it creates profit potential, it is the leading cause of slippage. When volatility is high, prices change very quickly. Important economic news, unexpected geopolitical developments, or central bank statements are the most common causes of these surges.

The price you send your order at may become outdated by the time it reaches the execution server if the market moves dozens of pips in just a second. Your order is then filled at the next available price, which can differ significantly because the market has moved.

Periods of low liquidity

Liquidity provides a cushion against price shocks. Large orders can be filled without significantly changing the price when liquidity is high, or when the market has many buyers and sellers. However, due to insufficient opposing orders at the current price, even a relatively small order can have a large price impact when liquidity is low.

To find enough volume, the order will “slip” down to the next available price levels. This often happens during certain periods, such as the “dead zone” between the New York close and the Tokyo open, and with exotic currency pairs that have lower trading volumes than major pairs.

Large order size compared to market depth

The amount of buy and sell orders at different price levels is displayed by the “depth of market” (DOM). A very large market order (such as 50 standard lots) can consume all the liquidity at the best price. Then, your order will consume the liquidity at the next best price, and the next one after that, and so on until the order is fully executed.

This process, called “market impact,” causes the average execution price to be lower than the price you initially saw. The trader’s own order size compared to available liquidity is a direct cause of this type of slippage in prop trading.

Delays in technology and execution

Technology is the final piece of the puzzle. Although it only takes milliseconds, every stage of the trade execution process takes time. Latency includes the time for the signal to travel from your home computer to the broker’s server, the broker’s internal system processing time, and the time needed to confirm order execution with the liquidity provider. This overall latency can be increased by slow internet connections, remote server locations, or inefficient brokerage platforms, creating more room for the market price to move and for slippage to occur.

Tips to improve execution speed & slippage in Prop Trading

Choose a reliable and reputable Prop Firm

The level of slippage you experience can be heavily influenced by the brokerage firm you trade with. Choose a broker, such as WeMasterTrade, that offers the lowest slippage levels in the market. More than 85% of satisfied traders have left positive reviews on Trustpilot, making WeMasterTrade one of the best firms today.

Trade when the market is stable and liquid

The level of slippage you experience can also be influenced by market conditions. You should trade when the market is liquid and stable – that is, when major trading sessions overlap, when the market is trending, or when the market is calm.

When the market is volatile and illiquid, you should limit your trading. Stay away from the market during periods of low trading volume, high volatility, or major news events.

To anticipate future market movements or reactions, you should also keep track of the economic calendar and the market’s general consensus.

Use the right order type

The level of slippage you experience can also be influenced by the type of order you choose. Use the order type most appropriate for your market conditions and trading strategy. In terms of slippage, different order types and execution speeds bring their own benefits and limitations.

Conclusion

Overall, execution speed & slippage in prop trading have a direct impact on traders’ profits. Therefore, traders must carefully consider and understand these factors. Hopefully, through this article, traders have gained the most comprehensive overview of execution speed & slippage in prop trading. Wishing all traders successful investments!