Many traders leave the market not because their trading strategy is poor, but because they fail to control drawdown in the early stages. Without a clear drawdown management approach, even a short losing streak can place significant pressure on an account and make recovery difficult. Drawdown control methods refer to principles that limit account decline through proper risk management and position sizing. Managing drawdown effectively helps traders reduce psychological stress and maintain consistency throughout the trading process. In this article, PF Insight analyzes drawdown control methods and explains why capital protection is more important than profit chasing in the early stages.

- Risk reward ratio explained and why it matters more than win rate

- Market structure trading: How traders identify trend and market direction

- How fair value gap trading helps traders optimize entry points

What is drawdown control methods

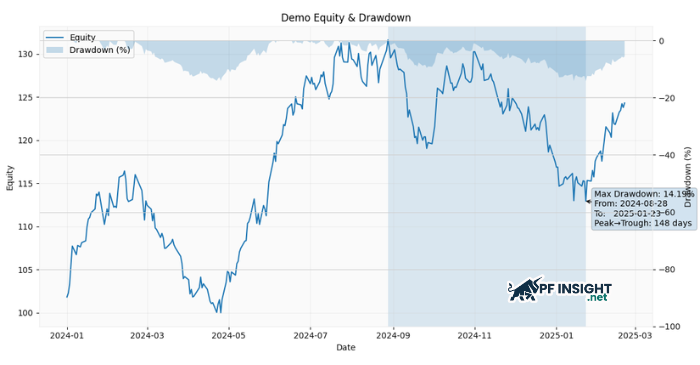

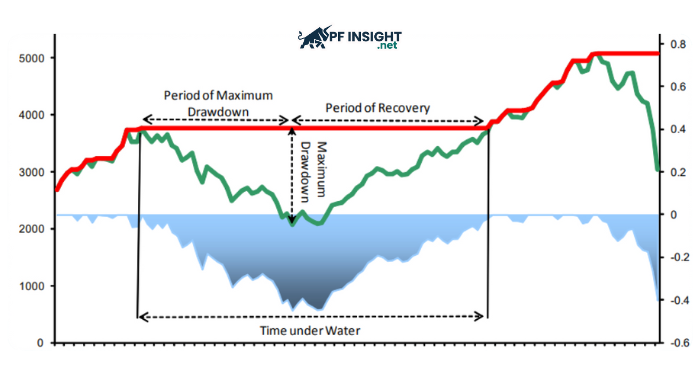

Drawdown control methods are a set of risk management principles used to limit the maximum decline of a trading account over a given period of time. Rather than focusing on generating profits, these methods prioritize controlling losses to ensure that the account does not enter a state that is difficult or impossible to recover from.

In essence, drawdown control is not a trading strategy or an entry system. It is the way traders define acceptable risk levels, including risk per trade, maximum allowable drawdown, and conditions under which trading should be reduced or paused. These boundaries help traders maintain discipline and prevent losses from exceeding the original plan.

For beginners, drawdown control methods act as a protective mechanism for the trading account. When drawdown is kept under control, traders gain more time to build experience, refine their approach, and improve decision-making, rather than being forced out of the market early due to excessive losses.

Why drawdown matters more than profit in the early stage

Drawdown determines the survival of a trading account

A deep drawdown can leave an account without sufficient capital to continue trading, regardless of how good the strategy may be.

Recovering from drawdown is far more difficult than generating new profits

When an account suffers a significant decline, the percentage return required to get back to breakeven increases sharply, creating substantial psychological pressure.

Large drawdowns distort decision-making.

The pressure to recover losses often leads to overtrading, increased position sizes, and abandoning risk management rules.

Controlling drawdown creates room for learning

Smaller drawdowns give traders time to analyze mistakes, adjust their approach, and build trading discipline.

Profit only matters when capital is protected

In the early stage, keeping the account stable is more important than chasing short term profits.

Common mistakes beginners make with drawdown

Not defining a maximum drawdown in advance

Many traders start trading without asking how much decline their account can tolerate before they need to stop. Without a clear limit, drawdown can quickly spiral out of control and push the account into a difficult or unrecoverable state.

Trying to recover losses by increasing position size

This is one of the most common and dangerous mistakes. Increasing position size after a loss usually comes from psychological pressure rather than objective analysis, and it often causes drawdown to expand faster instead of being reduced.

Continuing to trade when emotions are already affected

When an account is in drawdown, decision-making ability often deteriorates. Continuing to trade while stressed, impatient, or afraid of further losses can easily lead to a chain of consecutive mistakes.

Evaluating performance too early

Many traders judge their trading method after just a few winning or losing trades. This leads them to constantly change their approach, even though drawdown is a normal part of the trading process.

Failing to stop and reassess when drawdown exceeds a threshold

Instead of pausing to review risk, position sizing, and entry execution, many traders keep trading in the hope that the market will “give it back.” In practice, not stopping at the right time usually makes drawdown much worse.

Core drawdown control methods for trading basics

Limiting risk per trade

The most fundamental principle of drawdown control is ensuring that no single trade can cause significant damage to the account. When risk per trade is kept small relative to total capital, a losing streak will not push the account into a dangerous state too quickly. This gives traders enough room to make mistakes and learn from them.

Setting a maximum drawdown threshold for the entire account

Beginner traders need to clearly define an account drawdown level at which they must stop or adjust their trading approach. This threshold is not meant to eliminate losses entirely, but to prevent continued trading under loss of control and high psychological pressure.

Reducing position size during drawdown

When the account equity declines, keeping the same position size effectively increases relative risk. Reducing position size during a drawdown helps limit further losses and eases psychological pressure, allowing traders to make more rational decisions.

Having clear rules for pausing trading

An effective drawdown control method is knowing when to stop. Pausing trading after a series of losses or when drawdown exceeds a predefined level gives traders time to reassess risk, trading behavior, and mental state.

Prioritizing consistency over fast recovery

Many traders make the mistake of trying to recover their account as quickly as possible. In trading basics, the proper objective is to maintain discipline and stability rather than attempting to recover drawdown in the shortest time.

Conclusion

Drawdown control methods are not tools for maximizing profit, but a foundation for protecting capital and maintaining long-term survival in the market. When drawdown is properly controlled, traders have more room to learn, improve discipline, and develop a sustainable trading mindset. Understanding and applying drawdown control methods from the early stage helps traders avoid common mistakes that often force them out of the market too soon. Wishing you effective trading, and do not forget to explore more articles in our Knowledge Hub.