Many traders correctly identify market trends yet still suffer consistent losses because they enter trades at poor locations within the price structure. In most cases, the problem is not the strategy itself but a lack of understanding of where liquidity forms and how it is exploited. The dealing range in trading helps traders define clear high and low boundaries of price, allowing for more precise entries based on how the market truly operates. When combined with premium and discount zones, traders can avoid common price traps and significantly improve win rates over time. This PF Insight article will guide you through how to identify and apply dealing ranges effectively in real market conditions.

- Top prop firms 2025: best funded accounts & rules you need to know

- Average true range volatility: How traders adjust stop loss placement

- Moving average crossover and how traders identify trend changes

What is a dealing range in trading?

A dealing range is a price framework formed after the market sweeps both a swing high and a swing low, followed by a strong expansion move in one clear direction. This expansion reflects institutional participation and establishes the upper and lower boundaries of the range.

Simply put, the dealing range shows where the market is “re-pricing” after sufficient liquidity has been collected from both buyers and sellers.

The relationship between dealing range, market structure, and liquidity

In market structure trading, price does not move randomly. It frequently breaks key highs and lows to attract stop losses and pending orders from retail traders. Once liquidity on both sides is collected, institutions push price in the true directional move. The dealing range is the result of this process:

- Liquidity sweeps confirm short-term manipulation

- The expansion move reveals the real market direction

- The price inside the range becomes the institutional execution zone

This is why dealing range is tightly connected to both market structure and liquidity behavior.

Why dealing range improves entry timing

When used correctly, dealing range allows traders to:

- Avoid entering trades at overpriced or underpriced levels

- Identify high-probability continuation and reversal zones

- Naturally improve risk-to-reward ratios

- Trade with structure instead of emotional reactions

Rather than chasing breakouts, traders learn to wait for price to return to optimal zones inside the dealing range before entering positions.

How a dealing range forms in market structure

For a dealing range to form, the market usually goes through a liquidity-collection process on both sides before confirming its true direction. This process is not random; it follows a very common structure seen in smart money price action.

What does sweeping swing highs and swing lows mean?

A swing high sweep and swing low sweep occur when price temporarily breaks previous key highs or lows in order to trigger stop losses and pending orders.

Specifically:

- When price moves above a swing high, sell stop losses and buy stop orders are triggered

- When price moves below a swing low, buy stop losses and sell stop orders are triggered

These sweeps pull in large amounts of liquidity, which institutions need to enter positions at scale.

The expansion move confirms institutional flow

Once liquidity on both sides has been collected, the market typically produces a strong expansion move in one clear direction.

Common characteristics of an expansion move include:

- Large candle bodies with minimal wicks

- Fast and decisive price movement

- Breaks in short-term market structure

This move reflects institutional capital taking control and becomes the foundation for defining the dealing range.

How to mark the high and low of a dealing range

To identify a dealing range on your chart:

- Locate the most recent sweep of both swing high and swing low

- Find the strong expansion move that follows

- Mark: The lowest price before the expansion was the range low; the highest price of the expansion is the range high

The price area between these two points becomes the dealing range where the market is most likely to react in the next phase.

Premium and discount zones explained

Once the high and low of the dealing range have been identified, the next step is to divide this price range into two equal parts to define the premium zone and the discount zone. This framework allows traders to understand whether price is currently trading at a relatively “expensive” level or a “cheap” level within the market structure.

Dividing the dealing range into two halves

Splitting the dealing range is straightforward:

- Identify the range high (the highest price of the dealing range)

- Identify the range low (the lowest price of the dealing range)

- Calculate the midpoint, known as the equilibrium level

Everything above equilibrium is considered the premium zone, and everything below equilibrium is the discount zone.

This simple framework gives traders an objective pricing reference instead of relying on emotions or subjective judgment.

The meaning of “expensive vs cheap price”

From a smart money perspective:

- Price in the premium zone is considered expensive

- Price in the discount zone is considered cheap

Institutions generally avoid buying at expensive prices or selling at cheap prices unless their objective is to manipulate liquidity and position for larger moves. As a result, markets often drive price into the discount zone before initiating major bullish expansions and push price into the premium zone before significant bearish moves. This recurring behavior explains why price frequently retraces toward the middle of the dealing range to rebalance before continuing in the dominant market direction.

When to prioritize buys or sells

The core principle of using a dealing range is straightforward.

- In a bullish market structure or uptrend, traders should prioritize buy setups in the discount zone.

- In a bearish structure or downtrend, traders should focus on sell setups in the premium zone.

Trading from these optimal price areas helps:

- Reduce the likelihood of stop-loss sweeps

- Improve risk-to-reward ratios

- Eliminate emotional, impulsive entries

Instead of reacting to every minor price fluctuation, traders patiently wait for the price to return to high-probability zones where institutional participation is more likely to occur.

Why liquidity drives price inside a dealing range

Price does not move randomly within a dealing range. Most of the back-and-forth movement inside the range serves one primary purpose: attracting and exploiting liquidity. Large institutions require deep liquidity to enter positions with significant size without causing excessive slippage. As a result, they frequently drive price toward areas where retail traders’ stop losses and pending orders are heavily concentrated. This is why price often oscillates within the dealing range before a true directional move begins; the market is effectively gathering the liquidity needed for institutional execution.

How do stop-loss clusters form?

When price reacts multiple times at a key level within the premium or discount zone:

- Traders begin entering positions in the same direction

- Stop losses are typically placed in similar areas

- A “liquidity cluster” is formed

These clusters become ideal targets for the market to sweep before moving in the true directional trend.

Liquidity grabs – the liquidity sweep before expansion

A liquidity grab occurs when price deliberately makes a short-term break of a key level in order to:

- Trigger stop losses

- Attract breakout orders

- Generate sufficient liquidity for large institutions

Once liquidity has been collected, the market often reverses quickly and continues in the direction of the main trend.

False breaks – a common price trap within the dealing range

A false break is a direct consequence of a liquidity grab. Price appears to break out of a range or a key level, prompting many traders to enter trades impulsively. However, shortly afterward, the market reverses sharply and moves back into the discount or premium zone to complete liquidity collection. This is why many “technically correct” setups still fail if the position within the dealing range is not taken into account.

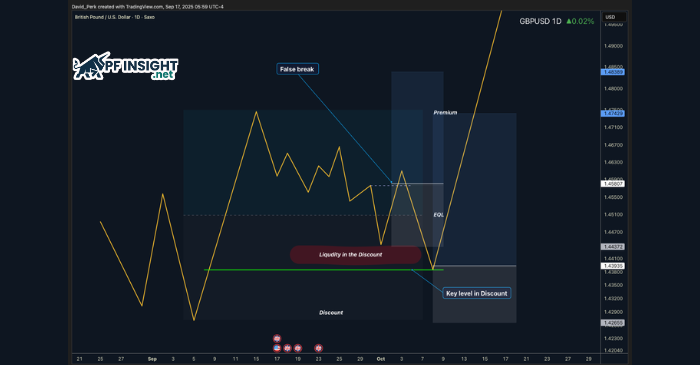

Real dealing range examples across markets

Understanding dealing range theory only becomes truly valuable when traders observe how the market reacts in real conditions. Below are typical examples that illustrate how price moves between premium and discount under the influence of liquidity.

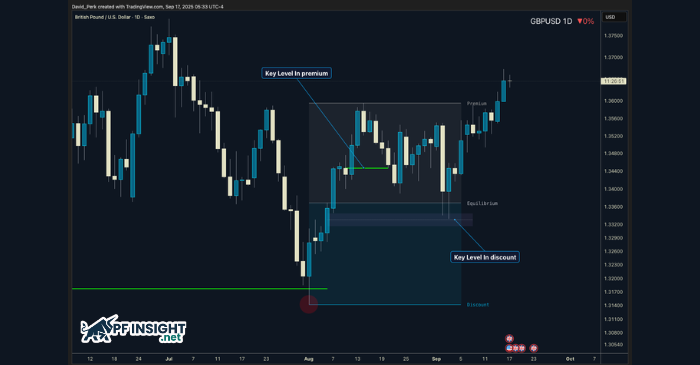

Example 1: Reactions from the premium zone

In the first example, price reacts multiple times at a key level located within the premium zone of the dealing range. From a technical perspective, the structure appears clean and often convinces traders that the market will continue higher immediately.

However, entering trades at premium increases risk and allows the market to build stop loss clusters below. Instead of continuing upward, price begins to reverse and moves toward the discount zone, where liquidity is truly concentrated.

This example highlights that relying solely on price patterns without considering position within the dealing range often leads to inefficient entries.

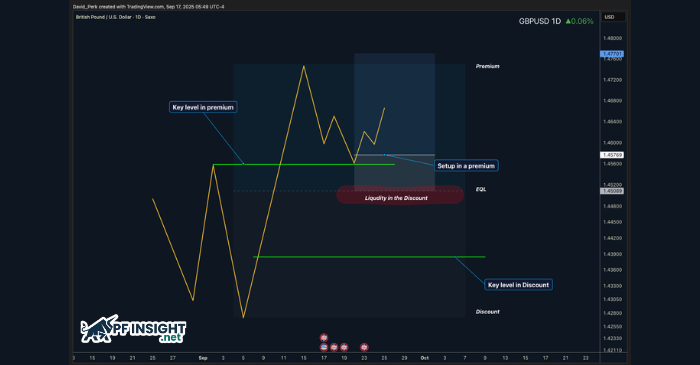

Example 2: Liquidity draw into discount

In the second example, after several reactions near premium, the market starts accumulating liquidity beneath short term lows. Early buyers place stop losses relatively close to each other, forming a clear liquidity zone.

Price is then driven aggressively into the discount zone to sweep these orders. Once liquidity is fully collected, the market reverses quickly and expands strongly in the direction of the main trend.

This is classic dealing range behavior, where price consistently seeks optimal zones before initiating major moves.

Example 3: High probability entry from discount

In this example, the trader patiently waits for price to return to the discount zone instead of entering early at premium. After liquidity below is swept and price reacts strongly at a key level within discount, the market begins a clear bullish expansion.

Entries in this area typically offer:

- Short stop losses

- High risk to reward ratios

- Strong trend continuation probability

This is the core advantage of trading based on dealing range logic rather than emotional decision making.

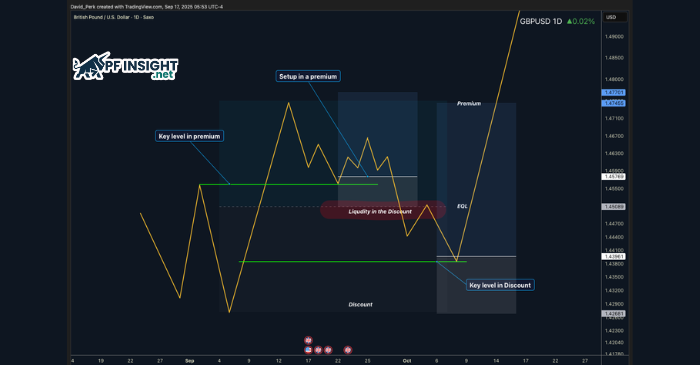

Example 4: False breakout before continuation

The final example illustrates a very common false break within the dealing range. Price temporarily breaks a key structural level, leading many traders to believe that the trend has reversed.

In reality, the break is designed to attract additional liquidity. Shortly afterward, price returns back inside the range, sweeps stop losses, and accelerates in the original direction.

False breaks are an effective mechanism for liquidity generation before major expansions, and a frequent trap for traders who do not understand dealing range dynamics.

How to trade using a dealing range step by step

Timeframe alignment for better accuracy

A dealing range loses much of its value if traders observe it on only a single timeframe. The market always operates through multi timeframe structure, where each timeframe reflects a different level of capital participation.

Higher timeframe – defining trading context

Higher timeframes such as Weekly, Daily, or H4 reveal:

- Whether the market is in an uptrend, downtrend, or consolidation phase

- Where the key dealing range is located

- Whether price is approaching premium or discount within the broader structure

HTF analysis helps traders avoid trading against the dominant trend and focus on high probability zones.

Lower timeframe – refining entry execution

When price reaches an optimal zone on HTF, lower timeframes are used to:

- Observe how price reacts to liquidity

- Identify minor sweeps or structure breaks

- Enter trades with tighter stop losses

Rather than guessing, traders wait for the market to provide confirmation before participating.

Effective timeframe combinations

Common multi timeframe models include:

- Analyze the range on Daily and execute on H1 or M15

- Analyze the range on H4 and execute on M15 or M5

- Analyze the range on Weekly and trade using H4

Scaling across timeframes allows clearer insight into price behavior while reducing noise.

Advantages of multi timeframe alignment

When entries align across both HTF and LTF:

- Win probability increases

- Random stop loss sweeps are reduced

- Risk to reward improves significantly

- Trading decisions become more confident

Timeframe alignment transforms dealing range from a theoretical concept into a practical trading system.

Common mistakes traders make with dealing ranges

- Trading in the middle of the dealing range where price lacks clear directional advantage and liquidity is unevenly distributed.

- Entering long positions in the premium zone during bullish market structure instead of waiting for price to retrace into discount.

- Selling in the discount zone during bearish conditions where liquidity is typically being built for a pullback toward premium.

- Ignoring liquidity sweeps and focusing only on technical patterns without understanding where stop-loss clusters form.

- Chasing breakouts inside or outside the dealing range without waiting for confirmation after liquidity has been collected.

- Using a single timeframe to define dealing ranges instead of aligning higher and lower timeframe structure.

- Placing stop losses at obvious technical levels where liquidity is most likely to be targeted.

Conclusion

Dealing range in trading provides a clear framework for understanding where price is positioned within market structure and liquidity flow. By combining premium and discount zones with liquidity analysis, traders can significantly improve entry timing and risk-reward performance. When applied across multiple timeframes, the dealing range becomes a powerful tool for consistent and disciplined trading decisions.