Risk management is a key element in financial trading, especially within the prop firm industry. Understanding how loss limits work is essential for the survival and growth of a trading account. Among the most discussed topics are the Daily Loss Limit and Max Drawdown.

In this article, Pfinsight.net explains the daily loss limit vs max drawdown difference to help traders manage their capital effectively and trade more sustainably.

What is the daily loss limit?

The daily loss limit refers to the maximum amount a trader is allowed to lose within a single trading day. If this limit is exceeded, the account may be suspended or considered a violation of the firm’s trading rules.

Key features of the daily loss limit

- Calculated daily: A specific loss threshold applies to each trading day.

- Fixed or percentage-based: It can be a fixed dollar amount or a percentage of equity, such as 5%.

- Resets daily: The limit resets at the start of each new trading day.

Example:

If you have a $100,000 account with a 5% daily loss limit, you cannot lose more than $5,000 in one day. If you lose $4,500 and then open new trades that result in an additional $600 loss, you will breach your limit.

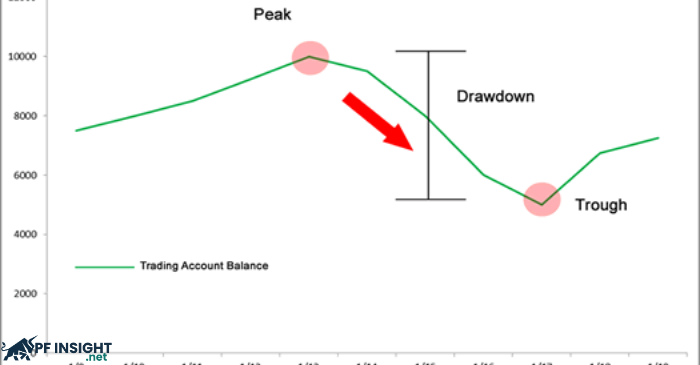

What is the max drawdown?

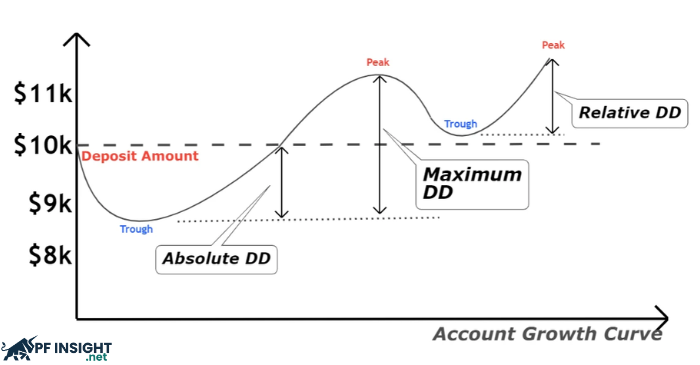

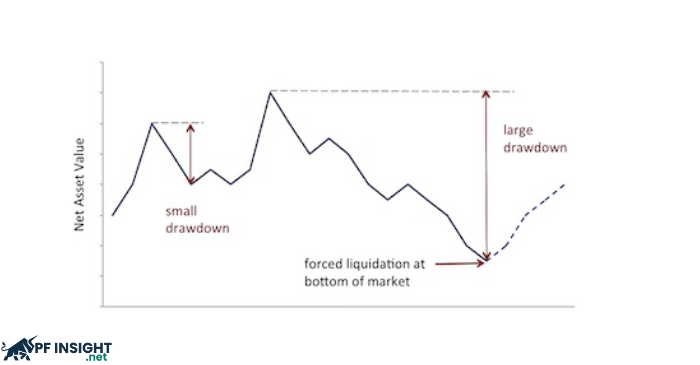

The max drawdown represents the total maximum loss an account can experience from its starting balance or from the highest equity peak reached.

Key characteristics of the max drawdown

- Cumulative measurement: Calculated over the entire account history, not just one trading day.

- Two common types:

- Absolute drawdown: Based on the initial balance.

- Relative or trailing drawdown: Calculated from the highest equity achieved.

Example:

If you have a $100,000 account with a 10% max drawdown, your balance cannot fall below $90,000.

If your equity increases to $110,000 with a trailing rule of 10%, the new threshold becomes $99,000.

Daily loss limit vs max drawdown difference

Both rules serve to protect traders and prop firms from excessive losses, but understanding the daily loss limit vs max drawdown difference is crucial for effective risk control.

The daily loss limit is a short-term safeguard – like a “daily brake system.” It prevents traders from losing too much in a single day or session. Because it resets daily, traders can start fresh each day, which helps restore emotional stability and trading discipline.

The max drawdown, on the other hand, is a long-term protective rule. It does not reset daily and tracks performance across multiple sessions. This highlights the daily loss limit vs max drawdown difference: the former manages short – term exposure, while the latter ensures overall account survival.

For instance, with a $100,000 account and a 5% daily loss limit, you cannot lose more than $5,000 in one day. However, the max drawdown could be absolute or trailing – in trailing mode, it tightens as your profits increase. This makes the daily loss limit vs max drawdown difference even more significant because one adapts to short-term control, and the other evolves with your performance over time.

While the daily limit enforces strict discipline, it can feel too rigid during high volatility. Conversely, the max drawdown allows more flexibility but requires patience and strong long-term planning. Understanding the daily loss limit vs max drawdown difference helps traders balance immediate risk control and sustainable growth.

Pros and cons of daily loss limit vs max drawdown difference

Pros and cons of the daily loss limit

Pros:

- Prevents traders from emotional overtrading or blowing up their accounts in one day.

- Maintains discipline by stopping impulsive or revenge trading.

- Ideal for prop firms to protect capital and avoid large single-day losses.

- Encourages responsible lot sizing and proper daily risk planning.

Cons:

- May eliminate traders even when their overall strategy is profitable.

- Can be too strict during volatile market sessions.

- Adds psychological pressure, as traders may fear violating the rule.

Pros and cons of the max drawdown

Pros:

- Protects capital over the long term and across multiple trading days.

- Offers more flexibility than a daily loss limit – traders can lose more in a single day as long as they stay above the overall drawdown limit.

- Supports long-term trading systems that can recover from short losing streaks.

- Encourages traders to think strategically about overall capital management.

Cons:

- Trailing drawdowns tighten as profits increase, reducing flexibility.

- Without a clear plan, a series of losing trades can quickly trigger a violation.

- Does not reset daily, which adds extra psychological stress.

- May limit creative or aggressive trading approaches.

Final thoughts on daily loss limit vs max drawdown difference

Both the daily loss limit and max drawdown are essential tools for traders, especially in prop firm challenges or funded accounts. The daily loss limit acts as a “short-term emergency brake,” while the max drawdown serves as the “long-term safety net” for your capital.

Understanding the daily loss limit vs max drawdown difference allows traders to build discipline, manage emotions, and sustain profitability. Any trader aiming for long-term success in prop firm trading must respect both rules – mastering these two limits is the foundation of lasting success in the financial markets.