CySEC is considered one of the most prestigious licenses in the global financial sector. It not only serves as proof of a trading platform’s legality but also reflects the transparency of its operations. In this article, PF Insight will analyze the significance of the CySEC license and guide you on how to perform a CySEC license check.

- How to calculate balance of trade and interpret the results

- Understanding prop firm profit analytics for smarter trading

- What is Prop Firm tax? Tips funded traders use to keep more profits

What is CySEC?

CySEC stands for Cyprus Securities and Exchange Commission and is the Greek name Επιτροπή Κεφαλαιαγοράς, is the financial regulator of the Republic of Cyprus. This license allows Forex and securities brokers to operate legally, while ensuring strict compliance with the transparency standards and regulations of the European financial markets.

CySEC ensures that all regulated exchanges have a MiFID “passport”. This is the key to providing legal financial services across the European Union. Thanks to this mechanism, companies do not need to apply for separate licenses in each EU member state. This saves time, reduces administrative procedures, expands business opportunities and improves the ability to serve investors in the EU.

The role of the Cyprus Securities and Exchange Commission (CySEC)

Before conducting a CySEC license check, investors need to understand the important role of this license. A CySEC license not only confirms the legitimacy of the trading platform but also demonstrates the level of compliance with strict financial regulations of the European Union. This is a key factor in protecting the rights and safety of investors.

- CySEC is primarily responsible for approving and licensing financial investment organizations, including consulting firms, brokers and exchanges. This authority covers a wide range of sectors such as securities, foreign exchange (Forex) and contracts for differences (CFDs), ensuring that entities comply with all applicable legal regulations.

- Second, CySEC exercises the function of closely monitoring the activities of investment companies and brokerage floors. This agency has the power to conduct inspections, assess compliance with regulations, and apply administrative or disciplinary sanctions to organizations that violate or provide services contrary to the licensed regulations.

- Third, the agency continuously updates and improves its supervisory regulations to improve the effectiveness of financial market management. Its goal is to create a transparent, fair and trustworthy investment environment, while promoting sustainable development and progress for all market participants.

- Fourth, it is responsible for monitoring and regulating trading activities taking place on the Cyprus Stock Exchange, and closely supervising listed companies, brokerage institutions and brokers to ensure transparency, compliance and stability of the financial markets.

- Fifth, CySEC is tasked with researching, updating and developing appropriate legal frameworks for existing financial products as well as new ones including cryptocurrencies. The goal is to ensure that these products are strictly regulated, operate transparently and in accordance with international financial standards.

What standards does CySEC license under?

Before obtaining legal certification through the CySEC license check, exchanges must meet a series of strict criteria set by the regulator, including capital requirements, financial transparency, and clear operating procedures.

- Representative office: The exchange is required to have its headquarters in the Republic of Cyprus and have at least three senior management personnel who are citizens or legal residents of the country to ensure transparency and effective oversight.

- Operating capital: According to CySEC license check standards, trading floors must meet quite high minimum capital requirements: 125,000 EUR for the STP model and 730,000 EUR for the Market Maker (MM) model, to ensure liquidity and financial security when operating in the market.

- Professional competence: The person in charge of the office must possess extensive professional knowledge in the financial field, along with extensive practical experience to ensure the ability to manage, operate and strictly comply with the standards set by CySEC.

- Investor protection fund: The exchange is required to maintain an investor protection fund to ensure the rights and financial security of customers in case the company encounters an accident, becomes insolvent or incurs serious risks during its operations.

- Infrastructure and service quality: According to CySEC license check standards, exchanges must maintain a transparent operating environment, apply modern technology and provide reliable services. The goal is to create a professional financial ecosystem, ensuring a safe and high-quality experience for all investors.

- Business structure: The exchange must build an effective, highly competitive business model with a solid financial foundation to ensure stable operations and maintain long-term reputation in the market.

How does CySEC regulate Forex brokers?

The CySEC regulator is run by a five-member board of senior regulators, consisting of the Chairman, Vice Chairman, two permanent members and a non-voting representative from the Central Bank of Cyprus. Unlike organisations such as the FCA or ASIC, the CySEC license check standard covers a wider range of products, including leveraged financial products, Forex bonuses, cryptocurrency trading as well as binary options, to ensure transparency and investor protection.

Forex brokers licensed by CySEC are required to operate within the strict legal framework set by this agency. At the same time, it monitors the entire operation of the brokers, ensuring compliance with regulations and obligations to protect investors.

- CySEC has the right to require Forex brokers to submit periodic financial reports, audited by independent international auditors to ensure transparency.

- Customers will be protected through the Investor Compensation Fund (ICF), with a maximum payout of 20,000 EUR if the exchange becomes insolvent or bankrupt.

- According to CySEC license check standards, Forex brokers must strictly comply with the responsibility of protecting investors’ interests. If violations of regulations are detected, CySEC can impose heavy penalties, including revoking the operating license.

- CySEC regulated brokers must completely segregate client funds in separate accounts, stored in reputable Tier 1 banks in Europe to ensure absolute safety.

- Under the new regulations issued based on the MiFID directive, all brokers under CySEC supervision must maintain a minimum working capital of 750,000 EUR. This regulation is intended to ensure financial soundness, help companies maintain stability and protect investors’ interests in all situations.

Why choose a CySEC licensed exchange?

Forex brokers that pass the CySEC license check process are considered to meet the standards of reliability and financial capacity. Before being licensed, they must undergo a rigorous assessment process, including checking transparency, service quality and legal compliance. Therefore, CySEC regulated brokers are always highly appreciated by the trading community for their reputation and safety.

In addition, conducting a CySEC license check helps traders better understand the reliability and management standards of this agency. CySEC always operates within the framework of the laws of the Republic of Cyprus and strictly complies with the provisions of the MiFID directive, ensuring transparency and safety for European investors.

CySEC is considered one of the most prestigious level 2 financial licensing agencies in the world. When a Forex broker passes the CySEC license check and is licensed to operate, it proves the management capacity, service quality as well as brand reputation of the broker in the eyes of international investors.

Here are the benefits of joining a CySEC licensed Forex broker:

Prevent fraud and ensure transaction security

Regulations issued by CySEC act as a shield to protect investors from fraudulent practices from brokers. The agency maintains transparency through a strict licensing process, regular audits and continuous monitoring, ensuring that all broker activities comply with international financial standards.

The agency’s comprehensive regulatory approach creates a robust monitoring system that helps prevent violations and strengthens the transparency of financial markets. In addition, the agency has adopted a number of measures to protect investors’ interests, including requiring the segregation of client accounts and brokerage operating funds.

Ensuring the safety of investors’ assets

Under the CySEC license check process, fund segregation is a mandatory and strict requirement. This regulation forces brokerages to completely separate clients’ funds from the company’s capital. All deposits must be kept at the Central Bank, a reputable credit institution or an authorized bank in a third country, to ensure absolute safety of investors’ assets. These accounts must be managed completely separately from the broker’s internal funds. This helps protect client assets, ensures transparency and the ability to withdraw funds at any time without being affected by the company’s financial activities.

Rights to benefit from the Investor Protection Fund

In addition to strict monitoring and auditing measures, investors are also protected by the Investor Compensation Fund (ICF). This fund was established by CySEC to support clients of member companies in the event of financial failure. In the event of a broker becoming insolvent, the ICF will compensate investors up to a maximum of 20,000 EUR.

An example of a CySEC license check is where an investor is reimbursed when a broker goes bankrupt. However, access to the Investor Compensation Fund (ICF) is only granted when certain conditions are met, such as the claim arising from investment services provided by ICF members, ensuring transparency and fairness in the compensation process.

Guide to CySEC license check

CySEC license check is a necessary step to confirm that the exchange is trustworthy and safe. Traders can use the lookup tool on the official CySEC website to quickly verify the legal status of brokers.

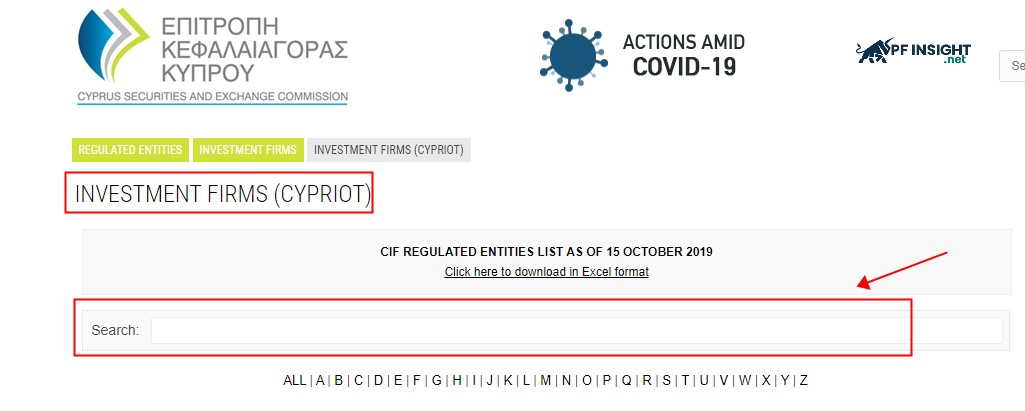

Step 1: Visit the official website of CySEC

To check the license, visit the official CySEC page at: (https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/](https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/) and enter the company name or license number into the search bar to quickly verify information.

Step 2: Check license status

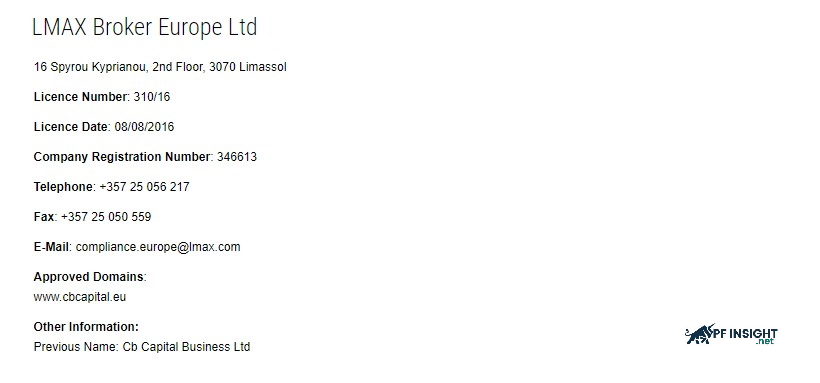

During the CySEC license check, if you find the broker’s license information, it proves that the broker is legally registered and qualified to provide financial services. On the contrary, if you cannot find any information, it is likely that the broker is not registered as a CIF or the license has been revoked, which means that this broker is not allowed to operate legally in the market.

Step 3: Broker data reconciliation

The search results usually provide details such as company name, address, license number, phone number and email. Investors should check this data to confirm whether the broker is CySEC-recognized and whether this is the broker you are trading with.

Step 4: Verify Forex service provider capability

During the CySEC license check, you need to verify whether the broker is qualified to provide retail Forex services. Check the Investment Services module to confirm whether the broker is registered with the 9 required services, which proves that they are qualified to provide contracts for differences (CFDs) and similar financial products to investors. You can also check in the Ancillary Services module and look for the keyword “Forex Services”, make sure it is ticked. This is an important step, because not all CIFs are allowed to provide Forex services, only those that meet the requirements are legal.

Conclude

Performing a CySEC license check is an important step for investors to verify the legitimacy and reputation of a Forex trading platform. By checking the license, comparing information and confirming the services that are allowed to be provided, traders can trade safely, reduce risks and increase confidence when participating in the global financial market.