Prop firms are increasingly developing and becoming popular among traders due to their attractive profits and funding opportunities. For this reason, financial brokers have also started partnering with prop firms to provide funding packages and a variety of platforms and tools for clients to choose from. In addition, broker connection for prop firms also contributes to increasing the reliability and safety of traders’ transactions. So, what exactly is broker connection for prop firms? What are the advantages of broker connection for prop firms in investing? Let’s explore with Pfinsight.net in today’s article!

What is a Prop Firm?

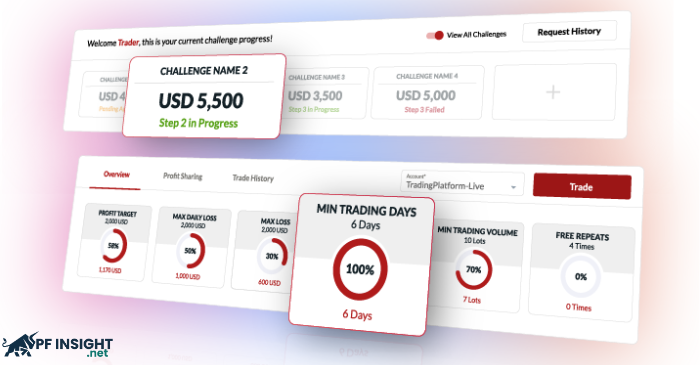

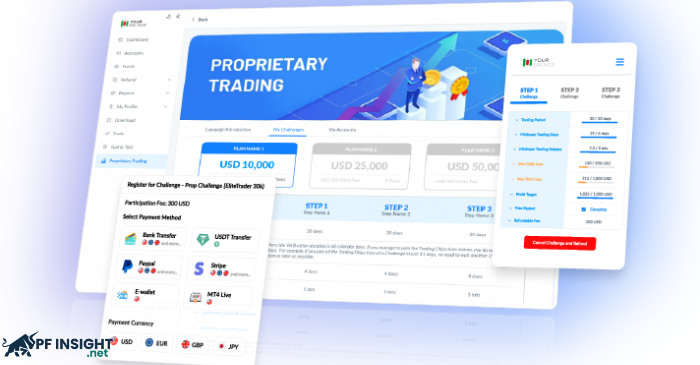

A prop firm is known as a proprietary trading company that allows traders to use the company’s capital without putting in their own funds. To open a trading account, traders only need to pass evaluation challenges instead of investing their own money and bearing all the risks.

Moreover, this strategy offers traders the opportunity to access abundant capital and increase their profits without worrying about losing their own funds. The trader and the firm share the trading profits according to a corresponding ratio. For skilled traders who lack sufficient capital to participate in larger markets, this is an attractive alternative.

What is broker connection for Prop Firms?

Broker connection for prop firms is the connection between a brokerage company and a proprietary trading firm that allows the broker and the traders of that firm to access international markets and liquidity through the broker’s infrastructure.

Proprietary trading firms use brokers as a medium to access markets. Brokers act as intermediaries who make the buying and selling of derivatives, securities, and other financial products easier. Advanced trading platforms, access to diverse markets, and the ability to execute large orders with minimal slippage are all ways in which a suitable broker can give you a competitive edge.

On the other hand, liquidity providers are institutions that enable trading to take place without significant delays or price discrepancies. They ensure that the market has enough volume for trades to be completed quickly and at stable prices. Proprietary firms, which regularly trade in large volumes, place great importance on the quality of liquidity. This can make the difference between a successful day and a losing day.

What are the benefits of broker connection for Prop Firms?

Brand differentiation

Reputable Forex brokers bring legal and brand credibility to the brokerage industry, giving them an immediate competitive advantage. Meanwhile, independent stock brokers, sometimes unregulated, struggle with investors’ skepticism about the reliability of their payments.

Proprietary trading firms position themselves as pioneers in the industry, alongside delivering immediate financial efficiency. Proprietary models have been adopted by large brokers such as Axi, Hantec, and IC Markets, which confirm this methodology. Their success gives other brokers considering similar strategies a roadmap and competitive pressure.

Strategic market expansion

The proprietary trading market is still growing at an exponential rate, evidenced by a sharp increase in searches for related terms over the past two years. As this trend accelerates, brokers offering reliable services are positioning themselves to dominate market share.

Proprietary trading also provides a calculated method of penetrating tightly regulated markets. For example, in the United States, where CFD trading is illegal, brokers can attract attention in previously inaccessible regions by structuring products through the proprietary trading model.

Revenue diversification

Proprietary trading generates counter-cyclical income models. In a crowded Forex market, challenge fees and evaluation fees provide brokers with a useful diversified source of revenue. By using trader-funded evaluations, businesses can generate stable revenue even during low trading periods, reinforcing the resilience and scalability of their business model.

Enhanced marketing efficiency

A significant shift has occurred in the customer acquisition economy. Proprietary trading campaigns often:

- Face fewer barriers to promotion.

- Broaden messaging reach and use analytics to show lower cost per customer acquisition.

- Target trader demographics that were previously inaccessible.

This leads to a significant increase in overall marketing effectiveness when combined with appropriate nurturing strategies, helping turn profitable proprietary traders into regular Forex accounts.

Infrastructure ddvantages

Reputable brokers have extremely low technical barriers to entry because they already possess the necessary core infrastructure. Without needing significant additional infrastructure investment, businesses can deploy a comprehensive proprietary trading solution by using existing trading platforms, CRM systems, liquidity provider partnerships, and payment processing procedures.

The role of brokers in proprietary trading

Not all brokers engaged in proprietary trading are the same. When choosing a broker, a proprietary trading business must consider several aspects, such as:

- Direct market access (DMA): To increase execution speed and reduce costs, proprietary firms must be able to communicate directly with exchange order books rather than traditional brokers.

- Technology and platform capabilities: Brokers’ trading platforms need to be robust and reliable to handle complex algorithms and large trading volumes that many proprietary firms execute.

- Commission structure: The cost structure of executing trades is a crucial factor because proprietary businesses operate on thin margins. A company’s profits can be significantly impacted by brokers offering competitive commissions.

- Customer service and support: Because proprietary trading operates 24/7, businesses need brokers who can provide 24/7 support to address any issues that may arise and ensure continuous trading operations.

Which brokers should be chosen for broker connection for Prop Firms?

An important choice for every proprietary trading firm is selecting the right broker. In addition to matching the company’s trading volume and strategy, the broker must provide the technological advantage necessary for high-frequency, algorithmic, and other complex trading techniques.

Direct Market Access (DMA) is essential for all firms; it is not a luxury. DMA allows traders to place buy and sell orders directly on exchange order books, potentially reducing transaction costs and achieving faster execution times. For strategies dependent on quick execution to capitalize on short-term market opportunities, this direct path to the market is critical.

The platform for a proprietary trading company’s operations is the technological infrastructure provided by the broker. A perfect broker offers a reliable and stable platform capable of managing the high order submission rates required for high-frequency trading tactics. This platform should also include sophisticated charting capabilities, real-time data feeds, and the ability to backtest plans using historical data.

Every penny counts in the narrow margins within which proprietary trading businesses operate. Therefore, the cost structure of a broker is an important factor to consider. Proprietary firms can maintain profitability with the support of brokers offering low financial costs, reasonable commissions, and minimal non-trading expenses.

Proprietary trading requires every issue with platform performance or trade execution to be resolved quickly to avoid costly downtime. The continuous operation of a proprietary firm greatly benefits from a broker providing dedicated customer service, knowledgeable about the technical aspects of the trading platform and responsive in real time.

Conclusion

Overall, the prop firm market is currently booming, yet it is still not fully licensed and expanded in the global market. Therefore, broker connection for prop firms will help the prop firm market develop more strongly, safely, and deliver better profits to traders. Hopefully, through this article, you have gained the most comprehensive overview of this market. Don’t forget to visit our website for more updates! Wishing all traders success!