A breakout trading strategy is a popular approach in the forex market that focuses on capturing strong price movements when the market breaks through key support or resistance levels. When a breakout occurs, volatility often increases and price tends to develop a clearer directional move.

This article explains how breakout trading works in forex, along with the key principles for confirmation and basic risk management. Join PF Insight as we explore this strategy.

- Best Prop Firms for swing traders offering high profit splits and low fees

- What is forex trading and why millions of traders participate in this market

- Stop loss strategy for new traders – From basics to advanced

Breakout trading strategy explained in forex markets

In forex markets, a breakout trading strategy focuses on moments when price exits a consolidation phase and volatility begins to expand. Understanding a breakout is not only about identifying the level that gets broken, but also about recognizing the shift in market behavior and momentum that follows.

Core concept of breakout trading

- A breakout occurs when price moves beyond a well-defined support or resistance level that has been tested multiple times.

- These price zones represent a temporary balance between buyers and sellers during a consolidation or range-bound phase.

- When this balance is disrupted, volatility typically increases and price tends to move more decisively.

- In essence, a breakout marks the transition from accumulation to volatility expansion.

How breakout trading is applied in forex

- Traders may look for long opportunities when price breaks above resistance, or short opportunities when price breaks below support.

- After a breakout, price often continues in the direction of the break, especially during periods of strong market momentum.

- Breakout trading is a reactive strategy that follows price behavior rather than attempting to predict tops or bottoms.

- The same breakout principles can be applied across multiple timeframes, as long as the broader market context is properly assessed.

Market conditions where breakout trading performs best

Not every breakout is worth trading. The effectiveness of a breakout trading strategy depends heavily on market context, especially volatility conditions and order flow at the moment price breaks out.

When breakout trading works best

Breakout trading tends to perform well when the market shows the following characteristics:

- Price consolidates within a narrow range for a sufficient period, forming clearly defined support and resistance levels.

- Volatility gradually contracts before the breakout, creating conditions for a volatility expansion afterward.

- The market has high liquidity, allowing price to move smoothly with less noise.

- The breakout occurs during active trading sessions, when participation and order flow are stronger.

When traders should be cautious with breakouts

Certain conditions reduce the reliability of breakout trading, including:

- Price breaks out briefly but lacks momentum, then quickly returns to the prior consolidation range.

- The market is driven by short-term news events that cause irregular or erratic volatility.

- Breakouts on lower timeframes that move against the primary trend on higher timeframes.

- Support and resistance levels that have not been tested enough times to be meaningful.

How traders assess market conditions before entering a breakout trade

Before trading a breakout, traders typically:

- Identify the broader trend and market structure on higher timeframes.

- Evaluate the quality of the consolidation phase and the clarity of the level being broken.

- Consider timing to ensure the market has sufficient liquidity and momentum to support follow-through.

Tools used to identify breakout opportunities

To trade breakouts effectively in the forex markets, traders need more than simply “seeing price break a level.” Technical tools help identify key price zones, assess momentum, and distinguish valid breakouts from false ones.

Support and resistance levels

- Support and resistance form the foundation of any breakout trading strategy.

- Levels that have been tested multiple times carry more significance when they are broken.

- Breakouts at these well-defined zones tend to have a higher probability of follow-through than breaks at random price levels.

Price patterns

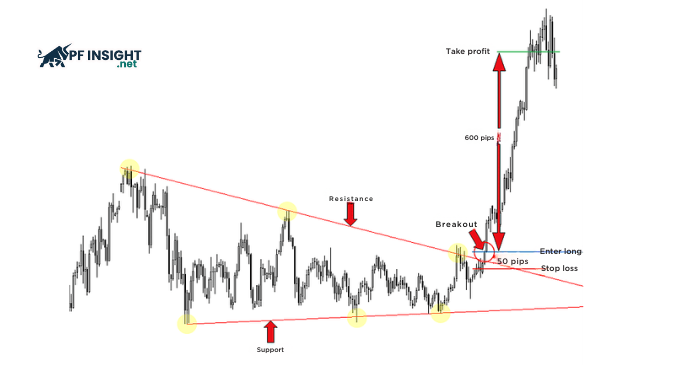

- Price patterns such as ranges, triangles, flags, or channels often form during consolidation phases.

- When price breaks the boundary of these patterns, the breakout can signal the start of a volatility expansion phase.

- Traders commonly combine price patterns with overall trend context to improve reliability.

Volume and volatility tools

- Volume and volatility help confirm the strength of a breakout.

- Breakouts accompanied by rising volume or increasing volatility are generally more reliable.

- Tools such as ATR or other volatility indicators are often used to estimate the potential price move after a breakout.

Higher timeframe analysis

- Higher timeframe analysis helps traders understand broader market structure and the dominant trend.

- Breakouts on lower timeframes that align with the higher timeframe trend typically have a higher chance of success.

- Ignoring higher timeframe context often leads to lower-quality breakout trades.

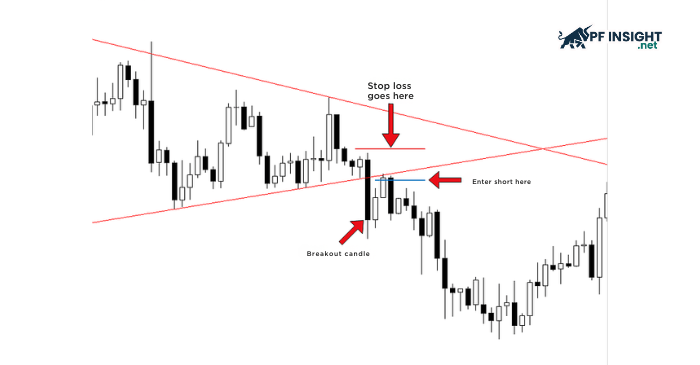

Planning breakout entries with confirmation

After identifying potential breakout zones, the next step is to plan entries in a disciplined way. In the forex markets, price breaking a technical level does not automatically mean the breakout will continue. This is why confirmation plays a central role in any breakout trading strategy.

Waiting for breakout confirmation

One of the most common mistakes is entering a trade the moment price touches or slightly breaks support or resistance. Effective breakout traders usually wait for price to close clearly above resistance or below support to confirm that the market has truly accepted the new price level.

Confirmation helps reduce the risk of trading false breakouts, where price only breaks briefly and then quickly returns to the previous consolidation range.

Common ways traders confirm breakouts

In practice, traders often use one or a combination of the following confirmation factors:

- Price closes decisively beyond a key support or resistance level.

- Price momentum increases after the breakout, reflected by larger candle ranges.

- The breakout occurs during active market sessions, when liquidity and participation are stronger.

These elements help traders distinguish valid breakouts from short-lived, noisy price moves.

Planning the entry point

Once a breakout is confirmed, traders need to decide how to enter based on their trading style. Some traders enter immediately after the confirmation candle closes, while others prefer to wait for a retest of the broken level to achieve a more conservative entry.

Regardless of the approach, the entry point should be defined in advance, not decided emotionally during periods of high volatility.

Preparing for risk management

Entry planning must always go hand in hand with defining stop loss levels and profit targets. Breakout trading is not only about catching strong price moves, but also about controlling risk when the breakout does not develop as expected.

Risk management principles for breakout traders

Breakout trading can generate strong price moves, but it also carries higher risk when the market fails to follow through. For this reason, risk management is not an optional add-on. It is the core element that allows a breakout trading strategy to remain sustainable in the forex markets.

Defining the stop loss before entering a trade

Every breakout trade should have a clearly defined stop loss from the outset. In breakout trading, the stop loss is commonly placed inside, or just beyond, the level that has been broken. If price returns to this area, the breakout is considered invalid.

A well-placed stop loss limits losses during false breakouts, instead of leaving traders exposed while hoping the market will reverse back in their favor.

Managing the risk-to-reward ratio

An essential principle is to evaluate the risk-to-reward ratio before entering any breakout trade. Many breakout traders only take setups where the potential reward meaningfully exceeds the predefined risk, helping offset inevitable losing trades.

Profit targets are often based on price structure or expected volatility expansion, which provides more realistic expectations than emotional decision-making.

Adjusting position size appropriately

Not every breakout justifies a large position. Traders should adjust position size based on the distance between the entry point and the stop loss, ensuring that each trade risks only a small, controlled portion of account equity.

This approach reduces the impact of losing streaks, which are a natural part of breakout trading.

Accepting failed breakouts as part of the process

False breakouts are unavoidable in the forex market. Effective risk management requires accepting that not every breakout will develop into a strong trend.

Exiting early when a breakout fails protects capital and allows the breakout strategy to remain viable over the long term, rather than being undermined by a few oversized losses.

A practical breakout trading workflow

After understanding how breakouts form, which market conditions are suitable, how to enter trades, and how to manage risk, traders need a clear process to apply a breakout trading strategy consistently in the forex markets. A simple but structured workflow helps reduce emotional decision-making and improves trading discipline.

Step 1. Identify the broader market context

Begin by analyzing higher timeframes to determine the primary trend and overall market structure. This step helps traders avoid trading breakouts that go against the broader context and focus instead on higher-probability opportunities.

Step 2. Mark key price levels

Next, identify clear support and resistance zones where price has reacted multiple times in the past. These levels form the foundation for spotting potential breakouts, especially when the market is in a consolidation phase.

Step 3. Wait for the breakout and confirmation

As price approaches a key level, traders should avoid entering immediately. Instead, wait for confirmation that a breakout has occurred. Confirmation may come from a decisive close beyond the level, increasing momentum, or price behavior that shows the market accepting the new price area.

Step 4. Plan the trade in advance

Once the breakout is confirmed, define the entry point, stop loss, and profit target before executing the trade. This plan should be based on price structure and risk management rules, not on emotions during periods of heightened volatility.

Step 5. Manage the trade and review performance

While the trade is active, follow the predefined plan and avoid making impulsive adjustments in response to short-term price fluctuations. After the trade is closed, reviewing the outcome helps traders assess breakout quality and refine their process for future trades.

Conclusion

Breakout trading strategy in the forex markets focuses on capturing moments when the market shifts from consolidation into volatility expansion. This approach works best when breakouts are analyzed within the right market context, supported by clear confirmation, and executed with a well-defined entry plan. However, not every price break leads to a strong follow-through, which is why risk management plays a critical role in breakout trading. When applied with discipline and consistency, breakout trading can become a sustainable strategy in forex trading.

We wish our readers effective trading and encourage you to explore more useful articles in our Trading Basics section.