What is breakout strategy for Prop Firm challenge? The Prop Firm challenge is one of the crucial aspects that traders must thoroughly understand before deciding to invest in any proprietary trading company. This is also why traders need strategies that help them overcome evaluations and challenges – such as the breakout strategy.

In today’s article, Pfinsight.net will provide you with an overview of the breakout strategy for Prop Firm challenge. Let’s dive in!

- The secret to applying Mean Reversion strategy for Prop Firm to easily pass the Challenge

- Understanding daily loss limit vs max drawdown difference in prop firms

- Mastering scalping strategies for Prop Firm challenges: Boost your profit potential

What is a breakout strategy?

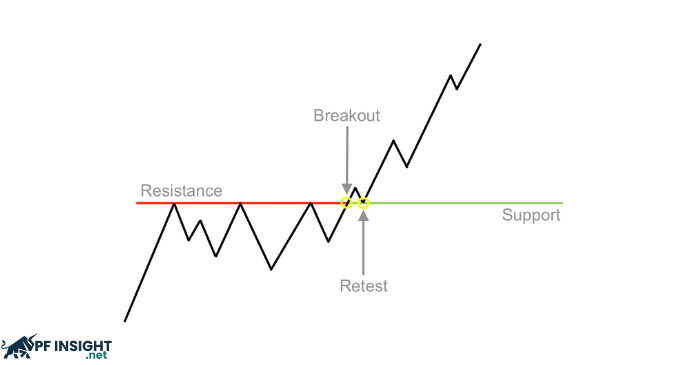

Buying or selling when the price breaks through a significant support or resistance level with substantial momentum is known as a breakout strategy.

The core idea behind this technique is simple: when the price breaks out of a consolidation zone or range, it often signals a shift in market sentiment and opens opportunities for a new trend to begin.

Traders must demonstrate discipline, consistency, and risk management skills during Prop Firm challenges. Because this strategy is straightforward, rule-based, and minimizes emotional decision-making, the breakout strategy is considered one of the best approaches for these challenges.

The significance of breakout strategy for Prop Firm challenge

Clear signals and precise guidance

Prop Firms highly value traders who use objective trading strategies. Instead of relying on emotional judgment, the breakout strategy provides a defined entry point.

You can confidently enter a position without fear of losses when the price breaks out of a support/resistance zone with a confirming candle and strong trading volume.

Attractive risk/reward ratio

Breakouts usually occur after a consolidation phase. In this case, you can set a very tight stop-loss – just above the broken resistance or slightly below the support.

As a result, you achieve a favorable risk/reward ratio, which is crucial to overcoming the difficulties set by firms like FTMO, MyForexFunds, The5ers, or FundedNext.

Easier compliance with Prop Firm rules

Most Prop Firms have strict guidelines regarding maximum drawdown and daily loss limits.

A breakout strategy helps you maintain discipline and automatically comply with risk limits by preventing overtrading and focusing primarily on high-probability setups.

Maintain consistency and emotional control

With a breakout strategy, all you need to do is react to clear signals rather than predict the market.

This helps you avoid emotional trading, reduces revenge trading, and maintains consistency – qualities that Prop Firms value most.

How to apply breakout strategy in a Prop Firm challenge?

The following five key steps will help you implement the breakout strategy for Prop Firm challenge safely and effectively during the evaluation phase.

Step 1: Identify key price levels

Marking strong support and resistance zones on higher timeframes (H1, H4, or Daily) should be the trader’s top priority.

Prices often react strongly at these levels – either rejecting or breaking through entirely. When the price continuously approaches these zones but fails to break out, it indicates accumulating pressure and a potential breakout.

Step 2: Wait for consolidation

Markets often move sideways within a narrow range before a breakout occurs. This is the “calm before the storm.”

A skilled trader will not enter too early but will instead wait for confirmation. Profits come from patience.

Step 3: Validate the breakout signal

Just because the price appears to break through resistance or support doesn’t mean you should enter immediately. Wait for confirming factors such as:

- A sudden increase in trading volume.

- A candle that closes entirely outside the resistance/support zone.

- A retest of the broken level followed by a clear rejection.

A true breakout – not a “fakeout” meant to trap retail traders – occurs when all three of these conditions are present.

Step 4: Manage risk carefully

Avoiding large losses on a single trade is one of the golden rules of the breakout strategy for Prop Firm challenge.

Keep your risk per trade between 1% and 2% of your capital. You can maintain discipline and adhere to Prop Firm drawdown rules by placing stop-loss orders just outside the breakout area and avoiding position extensions when the price moves against you.

Step 5: Stay consistent and manage profits wisely

Don’t try to “catch tops or bottoms.” Instead, follow these principles:

- Take partial profits at a 1:2 or 1:3 risk/reward ratio.

- Trail your stop-loss along the trend or move it to breakeven.

- After a big win, avoid trading immediately, as excitement can easily lead to mistakes.

Prop Firms value your ability to maintain profitability more than making massive short-term profits.

Common breakout strategy for Prop Firm challenge

The range breakout strategy

This strategy focuses on price volatility within a specific range. Traders monitor whether the price breaks below support or above resistance. A buy trade is initiated when the price breaks above resistance, while a sell trade is triggered when the price falls below support.

The trend continuation breakout strategy

When the price breaks out of a consolidation phase within an existing trend, it is known as a continuation breakout. In an uptrend, traders look to buy when the price breaks above resistance; in a downtrend, they sell when the price breaks below support.

The false breakout strategy

A false breakout (or “fakeout”) happens when the price temporarily breaks through support or resistance but then quickly returns to the previous range. Traders using this technique wait for a fakeout and then trade in the opposite direction, expecting a reversal.

The gap breakout strategy

When the market opens with a significant price movement, creating a gap between the previous close and the new opening price, it is called a gap breakout. Traders look for these gaps as potential signals that the previous trend will continue.

Common mistakes when using breakout strategy for Prop Firm challenge

Even the best strategy can lead to problems when applied incorrectly. Here are common mistakes traders make:

- Entering too early – before confirmation – resulting in getting caught in fakeouts.

- Trading against the main trend by ignoring the broader market context.

- Using excessive leverage, which can blow your account after one stop-out.

- Taking every breakout signal instead of focusing only on strong setups.

Although less common in Prop Firm challenges, these mistakes are risky and can lead to disqualification.

Many well-funded traders have reported that using the breakout strategy made it significantly easier to overcome these challenges.

A higher win rate, fewer drawdowns, and a more stable mindset are the results of reacting to price action with discipline rather than trying to predict the market’s future. To consistently meet Prop Firm profit targets, some traders even build their entire system around just two or three high-quality breakout setups per week.

Conclusion

Overall, the breakout strategy for Prop Firm challenge is one of the most effective and widely used methods among traders.

We hope this article has given you a comprehensive understanding and practical experience in applying the breakout strategy for Prop Firm challenge effectively. Don’t forget to visit our website for more useful insights and professional trading tips!