Many traders have experienced the feeling of entering a trade the moment they spot a “breakout incoming” signal, only for price to reverse, throwing off the timing and eliminating the edge. With a bollinger bands squeeze, the issue is not the tool itself, but how we read the signal and act too quickly. That is why PF Insight created this article to highlight the common mistakes that cause late entries, false breakouts, or getting caught in a “head fake.”

- What is the Stochastic RSI? Why is StochRSI more sensitive and faster than traditional RSI?

- Overbought and oversold levels and why they do not always signal reversals

- RSI divergence and how it signals potential trend reversals

What a Bollinger Bands squeeze actually tells you

The most important thing to understand is that a Bollinger Bands squeeze does not “predict direction.” It only reflects one condition: the market is entering a period of volatility contraction. In other words, this is when price often moves sideways, the trading range becomes narrower than usual, and the market appears to be “building pressure” before a strong expansion.

Because a squeeze is tied to volatility, it only tells you when the probability of a breakout is higher, but it does not indicate whether the breakout will be upward or downward. This is why many traders get trapped: as soon as they see the bands tighten, they rush to guess the direction and enter before any confirmation.

A more accurate perspective is this: a Bollinger Bands squeeze is like a warning signal that “a strong move may be coming,” while the actual direction must be determined using additional context such as the higher-timeframe trend, market structure, divergence, and volume. If you rely only on the squeeze and enter immediately, the chances of poor timing or getting hit by a “head fake” increase significantly.

The most common Bollinger squeeze mistakes

Treating every tight band as a squeeze

Common mistake: seeing narrower bands and immediately concluding “it’s squeezing” and preparing for a big breakout.

Why it worsens timing: not every contraction is tradable; many tight-band periods are just dull sideways action or low liquidity, which creates noise and fake-outs.

Quick fix: only trade squeezes with clear criteria (a standout contraction relative to the prior phase), preferably within a clear consolidation zone or near key levels.

Entering before volatility expansion

Common mistake: entering as soon as the squeeze forms, hoping to “front-run the breakout.”

Why it worsens timing: while volatility is still compressed, price often chops within a tight range. Entering too early makes you more likely to get stopped out or whipsawed, which triggers impatience and poor entries.

Quick fix: wait for volatility expansion signals: a break of consolidation, a clear candle close, or visible range expansion instead of guessing.

Assuming the squeeze predicts direction

Common mistake: assuming the squeeze is about to explode and it “must break up” (or down) based on gut feeling.

Why it worsens timing: a squeeze is a volatility signal, not a directional signal. If you guess wrong, you will enter early on the wrong side of the true move and get trapped in a sharp reversal.

Quick fix: only enter after directional confirmation: higher-timeframe trend context, market structure, RSI divergence, and volume cues.

Trading the first breakout candle

Common mistake: seeing a strong candle break out of the squeeze and jumping in immediately.

Why it worsens timing: the first breakout candle is often driven by news, stop hunts, or short-term flows. Entering immediately puts you at risk of buying the top or selling the bottom, with poor RR and high reversal risk.

Quick fix: prefer a “break → pullback/retest → entry” approach, or wait for confirmation that the level is holding.

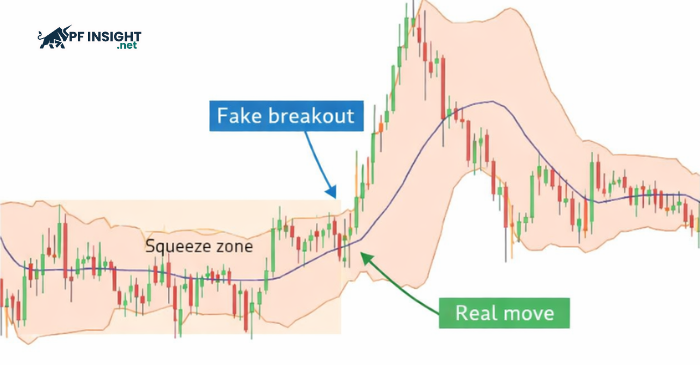

Ignoring head fakes (false breakouts)

Common mistake: believing the first breakout is real, without considering a trap move.

Why it worsens timing: squeezes often produce head fakes, where price breaks one direction to lure traders in, then reverses hard in the opposite direction. Entering too quickly leaves you stuck on the wrong side.

Quick fix: always define a clear invalidation level and a proper stop-loss; prioritize confirmation candles/volume, and avoid going all-in on the first break.

Forgetting the dominant trend context

Common mistake: trading the squeeze as a standalone setup, ignoring the higher-timeframe trend.

Why it worsens timing: if the larger trend is strong, counter-trend breakouts often fail or become only short pullbacks. You end up with “good timing but wrong direction” and lose edge right after entry.

Quick fix: use the higher-timeframe trend as a filter; prioritize trend-aligned squeezes, or wait for a clear structure break before confirming a reversal.

Using Bollinger Bands alone (no confirmation tools)

Common mistake: relying only on tightening bands and using Bollinger Bands mechanically for entry/exit decisions.

Why it worsens timing: Bollinger Bands only reflect volatility around the SMA and are not enough to confirm a real breakout. Without confirmation, you will get caught in repeated false breaks.

Quick fix: combine 1–2 confirmation factors such as RSI (divergence/momentum), volume signals (accumulation/distribution), or price structure.

Poor risk control destroys good timing

Common mistake: using oversized positions because you expect a “big move,” or placing stops based on emotion.

Why it worsens timing: even with good timing, stops that are too tight get hunted, while stops that are too wide ruin RR. Oversized risk makes you unable to tolerate normal volatility, causing you to exit at the wrong moment.

Quick fix: trade according to a plan, set stops based on structure/invalidation, size positions based on risk tolerance, not expectations.

How to fix poor breakout timing (practical rules)

Rule 1: qualify the squeeze (do not guess, use criteria)

Poor timing often starts with seeing tight bands and immediately assuming it is a tradable squeeze. In reality, you should only treat it as a squeeze when the contraction is clearly significant compared to the prior phase.

A simple approach:

- Only consider the setup when the bands have been contracting clearly for a long enough period (not just 1 – 2 candles).

- Prioritize squeezes that appear after a sideways consolidation phase (a clearly defined range).

- If the squeeze forms in a “mid-zone” with no clear support/resistance levels, be cautious because noise is more likely.

The goal of Rule 1: filter out 50% of low-quality setups before even thinking about entries.

Rule 2: confirm direction before committing (confirm direction before sizing in)

One of the biggest mistakes is using the squeeze to guess direction. A squeeze only tells you the market is likely to move strongly soon, while direction requires confirmation.

Simple direction confirmation methods (practical and not complicated):

- RSI / momentum: Look for RSI divergence supporting the breakout direction (bullish divergence → prioritize upside; bearish divergence → prioritize downside).

- Volume / buying vs selling pressure: A “real” breakout usually has stronger support (volume increasing or spiking reasonably in the breakout direction).

- Price structure: A break of the range followed by a close that holds above/below the broken level is usually more reliable.

The goal of Rule 2: minimize wrong-direction entries and getting caught in head fakes.

Rule 3: use a clean entry trigger (the clearer the entry, the better the timing)

To avoid “chasing the first breakout candle,” you need a clear entry trigger that you can repeat consistently.

Three practical entry triggers (choose one and apply it consistently):

Option A: break + close confirmation

- Wait for a candle close that clearly breaks the range/squeeze zone.

- Do not enter if price only wicks above/below within the candle.

Option B: break → pullback/retest → entry (most recommended)

- After the breakout, wait for price to pull back and retest the broken level.

- Enter when a continuation signal appears (rejection candle or reversal in the breakout direction).

Option C: structure break trigger

- Only enter after a clear structure break (higher high/higher low for buys, or lower low/lower high for sells).

- This trigger helps you avoid trading squeezes in noisy ranges.

The goal of Rule 3: fewer trades but higher quality entries, better RR, and fewer reversals.

Rule 4: define invalidation and exits before entry (no invalidation = broken timing)

Many traders ruin timing not because they entered poorly, but because they do not know when the setup is invalid. Without invalidation, you either hold too long or cut too early.

Mandatory checklist before entry:

- Invalidation level: when is the setup wrong? Example: price fully returns into the squeeze zone and closes against the breakout direction.

- Stop-loss placement: Set stops based on structure (below the low / above the high of the squeeze zone, or beyond a failed retest).

- Exit plan: take partial profits at your target RR, trail the remaining position using structure or volatility.

The goal of Rule 4: manage the trade according to plan, not emotions that destroy timing.

Best practices for consistent breakout timing

Use multi-timeframe analysis to avoid trading squeezes in the wrong context

One of the simplest ways to improve timing is not relying on just one timeframe. A squeeze on a lower timeframe can sometimes be nothing but noise, while the higher timeframe determines the dominant direction. Therefore, use the higher timeframe to define the overall trend first, then use the squeeze on the lower timeframe to optimize entries.

Prioritize squeezes that appear at “meaningful” zones

Not every squeeze is worth trading. Timing improves when you select squeezes that occur within clear context, such as tight consolidation zones, near support/resistance, or ahead of a structure break. In contrast, squeezes forming in a “mid-zone” often produce more false breakouts and cause mistimed entries.

Keep it simple: 1 – 2 confirmations are enough

Many traders struggle with timing because their systems are too complex. Watching too many indicators slows decision-making. In reality, with a Bollinger Bands squeeze, you only need the squeeze to signal “volatility is coming,” plus one layer of directional confirmation (RSI or volume/structure) to filter out most traps.

Always have a plan for head fakes

Head fakes are common with squeezes. If you treat the first breakout as real and enter too quickly, timing will almost certainly fail. A better approach is to always define a clear invalidation level, maintain stop-loss discipline, and be ready to shift your scenario if the market confirms the opposite direction.

Build a playbook instead of trading based on feelings

If you want consistent timing, you should track squeeze results by timeframe and market conditions. After a short period, you will know which squeeze types are worth trading and which ones often lead to fake-outs, significantly reducing late entries or wrong-direction trades.

Conclusion

Breakout timing is most often ruined by entering too early, guessing direction without confirmation, and failing to prepare for false breakouts or head fakes when trading a bollinger bands squeeze. When you know how to filter high-quality setups, wait for a clear trigger, and manage risk properly, your results become more consistent instead of relying on luck. Treat this article as a checklist to backtest and refine based on your market, timeframe, and trading style. You can also explore more articles in the Knowledge Hub to upgrade your trading mindset and skills every day.