After years of rapid growth, the prop trading industry entered 2025 amid a wave of new models, intense price competition, and aggressive expansion by funding firms. However, rather than continuing to expand horizontally, 2025 forced the industry to restructure from within. This was not a collapse but a necessary phase of consolidation, in which unsustainable…

Author Archives: Hank Reeves

In technical analysis, order block trading is often viewed as a tool for identifying price zones where large institutions are active. However, order blocks should not be understood as standalone trading signals but rather as the result of buying and selling pressure formed during the execution of large-scale orders. In today’s article, Pfinsight.net analyzes how…

Trong phân tích kỹ thuật, nhiều nhà giao dịch tìm kiếm tín hiệu từ các chỉ báo để giải thích thị trường. Tuy nhiên, đối với những người theo dõi giao dịch dựa trên hành động giá , chính chuyển động giá đã chứa đủ thông tin để hiểu cách thị trường vận hành thông…

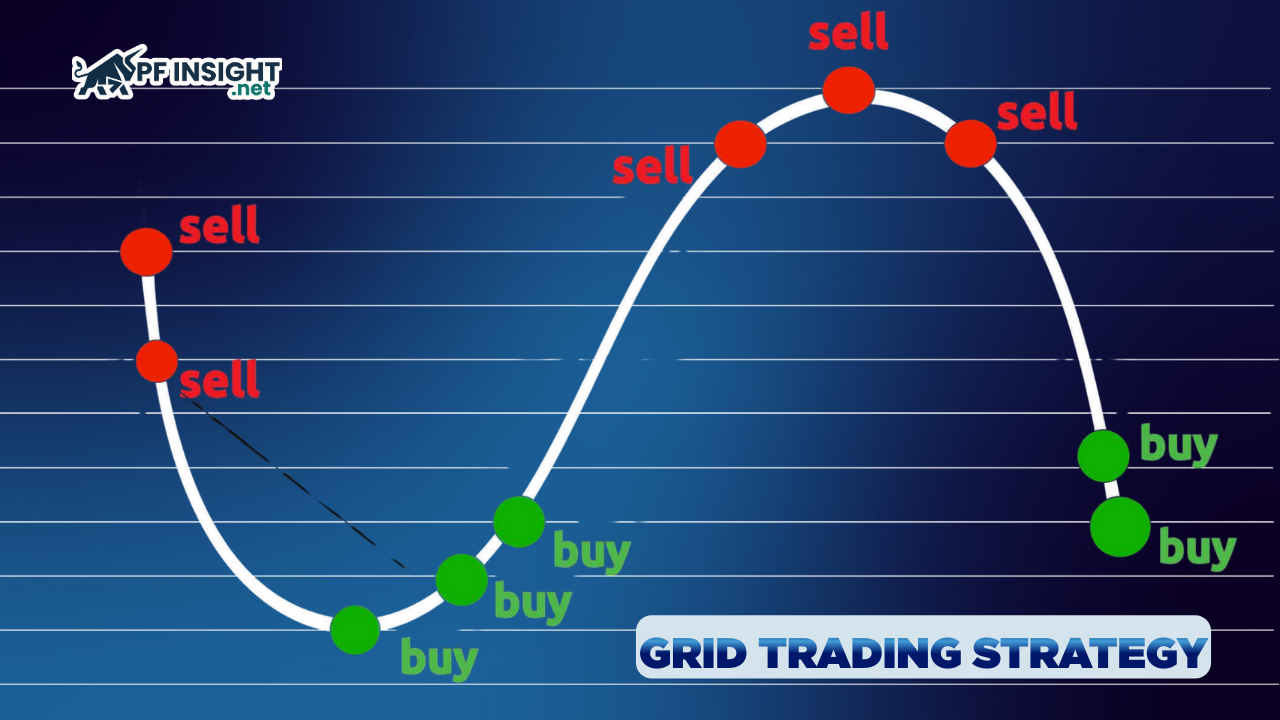

In financial markets, price does not always move in a clear trend. Many periods are defined by sideways price movement, where prices fluctuate within a limited range and make directional predictions difficult, especially for beginners. In such conditions, strategies that rely heavily on trend identification often struggle to perform consistently. This is why the grid…

The trend following strategy has long been one of the foundational trading approaches, not because it promises quick profits, but because it emphasizes consistency in the trading process. In market conditions that are constantly changing and difficult to predict, many traders continue to choose trend following as a clearly structured approach. Rather than attempting to…

Proprietary trading is no longer a short-term trend but has become a core pillar of the retail trading ecosystem. Despite ongoing controversy around the two-step evaluation model, prop firms play a central role in expanding access to capital, training traders, and revitalizing traditional brokers. Prop trading is not a passing phenomenon, but an inevitable future…

A breakout trading strategy is a popular approach in the forex market that focuses on capturing strong price movements when the market breaks through key support or resistance levels. When a breakout occurs, volatility often increases and price tends to develop a clearer directional move. This article explains how breakout trading works in forex, along…

VWAP trading strategy, or volume-weighted average price, is a measure of the average price traded throughout the day based on both price and trading volume. This indicator helps traders understand where the current price stands relative to the market’s average level. VWAP is especially useful in intraday trading, where timing and execution efficiency are critical….

PU Prime, a globally licensed online broker, has officially introduced the Official Verification Hub, a centralized verification tool designed to enhance trust, security, and transparency for the trading community. This launch is seen as an important step in the company’s strategy to protect users and raise safety standards across the online trading industry. Official Verification…

The ATR indicator, short for Average True Range, is a technical indicator designed to measure market volatility rather than predict price direction. For beginners, understanding this distinction is critical. Many new traders focus on whether price will move up or down, while overlooking a more important question: how much the market is likely to move….