The liquidity pool concept is a fundamental pillar in DeFi, enabling DEXs to swap tokens continuously without relying on a traditional order book. In trading, many traders also observe that price often gets “pulled” toward liquidity levels, where large clusters of pending orders and stop-losses are concentrated. Although these belong to different contexts, both revolve…

Author Archives: Hank Reeves

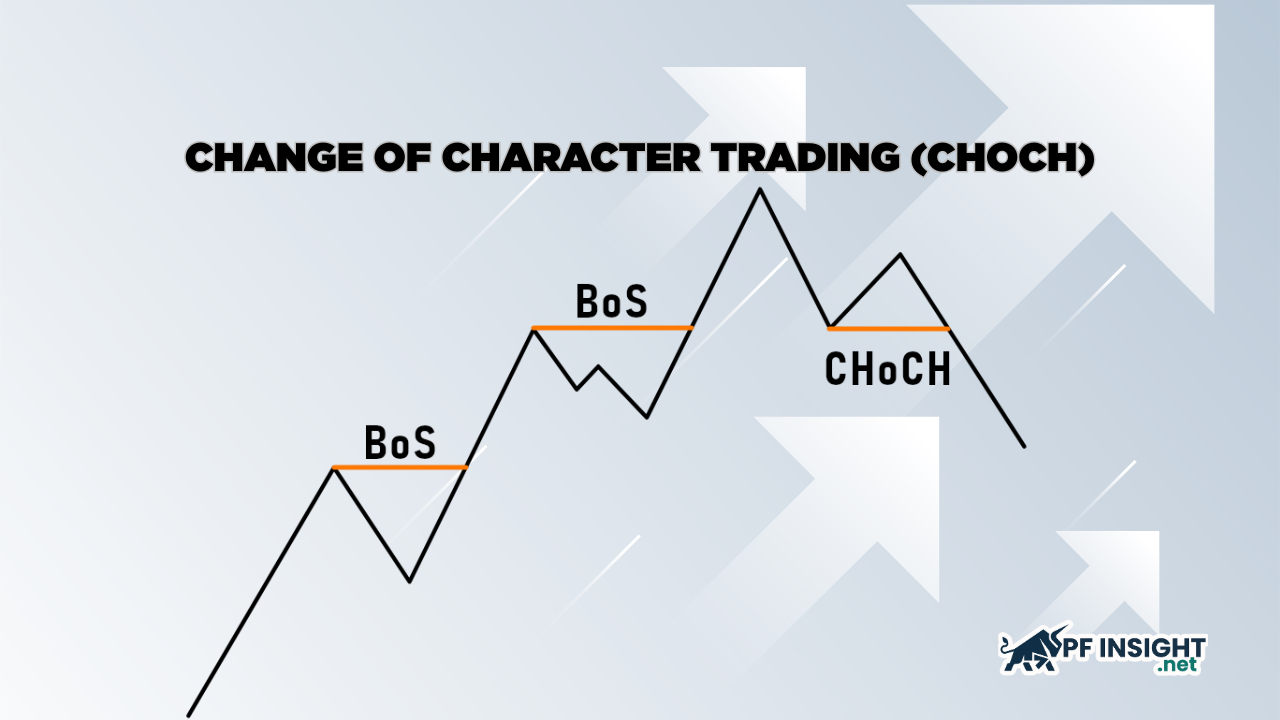

Change of character trading (CHOCH) is one of the most important concepts in market structure, helping traders recognize when the market starts to “change character” and may be preparing for a reversal. However, many traders still confuse CHOCH with Break of Structure (BOS) because both involve price breaking key structural levels. In this article, Pfinsight.net…

FundingTicks has announced it will begin winding down operations, describing the move as part of a “strategic plan” to refocus resources on areas that deliver long-term value to clients and partners. The decision follows backlash over new trading restrictions and profit-related changes introduced in late 2025. Importantly, the firm has published a detailed plan explaining…

When observing the market, what confuses traders most is not whether price is going up or down, but whether that trend is truly reliable or just temporary noise. Many traders enter based on gut feeling or a few strong candles, only to get “reversed” shortly after because they are trading against real directional pressure. This…

Average true range volatility (ATR) is one of the simplest yet most useful indicators, helping traders clearly understand market volatility before placing a trade. In fact, many stop-loss hits happen not because you misread the trend, but because your stop was “too tight” relative to volatility at that time. In this article, Pfinsight.net will walk…

Many traders have experienced the feeling of entering a trade the moment they spot a “breakout incoming” signal, only for price to reverse, throwing off the timing and eliminating the edge. With a bollinger bands squeeze, the issue is not the tool itself, but how we read the signal and act too quickly. That is…

Stochastic RSI is an indicator widely used by traders to identify when the market may be overbought or oversold. Compared to traditional RSI, this indicator tends to react faster and generate signals more frequently, helping traders spot momentum shifts earlier. However, because of its high sensitivity, it can also fluctuate sharply and produce noisy signals…

Many traders start with MACD because it is easy and familiar, but the longer they trade, the more they realize one issue: signals often come late, after price has already moved a significant distance. Meanwhile, the MACD histogram can reveal market momentum shifts earlier, acting like an “early warning system” before an actual crossover appears….

Trading discipline is an important factor that helps traders maintain long-term consistency. With the right trading discipline tips, you can limit emotion-driven decisions, avoid breaking rules, and keep performance consistent over time. In this article from Pfinsight.net, you will learn practical trading discipline tips to stay consistent in the long run. Backtesting trading strategies and…

The market enters 2026 with a series of notable developments: Google has tightened advertising requirements for prediction markets in the US; the prop futures platform FundingTicks has been criticized for changing its minimum 1-minute holding rule and applying it retroactively; Prop Firm Match released estimated data showing prop firms paid out nearly $325 million in…