Moneta Funded (monetafunded.com) is a new proprietary trading brand announced by David Bily, Founder & CEO of Moneta Markets. It is a proprietary trading firm that benefits from direct support from reputable brokers. The core objective of this platform is to establish a transparent and fair career progression path for the global trading community. By…

Author Archives: Daniel

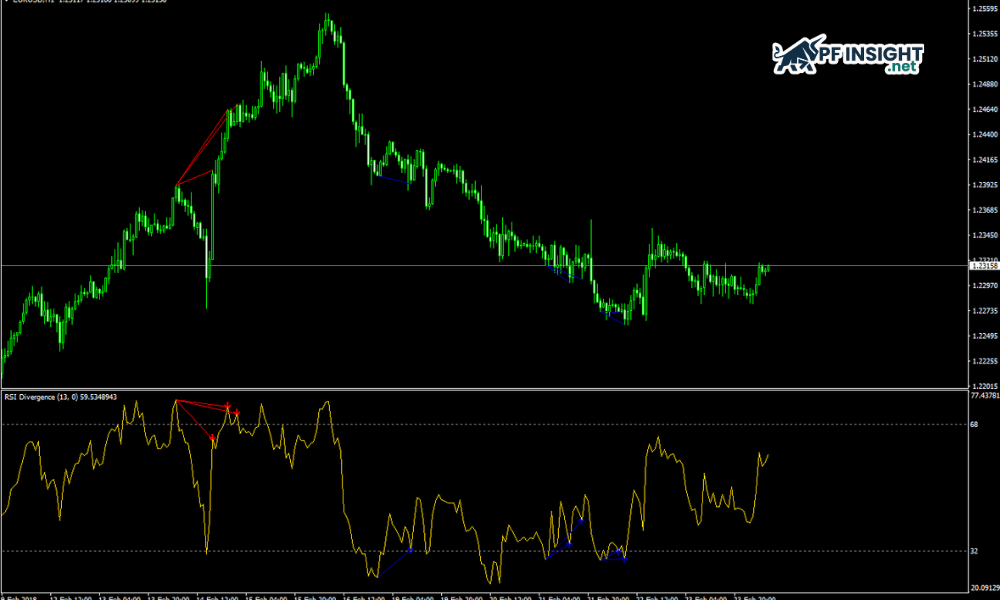

In technical analysis, the RSI divergence is a powerful tool that helps traders detect early signals of price reversals. When the RSI indicator does not align with the price trend, it signals a potential change in market momentum, helping traders make more accurate entry decisions and reduce the risk of losses. MACD histogram: How it…

Backtesting trading strategies is a fundamental step that helps traders evaluate the effectiveness of a strategy before applying it to the real market. By testing the strategy against past price data, traders can understand how the strategy reacts to different market conditions. Backtesting doesn’t guarantee future profits, but it helps mitigate risk and build confidence…

Algorithmic trading basics are crucial for traders to understand how computers automatically execute orders based on pre-programmed rules. Instead of relying solely on human emotion, algorithmic trading leverages data, processing speed, and mathematical logic to optimize trading decisions. Mastering these fundamental principles allows traders to approach the modern market more effectively and systematically. FOMO trading…

TrioMarkets has officially entered the proprietary trading market with a new brand called TrioFunded. This is a strategic move by the forex and CFD broker to provide funding challenge programs for traders. The platform is now live at triofunded.com, opening up access to significant funding for the professional trading community. TrioMarkets enters the prop trading…

In financial trading, markets don’t move randomly but always follow recurring patterns over time. Understanding market cycles in trading helps traders identify whether the market is in an accumulation, growth, distribution, or recession phase. By grasping market cycles, traders can choose appropriate strategies, avoid emotional trading, and improve long-term investment efficiency. Market structure trading: How…

Not all trading strategies depend on upward or downward trends. In fact, only traders who truly understand volatility can turn risk into advantage. Volatility trading concepts focus on measuring, analyzing, and trading based on the intensity of price fluctuations, thereby helping traders build strategies that adapt to all market conditions. Market structure trading: How traders…

Revenge trading is one of the most dangerous psychological mistakes traders often make after a loss. When anger and the desire to “quickly recoup” take over, traders easily break discipline, enter trades without analysis, and increase unnecessary risk. In this article, pfinsight.net this will help traders understand what revenge trading is, how to recognize and…

Topstep, a US-based futures exchange, has confirmed a serious data breach. The cyberattack, which occurred last September, compromised the personal information of many users, including their names and Social Security numbers. The company has now begun sending direct notifications to affected customers. DDoS attack raises questions over possible user data exposure In a letter to…

In financial trading, the biggest obstacle for traders often doesn’t lie in strategy but in a loss of psychological control. Trading psychology basics help traders understand their emotions, limit impulsive actions, and maintain discipline according to their established plans. In this article, PF Insight will analyze the role of trading psychology and how to adjust…